summary

Asset tokenization was once considered the best use case for blockchain technology, enabling borderless trading markets, 24/7 trading, fragmented asset ownership, instant settlement, and greater capital efficiency for real world assets (RWAs). However, early institutional adoption in this space was inhibited by regulatory uncertainty and tough enforcement under former SEC Chairman Gary Gensler, which delayed innovation for years. Now, with a new administration in place, the market environment has changed significantly. RWA adoption has accelerated rapidly in 2024 and 2025. BUIDL, a tokenized money market fund launched by BlackRock, saw a 224.5% increase in assets in March 2025 alone, with new assets reaching $1.283 billion. In his annual letter to shareholders, BlackRock CEO Larry Fink stressed the disruptive potential of tokenization, saying: " Every stock, every bond, every fund, every asset can be tokenized; if so, investing will be completely reformed." The entire industry is continuing to expand. Fidelity has submitted an application to the SEC to launch a tokenized U.S. Treasury fund on Ethereum, which is expected to be officially launched on May 30. At the same time, overall market expectations are also optimistic. According to Kaito's market attention (mindshare), RWA and stablecoins are one of the fastest growing narrative themes in the crypto market.

While many crypto veterans are already familiar with early RWA protocols such as Centrifuge, Maple, and Goldfinch, this report will focus on the new generation of public chain projects that specialize in RWA. These projects include Mantra , Plume , Ondo Chain , Chintai , Converge (a collaboration between Ethena and Securitize), Clearpool's Ozeon , RedBelly , and Polymesh . Although these projects are all committed to bringing off-chain assets to the blockchain, they have their own characteristics in terms of architectural design, types of strategic partners, and regulatory strategies. This report will explore the design features of these RWA public chains in depth, analyze the recent case of the OM token crash, and propose an analytical framework for evaluating the value of their native tokens based on existing market indicators.

The collapse of the leading RWA

Mantra OM Token Price Chart 2025

Mantra is undoubtedly a key project that cannot be ignored when discussing the RWA public chain. Since 2024, Mantra's native token OM has risen by more than 10,000%, reaching a fully diluted valuation (FDV) of $15 billion at its peak. However, in April 2025, the token experienced a flash crash, evaporating more than $5 billion in market value within a few hours. On April 13, the price of OM plummeted by about 90%, from about $6.32 to $0.49. According to Mantra's co-founder, the crash was allegedly caused by "a large-scale forced liquidation of a whale on an exchange with extremely low liquidity."

Although the specific cause of the crash remains controversial, we can get some clues from trading data. Before the incident, OM's average daily trading volume was less than $200,000, but it had nearly $10 billion in FDV, indicating extremely weak liquidity. In contrast, assets similar to FDV, such as Chainlink and Avalanche, have average daily trading volumes of $800 million and $400 million, respectively. Some analysts also pointed out that the team's background raised concerns, especially some team members were linked to previous fraudulent ICO projects, further undermining the market's trust in their projects.

After the incident, the Mantra team proposed to destroy 300 million OM tokens, accounting for 16.5% of the total supply, in an attempt to restore investor confidence. However, rebuilding market trust after such a heavy blow is extremely challenging. The Mantra case highlights a key lesson: even with high valuations and brilliant partners, if there is a lack of sufficient market depth and liquidity , all of this can collapse in an instant.

