TL,DR

In April 2025, the U.S. economy will present a pattern of slowing inflation and resilient labor market, but the Federal Reserve will face the difficulty of balancing inflation and growth in its prudent policy adjustments (slowing down balance sheet reduction); Trump's tariff policy escalation has caused violent shocks in the capital market, trade frictions and political uncertainty dominate the fragile market sentiment, and medium-term risks focus on the June FOMC meeting and the performance of corporate financial reports under the impact of tariffs.

As of April 26, 2025, the total market value of the global cryptocurrency market has rebounded to $3.07 trillion, up 4.17% from the previous month, with Bitcoin accounting for 63.3% and Ethereum accounting for 7.4%. During April, due to the volatility of Bitcoin prices and changes in Trump's tariff policy, market trading volume fluctuated violently. On April 22, trading volume rebounded to $140.1 billion, but it was still lower than the level during the high volatility period.

This month, the price of Bitcoin increased by about 12.8%, and the net inflow of Bitcoin ETF in April was $2.25 billion. The price of Ethereum fell by about 2% from the beginning of the month, and the net outflow of Ethereum ETF was about $13.8 million. The stablecoin market remained resilient, with an overall inflow of $4.74 billion in April. USDT and USDC increased by 3.51 billion and 1.76 billion respectively, and the circulation of USDE decreased by $500 million.

Bitcoin is experiencing a bull-bear game at the key resistance level of $95,000. Technical indicators are bullish, indicating that it may hit $100,000 to $107,000 after a breakthrough. Ethereum is aiming at the $1,830 resistance after breaking through the 20-day moving average. If it stabilizes, it will open up upside space of $2,550. If Solana holds steady at $153, it may challenge $180.

Trump's tariff policy caused a huge shock in the crypto market. Bitcoin once fell below $74,000, but as the policy eased, the price of Bitcoin gradually rebounded. The SEC postponed the Ethereum ETF pledge decision, and the approval of institutional ETFs such as Grayscale was delayed until June. Upexi transformed into a "Solana version of micro-strategy": GSR and others invested $100 million in SOL, but the market still has differences on the high volatility of SOL as a core reserve.

Bitcoin positioning game: gold or technology stocks, the correlation between Bitcoin and gold hit a two-year high, but its high volatility still highlights the dual attributes of "safe haven-risk", and the market's perception of its role has entered a critical reshaping period. Ethereum upgrade: Pectra upgrade focuses on improving pledge efficiency and the implementation of smart accounts. The entry of giants such as Coinbase promotes the tokenization narrative of US stocks, but compliance and technical bottlenecks still limit liquidity, and the early potential and risks of the track coexist.

1. Macro perspective

In April 2025, the US macroeconomic landscape is significantly affected by President Trump's massive tariff policy, and the complexity of the existing economic environment has been further exacerbated. These measures have changed the trade landscape, impacted global supply chains, and brought new uncertainties to businesses and markets. Policymakers are dealing with a more complex environment, seeking a balance between controlling inflation and supporting growth targets. The overall economic outlook is more cautious, and no immediate systemic risks have emerged.

1. Inflation

Inflationary pressures continued to ease. The consumer price index (CPI) rose 0.2% month-on-month in March, and the year-on-year growth rate fell to 2.4%, lower than 2.8% in February. The core CPI, excluding food and energy, rose only 0.1% month-on-month. It is worth noting that energy prices fell 2.4% in March, including a 6.3% drop in gasoline prices, which played a significant role in slowing overall inflation.

2. Labor Market

The labor market remains resilient. Nonfarm payrolls increased by 228,000 in March, much higher than the market expectation of 137,000 and higher than the 117,000 in February. However, the unemployment rate rose slightly to 4.2%, higher than the previous 4.1%. Although job growth remains solid, the rise in the unemployment rate suggests that there may be potential signs of weakness in the labor market.

3. Monetary Policy

The latest minutes of the Federal Open Market Committee (FOMC) show that the Fed will slow down the pace of balance sheet reduction from April, reflecting concerns about reserve adequacy and financial stability. Against the backdrop of rising uncertainty, the Fed continues to adhere to a data-based policy path, carefully balancing the dual goals of controlling inflation and supporting economic growth.

