20 days ago, Portal Labs wrote an article titled " CZ: It's easy to surpass 99% of Web3 players, but it's hard to beat the last 1%! " At that time, CZ's HODLism was highly praised.

However, in just a few days, Trump's tariff stick seemed to easily shatter everyone's belief in HODLism.

In April 2025, US President Trump once again issued a tariff policy, targeting the world and reshaping the trade landscape with the United States.

Why say “again”?

As early as the first term from 2017 to 2020, the Trump administration implemented a series of tariff policies based on the "America First" trade protectionism. At that time, the Dow Jones Industrial Average immediately fell by 500 points.

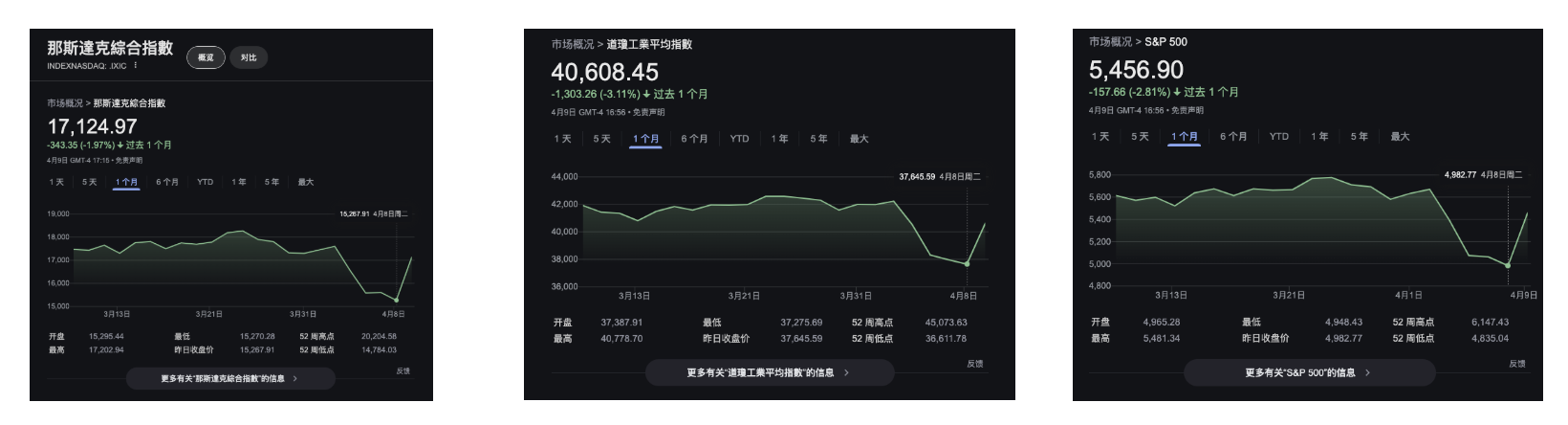

Back to 2025, during Trump's second term, he once again continued and escalated his tariff policy, and this time the scope and intensity of the impact were greater, with a particularly severe impact on the global financial market - the three major U.S. indexes all fell sharply. From April 2 to 8, the Nasdaq index fell by more than 2,300 points, the Dow fell by nearly 4,600 points, and the S&P 500 fell below 5,000.

In the crypto market, crypto assets represented by BTC also fell, and BTC fell to a low of 74,500 USDT on the evening of June 7. According to SoSoValue data, within 24 hours after the tariff policy came into effect, the crypto market was in the green, and mainstream crypto assets generally fell by 3%-10%, and the total market value directly evaporated by about 300 billion US dollars. Although there has been some improvement at present, it is still seriously damaged.

However, on April 10, as Trump announced that "tariffs will be suspended for 90 days for 75 countries in communication", both the traditional financial market and the crypto market began to pick up, and the BTC price returned to the 80,000 USDT level. According to the Bitget Wallet trend, 80.41% of the tokens in the entire crypto market are in the rising stage.

