1. Market observation

Keywords: sUSD, ETH, BTC

Affected by the Good Friday and Easter holidays, the U.S., Hong Kong, European and Australian stocks are closed today, of which the Hong Kong, European and Australian stocks will continue to be closed until next Monday. At the same time, the price of gold soared to an all-time high of $3,357 per ounce yesterday, sparking speculation about whether Bitcoin will follow suit. Historically, whenever gold rises, Bitcoin will break through its all-time highs a few months later. Joe Consorti, head of growth at Theya, pointed out that Bitcoin usually follows the trend of gold with a lag of 100-150 days, and Bitcoin is expected to reach a new all-time high between Q3 and Q4. However, JPMorgan Chase's latest report pointed out that in the context of the global trade war launched by Trump, investors are more inclined to invest their funds in gold rather than Bitcoin.

It is worth noting that according to Santiment data, transaction costs on the Ethereum network have dropped to their lowest level in five years, currently around $0.168 per transaction. Brian Quinlivan, marketing director at Santiment, explained that as fees have decreased, the number of people sending ETH and interacting with smart contracts has also decreased, which is essentially a supply and demand system. When network activity decreases, users do not need to bid high fees to speed up transaction confirmation, so the average fee decreases. From a trading perspective, low fees may hinder price rebounds, but traders seem to be patiently waiting for global economic uncertainty to pass before increasing the frequency of Ethereum and altcoin transactions. In addition, crypto analyst Ali Martinez said that the TD Sequential indicator (TD Sequential) issued a buy signal on the Bitcoin weekly chart. If the price of Bitcoin continues to close above $86,000, it may push its price further up to $90,000 or even $95,000.

On the regulatory front, Slovenia plans to impose a 25% tax on personal cryptocurrency profits from January 1, 2026, and the proposal is currently awaiting public feedback and parliamentary approval. The new rules will apply to profits from exchanging cryptocurrencies for fiat currency or using them to purchase goods and services, while exchanges between cryptocurrencies will remain tax-free. Meanwhile, Panama City Mayor Mayer Mizrachi Matalon announced that the city government has approved the use of Bitcoin, Ethereum, USDC and USDT to pay taxes, fees, tickets and licenses, and through cooperation with partner banks, cryptocurrencies will be converted into US dollars when paid. Meanwhile, Powell himself said at the Economic Club of Chicago that banks' rules related to cryptocurrencies may be "relaxed" in the future, and despite a wave of failures and frauds in the cryptocurrency field over the years, the field is becoming more mainstream.

On the macro level, the Wall Street Journal reported that Trump is considering firing Fed Chairman Powell, but former Fed Governor Walsh and Treasury Secretary Bensont both oppose the move. Michael Gapen, chief economist of Morgan Stanley in the United States, pointed out that paying attention to the monthly non-farm payroll report is a reliable indicator of the health of the economy, especially whether the pace of new jobs in the US labor market is sufficient to keep wage growth above inflation. Although the Trump administration's tariffs and immigration policies may drag down the economy this year, Gapen believes that the economy will still grow, but at a slower pace. It is worth noting that Trump said on Thursday that the tariff increase between the United States and China may be coming to an end, suggesting that he may seek to reduce the level of tariffs. This news pushed international oil and copper prices to rebound, and Asia-Pacific stock markets generally rose.

2. Key data (as of 12:00 HKT on April 18)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin : $84,600.27 (-9.56% year-to-date), daily spot volume $18.584 billion

Ethereum : $1,579.14 (-52.59% year-to-date), with a daily spot volume of $9.99 billion

Fear and corruption index : 33 (panic)

