Original article: https://polkadot.com/blog/understanding-dex-and-cex/

Compiled by: OneBlock+

Decentralized Finance (DeFi) is a movement to rebuild financial tools and services using open, programmable infrastructure. It replaces traditional intermediaries (such as banks and brokers) with smart contracts and decentralized protocols. With just a crypto wallet, anyone can access tools for trading, lending, borrowing, saving, and more - without permission or centralized control.

Exchanges play a fundamental role in this system. Some are centralized and function more like traditional financial institutions. Others are decentralized and run entirely on smart contracts. Understanding how each API works is an essential challenge for any explorer.

But it’s not just about how the technology works. The rise of decentralized exchanges is indicative of a broader shift away from centralized gatekeeping to open, permissionless access. It’s about financial empowerment, personal privacy, and creating systems that anyone can use — no matter where they live or what files they own.

What is a Centralized Exchange (CEX)?

Centralized exchanges are cryptocurrency trading platforms operated by companies or organizations that act as middlemen between buyers and sellers. Think Coinbase, Kraken, or Binance. These platforms allow you to use USD and other fiat currencies, and you can also trade coins and tokens directly on the platform.

How does CEX work?

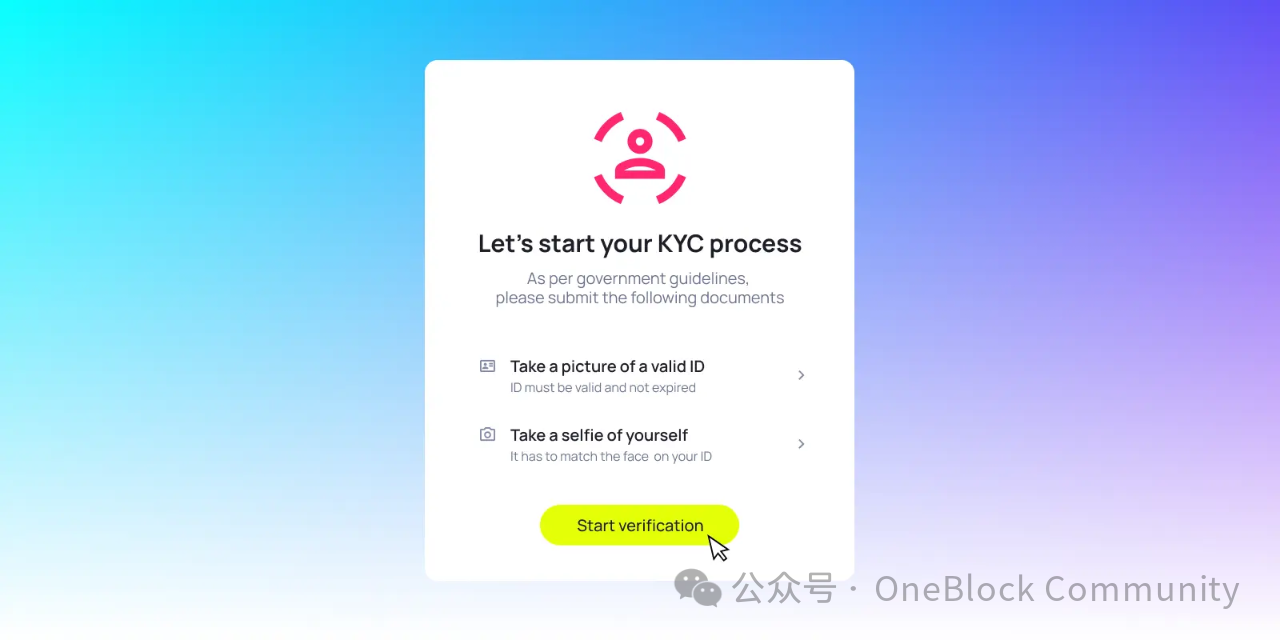

To use a centralized exchange, you first create an account and verify your identity using a government ID and proof of address. You can then deposit fiat currency using a linked bank account or card. From there, you can buy or trade cryptocurrencies using the platform’s dashboard.

The exchange holds your assets in a custodial wallet and matches your trades through its internal system. If you want to withdraw, you can either send your crypto to your own wallet or convert it back to fiat and cash out. Keep in mind that most CEXs have withdrawal fees and limits.

Benefits of using CEX

Ease of Use: The interface feels familiar. You can link your bank account or card and buy crypto without having to learn about wallets or gas fees. If you get stuck, there is usually a customer support team to help you. Keep in mind that real support will never contact you first or offer help over social media.

High liquidity and fast execution: CEX has a large user base and a fast trading engine, so transactions are fast and prices remain stable most of the time.

Compliance: These platforms are regulated in the countries where they operate, which may give some people peace of mind.