4. Capital Markets

Since April, the US stock market has experienced significant volatility. On April 21, the Dow Jones Industrial Average plunged nearly 1,000 points, marking its worst April performance since 1932. The market decline was mainly driven by the Trump administration's escalation of tariff policies and concerns about the threat to the independence of the Federal Reserve. The S&P 500 and Nasdaq also recorded sharp declines. Despite a brief rebound after news of the possible launch of trade negotiations, overall market sentiment remains fragile, and investors generally seek safe-haven assets to hedge against continued uncertainty.

5. Trade policy and economic outlook

Since President Trump announced wide-ranging tariffs on April 2, trade tensions have escalated rapidly, particularly intensifying U.S.-China trade frictions. These changes have disrupted global market sentiment and increased volatility in financial markets. The International Monetary Fund (IMF) subsequently lowered its 2025 U.S. economic growth forecast to 1.8%, citing the negative impact of tariffs and increased policy uncertainty. Analysts warned that the full economic impact of these policies has not yet been fully reflected in current data, but poses a significant risk to the medium-term outlook.

Summarize

In April 2025, the US economy showed a combination of slowing inflation and a resilient labor market. However, the intensification of trade tensions and political instability have significantly increased market volatility, casting a shadow on the economic outlook. The Fed faces increasingly narrow policy space: aggressive rate cuts may reignite inflation, while maintaining the status quo may exacerbate consumer pessimism and curb growth. Against the backdrop of the impact of tariffs not yet fully manifesting and global trade expectations shrinking, the market needs to be prepared for continued high volatility, especially paying attention to the June FOMC meeting and the performance of corporate earnings reports affected by tariffs in the second quarter.

