By Patti, ChainCatcher

Editor: TB, ChainCatcher

Onchain trading platform Glider is quietly rising.

Recently, Glider completed a $4 million financing led by a16z CSX, with participation from investment institutions such as Coinbase Ventures, Uniswap Ventures and GSR. The strong financing lineup has attracted the attention of the crypto community and triggered widespread attention in the industry to the onchain asset management track. Glider's popularity continues to rise.

Pain points of on-chain asset management

As for traditional financial management institutions, Bitwise, Grayscale, etc. usually adopt a custody model, and user assets are centrally managed by institutions. In Glider's view, although traditional asset management institutions provide professional management services to a certain extent, they also sacrifice the user's autonomy over assets.

Glider co-founder Brian Huang once said that what makes Glider different is that it will not custody users' assets like traditional finance, but will be achieved through blockchain technology.

But even on-chain, portfolio management faces many challenges:

High technical complexity threshold: In a multi-chain ecosystem, the heterogeneity of Gas tokens, the latency risk of cross-chain bridging, and the real-time requirements of rebalancing strategies make manual operations difficult when responding to market fluctuations.

Infrastructure is severely fragmented: There is a lack of standardized interfaces between DeFi protocols, and users need to frequently switch between AMM, lending protocols, and options platforms.

Asymmetric returns and risks: Retail investors often fall into the dilemma of "strategy becomes invalid once disclosed" during the process of strategy replication, while professional institutions build advantages by relying on quantitative models. This information gap leads to a small number of people holding most of the on-chain returns.

In response to the above problems, Glider proposed a new concept based on the balance between the automation execution layer and user control.

Intent-driven modular system

Glider co-founder John Johnson said that the creation of Glider was out of frustration with the fragmented infrastructure that has long plagued cryptocurrency portfolios, and Glider was born to completely eliminate this friction and achieve precise and automated execution across networks.

The core idea is to build the "middleware" of on-chain asset management, decoupling the strategy formulation, execution, risk control and other links into programmable modules. Users can configure parameters according to their own needs, or choose the smart templates provided by the platform.

The core of Glider's product is an intent-driven modular architecture. Users only need to set investment goals and strategic intentions, and the underlying chain abstraction technology will automatically complete cross-chain operations, asset adjustments, and transaction execution, reducing the burden of manual operations.

Glider's technology stack adopts a modular design with the following features:

Portfolio Construction

Users can customize their investment strategies using intuitive asset allocation tools or curated templates.

Automated execution

Glider searches for liquidity on different chains and manages rebalancing to trigger transactions. When market conditions change, the system can automatically execute preset strategies.

Unmanaged Integration

Users can connect any existing wallet (such as MetaMask, Rainbow, Safe, WalletConnect, etc.) without the need for a new mnemonic.

Integrated lending

Glider automatically lends and optimizes returns through trusted DeFi lending protocols such as AAVE. Users can use their assets for lending operations without transferring asset ownership to obtain additional income opportunities.

Collaborative Investment

Users can share strategies and customize them to continuously optimize their portfolios.

Integrated backtesting

Users can use historical data to test strategies on the Glider interface and compare performance with BTC, ETH and other benchmarks. Through the backtesting function, they can understand the performance of the strategy in advance.

Team Background

Judging from the currently disclosed founding team information, the team members are mainly Brian Huang and John Johnson.

As co-founders, Brian Huang and John Johnson also have impressive resumes, having worked at well-known institutions such as Anchorage Digital, XTX Markets, 0x and Matcha. Other team members also come from well-known companies in the industry such as Coinbase, MetaMask, 0x, Cega and PoolTogether.

Brian Huang holds a Ph.D. in Computer Science from MIT. He served as the chief architect of Anchorage Digital and led the development of a cross-chain hosting system that supports more than 20 public chains.

As an early core developer of the 0x protocol, John Johnson led the reconstruction project of the Matcha aggregation trading engine, which set an industry record of US$1.2 billion in daily trading volume.

Conclusion

Currently, Glider is still in technical testing and the product is scheduled to go online in the next few months.

According to the official website, the product is currently invitation-based and the waitlist is open.

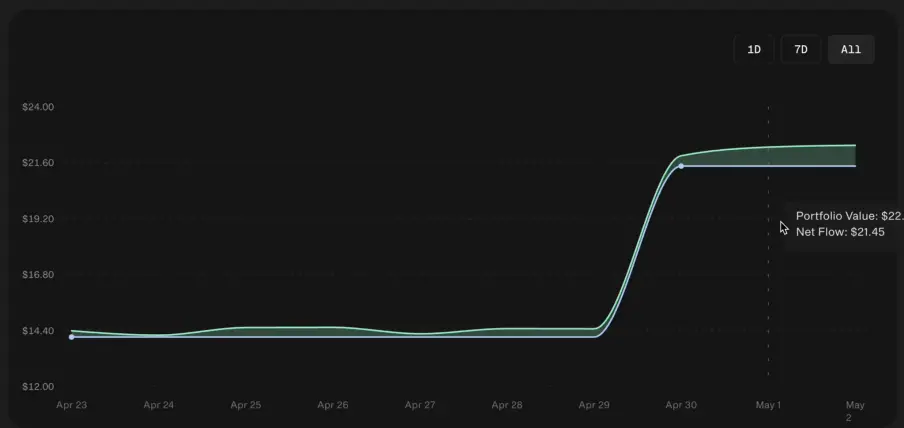

According to Glider builder @marcos_0x, more features of Glider are currently under development. Currently, Glider can display the current value of the user's investment portfolio and the net flow of funds (a key visual clue to understanding investment performance).

In addition, according to its official disclosure, it plans to make profits in the future by charging users management fees based on a certain percentage of the size of their managed assets.

As the cryptocurrency industry evolves from a "financial experiment" to a "value network," true decentralization should not come at the expense of user experience, but rather should internalize complexity through technological innovation.

John Johnson, co-founder of Lianchuang, once said: "Everyone should be able to adjust their investment portfolio precisely according to their own wishes, realize automation, and invest as they wish within their own risk tolerance and risk preference."

Perhaps, only when on-chain asset management can be as simple and easy to use as ETFs in traditional finance, DeFi will have the hope of transforming from a geek toy to a mainstream financial infrastructure.

Glider is making new attempts in the field of on-chain asset management.