CoinGecko just released its quarterly report for Q1 2025, and the numbers are quite eye-catching:

In the first quarter, the total market value of cryptocurrencies fell from 3.8 trillion at the beginning of the year to 2.8 trillion, a drop of 18.6%;

The average daily trading volume was 146 billion, a 27% decrease from the previous month.

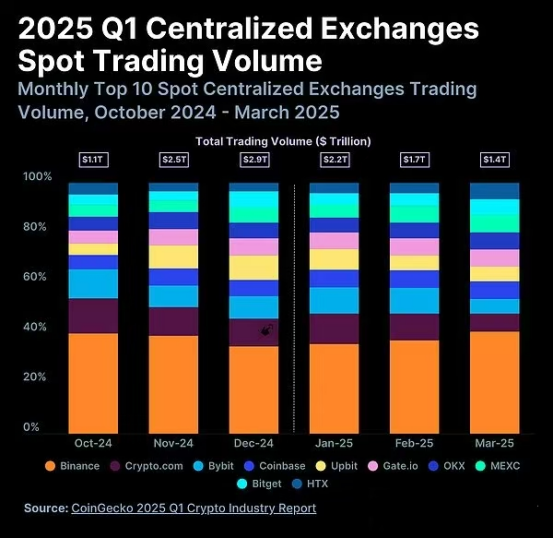

CEX also failed to hold up, with spot trading volume falling to 5.4 trillion, a decline of 16.3%.

The market is cooling down and the platforms are starting to stratify.

User activity has declined, transaction volumes of various companies have dropped, and the voices of KOLs calling for orders are not as loud as before.

But if you look closely, the status of each exchange is getting further and further apart - some are still moving forward steadily, while others have been clearly marginalized.

Some of them rely on the system and the market to hold up the basic market.

Some rely on social media and public opinion to keep up appearances and prevent collapse.

The major exchanges have been playing quite divided this season, each with its own game, some are collecting, some are grabbing, the game has not yet ended, but the cards have begun to be shuffled.

HTX: The only exchange that grew against the trend this quarter

In the first quarter, many exchanges experienced a decline in trading volume, but HTX unexpectedly saw positive growth.

According to data provided by Coingecko, HTX is the only mainstream exchange that achieved a month-on-month increase in spot trading volume in Q1 - an increase of 11.4%.

It didn’t promote AI, didn’t tell the big story of Web3, didn’t appear on many hot searches, and even the discussion in the community wasn’t very hot. What did it rely on? In two words: nothing.

It's really okay.

There were no explosions, no public opinion, no project failures, no users being blocked from withdrawing money. There was not even any downtime. The more chaotic the market, the quieter it is.

Of course, it didn’t stay stable by meditation. The key is that it didn’t let go of where it should be rolled out - in traditional sinking markets such as Latin America and Southeast Asia, activities are still going on, coins are still going up, and the community is still calling for it. Although the overall volume is not large, the number of people has not dropped and the traffic has not collapsed.

You say this is strategic? OK.

You said that no one noticed it and it escaped the impact? That's not unreasonable.

But in the final analysis, the market is like this now: if you don't get into trouble, you will be stable; if you are stable for long enough, others will naturally look at you.

Binance: It gets criticized the most, but if something happens to someone else, you should still transfer money to it first.

It is said that the market is not good, and users are indeed running away; but if you zip up the data, you will find that after running around, they finally run back.

To be honest, nowadays people are reluctant to keep their money on a platform that “looks lively” for too long.

When the market cools down and risk control is tightened, no one wants to wake up to find the withdrawal button is greyed out.

But you want to say that Binance’s stock price rebounded due to “word of mouth”? Forget it.

This platform is now the most convenient punching bag in the entire cryptocurrency circle——

No one understands the rules for listing and listing coins, the voting mechanism has been criticized, the internal rhythm has to be guessed, and even the FDUSD decoupling drama "starring Brother Sun" ended up with Binance being the hot search topic.

Criticizing Binance is no longer an emotion, it’s a habit.

But the market does not look at who gets scolded more, but who gets into less trouble.

At the end of Q1, Bybit exploded, and OKX also suspended its own DEX due to the Bybit theft;

What about Binance? As usual, the community is still criticizing and KOLs are criticizing, but the platform has not exploded. He Yi even opened a "wishing pool" and the popularity has not decreased at all. She stabilized the situation with just one sentence "1:1 redemption" during the FDUSD storm, and even Brother Sun didn't have to speak out.

What big moves did it make this quarter? Really nothing.

There is no rush for new tracks, new strategies, or new narratives.

But because it has no explosions, no card withdrawals, and no background surprises, it has become the most scarce ability at this stage - stability .

The cryptocurrency world never talks about emotions.

The market is really urgent. Whichever exchange you click on when your hands are shaking is the one you trust.

Binance may not be liked by people.

But it's not what scares you.

In CEX, it is really the only one that can achieve the goal of "being scolded every day, but still having to use it".

Bybit: The year is not favorable, the decline is obvious, Ben Zhou is really anxious

Bybit had a really bad quarter, stepping on several landmines in a row, and the mood of the entire platform was written all over their faces.

First it was hacked, and then without a sound, the data was directly exposed - the spot volume in March was cut in half, 52.4%, with no ambiguity, as if the platform itself did not want to keep any positions.

Then Twitter was in a state of emergency.

