This week, the BTC market fluctuated at a high level, hovering in the price range of 93500-95500. Some altcoins such as SUI Ecosystem, Virtual Ecosystem and some AI tokens have seen impressive gains. The overall market is still waiting for key data such as unemployment rate and non-agricultural data this week to determine the direction.

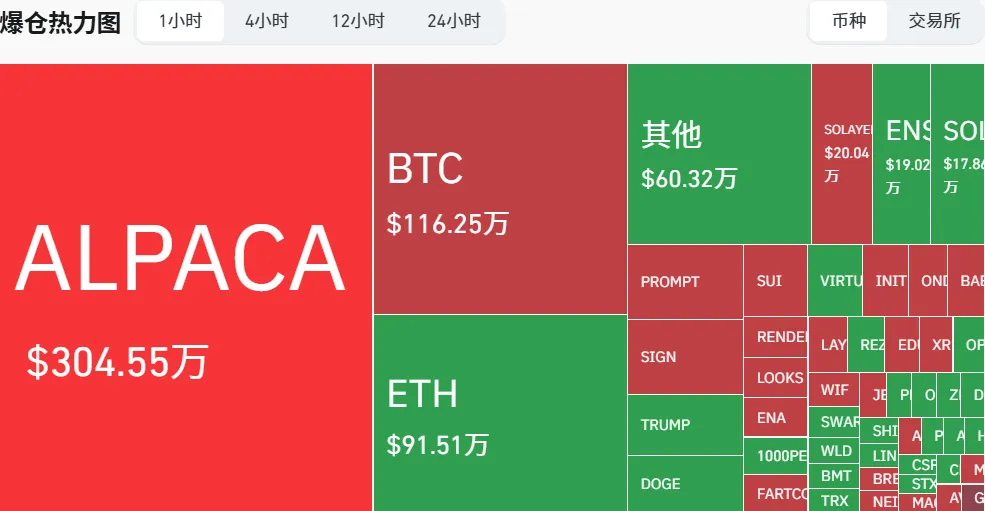

The crypto market presents a complex picture in the interweaving of regulation and market manipulation: the ALPACA incident revealed that the market makers manipulated low-market-cap coin contracts, using short squeezes and funding rates to harvest retail investors, highlighting the speculative risks in the market. At the same time, the US policy vane supports crypto assets, and the passage of the Arizona Strategic Bitcoin Reserve Act marks the acceleration of the mainstreaming of cryptocurrencies.

1. ALPACA incident: market makers manipulated the market, and funds determined the rise and fall

Alpaca Finance is a decentralized finance (DeFi) protocol based on Binance Smart Chain (BSC), focusing on leveraged yield farming. On April 24, 2025, Binance issued an announcement that it would delist four tokens (ALPACA, PDA, WING, VIB), including Alpaca Finance (ALPACA), on May 2. Usually, delisting from an exchange will cause a sharp drop in token prices, as this is seen as a signal that the project has lost liquidity and recognition. However, ALPACA saw an abnormal 71% increase after the announcement, with the highest increase reaching 237%. The price doubled nearly 10 times in a week, soaring from about $0.02893 (the historical low on April 17) to a high point. Especially in the near-delisting period, there have been frequent instantaneous plunges and surges, which have been harvesting retail liquidity and have become the focus of the contract market.

We will not study the details of the incident, but discuss the current market situation reflected by the typical event of ALPACA.

Clarify the dealer's thinking

Based on Alpaca's price performance and recent widespread speculation, we can roughly understand the Alpaca market maker's trading ideas, which can be used as a reference:

1. Clear purpose:

- The market maker knows that the contract will eventually be taken off the shelves, so he maximizes profits by manipulating prices. However, the spot liquidity is insufficient, and it is difficult to cash out by directly shipping.

2. The first stage: Control the market and stabilize the price for delivery (before April 30)

- Use funds to control the ALPACA contract price and maintain it at a high level.

- The goal is to complete platform delivery at a high price and obtain futures profits.

3. The second stage: attracting the opponent (before 30 days)

- If there are too few short sellers in the market, the market makers will take the initiative to dump the market.

