Authors: Liu Honglin, Zheng Hongde

Not long ago, the decentralized exchange (DEX) Hyperliquid once again became the focus of heated discussion in the crypto circle due to the "JELLY short squeeze incident". This crisis not only brought Hyperliquid's credibility to the bottom, but also made people rethink a commonplace question: Is the decentralized exchange (DEX) really expected to surpass the centralized exchange (CEX)?

Industry leaders have different views on this. Arthur Hayes predicted in his blog that Hyperliquid will decline, CZ reiterated that CEX is irreplaceable, and DEX supporters still firmly believe that "decentralization is the future." This article will start from the review of the incident, analyze the current situation and future trends of DEX and CEX, and provide ideas for this debate.

Crisis review: Decentralization’s “disguise” exposed

Let us first understand the causes and consequences of the Hyperliquid incident.

Hyperliquid is a decentralized exchange that focuses on perpetual contract trading. It provides counterparty support through the platform's liquidity pool, and boasts high efficiency, low cost, and high leverage. As of early 2025, Hyperliquid has occupied approximately 70% of the decentralized perpetual contract market, becoming an important player competing with centralized exchanges.

The cause of the incident was that an attacker took advantage of the platform's high-leverage trading mechanism and bought a large amount of JELLY spot through the chain and other exchanges on the evening of March 26, 2025, pushing the price of JELLY up nearly 10 times in a short period of time, and then quickly sold it, precisely attacking the platform's capital pool. Due to the large size of JELLY positions and insufficient liquidity, the platform's capital pool was forced to take over short orders of approximately 398 million JELLYs, and the floating loss was as high as 12 million US dollars. If the price continues to rise, the 240 million US dollars reserve may be fully liquidated, resulting in huge losses for the platform.

That night, Hyperliquid took two emergency measures:

1. Announcement of forced liquidation of affected positions at preferential prices.

2. Use the Foundation’s reserve funds to partially compensate users.

By forcibly liquidating positions at preferential prices, Hyperliquid not only did not incur any losses, but even made a profit of $703,000. It is somewhat unbelievable that Hyperliquid, which claims to be a decentralized exchange, has the right to make such centralized decisions, which has caused widespread doubts in the community about its commitment to decentralization. Statistics show that after the incident, Hyperliquid's TVL (total locked value) dropped 30% in 48 hours, from $800 million to $560 million, and its trading volume also shrank to 50% of the pre-crisis level.

Hyperliquid stepped on the brakes before the market was about to enter a liquidation spiral. Although the response seemed decisive and saved funds and core liquidity, it can actually be said that it exchanged trust for survival time, exposing many defects in the platform's mechanism design and governance:

Decision making is highly centralized

The decision to force liquidation at a preferential price, although an emergency measure in times of crisis, is highly centralized, similar to the "government rescue" in traditional finance. Hyperliquid officials claimed that the decision was passed by "validator voting", but the community generally questioned the transparency and participation of the vote, believing that it was more like a unilateral push by the team rather than a true community consensus. This practice runs counter to the principle of "decentralized autonomy" advocated by the platform.

Shortcomings of Mechanism Design

Hyperliquid allows up to 50 times leveraged trading, but lacks a dynamic risk control mechanism to deal with market manipulation. The attacker took advantage of this loophole to trigger liquidation by pulling the price for a short period of time, precisely attacking the HLP fund pool, showing the platform's inadequacy in risk management. The remedial measures of lowering the leverage limit and using the foundation's funds afterward, although relieving short-term pressure, cannot solve the deep-seated problems of the trading mechanism and power structure, and are a bit of a "symptom-based solution".

The crisis of trust is intensifying

The incident handling process weakened Hyperliquid's credibility, and users' trust in its decentralization dropped significantly. According to Dune Analytics data, within a week after the incident, Hyperliquid's daily active users dropped by 25%, and some funds flowed to other DEXs or CEXs such as Binance. On the community forum, there were endless comments that "Hyperliquid is dead."

For a DEX that aims to challenge centralized exchanges, such an incident is undoubtedly a dangerous signal. This crisis is not only a Waterloo for Hyperliquid itself, but also a wake-up call for the entire DEX industry: decentralization cannot just remain a slogan, but must be supported by a matching technical architecture and governance mechanism. Otherwise, the ideals of DEX will be difficult to withstand the impact of reality.

Arthur Hayes's prediction of decline: Is there still hope for Hyperliquid?