Why a new RWA chain is needed: Plume Network

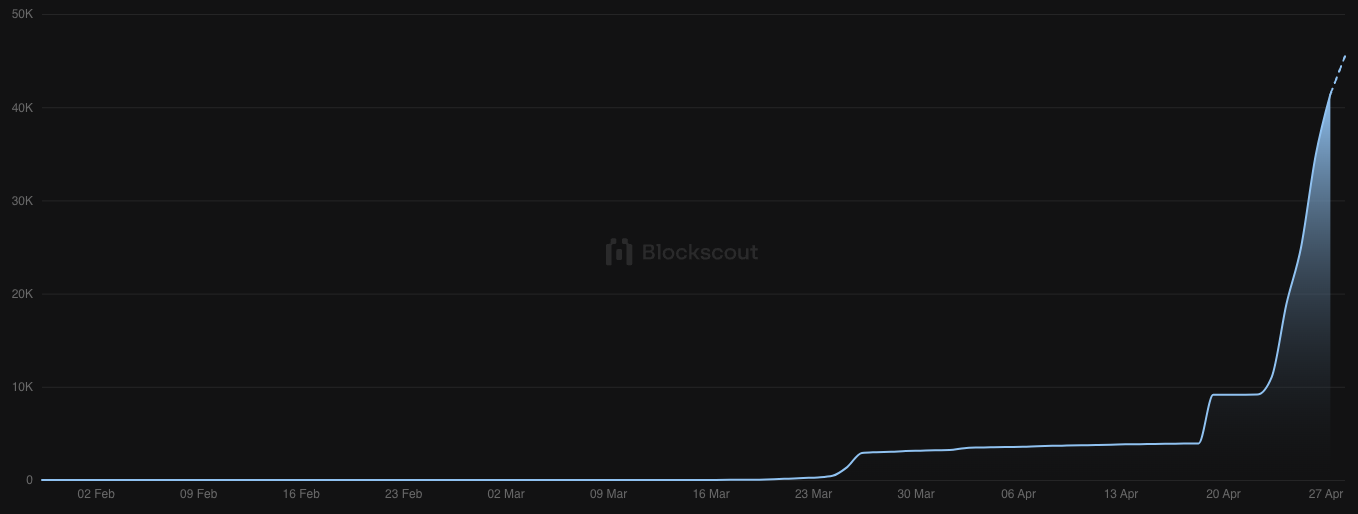

Number of Plume testnet users

A common question is: Why not issue RWA tokens directly on Ethereum or other existing public chains? In practice, to provide a seamless RWA experience, the required functionality is far beyond the scope of what general blockchains can provide.

First of all, compliance is the foundation of all RWA-specific public chains. Any application involving securities must implement KYC, AML (anti-money laundering), investor qualification review, transfer restrictions, and maintain audit reserves. These "review and qualification" mechanisms are often difficult to integrate after the fact. Although the ERC-3643 token standard on Ethereum has introduced identity verification and transfer controls, the dedicated RWA public chain can build compliance requirements into all contracts and transactions in the entire network to achieve global enforcement.

Take Plume Protocol as an example. Its Plume Arc architecture allows users to freely choose identity verification providers (such as Persona, Sumsub, Gateway and Ankr Verify) to generate encrypted KYC certificates through zero-knowledge proof (ZK) or fully homomorphic encryption (FHE) technology. The KYC certificate allows users to shuttle back and forth between multiple dApps without repeating tedious manual verification. Plume Arc also provides other modular services, including tokenization partners, issuers, fiat currency deposit and withdrawal channels, AML compliance services, and alternative trading system (ATS) partners, greatly improving the experience of institutions and investors participating in RWA issuance and trading.

While this built-in compliance mechanism is critical for regulated RWA applications, we cannot ignore a potential risk: if existing public chains widely adopt the same modular compliance standards, it may weaken the value of the existence of RWA-specific public chains.

Second, RWA relies heavily on off-chain data , such as legal documents, asset prices, and registration records. The Plume Nexus module is designed specifically for this purpose, with top data providers synchronizing off-chain data to the chain with low latency to ensure that the data is real-time and reliable.

Third, the target group of the RWA public chain is not limited to native cryptocurrency users. In view of the fact that the Web3 wallet is the main user interface, Plume launched the Plume Passport smart wallet, allowing users to fully control their RWA holdings without relying on third-party custody. In addition, the wallet supports gas-free transactions and integrates asset management in a single intuitive interface.

Fourth, RWA tokens generally face the problem of insufficient liquidity in the crypto market. Plume launched pUSD stablecoin, an asset basket composed of a variety of trusted stablecoins, and integrated and adopted in multiple dApps in the ecosystem. pUSD not only provides deep liquidity and price stability, but also enhances users' confidence in it as the main medium of exchange.