Average GAS : BTC 1.5 sat/vB, ETH 0.37 Gwei

Market share: BTC 63.1%, ETH 7.2%

Upbit 24-hour trading volume ranking : AERGO, XRP, IQ, STRAX, ARDR

24-hour BTC long-short ratio : 1.0358

Sector gains and losses : AI sector rose 4.12%, GameFi sector rose 2.98%

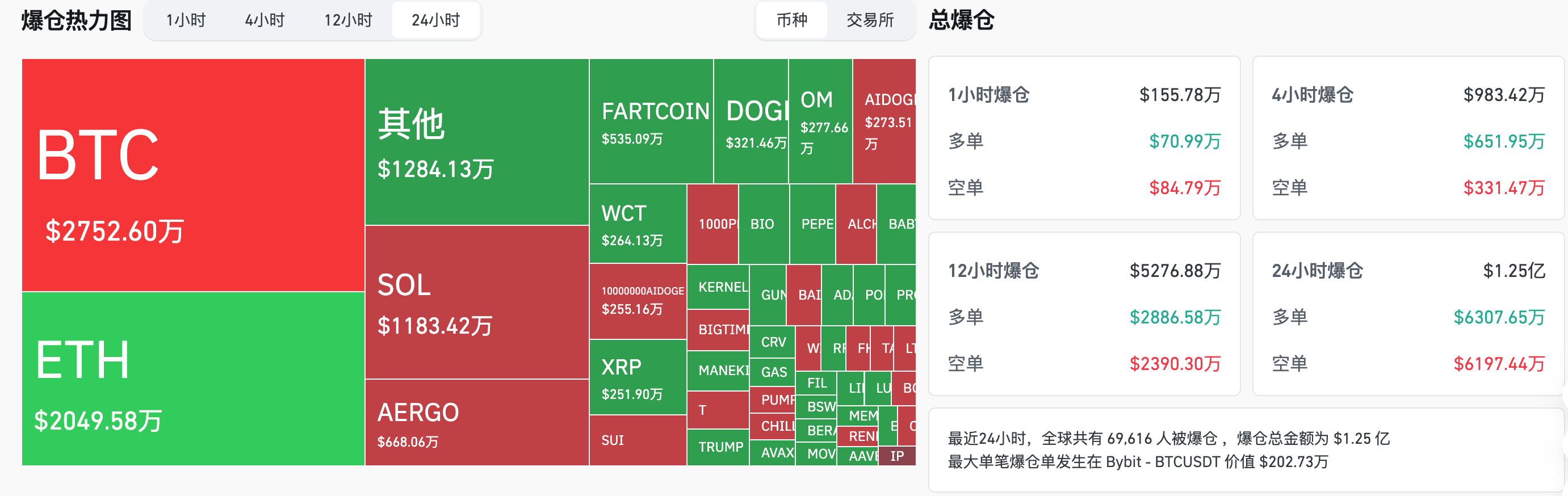

24-hour liquidation data : A total of 69,616 people were liquidated worldwide, with a total liquidation amount of US$125 million, including BTC liquidation of US$27.52 million, ETH liquidation of US$20.49 million, and SOL liquidation of US$11.83 million

BTC medium and long-term trend channel : upper channel line ($84121.77), lower channel line ($82456.00)

ETH medium and long-term trend channel : upper channel line ($1647.69), lower channel line ($1615.06)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 17 EST)

Bitcoin ETF: $108 million

Ethereum ETF: $0 million

4. Today’s Outlook

TRUMP will unlock 4% of the total supply of tokens on April 18, worth approximately $321 million

Immutable (IMX) will unlock approximately 24.52 million tokens at 8:00 am on April 18, accounting for 1.37% of the current circulation and worth approximately $1,060.

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens at 8:00 am on April 18, accounting for 17.5% of the current circulation and worth approximately $1,310.

QuantixAI (QAI) will unlock approximately 566,000 tokens at 8:00 am on April 18, accounting for 3960.24% of the current circulation, with a value of approximately US$49.9 million;

Fasttoken (FTN) will unlock about 20 million tokens on April 18, accounting for 4.65% of the current circulation and worth about $81 million.

Polyhedra Network (ZKJ) will unlock approximately 15.53 million tokens at 8:00 am on April 19, accounting for 25.72% of the current circulation, with a value of approximately $35.25 million.

The biggest increases in the top 500 stocks by market value today: KEEP up 67.41%, AERGO up 62.53%, T up 52.24%, STIK up 34.52%, and ZENT up 26.05%.

5. Hot News

Arizona Cryptocurrency Reserve Bill Passes House Committee, Moves to Third Reading

Binance Wallet to Host Lorenzo Protocol (BANK) Token Generation Event

sUSD de-pegging intensified to $0.6825, with a 24-hour drop of 16.5%

A whale invested nearly $8 million in five days to buy $HYPE, and has made a profit of $266,000

GOMBLE (GM) will be listed on Binance Alpha and launch airdrop activities

Family offices have nearly five times more allocations to spot Ethereum ETPs than to Bitcoin

Abraxas Capital-related wallets again withdrew 1,107 BTC from exchanges, worth $93.47 million

The U.S. SEC will hold the third crypto policy roundtable on April 25, focusing on custody issues

Powell: Banks' rules on cryptocurrencies may be "relaxed" in the future

Raydium launches LaunchLab token issuance platform, 25% of transaction fees used for RAY repurchase

DWF Labs opens US office and spends $25 million to buy WLFI tokens