- Create the illusion of a crash to attract retail investors or other funds to short sell.

- After there are too many short positions, the market will be pulled up to harvest the profits in the opposite direction.

4. The third stage: the market crash after the contract delivery (April 30~May 2)

- Delivery starts after the contract is settled.

- Taking advantage of the unstable market expectations after delivery, they gradually dumped the stocks to cash out and eat up the remaining liquidity value.

To sum up in one sentence:

The market maker makes a profit by manipulating the market and raising the contract price for delivery, lures short sellers into selling and then raises the price again to complete the harvest. After delivery, the market maker dumps the market and clears the position to reap the remaining value.

Price trends and banker actions

▲

│ (After delivery)

│ ┌─▼─┐

│ │ Shipping │

│ └─┬─┘

│ ┌───────▲───────┐

│ │ Rapid pull-up to short position │ Phase 3

│ ┌─▼─┐ └───────┬───────┘ (4.30-5.2)

│ │ Crash │ │ Step-by-step decline

│ └─┬─┘ │

│ ┌───────────────┐ │

│ │ High sideways price control │ │ (Timeline)

├─────┴───────────────┴────┴────────────►

│ April 30 (delivery date)

│Phase 1 (before April 30) Phase 2 (before April 30) Phase 3 (after April 30)

│Funds control the market to stabilize prices and dump stocks to lure short sellers → pull up prices to reap profits and sell off to clear positions

Air Force Becomes Fuel

In the Alpaca incident or in the broader market manipulation, the reason why "air forces" (short sellers) become "fuel" is that their funding rate payments provide additional capital for longs, driving prices up, so it is recommended not to try to trade against the dealer, but to follow the trend. The specific process is as follows:

1. Market expectations and short positions:

- After the delisting announcement was released, the market generally expected that "delisting = plummeting", retail investors and speculators were collectively bearish, short orders surged, and short positions in the ALPACA contract market far exceeded long positions.

- The behavior of short sellers caused the funding rate to go significantly negative, creating the conditions for a short squeeze.

2. Dealer’s operation:

- Before or in the early stages of the delisting news, the market maker (trader) accumulates a large amount of spot chips and establishes huge long positions through the contract market.

- Due to the small market value of ALPACA (about 26.53 million US dollars) and limited circulation (total supply of 188 million, 150 million in circulation), it is easy for the market makers to control the spot market and the cost is low.

- Market makers began to buy ALPACA in the spot market, pushing prices up while charging short sellers funding rates.

3. The role of funding rate:

- A negative funding rate means that short sellers have to pay fees to long sellers every hour, and the funding rate that the market maker receives from short sellers becomes additional capital.

- ALPACA's funding rate was significantly negative during the incident, and the market makers used these funds to continue buying spot, further pushing up prices.

4. Short squeeze feedback loop:

- After the price rises, short sellers face the dual pressure of losses and funding rate payments, forcing them to close their positions (i.e. buy back ALPACA).

- The liquidation of positions increases buying, further pushing up prices and triggering more forced liquidation of short sellers, creating a vicious cycle.

- ALPACA surged 7 times in two days, showing the strong effect of the short squeeze.

5. Acceleration factors:

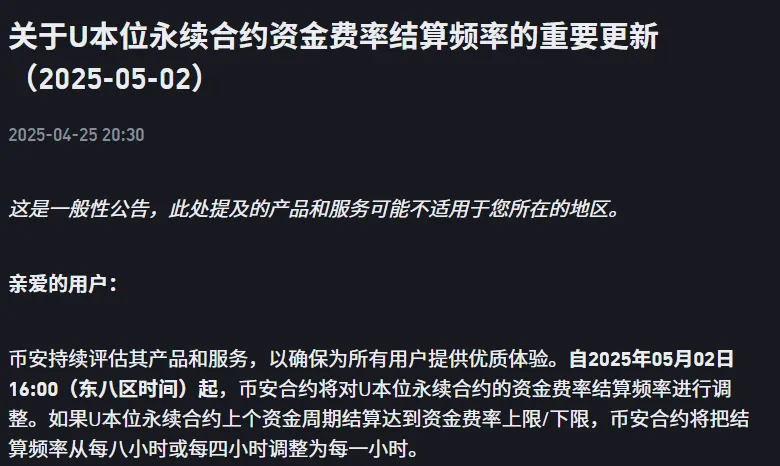

- Binance shortened the funding rate settlement cycle to 1 hour. Short sellers pay high fees every hour, which speeds up the liquidation of positions and further pushes up prices.