Fifth, the Plume public chain is EVM-compatible , allowing developers to deploy existing applications without major modifications and seamlessly integrate with the entire EVM ecosystem. At the same time, Plume Skylink can achieve cross-chain interoperability, covering 18 blockchain networks, and can stream revenue to user wallets on other chains in real time.

Finally, regulatory clarity for tokenized assets is rapidly improving. Blockchain projects that can proactively cooperate with regulatory standards are expected to gain an advantage in the future. Although Plume has not yet obtained a major license, its complete infrastructure has laid a solid foundation for future success, and once regulatory approval is obtained, it will have a strong competitive advantage.

Differences between RWA public chains

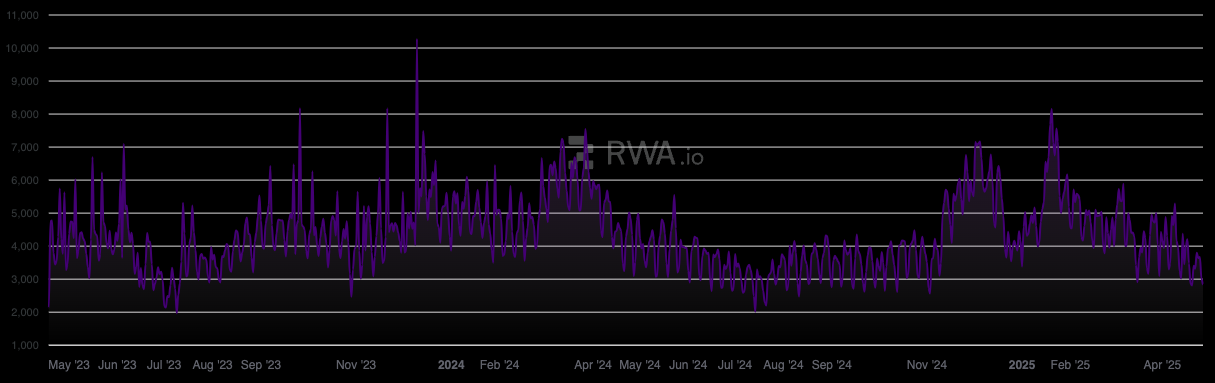

RWA overall social volume, RWA.io

All RWA public chain projects have the common goal of achieving RWA on-chain, and are committed to building in compliance mechanisms, connecting off-chain data, achieving low-latency transactions, and gathering deeper liquidity in their respective networks to gain a competitive advantage. However, there are still some differences in the implementation methods and product focus of each project.

Take Mantra as an example. Its decentralized identity (DID) module will issue a soulbound NFT as a digital identity after the user completes KYC certification through a compliant institution in a specific jurisdiction. Ondo Chain introduces built-in Proof of Reserves and Proof of Collateral mechanisms to enhance the market's confidence that each RWA token has sufficient support and lay the foundation for the development of more complex and capital-efficient on-chain financial instruments. In addition, Chintai provides white label services , allowing enterprises to customize the platform according to their own needs, including adjusting the user interface, setting transaction rules and fees, managing user accounts, configuring access rights, and using its proprietary automated compliance engine Sentinel AI .

Each chain also shows a high degree of differentiation in its compliance strategies. Mantra has obtained a virtual asset service provider ( VASP ) license issued by the Dubai Virtual Asset Regulatory Authority (VARA), which allows it to operate a virtual asset exchange in the UAE and the Middle East and North Africa region, and provide brokerage and investment management services. Chintai holds a capital market services ( CMS ) and a recognized market operator ( RMO ) license issued by the Monetary Authority of Singapore (MAS), allowing it to trade tokenized securities and operate a trading platform. Clearpool has completed the broker registration of the US Financial Industry Regulatory Authority (FINRA) and has been authorized by the UK Financial Conduct Authority (FCA) to operate a multilateral trading facility ( MTF ).

