Macroeconomic Review

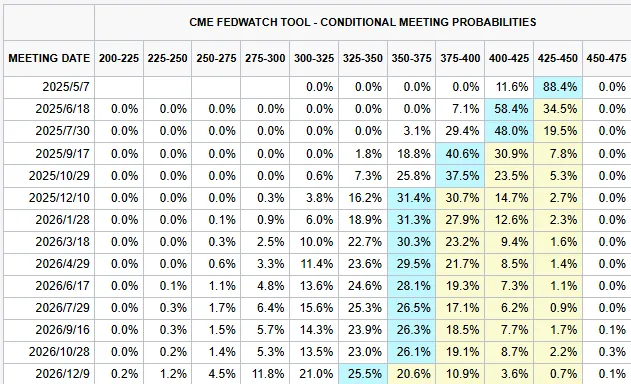

1. Adjustment of interest rate cut expectations: Overall, the trend is toward “the probability of interest rate cuts is decreasing”

- This week's economic data was generally stronger than expected, especially key data such as industrial output, employment market, import prices, and service industry PMI, which reduced the possibility of the Federal Reserve cutting interest rates in the short term.

- Since the market has already partially factored in expectations of a rate cut, the current data that exceeded expectations has reduced the probability of a rate cut, which in turn has affected market trends.

2. Market impact of lower probability of interest rate cuts

- Nasdaq index is under short-term pressure: historical data shows that whenever the probability of a rate cut drops by 20%, NDX may fall by 0.5%-2%.

- Bitcoin may also be under pressure: macro factors such as CPI and interest rate expectations have a high correlation with Bitcoin. If expectations for rate cuts decline, Bitcoin may follow the stock market adjustments in the short term.

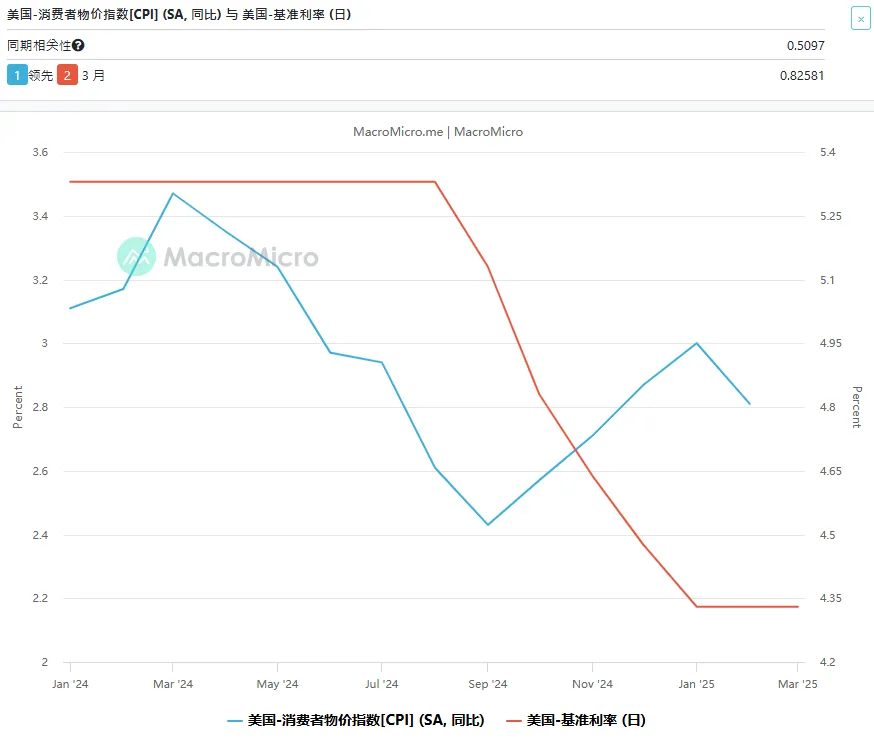

3. The relationship between CPI and the market: affecting interest rate cut expectations and asset prices

- CPI rises (high inflationary pressure) → expectations of interest rate cuts decrease → Nasdaq falls, and Bitcoin is under pressure.

- CPI falls (inflation eases) → rate cut expectations rise → Nasdaq rises, Bitcoin performs stronger.

- Historical data shows that for every 1% change in CPI, the Nasdaq will move in the opposite direction by about 7%, while Bitcoin may amplify the fluctuation range to more than 15%.

4. Asset Correlation Analysis: Nasdaq vs. Bitcoin

- The Nasdaq is positively correlated with Bitcoin (correlation coefficient 0.65–0.89).

- Long-term trend: For every 1% increase in the Nasdaq, Bitcoin may increase by about 0.46%.

