The macroeconomic turmoil has not yet subsided, funds are rationally repaired during the period of shock and bottoming out, the SOL chain performs outstandingly, and BTC maintains its dominance.

✅ Short-term perspective (1-2 weeks)

Market status: In the period of shock bottoming, the main force changes hands around BTC 8.45w, and ETH/BTC bottoms out weakly.

Capital flows: ETFs saw a small return, and the issuance of stablecoins returned to neutral, and cautious bottom-fishing sentiment emerged in the market.

Operation suggestions: Control your position and pay attention to whether BTC can effectively break through 88.7w; the SOL chain is active and you can bet on a short-term rebound with a light position.

🔄 Medium-term perspective (1-2 months)

Macroeconomic game: The Supreme Court ruling in May may determine the direction of the Federal Reserve’s independence, and the policy risk window still exists.

Funding structure: If ETF and stablecoin funds continue to flow back, the market is expected to bottom out and then rebound.

Sector allocation: BTC maintains its dominance, paying attention to the structural rotation opportunities brought about by the recovery of TVL and activity of SOL and BSC chains.

🪙 Long-term perspective (1-2 quarters)

Macro trends: US dollar credit risk + sovereign state encryption reserve plan, strengthen BTC "digital gold" logic.

Structural opportunities: BTC and gold constitute the core configuration, and the SOL chain may move out of an independent cycle and has medium- and long-term potential.

Strategic direction: attach importance to BTC's long-term asset allocation status, pay attention to the long-term value of ecological restoration public chains (SOL/BSC), and wait and see L2 for the time being.

1. Macro and market environment

The core risks of the Trump-Powell conflict:

- Trump's firing threats and the Supreme Court's May ruling could undermine the Fed's independence and trigger a crisis of confidence in the dollar and monetary policy.

- Powell's insistence on data-driven interest rate decisions may resist political pressure in the short term, but long-term uncertainty depends on legal and political games.

Trump's "challenge" to Powell and the Fed's independence crisis it has triggered are the core risk points in the current market. Gold has the most allocation value under the expectation of inflation and currency crisis. Cryptocurrency is suitable for those with high risk appetite. U.S. stocks and U.S. dollar assets need to be operated with caution. Investors should pay close attention to the Supreme Court ruling in May and the subsequent statements of the Federal Reserve, and maintain a flexible response strategy.

2. Analysis of capital flows & market structure of mainstream currencies

External Funding Flows

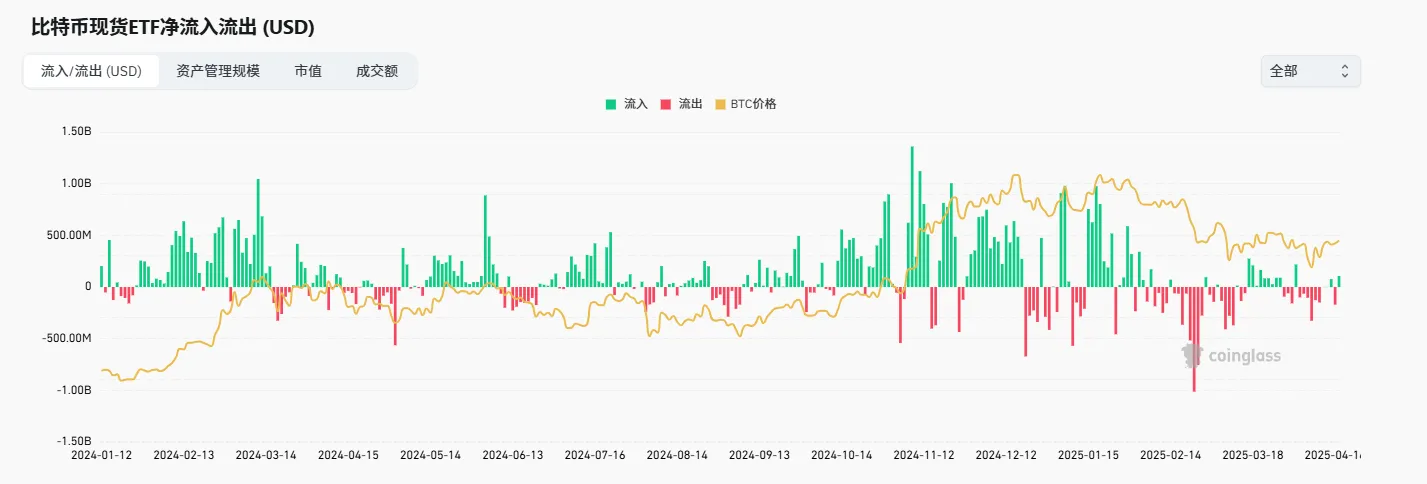

- ETF funds: This week's inflow was slightly 14 million, and short-term sentiment improved