2. Crypto Market Overview

Currency data analysis

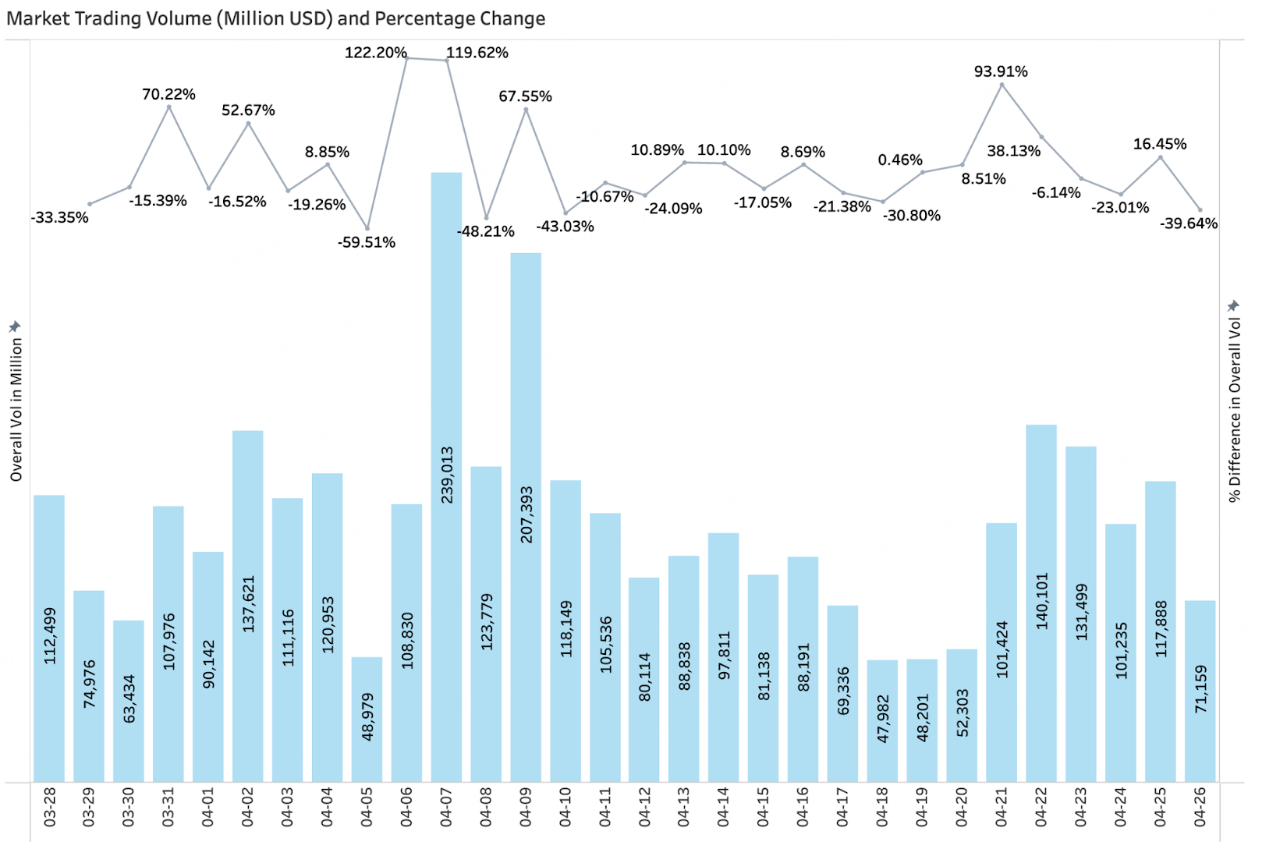

Trading volume & daily growth rate

According to CoinFGecko data, as of April 26, the average daily trading volume was $102.9 billion, down 13% from the previous cycle. On April 7 and April 9, affected by the drop of BTC to $74,000, the bottom-fishing sentiment heated up, driving a sharp surge in trading volume. On April 22, due to the end of the Trump tariff standoff, trading volume rebounded to $140.1 billion, but it was still significantly lower than the level during the high volatility period.