Disadvantages of using CEX

Not your keys, not your wallet: This is the biggest problem. You are trusting someone else to hold your crypto. If the exchange gets hacked or shuts down, your funds can be gone. We’ve seen this before. FTX didn’t just shut down. It took people’s assets with it.

Downtime during volatility: When markets are moving quickly, centralized exchanges can go down. You may be locked out when you try to trade, which means missing out on the best prices or opportunities.

Privacy Tradeoff: Due to KYC (Know Your Customer) and AML (Anti-Money Laundering) rules, you have to share personal information such as your ID, proof of address, and possibly even a selfie. This isn’t for everyone, especially if you’re using cryptocurrency for privacy.

Limited accessibility: CEXs often require a bank account, government documents, and a clean financial record. If you live in a sanctioned country or face political instability, you may be blocked entirely. These platforms can help people get started with crypto, but they’re not for everyone. This ignores the people who may need it the most.

What is a decentralized exchange (DEX)?

A decentralized exchange is a crypto trading platform that operates directly through smart contracts. There are no middlemen. You can trade directly from your wallet instead of going through a company. This is a major shift from the way centralized exchanges operate.

Some well-known DEXs include Uniswap, Curve, Aerodome, and Hydrate. These platforms live on-chain and allow you to exchange tokens peer-to-peer using automated tools like liquidity pools and pricing algorithms.

How do DEXs work?

When you trade on a DEX, you are interacting with a smart contract, not a company. Here’s what’s actually happening behind the scenes:

Connect your wallet. No login or account required. Then, you approve the transaction directly. This action triggers the smart contract.

Smart contracts do the rest. It uses an automated market maker (AMM), a type of smart contract that adjusts the price based on the amount of each token in the liquidity pool.

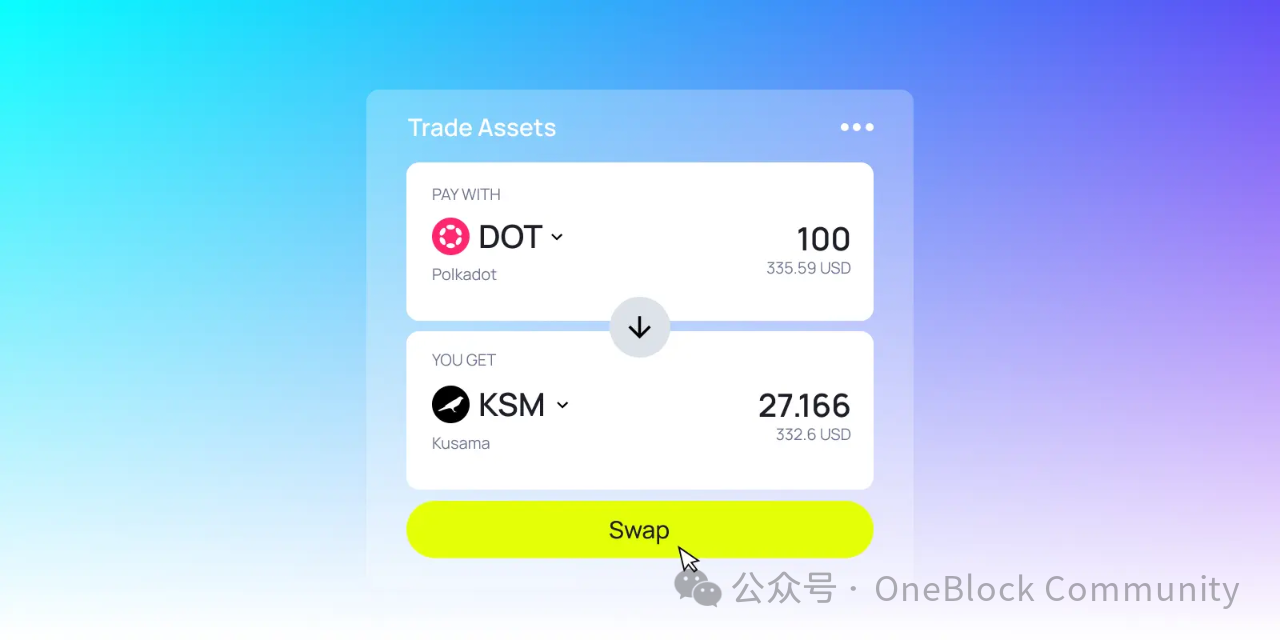

Liquidity pools make this possible. These are collections of token pairs provided by other users. When you make a swap, you are trading directly with that pool, not with someone else. For example, Hydration has a DOT/USDC pool, which means you can easily swap between these tokens without having a seller on the other side.

No order book, no middleman. Trades are settled on-chain. You get tokens, and the liquidity pool is automatically updated.

Everything is transparent, there is no central authority, and you have full control over your keys.

