US-China trade war in 2025

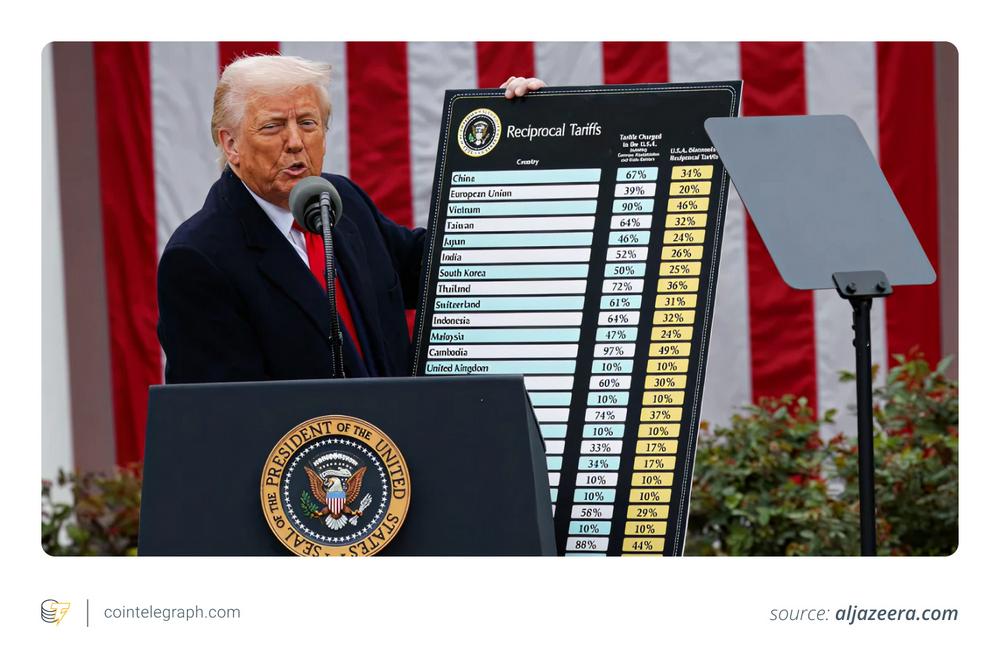

On April 2, 2025, US President Donald Trump declared a national economic emergency and introduced a series of new import tariff policies.

This policy, known as "Liberation Day," sets a 10% base tariff on all foreign goods and imposes a heavy tax of up to 145% on goods from China. The Trump administration describes this move as an important measure to resolve long-term trade imbalances and protect domestic industries.

China responded almost immediately: raising tariffs on U.S. products to 125% and restricting exports of rare earth elements, materials vital to global manufacturing. In just a few days, trade between the world's two largest economies cooled dramatically.

The market reacted sharply. The S&P 500 fell 15% in less than a week. As of April 7, the Nasdaq was down nearly 20% year to date. Investors were shocked by the scale of this escalation and the potential knock-on effects on global growth.

Crypto markets were no less restless. As stock markets fell and uncertainty spread, trading volumes for Bitcoin (then priced at $84,680) surged as many viewed the digital asset as a hedge.

Below we take a deeper look at the impact of this trade tension on financial markets, first on traditional stock markets and then on crypto assets.

The impact of the trade war on the stock market

The market doesn't like surprises, and it doesn't like trade wars even more.

When the United States announced a 145% tariff on Chinese imports in April 2025, Wall Street's reaction was swift and violent. The S&P 500 plunged more than 10% in just two days; technology stocks were hit even harder, with the Nasdaq down nearly 20% since the beginning of the year.

However, if you have experienced previous trade frictions, this scene is not unfamiliar. During the first round of the Sino-US trade war from 2018 to 2019, every tweet about negotiations or new tariffs could cause violent fluctuations in the stock market. And if the timeline is extended longer, the Smoot-Hawley Tariff Act of 1930 is one of the most notorious examples in history - the Great Depression was further exacerbated by soaring global tariffs and a sharp decline in trade.

So why have stocks been hit so hard? There are several reasons. First, tariffs raise the cost of imported goods, which can squeeze profit margins for companies that rely on global supply chains. For example, automakers or electronics brands will either swallow the profit pressure or pass it on to consumers if the cost of components rises. Either way, corporate earnings will be hurt, and earnings are the core driver of stock market valuations.

The second is the "panic effect." Trade wars often bring great uncertainty to the economy - will there be more tariffs? Will other countries fight back? This unpredictable situation will cause companies to postpone investment and recruitment, and consumers may also start to cut spending. Market uncertainty usually manifests itself as increased volatility. The indicator to measure this sentiment is Wall Street's famous "fear index" (VIX), which tends to soar in similar situations.

Central banks sometimes adjust interest rates or inject liquidity to cushion shocks. But monetary policy can only do so much when the root of the problem is political.