- Short-term volatility: For every 1% increase in the Nasdaq, Bitcoin may increase by 2.17% in the short term.

Data analysis

1. Fund Flow:

- Stablecoin fund flow: This week, the total amount of stablecoins slowly increased to 204.493 billion, setting a new record high

- ETF fund flows: ETFs received an inflow of 290 million this week, a relatively small amount.

- OTC: The premium level this week showed a slight fluctuation trend, and currently only has a slight premium level

1. Macro Market Analysis

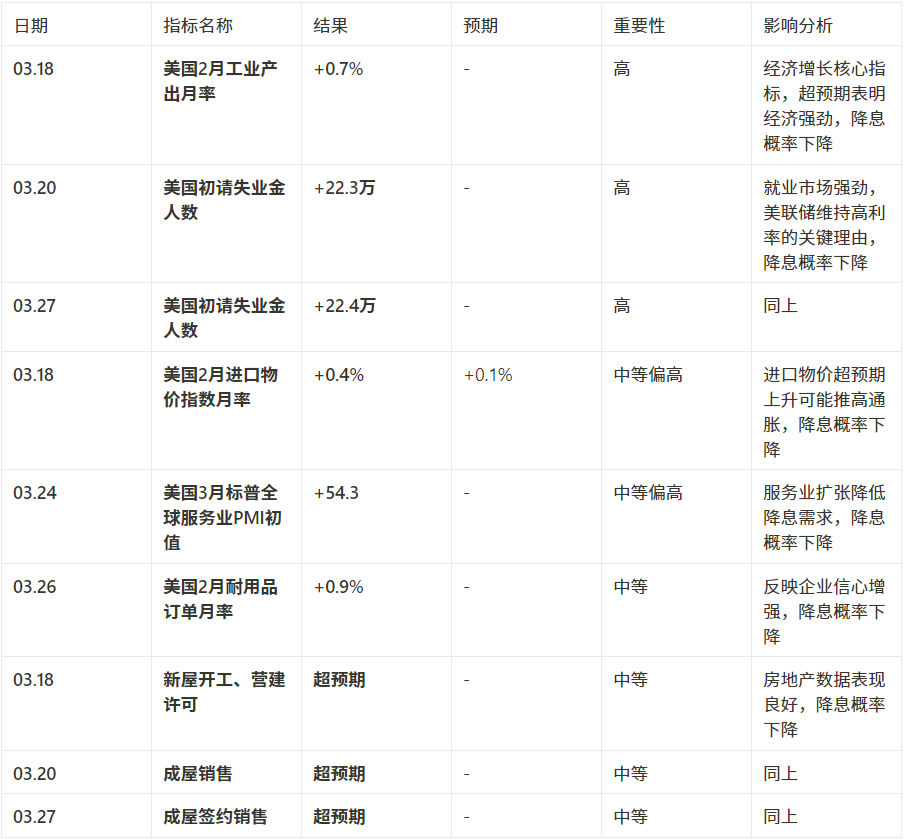

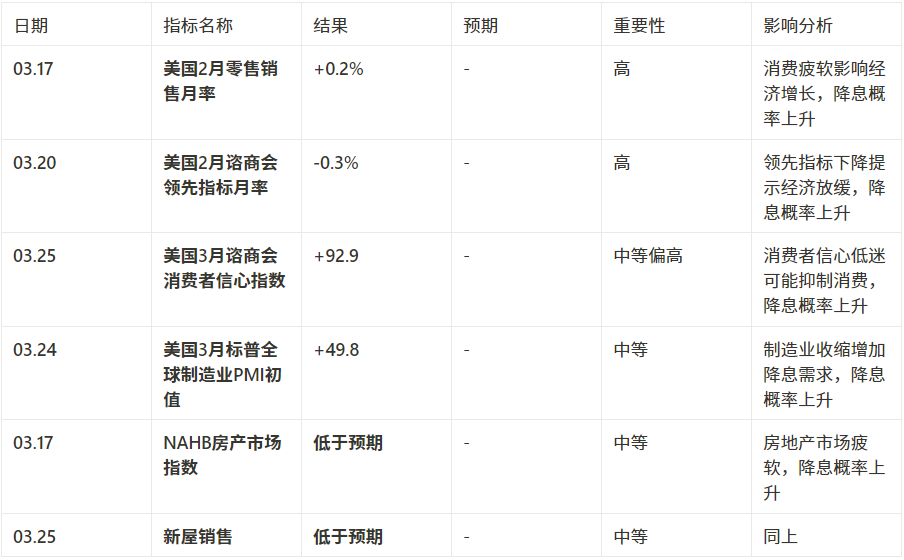

Monthly data review: factors affecting interest rate cut expectations

- Expectations of interest rate cuts weakened (surpassed expectations)

- Expectations of interest rate cuts increased (lower than expected data)

Data Summary

Adjustment of the probability of interest rate cut:

The data that exceeded expectations (industrial output, employment, import prices, etc.) generally prevailed, and the probability of interest rate cuts decreased.