Total Signature Value

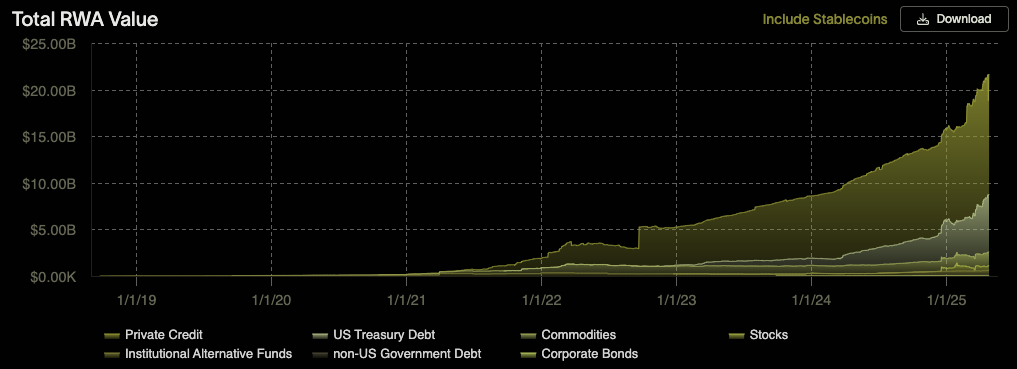

Total on-chain value of RWA, RWA.xyz

Many public chains focusing on RWA are still in the early stages of development. In fact, about half of the projects discussed in this article have not yet officially launched their mainnet. Therefore, traditional indicators for evaluating blockchain projects, such as gas consumption, number of active addresses, and total locked value (TVL), are not currently applicable to these projects. In order to evaluate the potential of these public chains, we can turn to the content of their announced cooperation agreements and aggregate the scale of assets expected to be on the chain, which we call the total signature value ( TVS ). However, we must interpret this type of data with caution. For example, Redbelly announced that it will cooperate with CarbonHood to tokenize up to $70 billion in carbon credits. Although the value is considerable, it should be viewed with caution as to whether it can be truly implemented in the end.

By analyzing these asset on-chain protocols, we can also identify the key asset categories that each public chain focuses on. For example, Mantra, Chintai, and Polymesh focus on real estate tokenization . According to Deloitte Financial Services Center, this market may grow to $4 trillion by 2035. Other public chains focus on securities and investment fund tokenization , which we believe is expected to achieve mass adoption faster. It is worth noting that Plume has established a large number of partnerships, mainly in the field of credit asset tokenization.

In addition, Ondo GM is expected to be launched on the Ondo chain, which is expected to realize the tokenization of trillion-dollar listed company stocks to on-chain transactions, which will be a major milestone in the industry. Although protocols such as Ondo, Converge and Clearpool have not yet announced the amazing scale of signed assets, they are currently operating considerable tokenized assets on the chain. For example:

Ondo currently holds over $1 billion in tokenized U.S. Treasuries;

Converge has over $4.7 billion in USDDe and $1.4 billion in tokenized Treasuries (USDtb);

Securitize’s tokenized RWA assets total over $4 billion;

Clearpool currently has ~$23m in active loan positions and ~$74m TVL (~$51m excluding CPOOL pledges).

These on-chain tokenized assets have laid a solid foundation for the relevant public chain protocols and will help further expand their emerging on-chain ecosystem.

