If we talk about who is the "hottest star" in the Payfi track, Morph, a consumer-grade public chain, should have a place.

Since February 2025, Morph has successively launched Morph Pay, Morph Black NFT Card and Morph Platinum NFT, which quickly became a hot topic in the Web3 community and the PayFi industry.

Perhaps you are curious, why would a project that positions itself as an L2 public chain turn to PayFi?

Mankiw's understanding is that Morph has always been committed to "empowering developers and creating applications that touch the hearts of consumers" and is committed to making blockchain technology a part of daily life through an efficient, secure and easy-to-use blockchain platform. Entering the PayFi track is not a sudden whim, but Morph has further deepened its consumer-level public chain positioning and focused on providing more diversified payment and financial services for users and ecological applications.

However, judging from the current community voice, there is still room for further improvement in product construction and business logic.

In this article, Attorney Mankiw will discuss with you the optimization direction and compliance approach of this type of PayFi product from a legal perspective based on Morph’s exploration.

Morph Project Overview

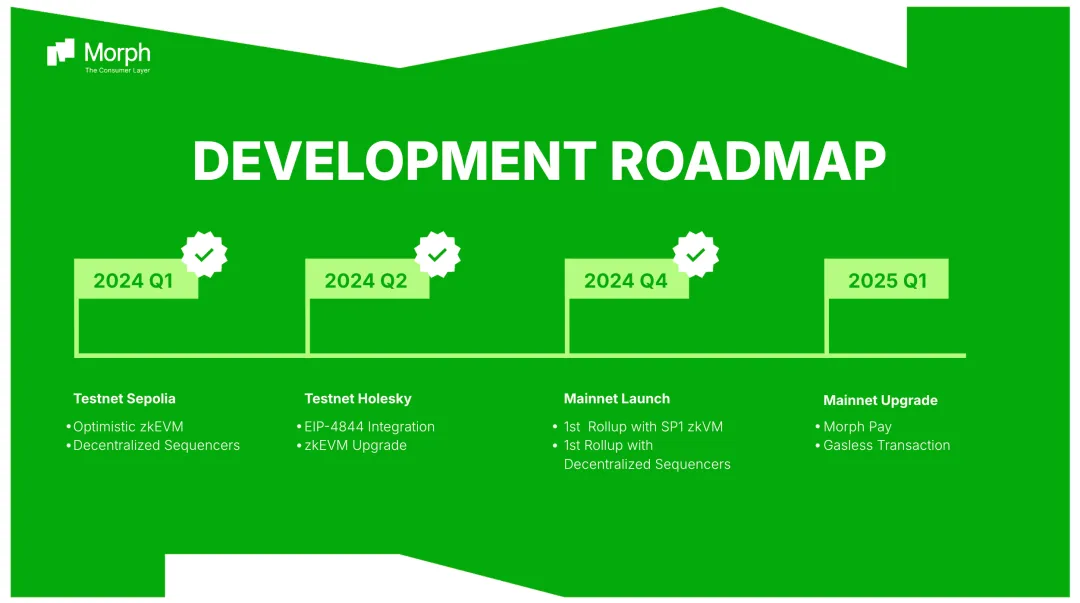

Without further ado, let's first take a look at the roadmap of the Morph project.

2024Q1-Q2: Technical architecture polishing period

In early to mid-2024, Morph's core mission is to improve the technical architecture and provide a solid technical foundation for the platform's future user growth and decentralized applications.

By implementing zkEVM, Morph enhances privacy protection and transaction efficiency. At the same time, EIP-4844 technology solves the problems of transaction storage and gas fees, improving the performance and scalability of the platform. The implementation of the decentralized sorter ensures the decentralized nature of the platform, laying a solid foundation for future large-scale decentralized applications and user growth.

2024Q4: Mainnet launch

In the fourth quarter of 2024, Morph successfully completed the launch of the mainnet, marking the Morph project has entered the productization stage. At the same time, the implementation of the modular architecture makes the platform more flexible in function expansion and application deployment. By improving the performance of the platform and simplifying the user experience,

During this period, Morph provided developers and users with more efficient and convenient services, ensuring the smooth deployment of large-scale decentralized applications.

2025Q1: PayFi launch

With the arrival of Q1 2025, Morph has reached a critical point in its strategic transformation.

Through the innovative product Morph Pay, Morph has not only moved from public chain infrastructure to a financial service platform, but also further expanded the PayFi track. The launch of Morph Pay is not just an addition to the payment tool, it integrates virtual assets and legal currency asset management, high-yield accounts, and ecological reward mechanisms, forming a complete PayFi ecological closed loop.