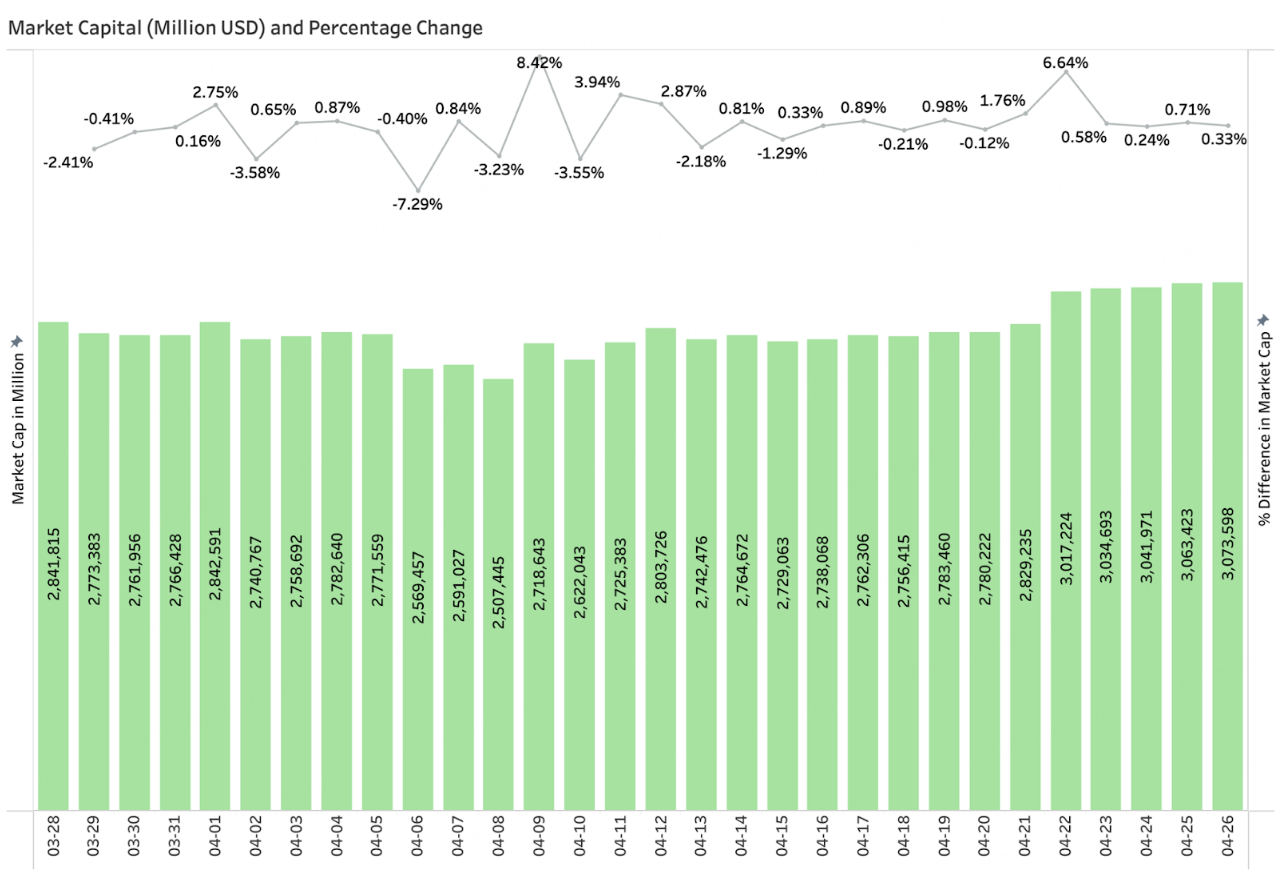

Total market value & daily growth

According to Coingecko data, as of April 26, the total market value of cryptocurrencies rebounded to $3.07 trillion, up 4.17% from the previous month. Among them, BTC accounts for 63.3% of the market, and ETH accounts for 7.4%, and ETH's market share is still low. From April 22 to 26, the total market value rebounded from $2.83 trillion to $3.07 trillion, with a cumulative increase of about 8.6%, and market sentiment turned to cautious bullishness.

New popular tokens in April

Among the popular tokens newly launched in April, VC coins are the main ones, including DeFi staking projects - BABY, STO, and infrastructure projects - INIT, WCT, HYPER, etc.

Token | Token Fullname | CoinGecko/CoinMarketCap | Exchange |

BABY | Babylon | Bitmart, Binance, OKX, Bybit, Bitget, Kraken, Kucoin, Gate, HTX, Mexc, Lbank, Phemex | |

INIT | Initia | Bitmart, Binance, Bybit, Bitget, Kraken, Kucoin, Gate, HTX, Mexc, Crypto, Lbank, Phemex | |

WCT | WalletConnect | Bitmart, Binance, OKX, Bybit, Bitget, Kraken, Kucoin, Gate, Mexc, Crypto, Lbank, Phemex | |

PROMPT | Wayfinder | Bitmart, OKX, Coinbase, Bitget, Kraken, Kucoin, Gate, Mexc, Crypto, Lbank, Phemex | |

ZORA | ZORA | Bitmart, Bybit, Coinbase, Bitget, Kraken, Kucoin, Gate, Mexc, Lbank, Phemex | |

GUN | GUNZ | Bitmart, Binance, Bitget, Kraken, Kucoin, Gate, Mexc, Crypto, Lbank, Phemex | |

HYPER | Hyperlane | Bitmart, Binance, Bybit, Bitget, Kucoin, Gate, Mexc, Crypto, Phemex | |