Driven by the Alpaca incident, on April 25, Binance announced that starting from 16:00 (ET on May 2, 2025), Binance Futures will adjust the funding rate settlement frequency of U-margin perpetual contracts.

If the settlement of the U-margin perpetual contract in the previous funding cycle reaches the upper/lower limit of the funding rate, Binance Futures will adjust the settlement frequency from every eight hours or every four hours to every hour. In a nutshell: when the rate is capped, it will automatically switch to a 1H funding fee.

Specific impact:

1. Increased pressure on shorts:

- The settlement cycle is shortened from 8 hours to 1 hour, and short positions need to pay negative funding rates every hour. For example, if the funding rate is -2%, the frequency will increase 24 times compared to the past, and the cost will accumulate faster.

- This forces shorts to close their positions faster, accelerating the short squeeze, especially in illiquid markets (such as ALPACA), where prices rise more sharply.

2. Shortening of the pull-up cycle:

- The dealer can only use a shorter period to quickly pull the market. For example, in the ALPACA incident, the price soared 7 times in two days, indicating that the operation rhythm has accelerated.

- As a result, the progress of the subsequent final shipment by the dealer will be greatly accelerated.

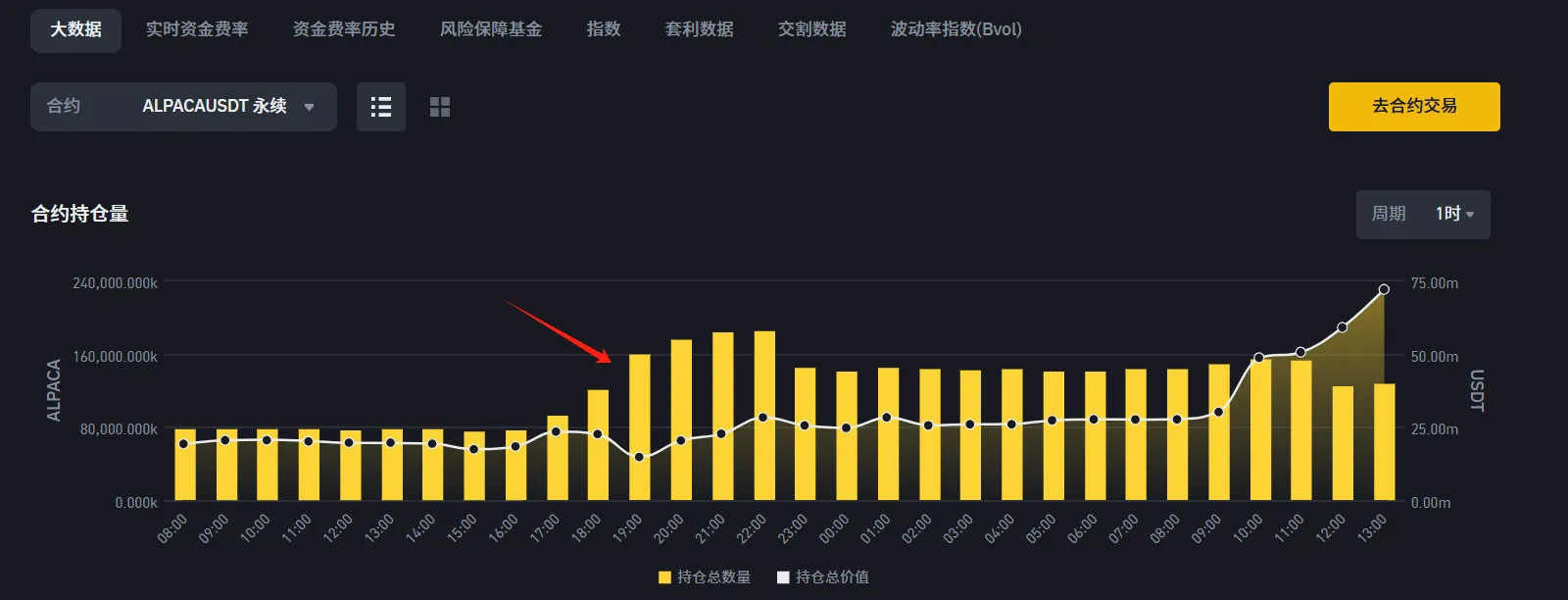

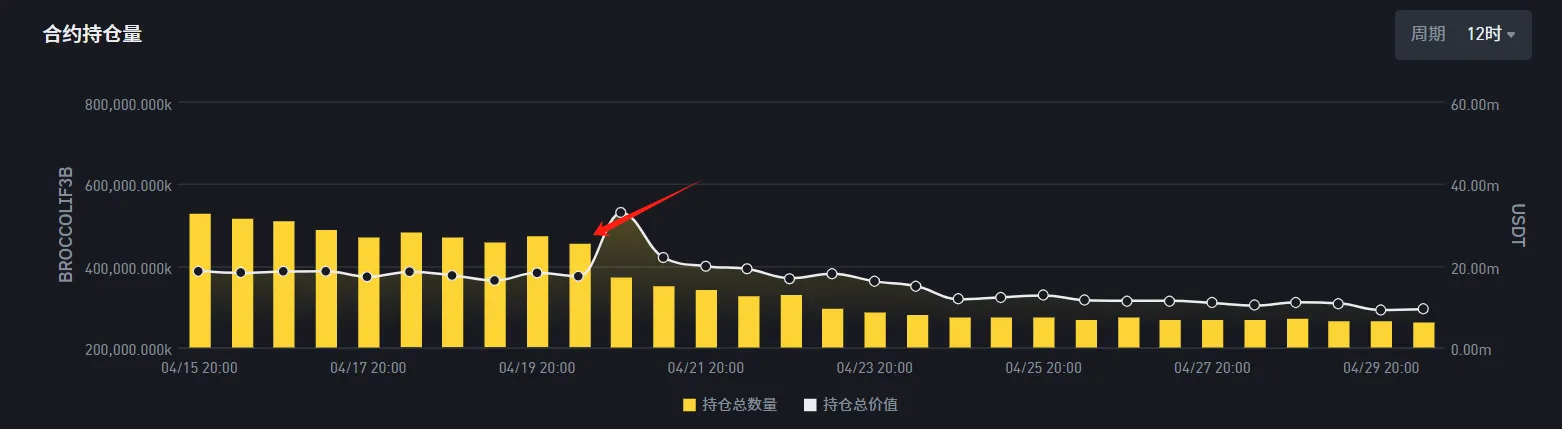

Combining low market capitalization + OI + Funding Rate strategy

Screening target: Pay attention to altcoins with low market capitalization (such as less than 100 million US dollars) and check their contract market activity. Observe OI. If OI is much higher than the market capitalization, or suddenly increases/decreases significantly, there may be dealer operations. OI surges and Funding Rate turns positive: the dealer may be long, consider following; OI surges but Funding Rate turns negative: the dealer may kill the long army, be vigilant. Of course, if OI decreases significantly, it is very likely that the dealer has closed the position, consider entering the short position. It will be more accurate if it can be combined with other indicators such as the market price and K-line.

- Strategy feasibility and adjustment

Previously, I focused on altcoins with low market capitalization and increased OI, trying to follow the market maker's trend to "eat meat". After the settlement cycle was shortened to 1 hour:

The strategy is still viable: Research shows that a highly negative funding rate and a rapid increase in OI are still a signal of a short squeeze. For example, in the ALPACA incident, a surge in OI coincided with a negative funding rate, and prices rose rapidly.

Faster pace: As short pressure accumulates faster, price movements are shorter and more intense. Investors need to react faster and may need automated tools to monitor funding rate and OI changes.