A KOL came up and fired back and forth, saying that Bybit had invited college students to open contracts, and even asked the legal department to report the OKX wallet. Even the Bali KOL team building was said to be a way to silence people. How could Ben Zhou not be anxious after seeing this? He personally stepped in to question, "Do you have any evidence?" and even cursed at the end!

You say he is impulsive, but this is not the first day he has been on this kind of situation; you say he is calm, but he was able to lower his status and post three messages in a row, which shows that he really couldn't stand it.

Off-field action followed suit.

KOL team building has not stopped, content marketing has been carried out vigorously, and the currency has not even warmed up yet before it was airdropped to BNB users.

See through it at a glance: they want to cut off Binance’s old positions.

But the people who support BNB are not attracted by wool. They are talking about "stability". You can't let them switch to the exchange just by giving them a few tokens. They don't want sweetness, but confidence.

There is also a saying in the circle that after being hacked last time, Bybit borrowed a sum of funds from Bitget as a buffer. Although no one has confirmed it, now looking at these two companies, they are competing for users while going back and forth, which is quite smelly.

It’s not that no one is in charge of Bybit, it’s that the control is too intense. It feels like a KOL who has suffered three consecutive losses and wants to turn over just by staring at the desktop, but his hands slip and his speech goes wild.

It’s not that it didn’t try hard this quarter, the problem is that it got too anxious and things got chaotic, and when things got chaotic, no one believed in it.

OKX: There are so many functions that you have to hold a meeting, and the experience is so heavy that you have to feel tired when withdrawing coins

OKX didn’t encounter any problems this quarter, but it also had many issues. The biggest feeling can be summed up in two words: heavy.

Everyone knows that OKX's selling point is its many functions, including wallets, investment research, quantitative analysis, Launchpad, on-chain identity, AI strategies, etc. When you first enter, it's like entering an Office suite in the trading world, with everything but a tutorial.

The problem is, no one really wants to learn new things nowadays.

When the market cools down, users just want to withdraw their coins with one button. They don’t want to click five times to find “fund transfer”, nor do they want to figure out which tabs “on-chain assets” and “platform assets” are on. Many people say that its experience is professional, and yes, it is so professional that “users have to learn it by themselves”.

It takes three levels of verification to withdraw coins, and sometimes the chain cannot be selected. USDT is stuck for two minutes when it comes out, which makes me lose my mind.

To be honest, there is nothing wrong with OKX's technology, its backend is stable, and its data looks good. The problem is that it wants to prove that it "can do everything", and as a result, it complicates "simple transactions".

Many users are not dissatisfied with it, but they don’t want to waste their time on it when the market is bad.

In addition, the Bybit confrontation on Twitter a while ago, although it had nothing to do with OKX on the surface, the KOL took the side, and the personality behind the platform was automatically attached to it - calm, calculating, with processes, and no feedback. Over time, even the living people in the community were silent.

OKX is not short of functions or budget now. What it lacks is the thought in users’ minds that “this is the first thing they think of when something goes wrong.”

Once this sentence is no longer yours, no matter how many functions you have, it will become a burden.

Bitget: Xie Jiayin is popular, but Bitget has not established its personality yet

Bitget has been quite active in the Chinese-speaking world this quarter, but it was not the platform that was active, but Xie Jiayin.

Lao Xie has now become the "exposed symbol" of Bitget, speaking on the microphone, posting, showing up, and taking sides, just like a KOL-level persona. Many users outside the circle even think that he is the boss, but in fact he is only the person in charge of the Chinese-speaking market. There is a boss above him, and he is responsible for the community, marketing, and rhythm.

It’s not that this is bad, at least Bitget has a voice in the Chinese community. But the problem is:

The platform itself did not become popular, but the person in charge did.

You say its contract has characteristics? Everyone has;

You said it's active? It's been giving away gifts recently;

You say it has brand recognition? Most people need three seconds to say what it is.

Bitget is now like a project that advertises frequently, but the users who actually open the App are still the old users. It is not that no one uses it, but it has not yet reached the "stable stage to accept new users".

There is another thing that everyone in the industry knows but no one talks about: the last time Bybit exploded, Bitget actually provided it with liquidity. On the surface, the two companies are now competing for KOLs and market share, but underneath, they may be settling accounts while putting out fires, and their relationship is more complicated than anyone else.

So you're saying Bitget has no voice this quarter? No, it's very loud;

It's still too early to say whether it's gaining momentum.

There are people in the community, but the market situation has not yet been determined; there are moves in the market, but the perception is still floating.

Who is the king?

After Q1, no one actually won.

HTX has bottomed out and ushered in a long-awaited growth;

As OKX becomes more and more important, will the user experience decline?

Bybit has been hit by a series of failures, and has been putting out fires this season;

Bitget was set up by someone, but the platform did not become an anchor;

Binance is still the one most easily criticized, but it is also the one that no one dares to leave in the end.

This quarter shows a reality:

The market does not depend on who speaks well, but on who causes less trouble;

Users don’t trust the platform, but look at which one is least likely to harm them.

You are slow to get started, slow to push, and conservative in your pace, and you will be scolded for everything;

But if the market really collapses, everyone knows exactly where the money should go.

Ultimately, the platform can be changed and the narrative can be recreated, but once trust is broken, it is difficult for users to give it a second time.

The Spring and Autumn period of CEX has not ended yet, and many platforms can still make money and turn over;

But starting from this quarter, for some platforms, the question is no longer whether they can increase.

But whether we can still take over the positions in the next round of fluctuations.