DARK | Dark Eclipse | Bitmart, Bitget, Kucoin, HTX, Mexc, Lbank, Phemex | |

STO | StakeStone | Bitmart, Bitget, Kucoin, Gate, HTX, Mexc, Lbank, Phemex |

3. On-chain data analysis

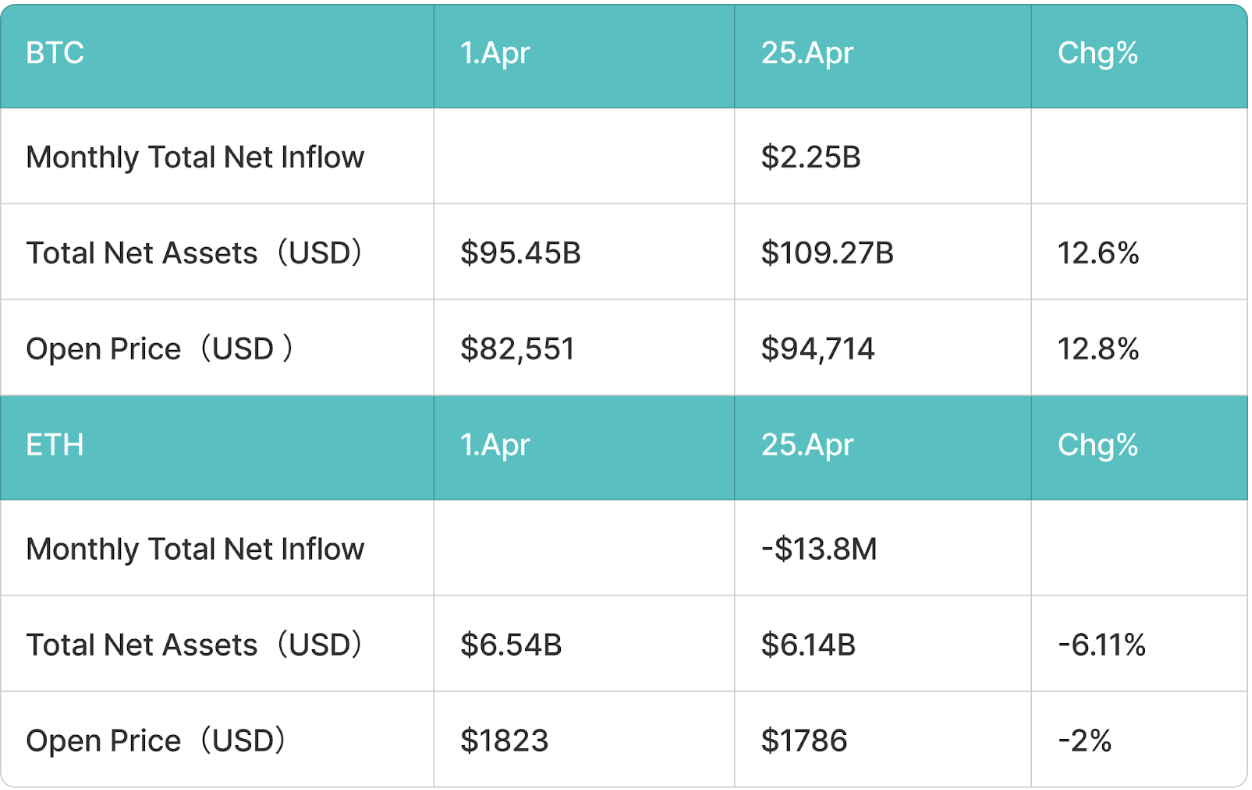

3.1 Analysis of BTC and ETH ETF inflows and outflows

BTC ETFs saw $2.25 billion in inflows in April

The US tariff policy in early April caused a sharp fluctuation in the cryptocurrency market, but the price of BTC rebounded sharply after Trump announced a temporary suspension of the tariff policy at the end of April. As of April 25, the price of BTC increased from $82,551 at the beginning of the month to $94,714, an increase of about 12.8%. In April, BTC ETF funds showed an inflow, with a total outflow of about US$2.25 billion.

ETH ETF outflows of $13.8 million in April

In April, the price of Ethereum continued to fall due to the impact of the US tariff policy. As of April 25, the price of ETH fell from $1823 at the beginning of the month to $1786, a drop of -2%. ETH ETF funds showed an outflow, with a total outflow of approximately US$13.8 million.