As tariffs hit, cryptocurrencies took a hit and then quickly rebounded

Cryptocurrency markets were also hit by the tariffs but rebounded a few days later, highlighting the volatile and sensitive nature of crypto assets amid global uncertainty.

After Trump announced a new round of tariffs, Bitcoin fell to about $76,000. Ethereum and other major cryptocurrencies also fell in sync, and the total market value of global cryptocurrencies evaporated by about $200 billion in a few days.

This type of sell-off is not uncommon. When uncertainty soars, such as when trade tensions escalate unexpectedly, investors tend to choose to "play it safe," withdrawing from high-volatility assets (such as cryptocurrencies) and moving into safer assets, such as cash or bonds. This is a classic "risk-off" mode.

But as you can see, cryptocurrencies don’t usually stay down for long. By mid-April, Bitcoin had rebounded to nearly $85,000. Mainstream tokens such as Ethereum (ETH $1,600) and Ripple (XRP $2.09) also recovered. For many investors, this rebound is another reminder that despite the volatility of the crypto market, it is increasingly seen as a “hedge tool” - an asset choice that is not affected by any government or policy.

During the Sino-US trade friction in 2018-2019, Bitcoin also showed a similar trend: a short-term decline followed by a rapid recovery. In early 2025, when the United States imposed tariffs on imports from Canada and Mexico, it also triggered a wave of declines in the crypto market, but it quickly reversed and rebounded.

In contrast, the stock market has a more difficult recovery. As of April 2025, the S&P 500 has fallen nearly 9% this year, and the Nasdaq has fallen more than 13%. Although the United States subsequently announced a 90-day suspension of tariffs on some countries, which brought a short-term boost, overall, stock market sentiment remains depressed.

What the trade war means for supply chains and consumers

The trade war of 2025 is rippling through global supply chains, causing chain reactions industry by industry.

From electronics to cars to medicine, the cost of moving goods around the world is rising. Take the impact on electronics and semiconductors, for example.

The electronics industry is the first to be hit. In 2024, the United States imported $146 billion worth of electronics from China. With the sharp increase in tariffs on these goods, companies will face up to $182 billion in additional costs each year if this tariff level continues.

This is also bad news for consumers. Take Apple as an example. Since the phone has not yet received a long-term exemption, the price of the iPhone 16 Pro Max may increase from $1,199 to more than $1,800. Considering that laptops, chips and smart devices may also face new tariffs in the future, the entire industry is in a state of high tension.

Tariffs rise, markets volatile, what happens next?

The bigger picture surrounding the U.S.-China trade war in 2025 remains murky, but its impact on investors, corporate executives and global policymakers is already evident.

We can look at future trends from three perspectives: short-term, medium-term and long-term .

In the short term, there was a bit of a respite. The US announced that some tech products, such as smartphones and laptops, would be temporarily exempted from the toughest tariffs, which gave markets a temporary relief. The S&P 500 rebounded, and global markets followed suit. Asia's technology index rose, and European markets such as Germany's DAX and the UK's FTSE 100 also rose. Strong earnings reports from the US bank industry further boosted market sentiment.

However, this relaxation may only be temporary . The exemption policy is still under evaluation, and overall trade policy is like quicksand and may change direction at any time.

In the medium term, risks are starting to increase . If the trade conflict continues, it is likely to seriously slow down global economic growth. JPMorgan Chase has raised the risk of a global recession to 60%, which is not a small number. Central banks around the world have also re-entered a wait-and-see and preparation mode - interest rate adjustments, coordinated actions, and emergency plans are once again on the agenda.

Some voices have begun to call for a global response, such as former British Prime Minister Gordon Brown, who suggested a global coordinated response similar to the 2008 financial crisis. And companies are also re-examining their supply chains, trying to find alternatives - but this is easier said than done.

In the long run, the global landscape may undergo structural changes . Many countries are trying to establish new trade agreements to reduce their dependence on traditional economic powers. For example, China is accelerating the internationalization of the RMB and promoting the "Belt and Road" initiative. The United States is increasing its investment in domestic manufacturing in an effort to reduce its dependence on imports.

This shift could have significant consequences. The World Trade Organization (WTO) has warned that total U.S.-China trade could shrink by as much as 80%. The two countries together account for about 3% of global trade, and such a sharp decline could cause severe shocks to the global economy.

Summarize

The trade war in 2025 is far more than a superficial digital game of tariffs. It has a profound impact on global economic confidence, market structure and geopolitical landscape. Short-term relief, medium-term storm, long-term reconstruction - this may be the reality we have to face next.

By Bradley Peak, CoinTelegraph

Compiled by: PowerBeats

original:

https://cointelegraph.com/explained/how-trade-wars-impact-stocks-and-crypto

Contact us and join the community

Follow and Join us

Telegram: @PecPowerversechain

Disclaimer: This article is a compilation of PowerBeats and does not constitute investment and application advice. You are welcome to share this article with more friends.