Market impact: Combined with the previous relationship between CPI and NDX, the decline in the probability of interest rate cuts may cause short-term pressure on the Nasdaq index (for every 20% decrease in the probability of interest rate cuts, the NDX may fall by 0.5%-2%). Importance ranking: Industrial output, employment data and retail sales have the greatest impact on the probability of interest rate cuts, and investors should focus on these indicators.

1. When CPI rises, inflation is hot, Nasdaq falls, and Bitcoin may also fall; when CPI falls, policies are loosened, Nasdaq rises, and Bitcoin rises even more sharply. Short-term fluctuations are large, and long-term trends depend on probability and market sentiment.

2. Every 1% change in pce will result in a 15% change in btc

1. Relationship between CPI and Nasdaq

- CPI rises (high inflation): The market is worried about the Fed's interest rate hike. Rising interest rates will depress the valuation of technology stocks, and the Nasdaq may fall. For every 1% increase in CPI, the Nasdaq may fall by about 7% in the short term, and is expected to fall by 4% in two months.

- CPI falls (inflation slows): the market expects loose policies or interest rate cuts, low interest rates are good for technology stocks, and the Nasdaq may rise. For example, if CPI exceeds expectations and rises by 0.1%, the Nasdaq may fall by 0.5%-2%; if it falls by 0.1%, it may rise by 1%-3%.

- The data shows that the two are negatively correlated (correlation coefficient is about -0.62), and CPI changes lead Nasdaq by about two months.

2. The impact of CPI on interest rate cuts

- If CPI rises by 0.1% beyond expectations, the probability of a rate cut may drop by 20-30% (for example, from 50% to 30%); if it drops by 0.1%, the probability may increase by 20-30% (for example, from 50% to 70%).

- When there is a large fluctuation (such as a 0.5% increase), the probability of a rate cut may plummet by more than 50%, and vice versa.

3. Nasdaq’s relationship with Bitcoin

- Nasdaq and Bitcoin are positively correlated (correlation coefficient 0.65–0.89). In the long term, if Nasdaq rises 1%, Bitcoin will rise by about 0.46%; in the short term, it will rise by 2.17%.

- Combined with the impact of CPI: For every 1% change in CPI, the Nasdaq will change by 7%. If Bitcoin is magnified, the change may be around 15%.