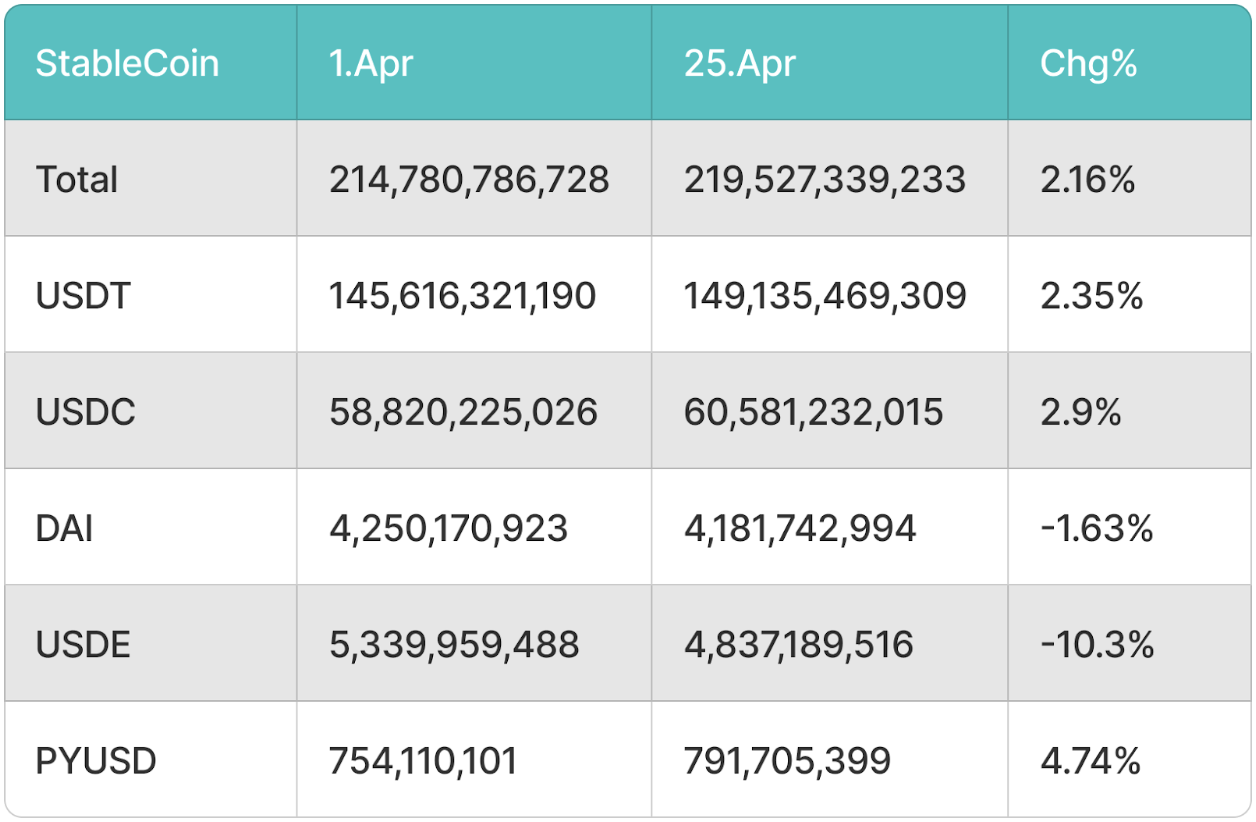

3.2 Analysis of Stablecoin Inflow and Outflow

Stablecoin inflows in April were approximately $4.74 billion, mainly from USDT and USDC

Although the US tariff policy has caused a sharp shock in the cryptocurrency market, the stablecoin market has continued its strong growth momentum. Among them, USDT and USDC have become the main drivers of growth this month, with the circulation volume increasing by approximately US$3.51 billion and US$1.76 billion, accounting for an important share of the expansion of the stablecoin market. On the contrary, the circulation volume of USDE has declined, with a decrease of US$500 million.

4. Price analysis of mainstream currencies

4.1 Analysis of BTC price changes

On April 23, Bitcoin formed a doji candlestick chart, showing hesitation between bulls and bears near the key $95,000 resistance level. The 20-day exponential moving average (EMA) has started to turn up, and the relative strength index (RSI) is close to the overbought zone, indicating that the current price trend is more likely to be upward.

If the buyers can sustain the momentum and hold their ground, a breakout above $95,000 could lead the BTC/USDT pair to rise further towards $100,000 and even $107,000. However, this bullish view will be negated if the price turns down sharply from $95,000 and breaks below the moving average support.