- Stablecoins: 1.463 billion new issuances this week, returning to normal levels

Market sentiment indicators

- OTC premiums soared: Stablecoin premiums have been falling, with USDT premiums reaching below the water level

- MVRV: Short-term MVRV rebounds synchronously with prices, no abnormal situation

Bitcoin (BTC)

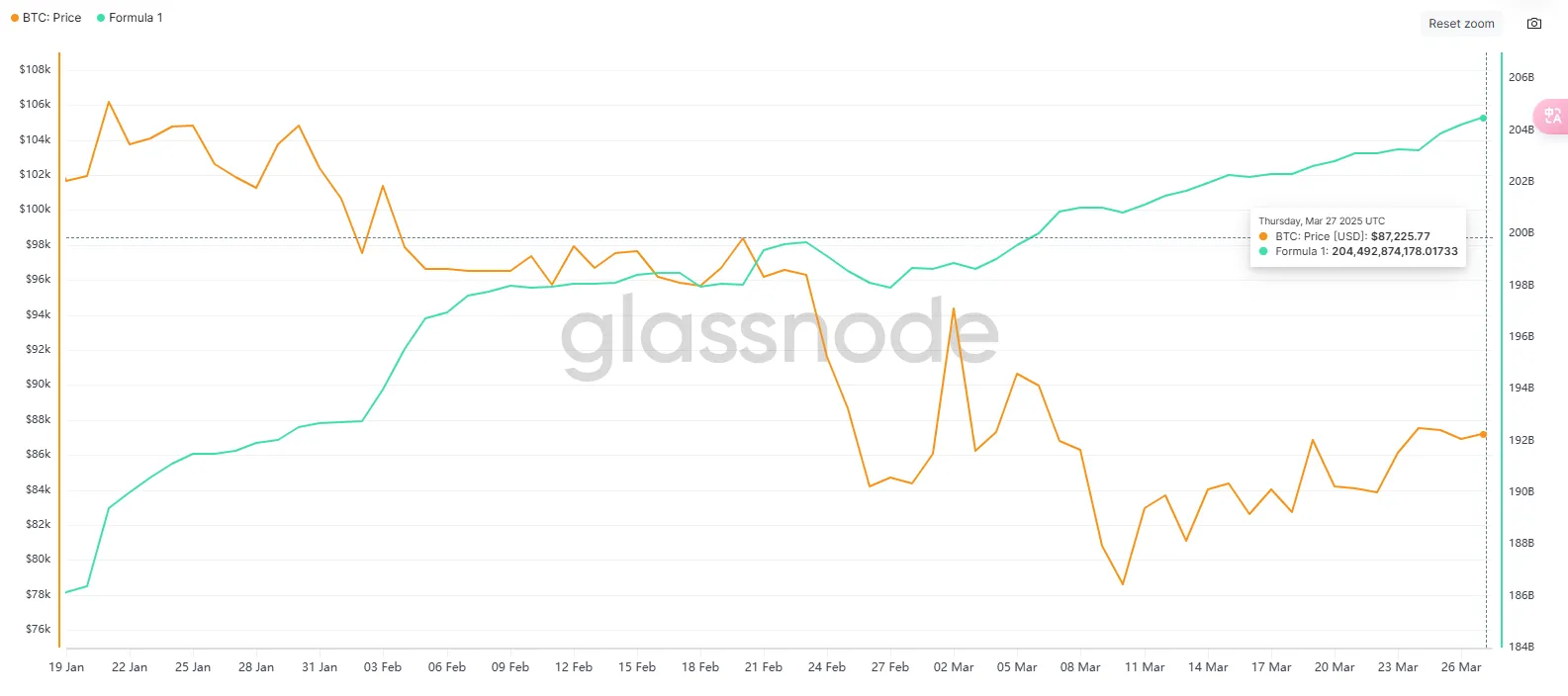

- Technical aspect: 8.6w-8.3w sideways consolidation phase with no obvious direction