Key data to watch next week

2. Data Analysis

1. Changes in short- and medium-term market data that affect the market this week

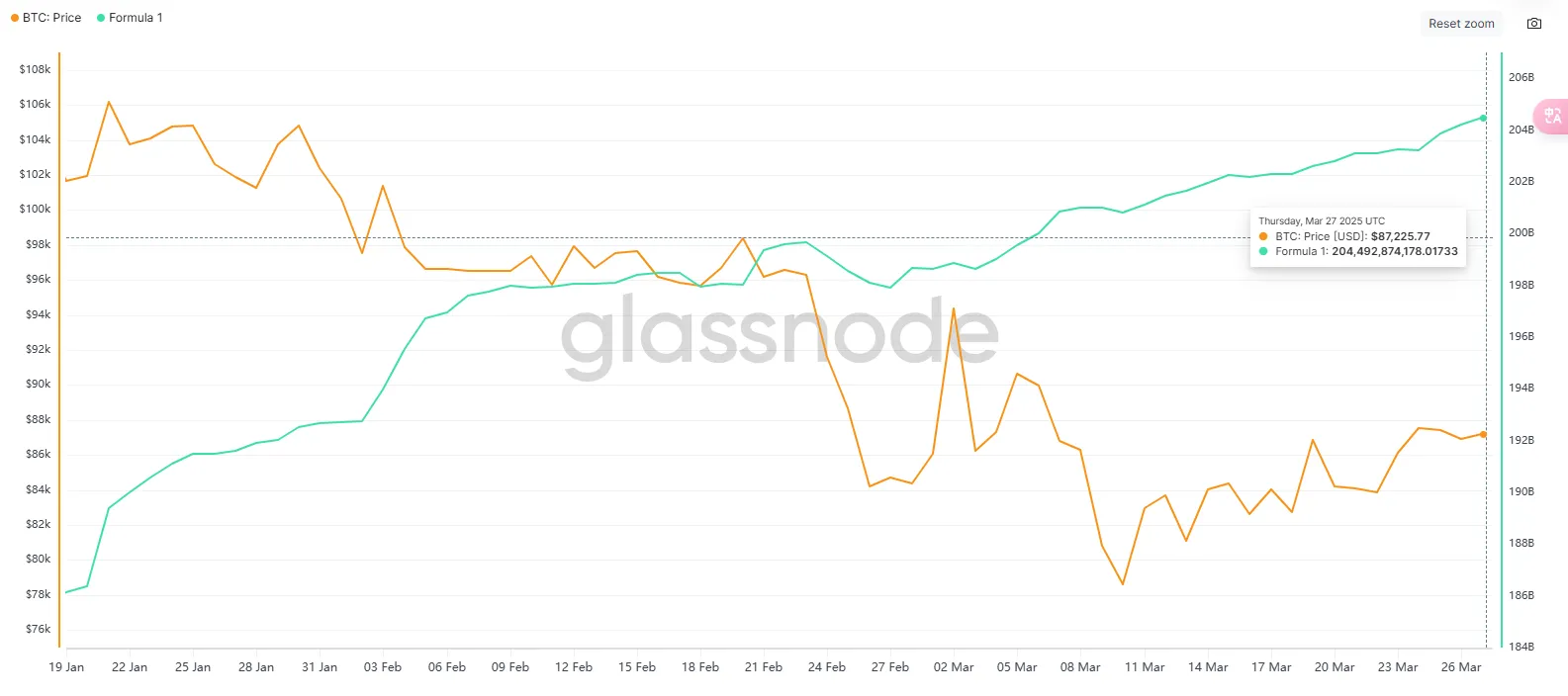

1.1 Stablecoin Fund Flow

The supply of stablecoins in the market continued to grow this week, with the total amount increasing to 204.493 billion, continuing to set a new record. The weekly increase was 1.704 billion, with an average daily increase of 243 million, which was a significant increase compared to last week. As of the 27th, the monthly increase was 5.825 billion, with an average daily increase of 830 million, an increase of 11% compared to the increase of 5.25 billion in the number of stablecoins in February, and a decrease of 53.4% compared to the average increase of 12.5 billion in the past 24/11-25/1 during the main uptrend.

Potential Market Impact

- Liquidity picks up, market sentiment remains optimistic

This week, 1.704 billion stablecoins were issued, a significant increase from the previous week. The overall issuance in March increased by 11% from February, indicating that market liquidity continued to pick up. Investor sentiment is relatively positive, and there are obvious signs of capital inflows, which may indicate that institutions and large investors are gradually increasing their positions.

- Impact on market prices

The overall issuance scale in March increased compared with February. Combined with the recent improvement in market sentiment, the recovery of stablecoin liquidity may become an important factor supporting the rise of BTC and other mainstream crypto assets. However, the current issuance scale is still far lower than the main rising wave period from November to January. It may support a rebound in the short term, but a larger scale of capital inflow is still needed to form a trend market.

- Funding sustainability still needs attention

Although the issuance of stablecoins in March has rebounded from February, the overall capital inflow level is still far lower than the main upward trend from November to January, with the issuance volume falling by 53.4%. This shows that the market is still in a stage of shock recovery, and whether the capital inflow trend can continue remains to be observed, especially the change in the issuance volume in the next few weeks will be an important signal for the further direction of the market.