4.2 Analysis of ETH price changes

Ethereum rebounded strongly on April 22 and broke above the 20-day EMA ($1,676). Next, buyers will try to push the price above the 50-day simple moving average (SMA) ($1,830). If successful, the ETH/USDT pair could rally to $2,111; if bulls continue to dominate, the price could rise to $2,550, indicating that the correction phase may be over.

On the contrary, if the price encounters strong resistance at $2,111 and falls back quickly, it means that the bears are still active at high levels, and ETH may maintain a volatile consolidation between $2,111 and $1,368.

4.3 Analysis of SOL price changes

Solana rebounded from the 20-day EMA ($133) on April 22 and attempted to break out of the overhead resistance of $153 on April 23. The EMA is sloping up and the RSI is in the positive zone, which shows that bulls have the upper hand. A successful close above $153 will open the door to a rally to $180 and reactivate the wide range of $110–260.

The bears need to act quickly. If the current levels cannot be defended and the price breaks below the moving average support, the SOL/USDT pair could fall back to the $120-$110 support area.

5. Hot events of this month

1. Trump’s tariff policy triggers volatility in the crypto market

On April 2, 2025, US President Trump announced a 10% "minimum benchmark tariff" for all trading partners and a higher "reciprocal tariff" for 60 countries, and the global financial market experienced dramatic fluctuations. On April 9, the Sino-US tariff war further intensified, with the US tariff rate on China soaring to 145%, and China retaliated by imposing 84%-125% tariffs on the US. This move caused a sharp drop in global stock markets, with the S&P 500 index falling more than 10% in two days, the biggest drop since the 2020 epidemic. At the same time, the price of Bitcoin fell to $74,627. On April 10, Trump announced a 90-day suspension of tariffs on 75 countries, but maintained a high tariff rate of 125%-145% on China. On April 22, Trump changed his attitude, saying that "tariffs on China will be significantly reduced", and US Treasury Secretary Benson also admitted that high tariffs were unsustainable, suggesting that China and the United States may restart negotiations. The crypto market subsequently rose in response, with Bitcoin reaching $93,948 and Ethereum reaching $1,818, both reaching their highest points since March.

2.SEC postpones pledge of Grayscale Ethereum ETF

The SEC has decided to postpone its decision on whether Grayscale's two Ethereum funds (Grayscale Ethereum Trust ETF and Grayscale Ethereum Mini Trust ETF) are allowed to be pledged. The new deadline for the decision is June 1, and the original decision scheduled for mid-April has been postponed. In addition, the SEC has also postponed decisions on other ETFs, including VanEck Bitcoin Trust and VanEck Ethereum Trust, as well as WisdomTree Bitcoin Fund, which will be postponed to June 3. The reason for the postponement involves regulatory issues regarding pledge and physical subscription/redemption mechanisms, especially for cryptocurrencies with high volatility. The SEC said it needs to consider pledge returns, ETF structure, and its impact on market liquidity and risk.

Since last year, the continued slump in Ethereum prices has caused investors to gradually lose confidence in Ethereum. The Ethereum spot ETF staking function is considered to be one of the key factors that stimulate the price of Ethereum, but this delay has once again frustrated investors' wishes. The staking service can bring additional returns to investors, so it is considered a key factor in enhancing the attractiveness of these Ethereum ETFs. However, staking has raised more complex regulatory issues, and the SEC needs more time to conduct a prudent assessment.

3. Upexi — Solana’s version of MicroStrategy

On April 21, GSR, a well-known cryptocurrency trading and investment company, completed a $100 million private equity investment in Upexi, Inc. (UPXI), a Nasdaq-listed consumer goods company, to support its Solana financial strategy transformation. The news stimulated Upexi's stock price to surge more than six times during the day. According to the agreement, Upexi plans to raise about $100 million. In addition to GSR leading the investment, participants in this round of financing include institutions such as Big Brain, Anagram, Delphi Ventures, as well as angel investors such as Austin Federa, Frank Chaparro, and CEO Allan Marshall. But it is worth noting that SOL has no supply limit and high volatility, and traditional institutions face challenges in accepting it as a core treasury.