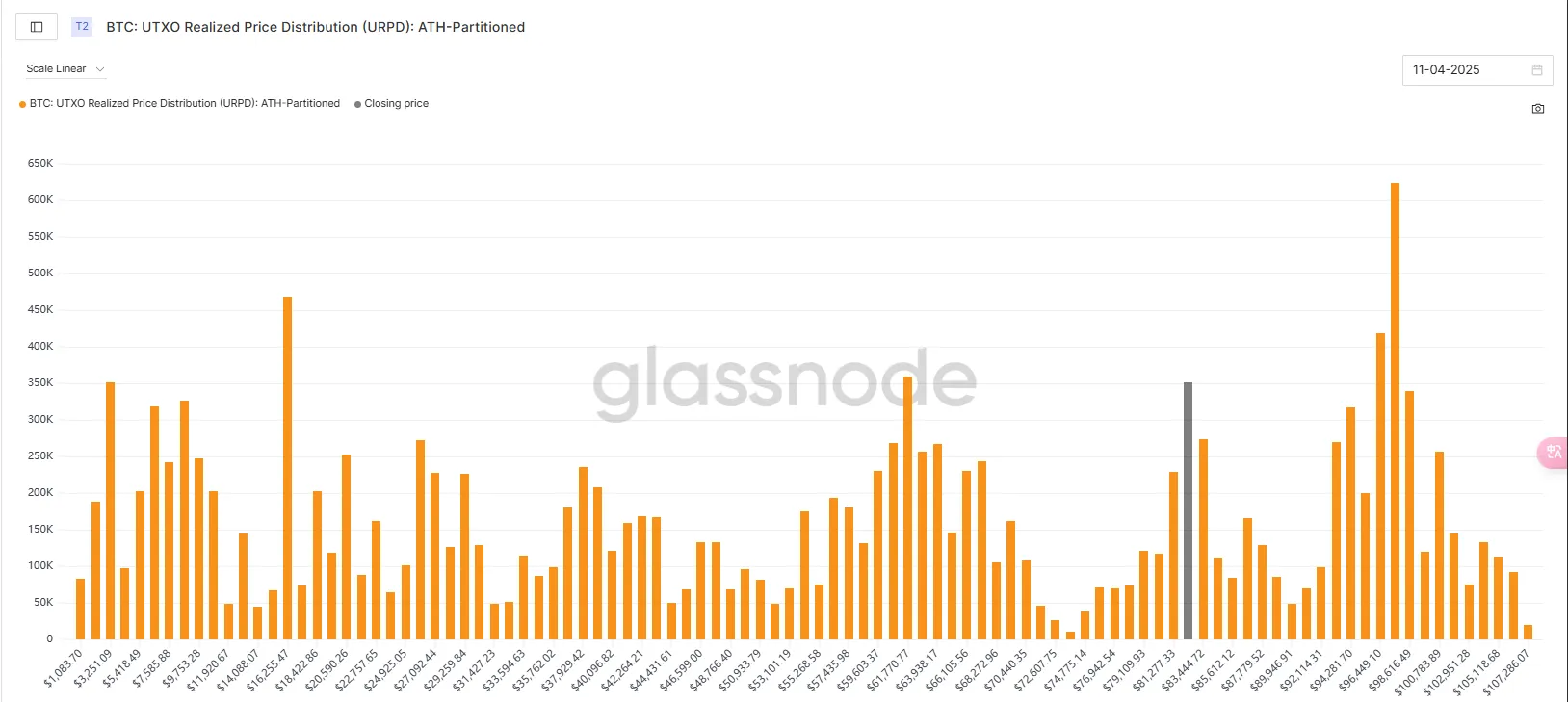

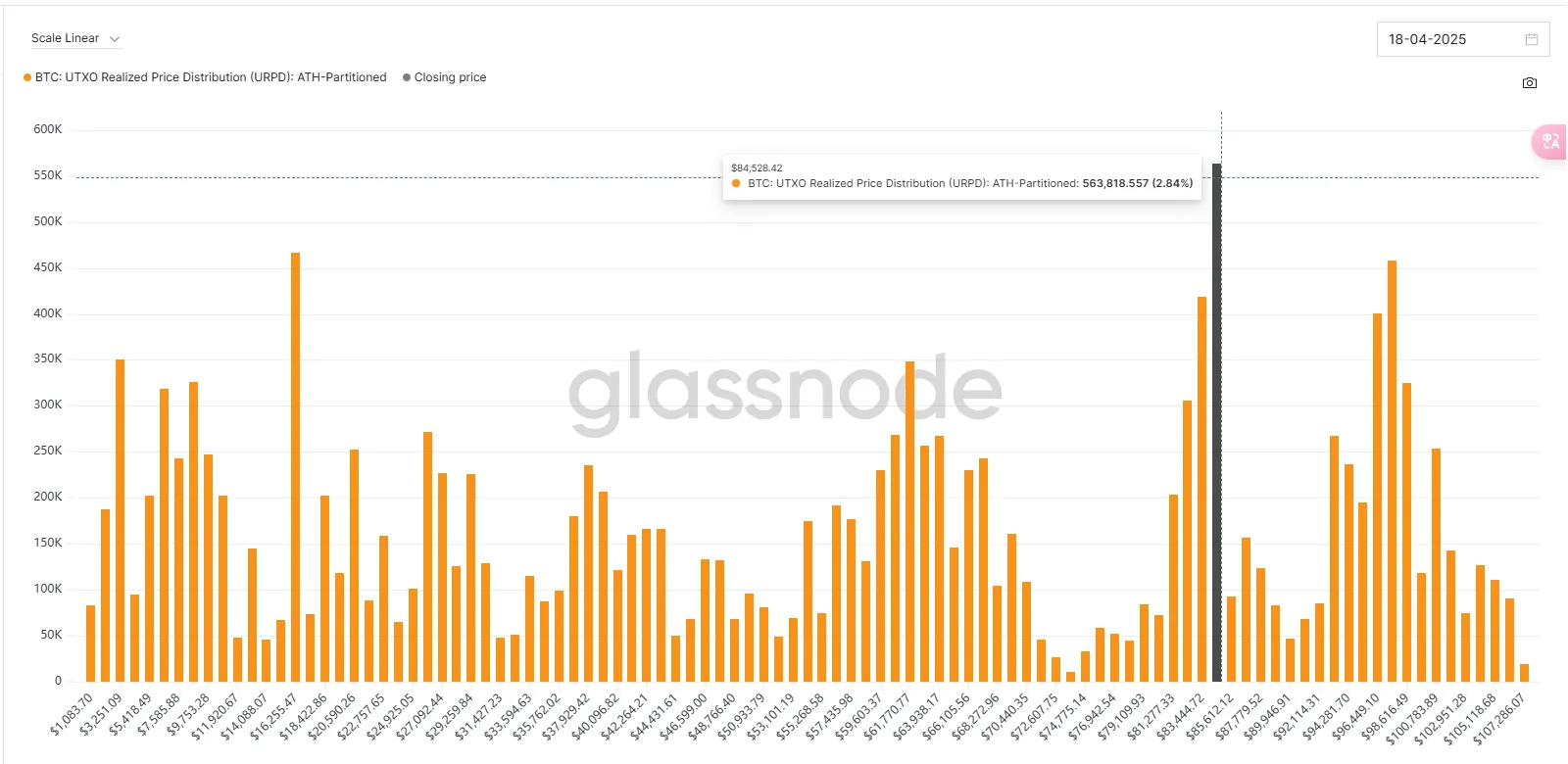

- On-chain chip distribution: The highest column in the chip-dense area dropped to 8.45w, and the upper 9.7w chips left the market significantly

Ethereum (ETH)

- The trend is weaker than BTC. ETH/BTC maintained volatility and then broke down this week, and funds continued to flow back to BTC dominance.

- On-chain changes: The increase in active addresses may indicate that the staged bottoming out has been completed.

1. Macroeconomic Review

Analysis of the conflict between Powell and Trump

The conflict between Trump and Powell is rooted in fundamental differences in monetary policy. Trump advocates low interest rates to stimulate economic growth, while the Fed led by Powell prioritizes controlling inflation and maintaining economic stability. Trump has publicly criticized Powell many times, saying that his interest rate cuts are insufficient and threatened to fire him, although the president does not have the legal power to directly fire the Fed chairman. This conflict is not only a personal confrontation, but also reflects the structural contradiction between political interference and the independence of the Federal Reserve.

History and current state of conflict

- History: Trump was dissatisfied with Powell’s interest rate policy during his first term (2017-2021). For example, when the interest rate was cut to 1.75%-2% in 2019, Trump still believed that it was not strong enough and publicly called Powell "cowardly, brainless, and short-sighted."

- Current situation: At the end of 2024, the Fed paused after cutting interest rates by 100 basis points. Powell said in April 2025 that he would observe the impact of Trump's tariff policy on inflation and keep interest rates unchanged. Trump continued to pressure for a faster rate cut and reiterated on social media that Powell should "step down as soon as possible."