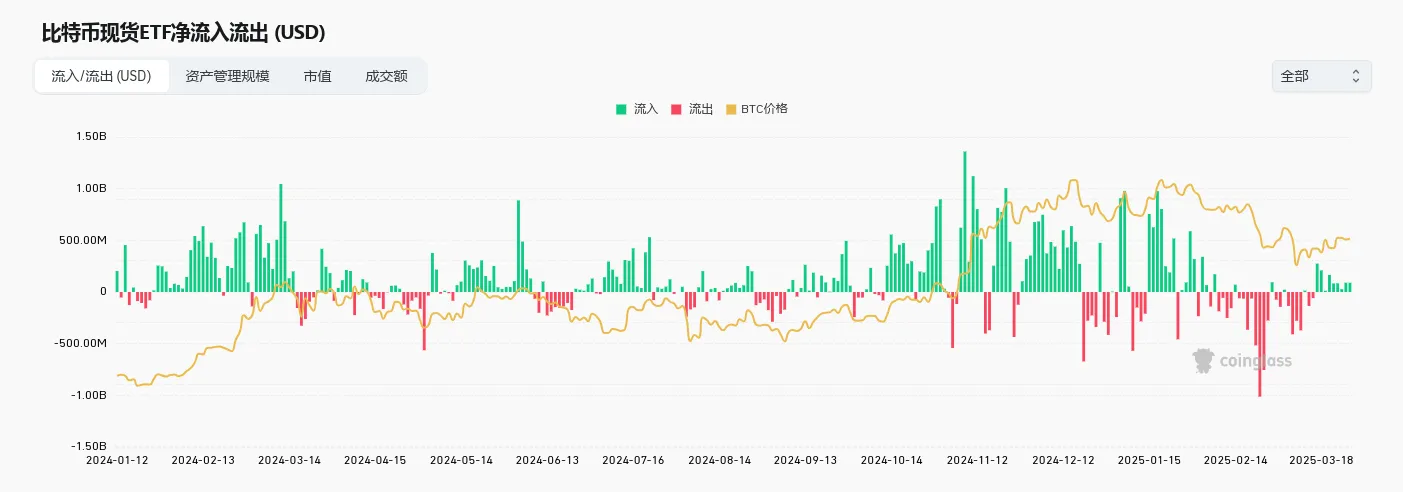

1.2 ETF Fund Flow

ETFs had a net inflow of $290 million this week, but it was down from $590 million last week. In March, the overall ETF fund flow showed a fluctuating recovery trend. There was a large outflow of $1.348 billion from March 7 to March 14, but inflows began to resume after March 17. However, the current inflow scale is small and is not enough to push BTC into a new round of rising prices. It is still necessary to observe the future fund movements.

Potential Market Impact

- The impact of ETF funds on the market: After a sharp correction in early March, BTC prices are currently fluctuating around 85,000, and the flow of ETF funds has become a key variable. If ETF funds continue to flow in in the next few weeks, BTC prices may continue to stabilize and gradually recover. Compared with the large outflow in February, the recent ETF fund inflows have shown a volatile recovery, and the sustainability remains to be seen.

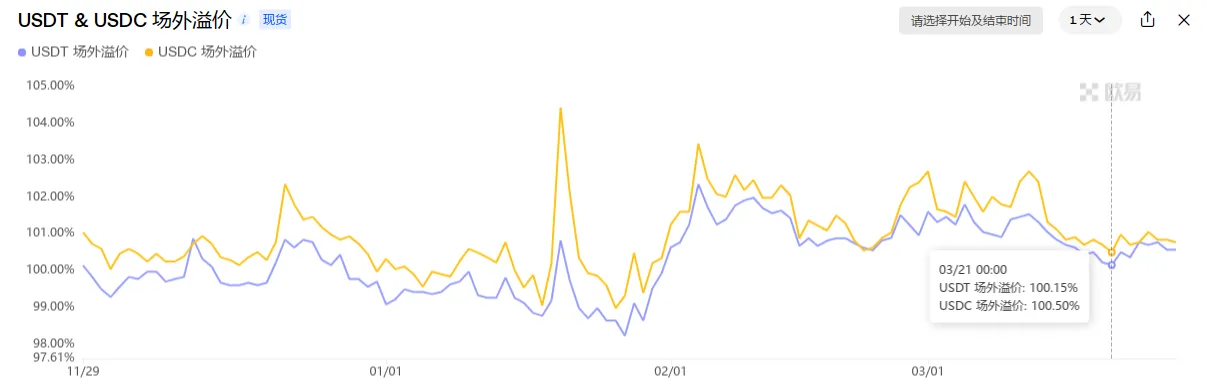

1.3 Premium or discount in over-the-counter transactions

- As of 0:00 on the 28th, the trend of the over-the-counter premium and discount this week was in a slight upward fluctuation, and the current micro-premium is above the water level. The corresponding market performance is that BTC chose to attack upward after a narrow fluctuation of 8.4w on the 21st-23rd, and then reached 8.8w on the 25th and entered a wide fluctuation. In the later period, it has not broken through the high point of the 25th after multiple attempts, which may indicate that the current price is not attractive enough to users and the premium fluctuation is not obvious.

