A civil judgment from a Shanghai court that has been circulating recently has caused some controversy in the cryptocurrency circle, mainly in terms of the understanding and application of civil judgment rules for virtual currency trading. Although Lawyer Liu mainly defends criminal cases in the cryptocurrency circle, he has also paid attention to and studied civil judgments in the cryptocurrency circle since the "9.24 Notice" in 2021. In this article, I would like to express my views on the judgment of a Shanghai court.

(Picture from the Internet, please delete if infringed)

I. Brief Introduction of the Case

First of all, it should be noted that Lawyer Liu has not seen the complete judgment, but from the existing content, the basic situation of this virtual currency trading/investment dispute can be basically outlined:

In 2021, Zhang (plaintiff) and Shen (defendant) met through an introduction. Shen sold to Zhang the virtual currency wealth management product he represented (described as "'U' wealth management product" in the judgment). Zhang then transferred (RMB) XXX yuan to Shen in two installments to purchase the U coin wealth management product in the hope of obtaining high returns. All the virtual currency wealth management products purchased by Zhang after the transfer were controlled and managed by Shen. Later, the wealth management platform operated abnormally and stopped trading. Zhang asked Shen for a refund. Shen transferred part of the money to Zhang, but the remaining money has not been refunded. Zhang then sued Shen in court.

II. Court Decision

The court held that according to the "9.24 Notice" and other relevant regulations, no one may engage in the issuance, financing, sale, exchange and other businesses of virtual currency in China. The virtual currency financial management promoted by the defendant Shen to the plaintiff Zhang "behavior is illegal financial activities and violates public prosecution ethics";

The court also held that after the defendant Shen received the money from the plaintiff Zhang, he did not open a trading account for Zhang on the financial management platform, nor did he transfer the U coins (financial management products) to Zhang. Instead, Shen controlled the sale and withdrawal of U coins himself, and Zhang could not do it on his own. Therefore, when the financial management platform was abnormal and transactions could not be made, Shen should be responsible for Zhang's losses.