- Law and reality: Powell insisted that the president did not have the power to fire him early and that the law supports the independence of the Fed chairman. However, Trump's recent moves to fire members of other independent agencies and the upcoming Supreme Court case have added uncertainty.

Warren's concerns and the independence of the Federal Reserve Senator Warren warned that if Trump fired Powell, it would seriously damage the independence of the Federal Reserve and could cause a market crash. The independence of the Federal Reserve is seen as the cornerstone of the stability of the US economy. Political interference could lead to a collapse of market confidence in interest rate policies, which in turn could trigger stock and bond market fluctuations. Warren stressed that if interest rates were arbitrarily manipulated by the president, the US economy would lose credibility and become no different from a "second-rate dictatorship."

Potential consequences

- Short term: Trump’s threats could heighten market volatility, especially ahead of the Supreme Court ruling, as investors become more sensitive to policy uncertainty.

- Long term: If the independence of the Federal Reserve is impaired, the market may reassess the stability of US dollar assets, leading to capital outflows, US dollar depreciation or increased inflationary pressure.

The impact of tariff conflicts on cryptocurrencies, US stocks and other assets

Trump's tariff policy (such as imposing tariffs ranging from 25% to 70% on major trading partners) aims to address trade imbalances, increase fiscal revenue and reshape the US manufacturing industry, but its uncertainty and potential inflationary effects have a complex impact on asset markets. The following is an analysis from the perspectives of cryptocurrencies, US stocks, US dollar assets and gold.