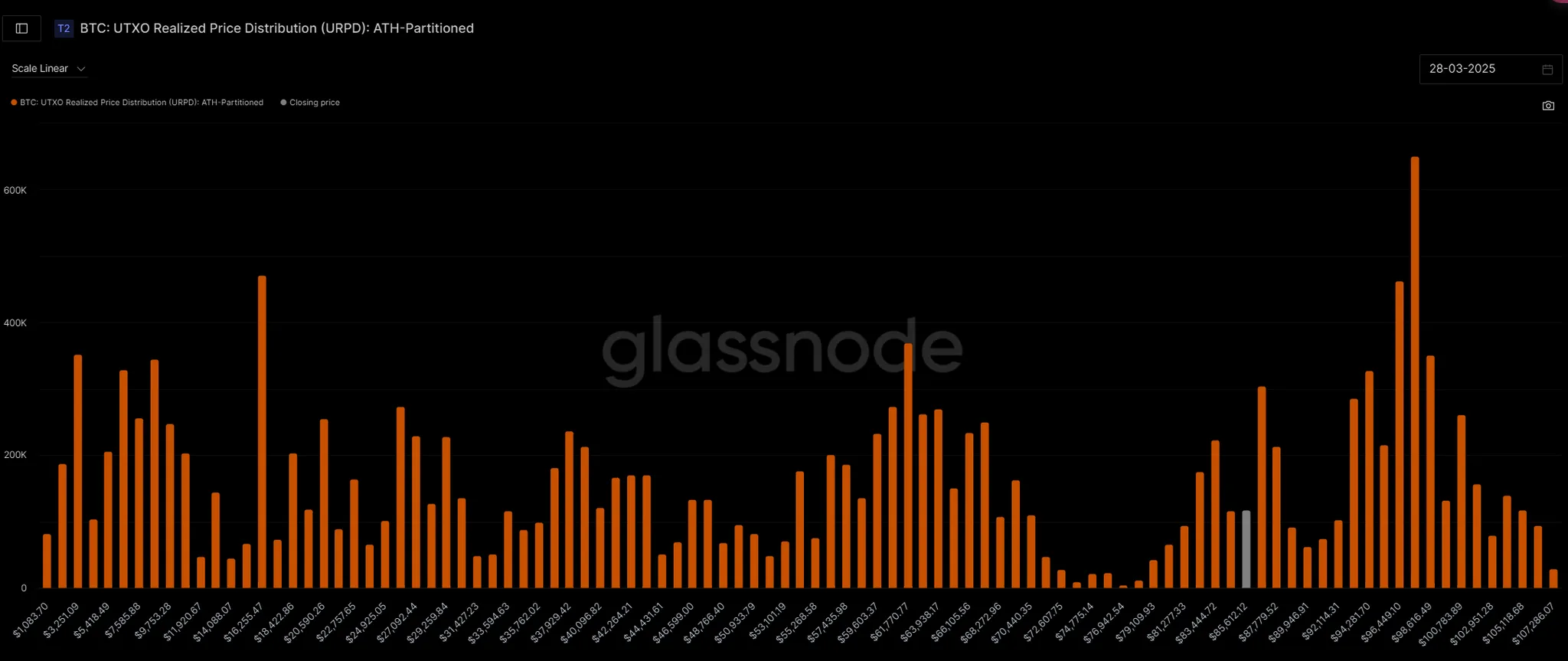

1.4URPD

We analyzed this data in detail two issues ago, and we will not go into details in this issue. We can see that there are still 3.28% of chips at 97532 on March 28. This part of chips has become the most obvious fixed chips in the market since February. This part of chips has not changed significantly since we started recording the change point data, which has been more than 50 days. The market currently forms a short-term resistance level at 96695 (1.53%) above, and a small support level at 83444 (1.12%) below.