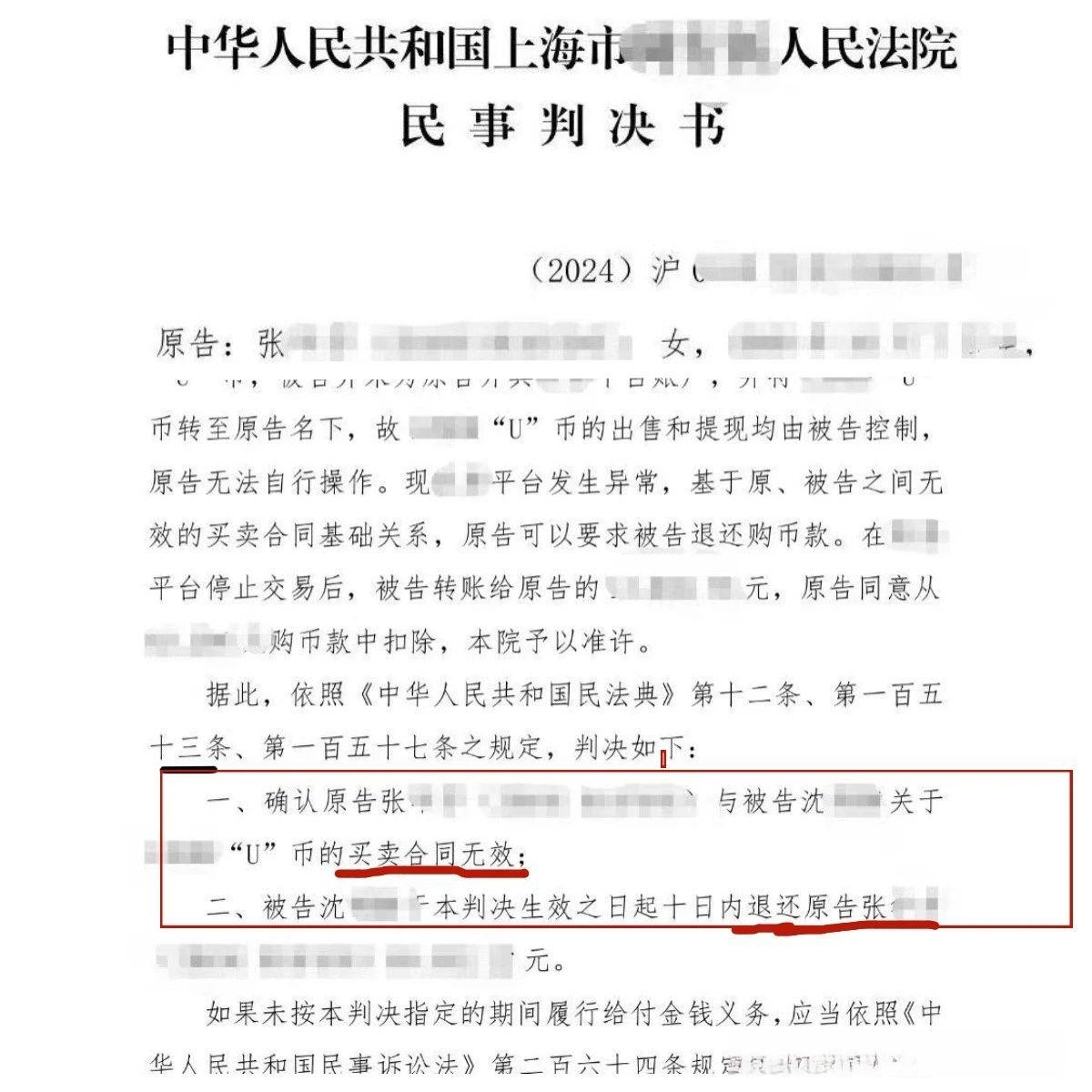

Ultimately, the court ruled that the U-coin purchase and sale contract between Zhang and Shen was invalid , and Shen was required to return the XXX yuan that Zhang had spent on the purchase of the coins (minus the portion that had already been returned) within ten days of the judgment taking effect.

3. Lawyer Analysis

First, it is not easy for the court to accept civil cases involving virtual currency and make a judgment at present. It may also be because the plaintiff is the party that pays RMB. If the plaintiff in this case pays virtual currency, it may be difficult for the court to accept the case.

Secondly, for the party who pays RMB to buy U-coins for financial management, when the financial management purpose cannot be achieved, what kind of legal remedy should be provided? We know that the "9.24 Notice" does have a provision: "If any legal person, non-legal person organization or natural person invests in virtual currency and related derivatives and violates public order and good morals, the relevant civil legal acts shall be invalid , and the losses caused by it shall be borne by themselves."

In its judgment, a court in Shanghai analyzed the part of "the relevant civil legal acts are invalid", but seemed to have overlooked the sentence " the losses caused by this shall be borne by the investor himself ". My understanding is that the losses caused by investing in virtual currency should be borne by the investor himself, not by the entrusted agent (in this case, Shen); of course, the judge also stated his reasons: Shen did not give the virtual currency to Zhang for control, but controlled it himself, so the risks caused by the abnormal operation of the investment platform should also be borne by Shen. I think this is actually a disguised "bottom line clause". If Zhang and Shen agreed that the U coins purchased by Zhang would be managed and invested by Shen, and the abnormality of the operating platform was not caused by Shen, then Zhang's losses should be borne by himself, because the person who invested in virtual currency was Zhang, not Shen.

Finally, even if the judge has great discretion in civil and commercial cases, or considering the principle of fairness, Shen needs to bear responsibility for Zhang's losses, it should be done according to the existing regulations - according to Article 84 of the Minutes of the National Court Financial Trial Work Conference (Draft for Comments):

If the parties agree in the contract that the principal registers an account on the virtual currency trading platform in his own name and entrusts the trustee to engage in investment activities; or if the principal directly delivers the funds to the trustee, and the trustee engages in investment management in his own name or in the name of another person, it can be determined that the two parties have established a commissioned investment contract. If the contract is signed after the release of the "Announcement on Preventing the Risks of Token Issuance and Financing" (September 4, 2017), the People's Court shall determine that the entrustment contract is invalid because the agency matters are illegal. For the losses suffered by the principal, the cause of the entrusted matters can be used as the main consideration for determining the degree of fault, and the parties shall share the losses.

From this, we can at least be sure that; first, the contract signed between Zhang and Shen was not a virtual currency purchase and sale contract, but a commissioned investment contract; second, the contract signed between Zhang and Shen occurred after the "9.4 Announcement". According to the above provisions, the different fault ratios of Zhang and Shen should be considered for Zhang's losses, and the losses should be borne jointly by both parties, rather than just by Shen.

IV. Conclusion

However, this case is only a civil dispute after all, and Lawyer Liu is not Shen's lawyer. Zhang and his lawyer still achieved a good result in this case. If I were Zhang's lawyer, I would also do my best to get the court to order Shen to return all the investment funds.

Although this case of the Shanghai Court is not very representative, and even from an objective and neutral standpoint, Lawyer Liu believes that the judgment is still very controversial. But looking back, it is inappropriate for the court to accept civil disputes involving virtual currencies. If you have such disputes, you can use the judgment of the Shanghai Court as a reference to urge the local court to accept the case for trial.