6. Outlook for next month

1. The market is reshaping Bitcoin’s positioning

Since the introduction of the tariff policy, global economic uncertainty has increased, causing gold prices to soar to $3,500 per ounce, a record high. At the same time, the U.S. stock, U.S. bond and foreign exchange markets have fallen sharply, and investors have been looking for safe-haven assets. In this context, whether Bitcoin can serve as a substitute for gold has become the focus of market attention. As the correlation between Bitcoin and gold has risen significantly, reaching its highest level in two years, it shows that investors have begun to regard Bitcoin as a potential safe-haven asset amid increasing macroeconomic uncertainty. However, although Bitcoin has shown similar safe-haven characteristics to gold in some cases, its high volatility and market sentiment-driven characteristics still make it more similar to risky assets such as technology stocks. Therefore, the market is currently at a critical positioning stage: whether Bitcoin is a safe-haven asset like gold or a risky asset like technology stocks, this positioning depends not only on Bitcoin's correlation with gold, but also on its market sentiment-driven characteristics, volatility, and investors' confidence in it as a safe-haven tool. In the future, as the market has a deeper understanding of Bitcoin's characteristics, its role in the portfolio may become clearer.

2. Ethereum Pectra upgrade and ETF pledge pass expectations

The Pectra upgrade is the next major milestone for the Ethereum network and is expected to be implemented on May 7, 2025. This upgrade consists of two main parts: Prague execution layer upgrade and Electra protocol layer upgrade. This upgrade focuses on enhancing the scalability of the Ethereum network, reducing transaction fees, improving security, and introducing smart accounts. There are currently 8 confirmed upgrade contents:

EIP-2537: Optimize signature verification, improve signature verification efficiency, and enhance security (higher than the old solution).

EIP-2935: Simplify access to historical data, store recent block hashes, and make it easier for stateless clients to obtain historical information.

EIP-7251: Increase the staking limit, raising the upper limit of ETH that a single validator can stake from 32 to 2048, reducing network load.

EIP-7702: Smart account management, ordinary accounts can be temporarily converted into smart contract accounts, supporting transaction bundling and payment of transaction fees with other tokens.

EIP-7742: Dynamic data capacity adjustment, adjust block data capacity on demand, and improve the data processing capabilities of the second-layer network.

EIP-6110: Accelerate validator onboarding, process validator deposits directly on-chain, shorten waiting times and improve security.

EIP-7002: Automated withdrawal process, allowing smart contracts to automatically trigger withdrawals, improving the flexibility of staking services and user control.

EIP-7691: Expand data processing, double the amount of data processed in each block, reduce transaction costs and support high-demand scenarios.

The Ethereum Pectra upgrade has brought important technical improvements, improving interoperability and network efficiency. Combined with the approaching approval window for Ethereum spot staking function in early June, relevant technical progress and regulatory trends may become the focus of the market's observation of the Ethereum ecosystem next month.

3. RWA US stocks on the blockchain

Since 2024, the RWA market has continued to grow. From 2024 to April 2025, the market value of RWA increased from US$8.4 billion to US$20.87 billion, an increase of more than 148%. Among them, the US stock chain is a key branch of the RWA track. Through blockchain technology, US listed stocks are converted into on-chain token assets, realizing 7×24-hour trading and cross-time zone liquidity sharing. Through tokenization, the participation threshold of US stocks is lowered to reach retail investors in emerging markets (investors who cannot buy US stocks due to regional restrictions) and improve the liquidity of US stock assets. In March this year, Coinbase CEO Brian Armstrong said at X that Coinbase is actively exploring the possibility of tokenizing the company's stocks. This statement once again aroused market discussions on the RWA US stock chain. Currently, the popular US stock chain projects in the market include Backed, Injective, BounceBit, etc., but these projects are limited by compliance, technical issues, etc., resulting in the current number of supported stocks, liquidity and chain methods need to be strengthened. Although the U.S. stock chain is still in its early stages, with the participation of leading companies in traditional finance and crypto markets such as Coinbase, RWA U.S. stock chain is expected to become one of the popular tracks for emerging narratives in the future.