However, according to CoinMarketCap data, the market sentiment has been extremely fearful recently. In particular, Trump’s recent remarks on his social media platform have led some analysts to believe that his actions are suspected of being insider trading. In addition, some people in the market are worried that “in extreme cases, MicroStrategy may be forced to sell BTC, leading to a death spiral.”

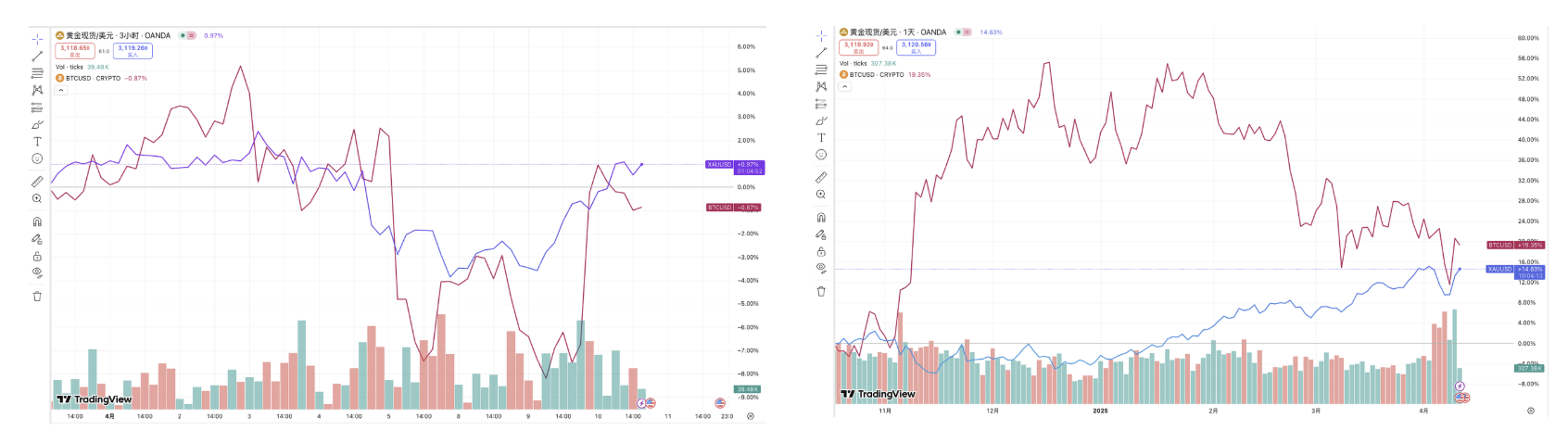

Previously, BTC has been dubbed as digital gold, one of the important reasons being that it can serve as an emergency hedge like gold. However, whether in this tariff incident or in the past six months, it is clear that BTC has not perfectly assumed this role.

The above is the price trend chart of BTC and spot gold in TradingView. The former is the trend since April. Although affected by the overall environment, BTC and gold rose and fell at the same time, BTC showed higher volatility compared with gold; while the latter is a comparison of the trend in the past six months. It can be found that the trend of gold continues to rise, while the price of BTC is just the opposite.

In fact, if you superimpose the trends of BTC and the three major U.S. indexes, you will find that the linkage between the four is significantly increasing.

In addition, according to CoinDesk, affected by geopolitical and tariff uncertainties, tokenized gold assets have performed strongly in recent days, with a market value approaching $2 billion, becoming a hot spot for safe havens in the crypto market. CEX.IO reports that since Trump took office on January 20, the trading volumes of Paxos Gold (PAXG) and Tether Gold (XAUT) have increased by 900% and 300% respectively.

So, what are we investing in?

As a safe-haven asset, BTC should have been able to rise against the trend like gold (although gold has certain fluctuations, the overall trend is stable and rising). However, the facts show that in the face of macro risks, it has not shown the independence of a "safe-haven asset", but has been closer to the trend of high-risk assets.

At the Hong Kong Crypto Finance Forum on April 8, Professor Lin Chen of the University of Hong Kong said that since the launch of the BTC spot ETF, with the allocation of traditional financial institutions, BTC has become more and more like a "high-Beta asset included in the global capital allocation system", and its price fluctuations are increasingly affected by factors such as U.S. Treasury yields, the U.S. dollar index, and macroeconomic policy expectations.