Benefits of using DEX

You hold your own keys: There is no custodial setup. You can trade directly from a non-custodial wallet, which means you are always in control of your assets. No one can freeze your funds or close your account.

Open access from anywhere: All you need is a wallet. You don’t need to upload an ID or have a bank account. This makes DEX one of the few options for people excluded from traditional systems.

Censorship resistance: Since DEXs are powered by smart contracts instead of centralized infrastructure, they are harder to censor or shut down. Exchanges will continue to work as long as the network exists. This is Web3 as public infrastructure.

Disadvantages of using DEX

Steeper learning curve: DEXs give you more control, but they take some time to get used to. You need to manage your own wallet, pay transaction fees, verify token contracts through trusted sources like the project website or data platforms like Coingecko or CoinMarketCap, and understand concepts like slippage and how to read block explorers in case something goes wrong.

The user experience still needs improvement: wallets disconnect, trades fail. The technology is getting better, but not as smooth as centralized platforms. Centralized exchanges usually have safeguards in place to protect your funds if something goes wrong. On a DEX, you are often on your own.

You need crypto to use a DEX: Most DEXs don’t support fiat currencies. You can’t connect your bank account or card and buy tokens directly. To trade on a DEX, you need to already have crypto in your wallet. For most people, this means using a centralized exchange or a fiat on-ramp before entering the world of decentralized finance.

DEX on Polkadot

These platforms allow you to trade tokens, earn rewards, and explore challenges while maintaining full control over your assets.

Hydration: Best for efficient trading of a wide range of tokens. It is ideal for large trades or busy market moments, and its system is designed to minimize price changes.

StellaSwap: StellaSwap is great for users who are familiar with MetaMask or Ethereum-based tools. It offers token swaps, liquidity mining, and a clean, beginner-friendly experience.

To use Hydration or StellaSwap, you need a Polkadot-compatible wallet such as Nova, Talisman, or SubWallet. These wallets connect directly to exchanges so you can trade, provide liquidity, and explore DeFi tools while maintaining control of your assets.

CEX vs DEX: Main Differences

While both CEXs and DEXs allow you to trade cryptocurrencies, they do so in fundamentally different ways. From how assets are stored to who has access, the two models reflect opposite ends of the spectrum in terms of control, trust, and openness.

Custody: When you use a centralized exchange, the platform holds your keys and controls your funds. On a DEX, you hold your keys and trade directly from your own wallet. There are no middlemen.

Regulation and KYC: CEXs are built to comply with financial regulations. This means passing identity checks and getting your account approved. DEXs are permissionless. Anyone with a wallet can use them, no ID required.

Security and transparency: CEX runs on private infrastructure. You don’t always know what’s going on behind the scenes. DEX runs on public smart contracts where transactions and logic are visible on-chain.

Access and inclusion: CEXs often restrict access based on location, documentation, or financial history. DEXs have no gatekeepers. If you have a wallet and an internet connection, you can trade.

DEX and the future of a fairer financial system

Decentralization is not just technical. It’s about reducing our reliance on institutions that decide who has access and who doesn’t. In a centralized system, your options depend on where you live, what documents you have, and which banks will work with you.

DEXs are different. There are no gatekeepers. All you need is a wallet and internet access. This can be a lifeline for people in unstable or restricted environments. In places like Venezuela, Nigeria, and Ukraine, cryptocurrencies have helped people protect their savings, access stable assets, and move money without worrying about censorship.

This is what Web3 is all about: open tools that anyone can use. With a DEX, you hold your own keys, control your assets, and decide your path. This is not only a better experience, but also a more fair and resilient system.

DEXs in Action: Expanding Global Financial Accessibility

Uniswap in Nigeria: During the 2020 Nigerian protests, authorities froze the bank accounts of activist groups. In response, organizers turned to cryptocurrencies. Some used Uniswap to convert donations without relying on banks. The government was unable to block these transactions.

Ukrainians use DEXs during the invasion: Early in the war in Ukraine, many people turned to DEXs and self-custodial wallets to protect their assets and move funds when centralized platforms were restricted or offline.

Building an open financial system with Polkadot

Both centralized and decentralized exchanges play an important role in cryptocurrency today. Centralized platforms offer ease of use and accessibility to newcomers. But it is decentralized exchanges that reflect the core values of Web3 — openness, transparency, peer-to-peer transactions, and individual ownership.

Polkadot lays the foundation for this decentralized future by enabling fast, secure cross-chain activity and shared security across the ecosystem. These features power a flexible, scalable, and truly permissionless DEX designed to put ownership back where it belongs: to the user.

Ready to explore DeFi on Polkadot? Start by choosing a wallet that gives you full control over your assets. Browse wallets that support self-custody and connect to decentralized applications over the web.