In the Old Testament of the Bible, "David vs. Goliath" is a well-known story. Goliath is a tall, well-equipped warrior, representing the image of being powerful and invincible. David is just a weak teenager, armed with a slingshot and a few stones.

*Image source: from the Internet

Arthur Hayes, a well-known figure in the crypto community, quoted this proverb in his latest tweet, comparing Hyperliquid to David the shepherd in "David vs Goliath", believing that Hyperliquid is at an absolute disadvantage in front of powerful competitors (such as Binance and dYdX). He pointed out that the handling of the JELLY incident exposed the falseness of Hyperliquid's decentralization and its vulnerability in crises, and bluntly said "Stop pretending that Hyperliquid is decentralized", predicting that it will follow the path of decline like FTX and eventually be eliminated by the market.

Hayes's "decline prediction" is not groundless. Hyperliquid's handling of the situation has indeed exposed the platform's problems in risk management and product design, and a trust crisis is inevitable in the short term. However, I believe that Hyperliquid's fate is not irreversible, and the key lies in the team's next move.

In 2016, Ethereum experienced the TheDAO incident, where ETH worth $50 million was stolen, splitting the community and even triggering a dispute over hard fork rollback transactions. However, Ethereum did not decline, but took the opportunity to improve the smart contract security standards and lay the foundation for its development.

Hyperliquid has a similar opportunity. The vulnerability exposed by the JELLY incident may be a stepping stone for development. The platform should take some corrective measures, such as:

1. Transparent auditing to rebuild credibility: Publicly disclose the audit report of the fund pool and the details of the liquidation decision to let the community see the sincerity.

2. Optimize the mechanism and prevent risks: Improve the liquidation mechanism and introduce dynamic risk control such as real-time adjustment of leverage to prevent similar pull-up sniping. dYdX's perpetual contract has effectively reduced systemic risks through oracles and dynamic margins. Hyperliquid's technical upgrade direction may be a reference.

3. Decentralized governance and rebuilding consensus: transforming “validator voting” from formalism to true autonomy and expanding community participation.

If transparent auditing, optimized liquidation mechanisms, and confidence can be restored, there may be a chance for a comeback. Hayes's view of "David vs. Goliath" may be too pessimistic. You know, the ending of the story in the Old Testament is that David defeated the seemingly invincible giant Goliath with wisdom and courage.

Even if Hyperliquid faces a life-or-death test, the demand for the DEX track remains solid. In 2024, the number of DeFi users worldwide will exceed 150 million, and the peak daily trading volume of DEX will reach 2 billion US dollars. With a solid demand base, users' demand for "controlling their own assets" and "decentralization" has never weakened. Hyperliquid users will not completely abandon this model because of a crisis - they expect a safer and fairer platform.

Of course, if Hyperliquid cannot improve its mechanism and plug loopholes, its decline is inevitable. The market is very realistic. Without trust, funds and users will immediately turn to CEX or other DEXs such as Binance. Even if Hyperliquid falls, the DEX track will not end. New players will continue to emerge, and only those who can do a good job of the mechanism can become the final winner. DEX still has a long way to go. Hyperliquid may decline, but DEX will never.

Which one is the future, DEX or CEX?

Since the last bull market, many people believe that DEX will eventually surpass CEX; but recently there have been doubts, including Zhao Changpeng who reiterated that DEX is inferior to CEX. Which one is the future, DEX or CEX?

In fact, at the current stage, DEX and CEX are not in a zero-sum game or a "life-and-death" competitive relationship, but rather complementary coexistence. Each is in an indispensable ecological niche, meeting different user needs, and also has its own problems. DEX has experienced the Hyperliquid incident, and CEX has also experienced the largest cryptocurrency theft incident such as Bybit not long ago. It is not difficult to see that the current situation is that CEX and DEX each have their own advantages, and there is a difference in user usage needs, and they are constantly weighing them.

Advantages of CEX: “Centralized convenience” is difficult to be replaced in the short term

At present, CEX still largely serves as the first stop for novices to get started and is also the home ground for large traders.

1. CEX provides a convenient channel for recharging fiat currency, becoming the main bridge for new users to enter the crypto world from fiat currency.

2. Mature infrastructure and the ability to connect with traditional finance. For example, CEX provides higher trading depth, lower latency, and professional customer service. Large traders need a platform that can quickly process large orders, and CEX's deep liquidity can easily digest them.