Market Outlook:

- For the rest of April, market volatility is likely to remain high due to Trump's continued pressure and uncertainty over tariff policies.

- The Supreme Court’s ruling in May will be a critical node. If it supports Trump, market volatility may intensify; if it does not, short-term panic may ease, but long-term risks will remain.

- Combined with the CME’s “Fed Watch Tool” (high probability of a 25 basis point rate cut in June), the Fed may maintain a cautious stance, exacerbating tensions with Trump in the short term.

Summary: Trump's "challenge" to Powell and the Fed independence crisis it triggered are the core risk points of the current market. Gold has the most allocation value under the expectation of inflation and currency crisis. Cryptocurrency is suitable for those with high risk appetite. U.S. stocks and U.S. dollar assets need to be operated with caution. Investors should pay close attention to the Supreme Court ruling in May and the subsequent statements of the Federal Reserve, and maintain a flexible response strategy.

1. Cryptocurrency

Influence:

Increased short-term volatility: Market uncertainty caused by tariffs and fluctuations in the US dollar exchange rate may boost speculative demand for cryptocurrencies. Assets such as Bitcoin are often seen as "safe haven assets" or "inflation hedges" during market turmoil, especially when investors are worried about the depreciation of the US dollar or rising inflation.

Long-term trends:

- Positive: The instability of the global monetary order (overvalued US dollar, debt cycle turning point) may push up the demand for gold and Bitcoin. However, Bitcoin is slightly less attractive than gold due to its greater regulatory risks and volatility.

- Risks: Cryptocurrencies could come under pressure if inflation from tariffs forces the Federal Reserve to delay rate cuts, as higher interest rates reduce appetite for riskier assets.

Cryptocurrencies could benefit from market turmoil and inflation expectations amid tariff conflict, but volatility remains high

2. US stocks

Influence:

Overall pressure: Tariffs increase corporate costs (increase in prices of imported raw materials), weaken consumer spending power (increase in prices of consumer goods), and reduce corporate profits. Most companies operating in the United States (including high-quality companies) may be harmed, and low-quality companies may even face bankruptcy risks.

Differentiation effect:

- Sectors that would benefit: Companies that produce locally and face foreign competition, such as U.S. Steel, are likely to benefit from tariff protection, but they make up a small portion of the market.

- Affected sectors: Manufacturing, retail and technology companies that rely on import supply chains have been hit hard.

Market expectations:

- Scholars such as Krugman have warned that uncertainty over tariffs could lead to reduced corporate investment and ultimately trigger a recession.

- The extreme tariff scenario analyzed by Citigroup (45%-70% tariffs across the board) could cause U.S. stocks to fall as high tariffs weaken corporate profits and consumer demand.

- Howard Musk believes that tariffs could trigger market chaos similar to Brexit, and U.S. stock volatility will increase in the short term.

Long-term outlook: Optimists such as Bessant believe that if the manufacturing industry successfully returns to the U.S., the U.S. stock market may prosper in the long term due to economic transformation, but the premise is that the government debt does not explode and short-term fluctuations do not trigger a systemic crisis.

Conclusion: US stocks are under short-term pressure and volatility is rising. The long-term outlook depends on the effectiveness of the implementation of tariff policies and the success of economic transformation.

3. Gold

Influence:

- Strong support: Gold is the best hedge asset at the turning point of the currency and debt cycle because it does not constitute a liability to others, and central banks tend to hold gold during times of conflict. The inflation expectations caused by tariffs and the risk of a depreciation of the US dollar further increase the attractiveness of gold.

- Market logic: Gold performs well in a stagflation environment, especially when the global monetary order is turbulent.

- Allocation recommendation: Dalio recommends that gold account for 10%-15% of the portfolio, taking precedence over Bitcoin due to its lower volatility and regulatory risks.

Conclusion: Gold is the preferred safe-haven asset amid tariff conflicts and economic uncertainties, and has high long-term allocation value.

Key data to watch next week

2. On-chain data analysis

1. Changes in short- and medium-term market data that affect the market this week

1.1 Stablecoin Fund Flow

This week, 1.463 billion stablecoins were issued, with an average daily issuance of 209 million. The issuance has returned to normal levels, indicating that market confidence is gradually recovering and capital liquidity has rebounded, but it has not yet entered the overheating stage. It is expected that the market will be dominated by fluctuations in the short term, and we need to pay attention to the coordination of market momentum and multi-factor resonance.

The market may have completed a reshuffle after the issuance of additional shares returned to a "neutral level"

Stablecoins rebounded quickly from the negative growth (capital outflow) of the previous week, but it was not an "excessive surge", indicating that the last round of turmoil did not trigger systemic outflows, and the funds were only temporarily seeking safety. Now they are returning in an orderly manner, and there has been no "funds rushing in" in pursuit of rising prices, reflecting a rational repair.