RWA Token Valuation

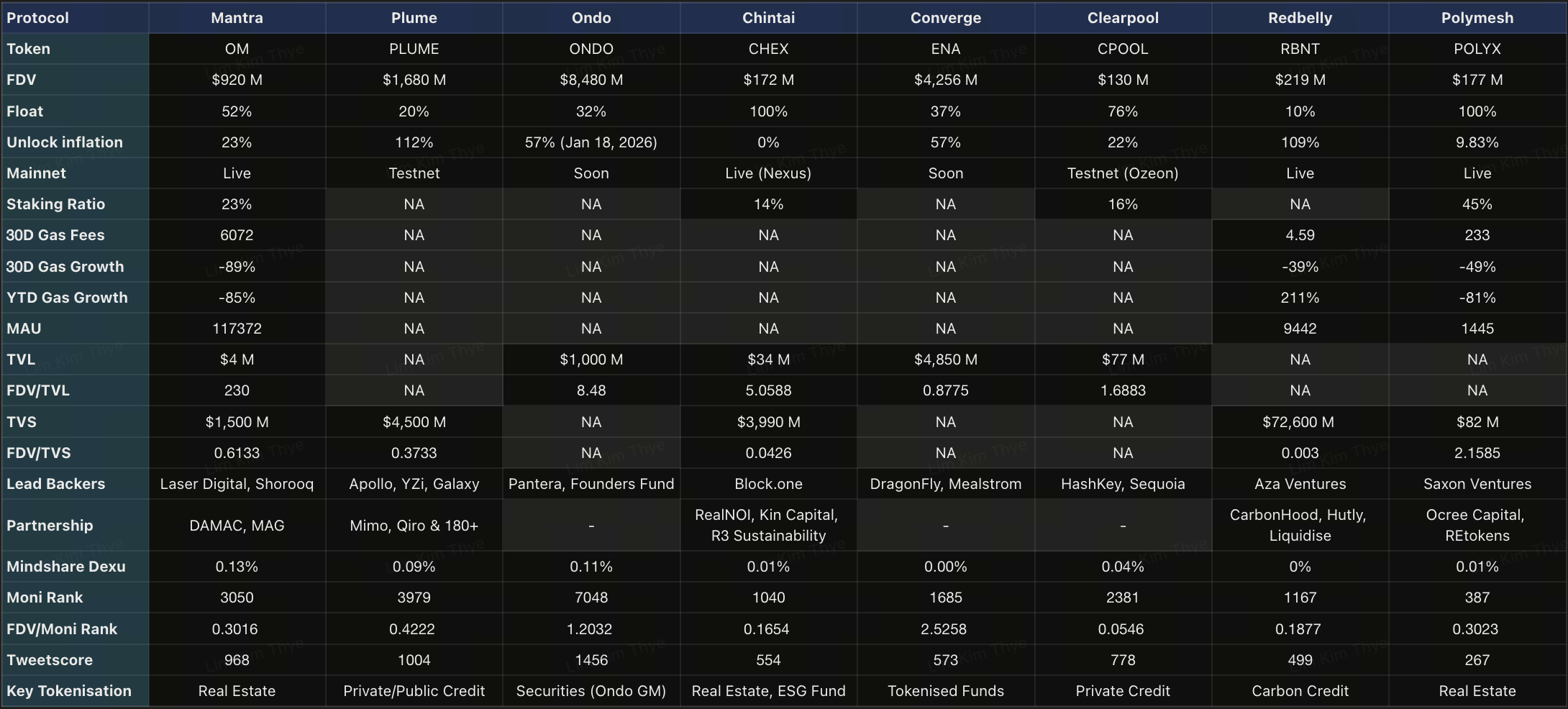

RWA public chain comparison chart

The tokens of these RWA public chain projects have similar uses, mainly for governance, transaction fees and staking. However, there are still important differences in some designs. For example, Clearpool's Ozeon and Converge's tokens are not used as gas, and their transaction fees are paid in their own stablecoins USDX and USDe . Despite this, all tokens can be used as collateral assets to help maintain network security. In addition, CHEX can be pledged in a liquidity pool with the US dollar stablecoin to receive additional rewards from on-chain trading activities. At the same time, Chintai adopts a token repurchase and destruction mechanism, using 5% of the platform's revenue to repurchase CHEX in the secondary market and destroy it. Clearpool also uses a similar mechanism, using 50% of the protocol revenue for the repurchase and destruction of CPOOL. Although Plume has the advantage of a huge partnership, its token circulation is low, and it also faces inflationary pressure from the large number of tokens that are about to be unlocked. Mantra's OM token can provide additional stakedrops income to stakers, that is, token airdrops issued by protocols newly listed on the Mantra chain. Ondo currently has the highest FDV among RWA public chains. The team has great ambitions, and if it successfully realizes its vision of securities tokenization (especially stock tokenization) trading, FDV may still have further room for growth.

