Author: Lawrence, Mars Finance

1. A brief history of Doodles: From “cartoon avatars” to the ambition of “Web3 Disney”

As one of the most iconic blue-chip NFT projects in the Ethereum ecosystem, the growth history of Doodles is a textbook case of IP incubation in the Web3 era.

1. The starting point of co-creation between artistic genes and the community (2021-2022)

In October 2021, 10,000 colorful cartoon avatars created by Canadian illustrator Scott Martin (Burnt Toast) landed on Ethereum. These NFTs, named Doodles, quickly broke through the circle with their unique "children's stick figure" style, and the floor price soared to more than 5 ETH, joining the "blue chip club".

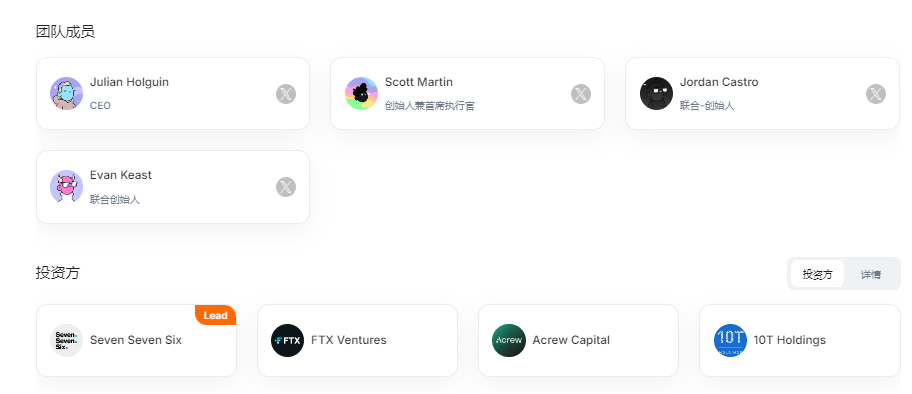

The three founders of the core team — Scott Martin, Evan Keast and Jordan Castro — each play a key role:

- Scott Martin: Visual soul, responsible for all character design and world view construction

- Evan & Jordan: Former CryptoKitties core members, well versed in NFT community operation rules

Different from other PFP (Profile Picture) projects, Doodles emphasizes the concept of "holders are shareholders" from the beginning:

- Set up a Doodlebank community treasury, where holders vote to decide how to use the funds

- Distribute wearable devices through mechanisms such as Genesis Box to achieve dynamic upgrades of NFT

2. Cross-border expansion and capital support (2022-2024)

2022 will be a strategic turning point for Doodles:

- Executive introductions: Former Billboard president Julian Holguin becomes CEO, music superstar Pharrell Williams becomes chief brand officer

- Capital Action: Completed $54 million in financing at a valuation of $704 million, led by 776 Fund (owned by Reddit co-founder Alexis Ohanian)

- Ecological layout:

- Acquires Emmy-nominated animation studio Golden Wolf

- Launched joint products with Adidas and McDonald's

- Develop Doodles 2 dynamic NFT system to support cross-platform character customization

At this point, Doodles has evolved from a simple NFT project to a "Web3 Entertainment Group", and its business scope covers multiple scenarios such as animation, music, games, and offline activities.

3. Transformation in crisis (2025)

In January 2025, founder Scott Martin returned to the position of CEO and announced a return to the "radical innovation" route:

- Stop overly commercialized collaborations (such as McDonald’s coffee collaborations)

- Launched DreamNet ecosystem to build an AI-driven decentralized content platform

- Behind this adjustment is the reality of the continued downturn in the NFT market: Doodles transaction volume in 2024 fell 67% year-on-year, and the floor price has long hovered in the 3 ETH range.

2. Tokenization breakthrough: DOOD’s economic model and strategic logic

In the context of the overall cold reception of the NFT track, Doodles chose to break through with tokenization. On May 9, 2025, its native token DOOD will be launched on Solana and plans to cross-chain to Base L2.

1. Token Economics: Reconstructing Interests under Community Narratives

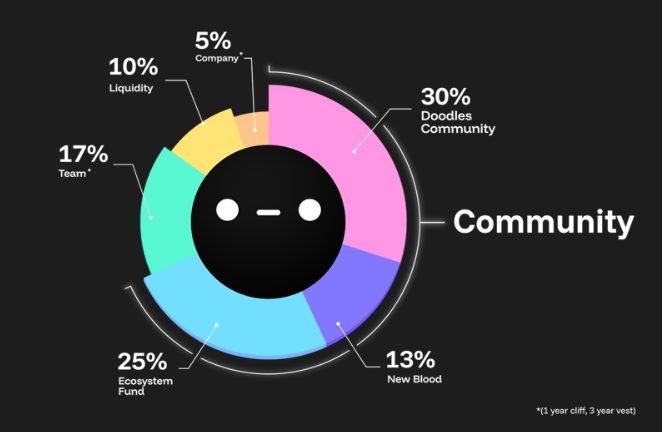

According to the white paper, the total supply of DOOD is 10 billion, and the distribution framework is as follows:

Design highlights:

- Community priority: 68% of tokens go to the community, higher than similar projects (such as Azuki's 37.5%)