II. Policy Supervision

1.【4.27】Cointelegraph published an article on X saying that the U.S. Securities and Exchange Commission (SEC) has approved ProShares Trust's XRP ETF to be publicly listed on April 30, but it was later proved that ProShares' three XRP ETFs were not spot.

- Late at night on the 27th, Cointelegraph revealed that the US SEC had approved ProShares Trust's XRP ETF to be publicly listed on April 30. In a short period of time, the price of XRP started to rise, but crypto reporter @EleanorTerrett later clarified: "In fact, this is only an application for futures-type and leveraged/inverse products. This type of product does not require formal approval like spot ETFs. As long as the SEC does not raise any objections within a certain period of time, it will automatically take effect."

The three futures ETFs that came into effect this time include:

ProShares Ultra XRP ETF: Provides twice the return of XRP futures prices.

ProShares UltraShort XRP ETF: Provides a return twice the inverse of the XRP futures price.

ProShares Short XRP ETF: Provides inverse returns to XRP futures prices.

These products are different from the "XRP spot ETF" that the market expects.

- Spot ETF approval delayed: On April 30, the SEC postponed the decision on multiple spot cryptocurrency ETF applications, including Franklin's SOL and XRP ETFs, Grayscale's HBAR ETF, and Bitwise's DOGE ETF. It also involved Ethereum ETF staking and Bitcoin ETF physical subscription and redemption plans. The approval is expected to be completed in June 2025.

- Optimistic about approval: Bloomberg Intelligence predicts that the approval probability of LTC, SOL and crypto asset basket ETF is 90%, XRP is 85%, DOGE and HBAR are 80%, and DOT, AVAX, and ADA are 75%. All 19b-4 documents have been confirmed by the SEC, and the approval deadline is concentrated in the second half of 2025.

The listing of ProShares XRP futures ETF provides more short-term trading options. CME XRP futures and Brazil spot ETF have further expanded its market size. Currently, we can focus on the approval of Franklin XRP spot ETF on June 17. If approved, it may drive greater capital inflows.