1.2 ETF Fund Flow

This week, ETF inflows rebounded slightly by 14 million. Market sentiment may be gradually recovering, but confidence is still in the repair stage. Despite the rise in BTC prices, ETF inflows have not increased significantly. The market has not yet shown signs of large-scale capital inflows, so it needs to be observed in the short term.

Potential impact on the market:

Although ETF inflows have rebounded this week, the overall scale is relatively small, indicating that market sentiment is still in the repair stage and prices may continue to fluctuate. In the short term, we need to pay close attention to whether fund flows continue to rebound to determine whether the market has stronger upward momentum.

1.3 OTC Discounts and Premiums

This week, the OTC premium and discount have been on a downward trend, and the USDT premium has already reached underwater. The corresponding market performance is that BTC fluctuates between 86,000 and 83,000. The decline in the OTC premium level may be due to the short-term bottom-fishing chips taking profits and the upper chips leaving the market (analyzed below).

1.4 URPD

The left picture is the BTC on-chain chip structure chart on April 11, and the right picture is the on-chain chip structure chart on April 18. In comparison, the chip volume near 84528 this week rose rapidly to 2.84%, becoming the new maximum chip volume. The maximum chip peak reduction time of 97532 in the left picture was on the 16th, when BTC surged to 86496. The chip volume dropped from 3.1% to 2.31%, a decrease of 0.79%, indicating that some high-level investors stopped losses after the rebound. These high-level investors did not stop losses when BTC fell to 75,000 in the early stage, but stopped losses in the last two or three days of this week. It is not sure what they saw or based on what judgment they made, but judging from the data line, they should be cautious at present.

Of course, if we interpret it from another perspective, the current price can stay at this position, and new funds have entered the market, forming a new main cost area. It reflects that market confidence has been restored but is still cautious. At present, the position of 84,000-86,000 is the key position of the long-short game.