- Multi-chain compatibility: The first launch of Solana takes advantage of its high TPS (65,000+/second) and meme culture, and the subsequent cross-chain Base is connected to the Ethereum ecosystem

Potential disputes:

- The definition of "new blood" is vague: the allocation of 13% of New Blood lacks transparent rules and poses a risk of internal manipulation

- Institutional exit pressure: Early investors such as 776 Fund have not announced exit plans, and may cash out through ecological funds

2. Value Capture: From JPG to “Digital Skin”

DOOD is positioned as the "economic blood" of the Doodles ecosystem, and its value capture mechanism revolves around three layers:

1. Governance

- Proposal voting: holders can participate in the decision-making of DreamNet content creation direction

- Staking income: Lock up tokens to get animation IP dividends, co-branded product discounts and other benefits

2. Consumption scenarios

- DoodlesTV: Pay DOOD to watch exclusive animated shorts

- Virtual fashion: Buy wearable devices on the Stoodio platform

- In-game purchases: Prop trading in future metaverse games

3. Speculative targets

- Solana on-chain MEME culture boosts trading popularity

- Cross-chain bridging with Base could lead to arbitrage opportunities

But compared with its competitors, DOOD's practicality is still weak:

- Comparison with PENGU: Pudgy Penguins has generated stable cash flow through physical toys

- Compared with ANIME: Azuki is tied to the anime crowdfunding platform and has a clear consumption scenario

3. Deconstructing the motivation for issuing currency: a life-saving medicine or a sickle for harvesting?

At a time when NFT transaction volume has been halved and blue-chip projects are experiencing sluggish growth, Doodles’ decision to issue coins has sparked polarized responses.

Strategic rationality

1. Solving the liquidity dilemma

The non-standard nature of NFTs leads to a lack of liquidity. By binding tokens, holders can obtain liquid assets through staking, airdrops, etc., avoiding the pressure of selling NFTs at a lower price.

2. Community Activation Experiment

The operation of the DreamNet system relies on token incentives:

- Creators who upload content can get DOOD rewards

- Users earn points by participating in interactions (likes, reposts)

- This “creation is mining” model attempts to replicate StepN’s successful path.

3. Capital exit requirements

Early-stage investment institutions need to exit through token listing. Based on the estimated $54 million in financing, DOOD's FDV (fully diluted valuation) needs to reach $700 million for VCs to avoid losing money, while the current market value of Doodles' NFT is only $64.8 million.

Suspected of cutting leeks

1. Hidden dangers in token distribution

Although the community allocation ratio is as high as 68%, the subdivision rules are questionable:

- 30% of the community airdrops do not specify the snapshot time, which poses a risk of "rat trading"

- The ecological fund is controlled by the team and may be used to manipulate market prices

2. MEME-ization Trap

The choice of Solana as the first launch is essentially to cater to the MEME hype culture. Refer to the average life cycle of tokens on this chain:

- 80% of projects lost 90% of their market value within 1 month of listing

- Trading volume is concentrated in CEX, and on-chain liquidity is scarce

3. NFT reflexivity risk

The decline in token prices may trigger a wave of NFT selling, forming a "death spiral". After Azuki issued its token in 2024, its NFT floor price fell by 58%.

IV. IPO Outlook: Short-selling Signals and Risk Warnings

According to the Marsbit Research Institute model, DOOD may show the following trends:

Short-term speculative window

- First day of listing: Driven by MEME sentiment, FDV may rise to $1.5-2 billion

- Airdrop selling pressure: Based on the 30% community allocation, the potential selling volume in the first week reached 3 billion (about 450 million US dollars)

Medium and long-term risks

- Ecosystem cashing pressure: If DreamNet MVP product is not launched within 6 months, the token will lose narrative support

- Multi-chain operation and maintenance costs: Solana and Base’s cross-chain bridge may become a target of hacker attacks

Short selling strategy suggestions

Suitable for short selling signals:

- FDV exceeds $2.5 billion (corresponding to DOOD unit price of $0.25)

- Large transfers to team addresses

- DreamNet release delayed

Risk Warning:

- Solana has a high degree of market control on the chain, so beware of the risk of short squeeze

- Binance and other exchanges may introduce short selling restrictions

5. Conclusion: Paradigm Revolution and Speculative Bubble of Web3IP

Doodles’ tokenization experiment is essentially an adventure about “securitization of digital assets.” Its idealistic side is reflected in:

- Trying to achieve value sharing between creators and consumers through token economy

- Exploring the transformation of NFT from collectibles to "digital identity passports"

But the cruelty of reality is equally clear:

- In the interest chain formed by VCs, exchanges, and market makers, the community is still in a weak position

- The maturity of the Web3 entertainment ecosystem is far from supporting a valuation of tens of billions

For ordinary investors, the advice is:

- Short-term participation: Take advantage of the liquidity premium arbitrage in the early stage of the exchange listing, and set the stop loss line to -20%

- Long-term avoidance: Unless the user retention rate of DreamNet exceeds 50% after its launch, it is not advisable to hold the position for more than 3 months.

- Ecological Observation: Focus on the music collaboration with Pharrell Williams and the animation output progress of Golden Wolf

In the crypto world, “innovation” and “harvest” are often two sides of the same coin. Whether Doodles can break the curse of “coin issuance is the peak”, the autumn and winter of 2025 will be a key test period.