3. CEX has compliance guarantees, passes identity verification and anti-money laundering checks, and is connected to traditional finance. For example, the centralized exchange Coinbase is very popular in the United States because institutional funds find it reliable.

Core features: low threshold, deep liquidity, strong compliance

The attraction of DEX: the core value of transparency and freedom is valuable

With DEX platforms like Uniswap and GMGN, the ecology and operation are becoming more and more friendly, and the transaction speed and liquidity are gradually improving. The centralized characteristics bring more advantages that CEX does not have:

1. DEX uses wallets as interfaces and completes transactions directly through smart contracts. Assets are always in one’s own hands. This model naturally fits the concept of “decentralization” of blockchain.

2. Different from the “black box” of CEX, DEX uses smart contracts throughout the process, and the rules are open and traceable on the chain, which ensures fairness;

3. Decentralization brings flexibility and opportunities. For example, in the face of a coin issuance event like TRUMP, new coins are often listed on DEX for trading as soon as possible. Due to the centralized review and listing process of CEX, it is usually a step slower or even misses the window period. DEX allows players to seize early opportunities without being restricted by the rhythm of CEX.

4. Open source and community-driven features enable faster innovation, can quickly incubate novel mechanisms, and provide a trading venue for developers’ emerging projects, which is an area that many CEXs are reluctant to enter due to compliance or commercial considerations.

Core features: non-custodial security, transparent freedom, flexibility, and innovation-driven

CEX needs to rethink its moat

We can see that DEX is developing rapidly, such as breakthroughs in chain abstraction and cross-chain interoperability. For example, the next-generation DEX like UniversalX has greatly reduced the complexity of user operations. Users do not need to understand the differences between the underlying chains, and can seamlessly trade tokens on any chain through their wallets. The "plug and play" model eliminates the technical barriers of traditional DEX and frees users from dependence on third-party custody, truly realizing asset autonomy.

Recalling the computer operations in the 1990s, the systems were complex and difficult to understand, and only a few people could use them proficiently. The command line interface, complex configuration requirements, and technical knowledge thresholds discouraged most people. Today's on-chain operations and DEX are facing a similar stage - concepts such as private key management, cross-chain interaction, and gas fees are still obscure and difficult for ordinary users.

Although CEX currently has many significant advantages and still dominates the industry in terms of trading volume and user base, innovations like UniversalX are gradually changing this situation. Just like the graphical interface revolution that eventually brought computers into thousands of households, the evolution of DEX will also promote the popularization of blockchain technology, from geek culture to mass resonance, and continue to shake the user base of CEX.

If DEX can further optimize the user experience, optimize the mechanism and improve liquidity, and gradually reach the current level of CEX, then CEX will have to rethink what its moat is. Simply relying on transaction efficiency or fiat currency channels may no longer be enough to maintain a competitive advantage, because the decentralized nature and transparency of DEX are more in line with the long-term vision of blockchain, and the convenience of wallets as traffic entrances may also attract more users to switch from CEX to DEX.

CEX can continue the advantages of compliance and make further breakthroughs from convenience to compliance. By deeply cooperating with regulators and positioning itself as a bridge for traditional capital to enter the crypto world, it can consolidate its market position. This transformation may continue CEX's existing advantages and open up new growth space.