2. Changes in mid-term market data that affect the market this week

2.1 Proportion of coins held by coin holding addresses

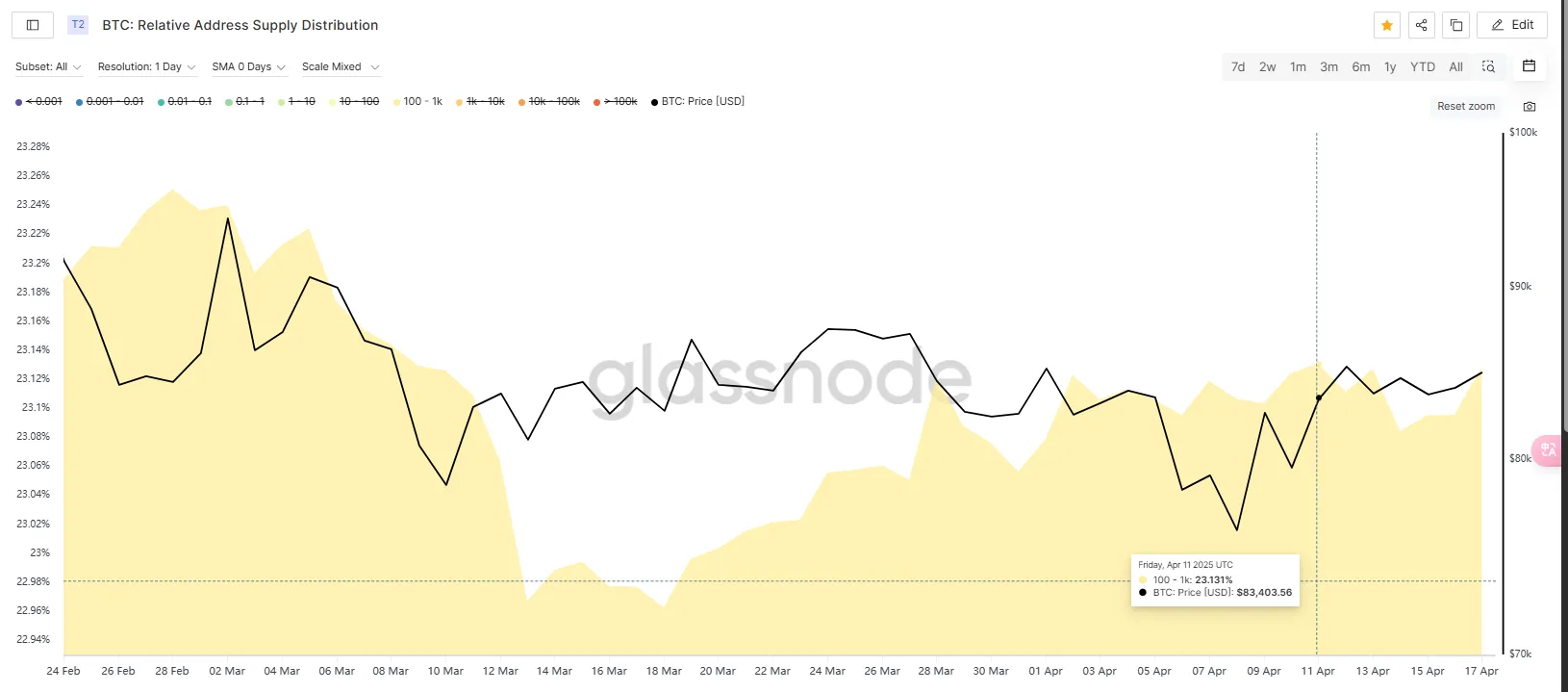

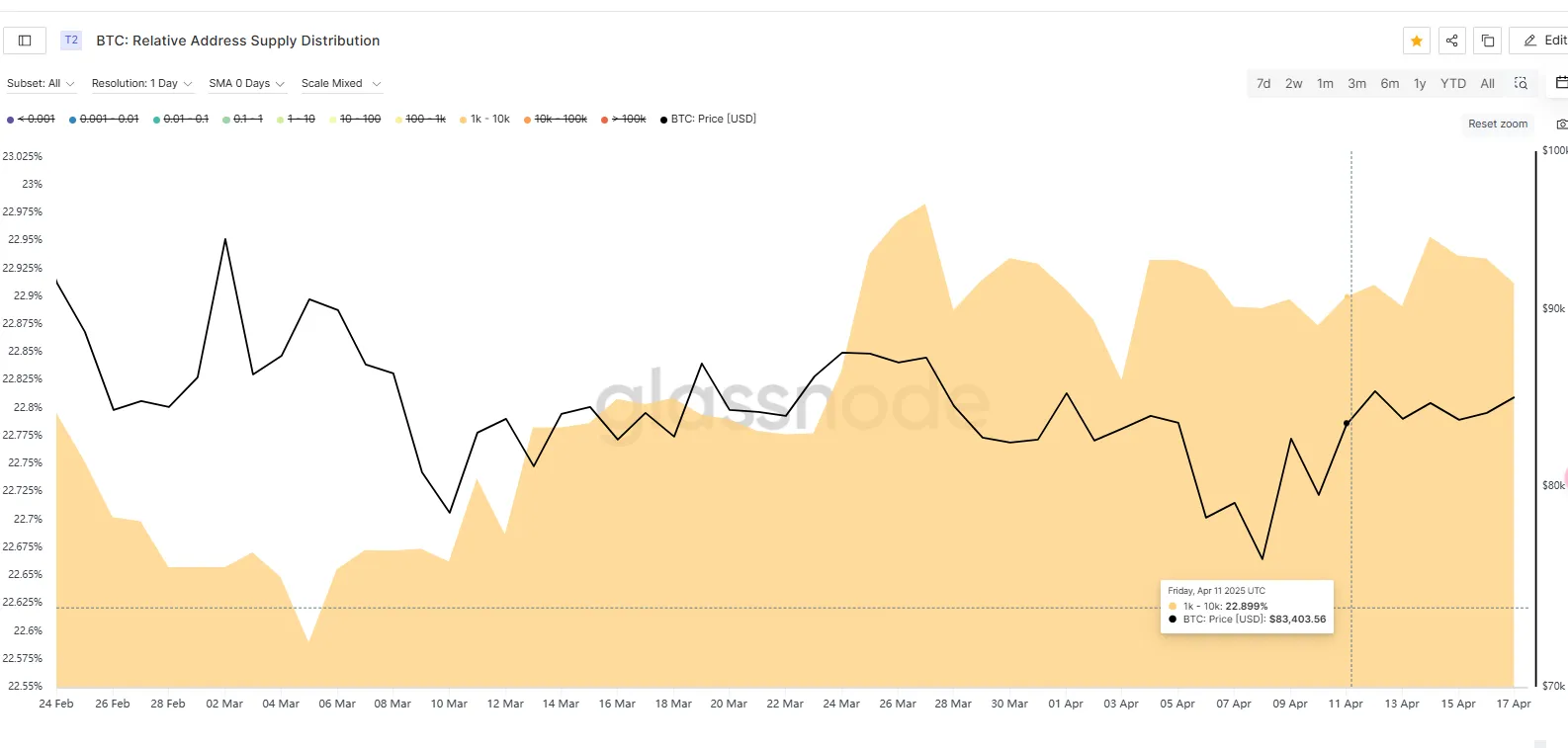

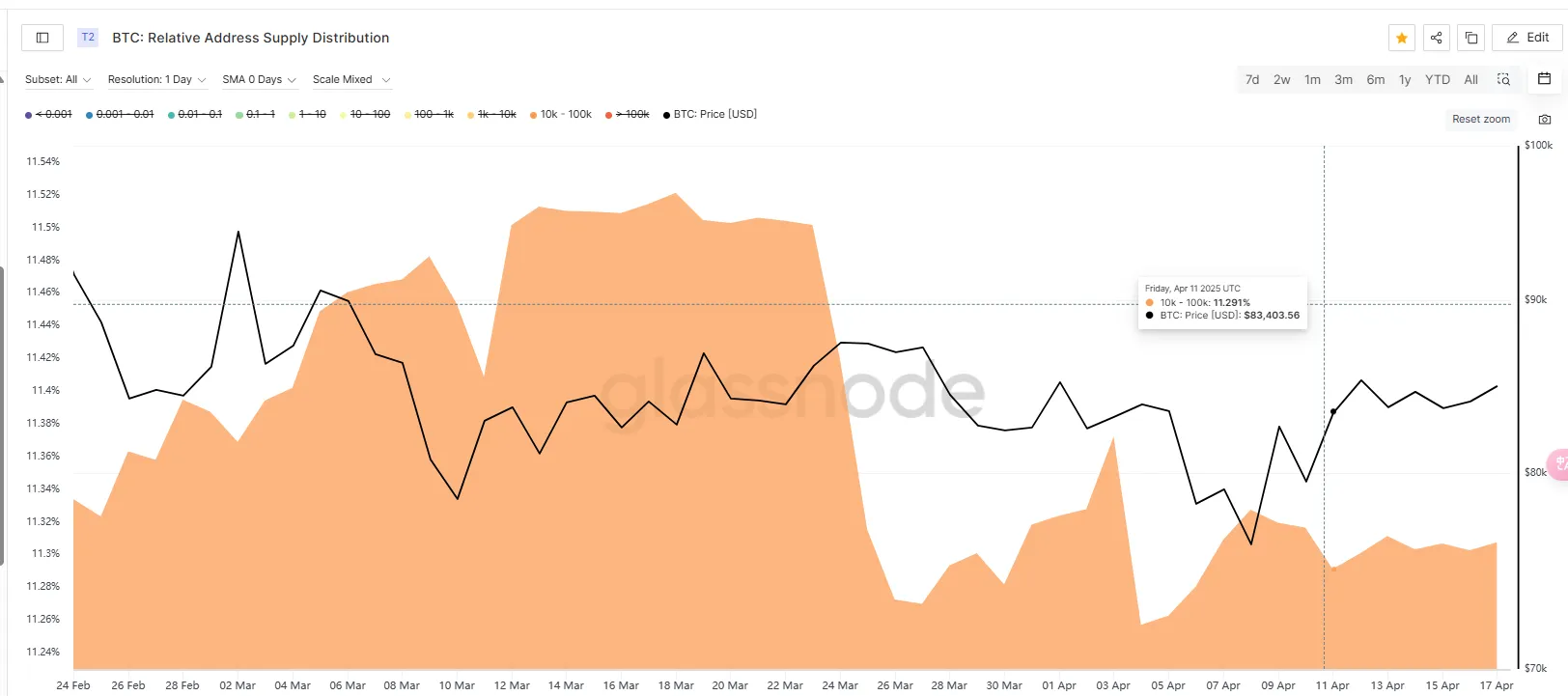

This week, the BTC price is in a narrow range of fluctuations after reaching a high. Judging from the on-chain chip holdings, the addresses with 100-1k have been trading in waves with market fluctuations, the addresses with 1k-10k have a slow growth trend, and the addresses with 10k-100k have no major fluctuations.

2.2 Short-term chips-MVRV

The MVRV indicator of BTC's short-term holders also rebounded synchronously with the price rebound. It has a high positive correlation with BTC and there is no abnormality at the moment, so we will continue to pay attention to it.

2.3 Market Pattern Analysis

BTC has been in the sideways range of 8.6-8.3w for 7 days. It is currently fluctuating in a narrow range around 8.45w. Affected by the three consecutive days of the US stock market closure, it has not yet chosen a direction. The Bollinger Bands show that the daily sideways range has been above the middle track and is also consolidating above the downward trend line. The form is strong and there is a possibility of a surge. The liquidation strength of 8.67w above is still very attractive on the liquidation map. If it surges first, it is necessary to focus on the magnitude of the surge after liquidation. If it fails to break through the yellow line 8.87w in the figure, it may be a false breakthrough, thus ushering in a large retracement. If you choose to fall below 8.3w first, you need to pay attention to the support of 8w below and whether the rebound can enter the trading range above 8.3w.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Sylvia / Jim / Mat / Cage / WolfDAO

Edited by: Punko / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, research or appreciation only.