In addition, Morph further strengthened its PayFi ecosystem by launching two NFTs, Morph Black NFT and Morph Platinum NFT. These NFTs are respectively bound to different user rights, such as exclusive airdrops, payment discounts, etc. Through these NFTs, Morph not only strengthens the binding of user identities, but also provides a points reward and profit mechanism, further enhancing user participation and platform stickiness.

A deep dive into the business model

As an emerging blockchain track, PayFi combines the two elements of traditional payment (Pay) and decentralized finance (Fi), aiming to provide more convenient, efficient and transparent financial services through blockchain technology. This track is not limited to simple payments and transactions, but also covers multi-level financial functions, solving the pain points in the traditional financial system through innovative products and services.

Compared with most PayFi projects, Morph's PayFi core module is unique. In addition to traditional payment and DeFi functions, it also integrates NFT rights and incentive mechanisms, and has more innovative elements in user engagement and platform stickiness.

1. Account management + high yield mechanism

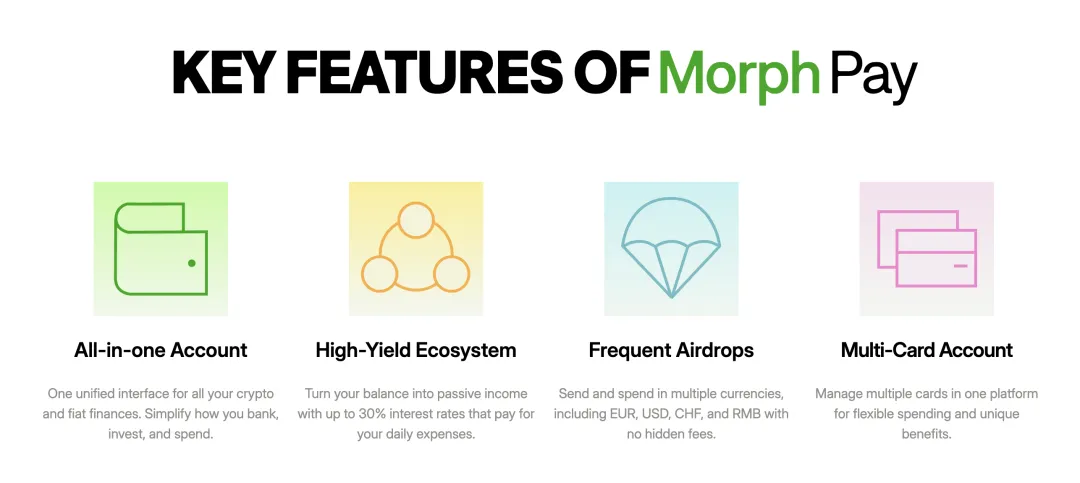

In the PayFi ecosystem, the platform usually provides users with a unified account management system, allowing users to easily manage virtual assets and legal currency assets. These accounts are not only used for the storage and transfer of funds, but also provide users with high-yield functions.

On the Morph Pay platform, users can manage their virtual assets and legal currency assets through a single entry, thereby achieving unified management of assets. In addition, the platform provides an annualized return mechanism of up to 30%, and users can use this mechanism to increase the value of their assets while enjoying the payment function. This mechanism not only provides potential returns for digital asset holders, but also allows traditional legal currency users to experience similar financial benefits.

In this core module, the compliance points that need attention are:

Promises of returns may raise concerns among regulators, especially when the return structure is not transparent or asset flows and risk information are not clearly disclosed. Platforms need to ensure that their high-yield account features comply with local financial regulatory requirements and avoid being considered as asset management products or unregistered financial instruments.

In some jurisdictions (such as Hong Kong and Singapore), high-yield products are subject to strict supervision. The platform should ensure that its transparency and risk disclosure comply with legal requirements to avoid potential legal risks.

2. Payment Card + NFT Rights

In the PayFi model, the combination of payment tools and incentive mechanisms is an important means for the platform to attract users. By providing a variety of card products, the platform can not only meet users' daily payment needs, but also provide users with exclusive rights and rewards.

In the Morph ecosystem, Morph Pay Card is the core payment tool, providing online and offline payment functions. By combining the NFT incentive mechanism, users holding Morph Black NFT and Morph Platinum NFT can enjoy customized payment discounts, privileges and platform rewards, further enhancing the payment experience. These NFT cards complement the functions of payment cards. In addition to providing payment convenience, they also give users more customized payment discounts, privileges and platform incentives.