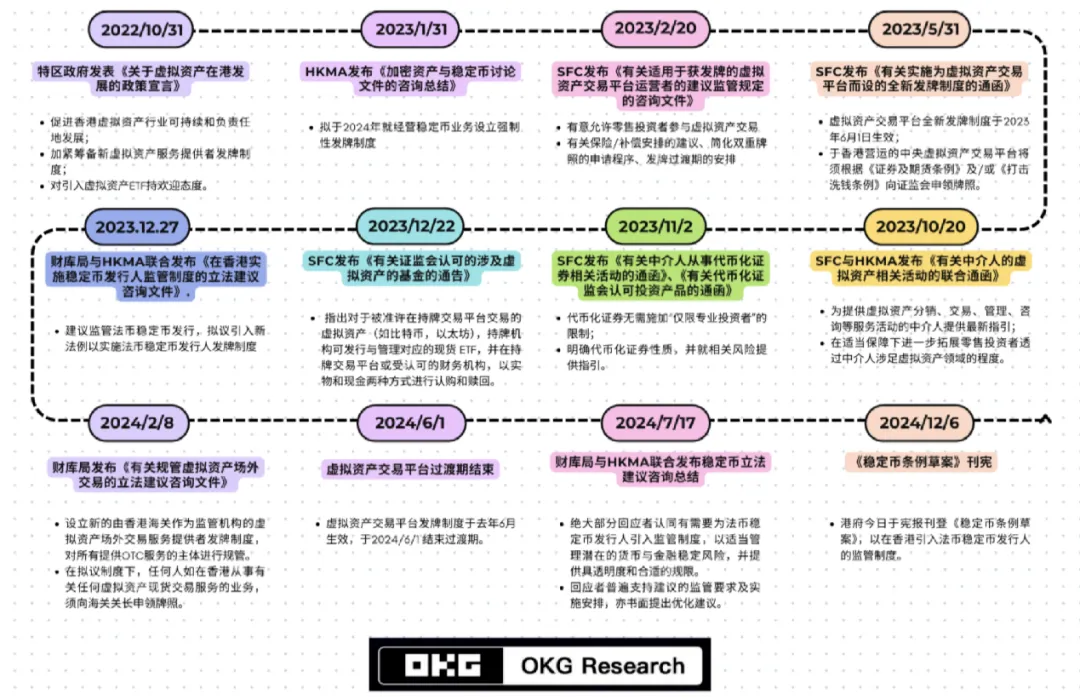

As the saying goes, a duck knows when the water in a river is warm. Lawyer Mankiw has always maintained research and attention on the blockchain policies of mainstream countries and regions around the world, and has clearly sensed that the crypto industry is gradually moving from "wild growth" to standardization. In 2024, more than 50 countries around the world have introduced regulatory frameworks for crypto assets, such as the EU's MiCA regulations and the United States' Stablecoin Transparency Act. Institutional investors (such as hedge funds and pension funds) have an increasingly strong demand for compliance. They need legal and secure channels to enter the crypto market, and this is where CEX's natural advantage lies. Compared with the decentralized nature of DEX, CEX is easier to connect with the existing financial system, provide compliance services such as KYC and AML, and meet regulatory and institutional requirements.

Hong Kong HashKey is a typical example. As one of the first CEXs in Hong Kong to obtain a virtual asset trading license issued by the Securities and Futures Commission (SFC), HashKey has successfully attracted the attention of traditional finance through compliant operations. HashKey launched custody and trading services for institutional clients, and cooperated with Standard Chartered Bank to provide fiat currency deposit and withdrawal channels. It has attracted more than 20 institutional clients and managed assets of more than US$500 million. In addition, HashKey also plans to launch compliant stablecoin products to further connect traditional funds with the crypto market. This "compliance first" strategy not only allows HashKey to gain a firm foothold in the Asian market, but also provides a reference for the development of other CEXs.

This compliance breakthrough will not only consolidate CEX's position in the existing market, but also bring incremental funds to the industry, and bring the traditional field into the Web3 market. According to Morgan Stanley's forecast, by 2030, traditional financial institutions will allocate $1.5 trillion to crypto assets, and if CEX can become the "gatekeeper" of this trend, its moat will be indestructible. In contrast, DEX is difficult to meet regulatory requirements in the short term due to its decentralized nature, which provides CEX with a valuable time window.

Attorney Mankiw's Summary

The crisis of Hyperliquid is like a mirror, reflecting the real challenges faced by DEX in the pursuit of the decentralization ideal: at the same time, CEX is not impregnable, and the risks of centralized platforms cannot be ignored. The competition between DEX and CEX is not a simple "who replaces whom", but a long-term game about convenience, autonomy and compliance.

In the short term, CEX will remain the dominant force in the crypto market, especially for newcomers and institutional investors, with its mature infrastructure, deep liquidity and compliance advantages. However, the rise of DEX is irreversible. Its core values of transparency and freedom and technological innovation are gradually breaking down the barriers to use, attracting more and more users to embrace the "trustless" future. The success or failure of Hyperliquid is just a microcosm of the DEX track. The development of DEX will not stagnate and is continuing to realize its potential to surpass CEX.

For CEX, perhaps the future moat lies in the deep breakthrough of compliance. Practices represented by HashKey show that through in-depth cooperation with regulators, CEX is expected to become a bridge between traditional capital and the crypto world and seize the trillion-level incremental market of institutional funds.

Ultimately, DEX and CEX may not become "dominant", but will coexist and evolve in their respective ecological niches, working together to drive the crypto industry towards maturity. We are fortunate to be in the "90s" of Web3, an era full of change and possibilities. Let us witness this great evolution of technology and ideas together.