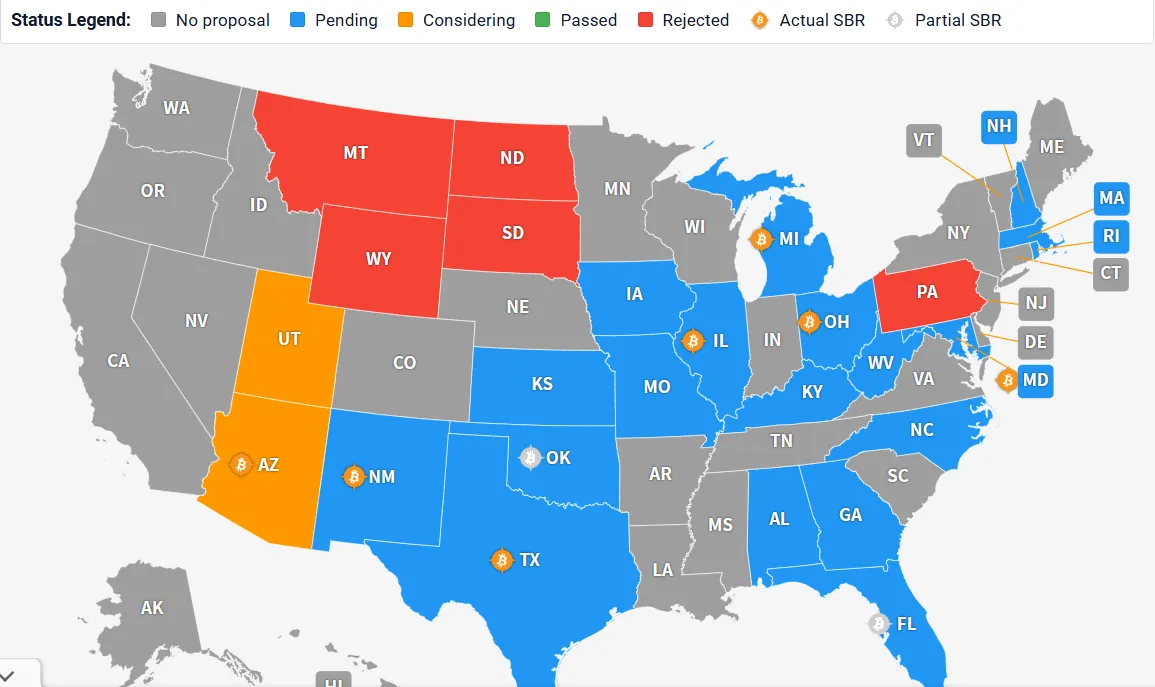

2. [4.29] Arizona Bitcoin Reserve Act passed by the Congress, and may become the first state in the United States to establish a Bitcoin reserve

- On April 29, 2025, the Arizona House of Representatives passed two Strategic Bitcoin Reserve Acts (SB 1025 and SB 1373), which are awaiting the signature of Governor Katie Hobbs, making Arizona the first state in the United States to require public funds to invest in Bitcoin. SB 1373 proposes the establishment of a digital asset strategic reserve fund, with funds from seized assets and grants, with a maximum of 10% invested in digital assets each year; SB 1025 allows state finances and pension systems to invest 10% in Bitcoin. The bills reflect the mainstreaming trend of cryptocurrencies, and other states and federal levels are also promoting similar policies.

- The first Bitcoin Reserve Act in the United States to pass both chambers (Senate and House of Representatives) marks the transformation of cryptocurrencies from marginal assets to mainstream financial assets. The passage of the bill may inspire other states (such as Iowa, Missouri, and Texas) to accelerate similar legislation, forming a "domino effect" of state-level crypto investment.

- SB 1025: Allows state finances and retirement systems to invest up to 10% of their funds in Bitcoin, and supports the storage of Bitcoin in a secure Federal Reserve account (if the Federal Reserve is established). Investing in Bitcoin: (Arizona State Fund $28 billion + Arizona Retirement System $50 billion) ✖ 10% = $7.8 billion.

- SB 1373: Proposes the establishment of a digital asset strategic reserve fund managed by the state treasurer. The funding sources include seized assets and legislative appropriations. Up to 10% can be invested in digital assets such as BTC each fiscal year, and loans can be made without increasing risk.

- The probability of bill veto still exists (it has been vetoed at the time of publication): Katie Hobbs, a Democrat, will serve as the 24th Governor of Arizona from 2023. She was Secretary of State and State Representative. She has a background in social work, focuses on water security, housing and economy, and faces legislative challenges led by Republicans. On April 18, 2023, on her 100th day in office, she broke the record for vetoes by a governor in a single term, vetoing 63 Republican-led bills, surpassing the previous record (Janet Napolitano's 58). The veto included the "tamale bill" (family food bill), which sparked national controversy. The veto rate in 2024 was 22%, the highest among governors in the United States, and she was named the "veto machine". Although she has not explicitly stated her support or opposition to cryptocurrency investment, her veto tendency (22% veto rate in 2024) and Democratic background may make her cautious about high-risk investments.

Whether the bill is eventually passed or not, it will not affect the current widespread BTC reserves in the United States. Currently, 28 states in the United States have proposed 47 reserve bills, 18 of which have entered the legislative process. At the national level, Trump's executive order established a strategic Bitcoin reserve by confiscating about 200,000 Bitcoins, prohibiting sales and requiring audits, but it did not have much catalytic effect because it did not meet market expectations. The more authoritative one is the

Cynthia Lummis, a Republican senator from Wyoming, proposed that the U.S. Treasury Department purchase 200,000 bitcoins per year for five years, totaling 1 million bitcoins (about 5% of the total supply of 21 million bitcoins), as a strategic reserve asset, similar to gold reserves, and reserve bitcoins must be held for at least 20 years and can only be used to repay federal debts. The bill is still under discussion in the Senate and may take one to two years to actually be implemented. Although there is no positive push in the short term, the long-term reserve trend is already in full swing. At least in the next two years, we can expect the reserve bill to be truly implemented.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Nora / WolfDAO

Editorial review: Mat / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, communication, research or appreciation only.