In general, the RWA public chain race is still in its early stages. Each protocol needs to continue to promote product implementation and maintain market attention in order to achieve long-term growth. As one of the earliest RWA public chains, although Polymesh successfully introduced Binance as a validator very early, it has gradually become marginalized in terms of community influence, which is also reflected in its FDV performance. At present, Mantra, Plume and Ondo are clearly in the lead in mindshare , and this "narrative dividend" can boost valuations in the short term. At the same time, because Ethena has a high mindshare of approximately 0.27%, Converge expects to soon accumulate more market attention. Finally, Clearpool's valuation is relatively reasonable from all angles. It has a relatively low valuation, a certain degree of market attention, low expected inflation rate, a TVL of US$77 million, and a cumulative loan issuance of US$784 million.

Summary

All RWA public chain projects are still in a very early stage of development. They must continue to promote product implementation and keep up with changes in the regulatory framework in order to gain a leading advantage after regulation becomes clear. For example, Ondo has started a dialogue with the US SEC's Crypto Asset Task Force to propose a solution to tokenize securities. This is a key development because in this area, projects that seize the initiative can build liquidity depth to strengthen their competitive advantage.

For investors, continuing to track the development of each public chain after its mainnet launch will help to grasp the network adoption and actual use case implementation at the first time. Although major cooperation announcements are worth paying attention to, the depth of participation and actual commitment of the partners should be evaluated more. In addition to strong execution, high-quality projects also need reasonable token valuations to bring real returns to investors. Knowing when to profit and when to hold on is a key strategy to participate in this race.

From a risk-reward perspective, the RWA public chain is a relatively safe way to participate in the RWA race. According to the FAT protocol argument , the basic public chain will benefit from the development and expansion of the application ecosystem built on it. The RWA race is expected to grow rapidly in 2025, and its upward momentum cannot be ignored. According to the Boston Consulting Company's forecast, the RWA market size is expected to reach 16 trillion US dollars in 2030, corresponding to an average annual compound growth rate of 63.72% .

refer to

https://docs.mantrachain.io/mainnet-om-information/chain-features

https://snapshot.box/#/s:mantra-dao.eth/proposal/0x46c0b602c7ca8e3d06f07fa70e54ab8bc6a9de0611568c1a5dbb4a8c8ef30626

https://snapshot.box/#/s:mantra-dao.eth/proposal/0x46c0b602c7ca8e3d06f07fa70e54ab8bc6a9de0611568c1a5dbb4a8c8ef30626

https://www.mantrachain.io/resources/announcements/statement-of-events-13-april-2025

https://www.mantrachain.io/resources/announcements/token-update-300m-om-burn

https://om.mantrachain.io/

https://docs.plumenetwork.xyz/plume/plume-chain/architecture

https://docs.plumenetwork.xyz/plume/arc/identity-verification

https://plumenetwork.xyz/blog/tokenomics

https://testnet-explorer.plumenetwork.xyz/

https://docs.ondo.finance/ondo-chain/overview

https://blog.ondo.finance/introducing-ondo-chain/

https://ondo.finance/global-markets

https://www.chextoken.com/

https://chintainexus.com/group/chexroadmap.pdf

https://www.convergeonchain.xyz/blog-posts/converge-tech-specification-roadmap

https://medium.com/@SonicAgamemnon/chintai-nexus-unleashed-f74c93a82433

https://chintainexus.com/group/chexroadmap.pdf

https://docs.clearpool.finance/clearpool/dao/cpool/tokenomics

https://ozean.finance/

https://redbelly.network/blogs

https://redbelly.routescan.io/

https://6788543.fs1.hubspotusercontent-na1.net/hubfs/6788543/The%20Redbelly%20Network%20Whitepaper%20v1.3.1.pdf

https://polymesh.subscan.io/

https://polymesh.network/tokenomics

https://app.rwa.xyz/

https://insights.rwa.io/

https://dexu.ai/overview

https://discover.getmoni.io/checker

https://app.tweetscout.io/trending

https://web-assets.bcg.com/1e/a2/5b5f2b7e42dfad2cb3113a291222/on-chain-asset-tokenization.pdf

https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-predictions/2025/tokenized-real-estate.html

https://www.blackrock.com/corporate/investor-relations/larry-fink-annual-chairmans-letter