This means that for institutional investors, BTC has not fully assumed the role of a "safe-haven tool", but is instead seen as a risk exposure to the macro environment. In an environment of high interest rates, a strong dollar, and a turbulent financial system, BTC does not naturally have a "counter-cyclical" advantage, but is more of a highly elastic speculative target.

If BTC cannot play a safe-haven role at a critical moment, and even behaves as sensitive as technology stocks in the face of systemic risks, then is it digital gold, or another highly volatile asset with a label of faith? This is not a denial of BTC, but a rethinking of the "pricing logic" of the entire crypto asset.

However, the good news is that "volats have cycles, and the market is still moving forward."

Because similar tariff farces have been staged more than once in American history, and the final result is often to push the global trade mechanism towards a more mature and rational direction. For example, the most notorious tariff bill in American history was the Smoot-Hawley Tariff Act signed by President Hoover in 1930, which raised tariffs on thousands of commodities to historical highs in an attempt to save the domestic economy through protectionism. However, it led to further deterioration of the US economy, soaring unemployment, and a nearly two-thirds decline in global trade. Three years later, the Roosevelt administration had to correct its mistakes with the Reciprocal Tariff Act, launching the United States' long-term free trade strategy.

Back to this incident, the Trump administration's proposed super-strong tariff policy, although more powerful and covering a wider range, quickly "put on the brakes" after the market reacted extremely violently in the short term. This in itself sends a signal: it is more like a bargaining chip rather than a substantive conflict.

In fact, Trump is very good at walking the line between "creating risks" and "controlling risks." At the same time, he is not shy about using the financial market as a political tool.

Another thing worth noting is that according to data from the U.S. Treasury and CBO, the size of U.S. debt maturing in 2025 exceeds 9 trillion U.S. dollars. The fiscal deficit problem is imminent, and the Federal Reserve has little window left to maintain high interest rates.

The tariff action at this time may be more likely to be a means of bringing about a "new round of capital repatriation" to the United States: on the one hand, it increases the demand for the US dollar in the name of taxation, and on the other hand, it creates market uncertainty while lowering asset prices and increasing the attractiveness of safe-haven assets, thereby opening up a capital entrance to the U.S. bond market.

Of course, Portal Labs also believes that based on his various operations before announcing the exemption, it is also a common practice for Trump to seek economic benefits through politics.

So, can crypto players still stick to long-termism?

Whether from the perspective of policy or the market, it is clear that long-termism is no longer just BTC HODL. Trump's frequent changes in tariff policies have led to a great risk aversion in the market. Before the trade war and tariff war end, market uncertainty will continue for a long time, and market volatility will also continue.

It is worth noting that at the BNB Chain community event on April 7, when asked whether he should still stick to "HODL", CZ pointed out that some really have fundamentals and practical applications, and you can hold them for a long time. At the same time, he believes that BTC is now a reserve asset, and holding it will increase in value in the long run, but in addition, some fundamentals are better and can outperform BTC in a certain period of time. And these require a higher level of cognition to understand and discover.

Looking back, what has truly stood the test of time in the crypto market is never the short-term price advantage, but the structural assets and on-chain application networks that still exist and are still used after each narrative collapse. Whether it is infrastructure such as public chains, DePIN, and AI, or decentralized applications such as wallets and cross-chain bridges, they are the underlying soil that supports the continued progress of this industry.

When the "Beta attribute" obscures the original intention of Bitcoin itself, what we need at this time is not a new emotional placebo, but to re-establish our judgment on the true value of the chain.

Long-termism is never an obsession with the price of coins, but an understanding and participation in the evolution of structures. Just like what our country has always insisted on, it is open to the application of encryption technology and conservative about the financial attributes of tokens. What is really worth investing in is never a candlestick on the price chart, but those Web3 projects that use code and mechanisms to build a new order.

Therefore, instead of worrying about the market, it is better to understand those projects that are still iterating protocols, promoting implementation, and truly trying to use blockchain to solve real problems.