2. Changes in mid-term market data that affect the market this week

2.1 Proportion of coins held by coin holding addresses

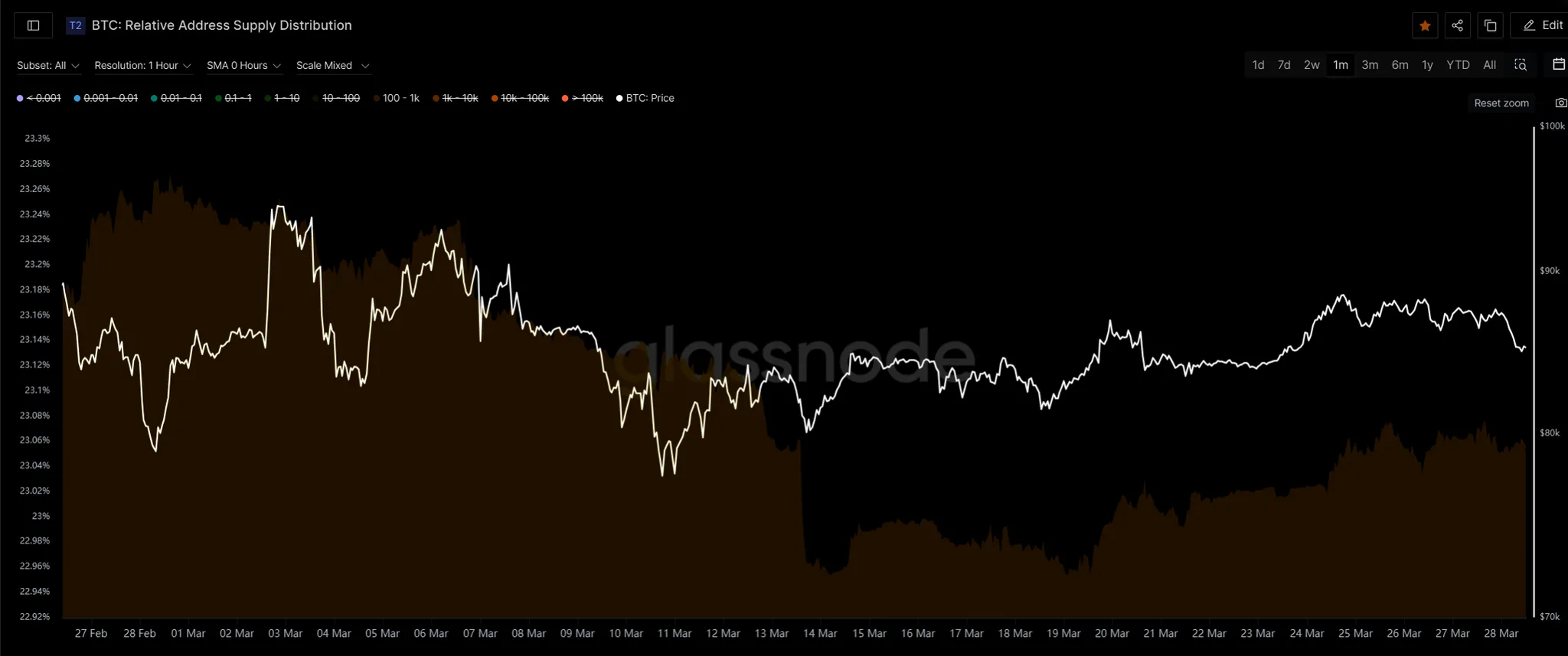

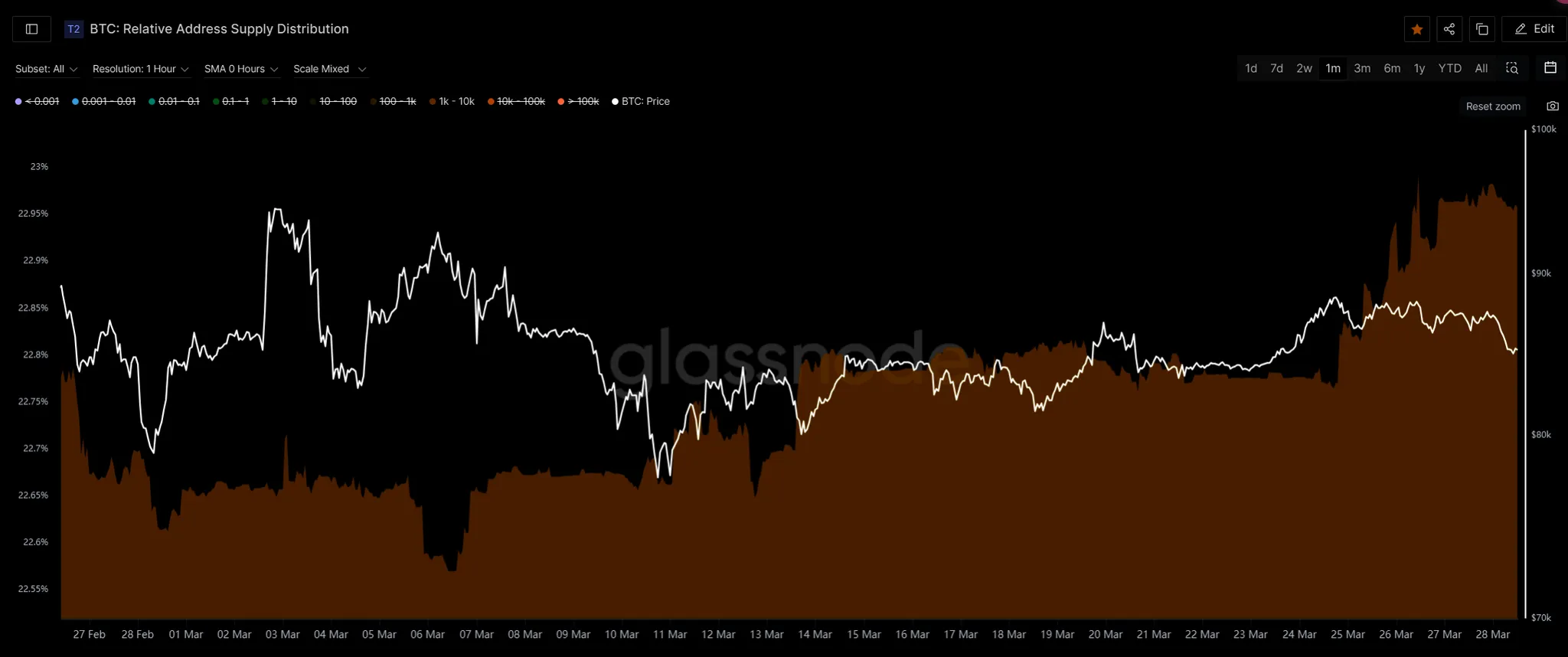

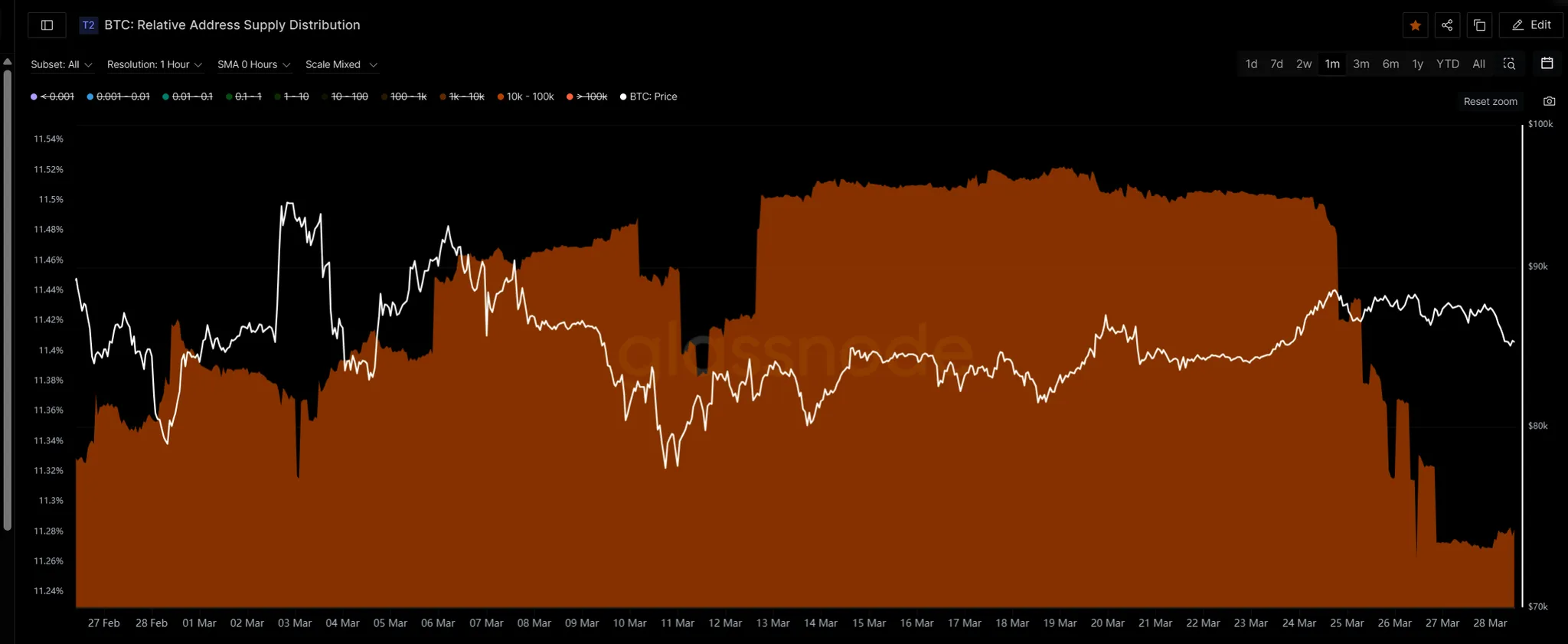

In the last issue, we mentioned that the addresses holding 100-1K coins fell for the first time since this round of rise from 3.05 to 3.13 (23.224%-22.967%). There was no obvious rebound in the previous period and it was in a sideways state. There was a slight rebound from the hourly level in this period, but the rebound was not large. On the contrary, the addresses holding 1K-1W coins showed a significant increase in this period. From 3.23 to 3.25 (22.777%-22.938%), the price rose from 84,000 to 88,500. These addresses began to increase their holdings. On the contrary, after the price rose, the addresses holding 10,000-100,000 coins actually reduced their holdings (11.502%-11.272%), showing a situation of chips shifting downward.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Sylvia / Jim / Mat / Cage / WolfDAO

Edited by: Punko / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, research or appreciation only.