The combination of Morph Pay Card and NFT card provides the platform with dual functions of payment and incentives, creating the core module of PayFi ecosystem. Users not only enjoy payment convenience, but also obtain long-term financial returns and exclusive rights, which enhances the user participation and loyalty of the platform.

In this core module, the compliance points that need attention are:

If the platform involves cross-border payments and exchange of virtual assets and fiat currencies, it is necessary to ensure that the payment tools comply with anti-money laundering (AML) and customer identity verification (KYC) requirements, and ensure their compliance in different jurisdictions.

If an incentive instrument (such as NFT) confers actual benefits or preferential rights, it may be considered a security, especially in markets such as the United States and Europe. Therefore, platforms need to pay special attention to whether the design of incentive instruments complies with local securities regulatory requirements, especially if they are associated with token issuance or token pre-sales, which may require risk disclosure and ensure compliance with regulations.

The platform needs to clearly disclose the reward mechanism, ensure that users understand the relationship between points and token issuance, avoid undisclosed risks, and ensure that the reward mechanism complies with financial promotion regulations.

3. Points + Airdrop

In the PayFi model, the platform further encourages users to participate in the construction of the platform ecosystem by setting up a points system, airdrop activities, and guiding behaviors. These mechanisms can not only increase user participation in the platform, but also lay the path for asset flow in user behavior.

In the Morph ecosystem, the platform further enhances user interaction and participation through the Morph Points and airdrop incentive mechanism. Users can obtain Morph Points by participating in different activities, completing tasks or transactions. These points can be used to redeem platform rewards or participate in airdrop activities. These airdrops are often associated with future token issuance (TGE), and the rewards obtained by users through participating in airdrops may become part of future tokens.

The use of Morph Points is not limited to point redemption, but may also be associated with users’ priority experience on the platform, community rewards, NFT card rights, etc., further enhancing user loyalty and platform stickiness.

In this core module, the compliance points that need attention are:

From a functional perspective, points or airdrops are essentially incentive mechanisms. Therefore, like the above incentive tools, if they are related to token distribution, the platform must ensure openness and transparency and fulfill its risk disclosure obligations in order to comply with relevant financial promotion regulations and securities laws in the user's location.

If the platform guides users to take certain actions, such as registering, trading, or joining a community, through points and airdrops, the platform should ensure that these actions comply with relevant financial regulations and avoid unauthorized financial promotion. In particular, in different regions, platforms need to pay special attention to the regulatory requirements for virtual asset-related promotion.

Attorney Mankiw's Summary

From Morph's exploration, we can see that PayFi, as an emerging track in the blockchain industry, is gradually shifting from an extension of payment tools to a multi-dimensional platform with more financial service functions. Through innovative payment tools, decentralized financial services, and user incentive mechanisms, the PayFi project can provide users with a more convenient and efficient financial experience.

In this process, Morph has demonstrated the potential of this track by combining payment and financial incentive mechanisms, but its recent community disputes over NFT cards also show that the PayFi project still needs to better manage incentive mechanisms and user expectations during its development. These problems are not only unique to Morph, but are challenges faced by the entire industry.

Therefore, how to deal with these challenges may affect the sustainable development of this type of PayFi project. Attorney Mankiw believes:

1. From a business logic perspective, it is necessary to strengthen the balance between incentive mechanisms and user experience. This is especially true when it comes to rewards in the form of NFTs, points, airdrops, etc. When designing these mechanisms, project owners must not only ensure that they can effectively increase user participation, but also consider the long-term loyalty and ecological stickiness of users. Only by rationally planning the relationship between incentives and long-term value can we avoid “one-shot deals”.

2. In terms of operation and management, special attention should be paid to communication with users. In particular, when it comes to sensitive operations such as equity distribution and NFT card issuance, all key information, including product features, equity and potential risks, should be disclosed to the community in a timely and transparent manner. Overly vague market promises or failure to respond to user concerns in a timely manner can easily cause unnecessary market confusion and negative emotions, which in turn affects the brand image and user base.

3. In terms of compliance requirements, PayFi projects usually involve sensitive areas such as the exchange of virtual assets and legal currencies, user profit promises, etc. Although it is a cliché, it still makes sense to ensure that all products comply with local financial regulatory requirements, including AML/KYC, review, risk disclosure, etc.

/ END.

Authors: Iris, Shao Jiayi