Crypto has become one of the most dynamic and promising sectors in the field of financial technology. With the entry of many institutional funds, how to reasonably value Crypto projects has become a key issue. Traditional financial assets have mature valuation systems, such as the discounted cash flow model (DCF Model) and the price-to-earnings ratio valuation method (P/E).

There are many types of Crypto projects, including public chains, CEX platform coins, DeFi projects, meme coins, etc. They each have different characteristics, economic models, and token functions. It is necessary to explore valuation models that are suitable for each track.

1. Public Chain - Metcalfe's Law

Analysis of the law

The core content of Metcalfe's Law: The value of the network is proportional to the square of the number of nodes.

V = K*N² (where V is the network value, N is the number of valid nodes, and K is a constant)

Metcalfe's Law is widely recognized in the value prediction of Internet companies. For example, in the paper "An Independent Study on the Value of Facebook and Tencent, China's Largest Social Networking Company (Zhang et al., 2015)", over a statistical period of 10 years, the value and number of users of these companies showed the characteristics of Metcalfe's Law.

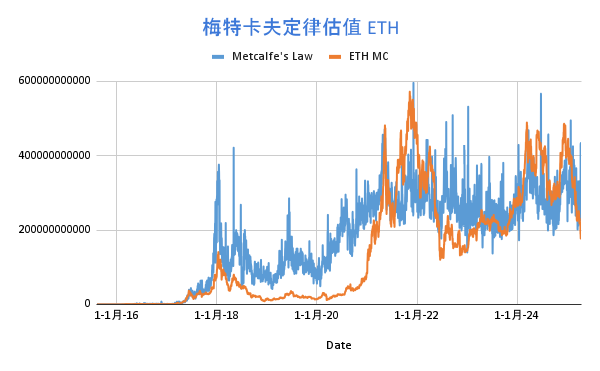

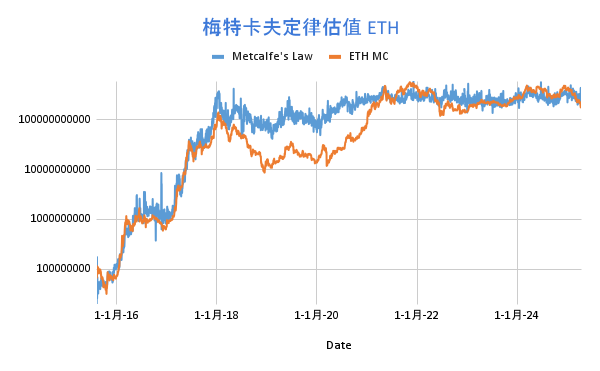

ETH Example

Metcalfe's law also applies to the valuation of blockchain public chain projects. Western scholars have found that the market value of Ethereum is in a logarithmic linear relationship with daily active users, which is basically consistent with the formula of Metcalfe's law. However, the market value of the Ethereum network is proportional to the user's N^(1.43), and the constant K is 3000. The calculation formula is as follows:

V = 3000 * N^1.43

According to statistics, there is some correlation between Metcalfe's Law valuation method and ETH market value trend:

Logarithmic trend chart:

Limitation Analysis

Metcalfe’s Law has limitations when applied to emerging public chains. In the early stages of public chain development, the user base is relatively small, and it is not suitable to use Metcalfe’s Law for valuation, such as the early Solana and Tron.

In addition, Metcalfe's Law is also unable to reflect the impact of the pledge rate on token prices, the long-term impact of Gas fee burn under the EIP1559 mechanism, and the public chain ecosystem's possible game based on Security Ratio versus TVS (Total Value Secured).

2. CEX Platform Coins - Profitable Buyback & Destruction Model

Model analysis

Centralized exchange platform coins are similar to equity tokens and are related to exchange revenue (transaction fee income, listing fees, other financial services, etc.), public chain ecosystem development, and exchange market share. Platform coins generally have a repurchase and destruction mechanism, and may also have a Gas Fee Burn mechanism in the public chain.

The valuation of platform coins needs to consider the overall revenue of the platform, discount future cash flows to estimate the intrinsic value of the platform coins, and also consider the destruction mechanism of the platform coins, and measure the changes in its scarcity. Therefore, the rise and fall of platform coins are generally related to the growth rate of the trading volume of the trading platform and the reduction rate of the platform coin supply. The simplified profit repurchase & destruction model valuation method is calculated as follows:

Platform coin value growth rate = K*transaction volume growth rate*supply destruction rate (where K is a constant)

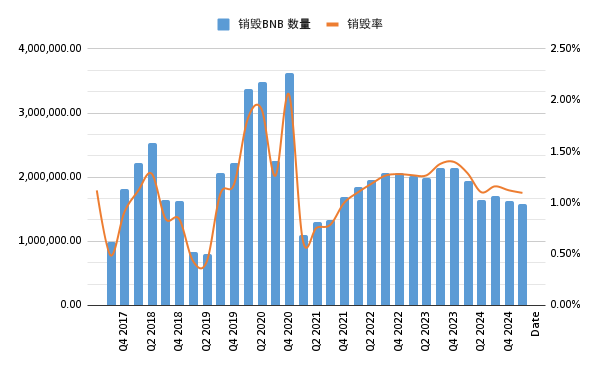

BNB Instances

BNB is the most classic exchange platform currency. Since its launch in 2017, it has received wide acclaim from investors. BNB's empowerment has gone through two stages:

Phase 1: Profit repurchase - From 2017 to 2020, Binance used 20% of its profits to repurchase and destroy BNB every quarter;

Phase 2: Auto-Burn + BEP95 - The Auto-Burn mechanism will be implemented in 2021. Instead of referring to Binance profits, the amount of destruction will be calculated based on the price of BNB and the number of BNB Chain quarterly blocks. In addition, there is a BEP95 real-time destruction mechanism (similar to Ethereum's EIP1559). 10% of each block reward will be destroyed. So far, a total of 2,599,141 BNBs have been destroyed through the BEP95 mechanism.

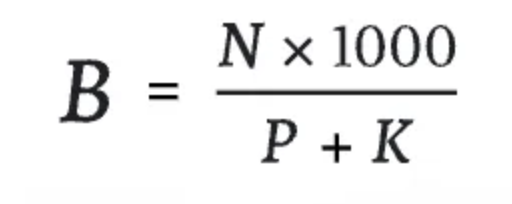

The Auto-Burn mechanism calculates the amount of destruction based on the following formula:

Among them, N is the quarterly block output of BNB Chain, P is the quarterly average price of BNB, and K is a constant (the initial value is 1000, adjusted by BEP).

Assuming that Binance transaction volume growth rate in 2024 is 40%, BNB supply destruction rate in 2024 is 3.5%, and constant K is 10, then:

BNB value growth rate = 10*40%*3.5% = 14%

That is to say, assuming this data, BNB should increase by 14% in 2024 compared to 2023.

Since 2017, a total of more than 59.529 million BNB have been destroyed, with an average of 1.12% of the remaining BNB destroyed each quarter.

Limitation Analysis

When using this valuation method in actual operations, it is necessary to pay close attention to the changes in the market share of the exchange. For example, if the market share of an exchange continues to decline, even if its current profit performance is acceptable, future profit expectations may be affected, thereby reducing the valuation of the platform currency.

Changes in regulatory policies also have a significant impact on the valuation of CEX platform coins. Policy uncertainty may lead to changes in market expectations for platform coins.

3. DeFi Projects - Token Cash Flow Discount Valuation Method

The core logic of the DeFi project using the discounted cash flow (DCF) valuation method is to predict the cash flow that the token can generate in the future and discount it to the current value at a certain discount rate.

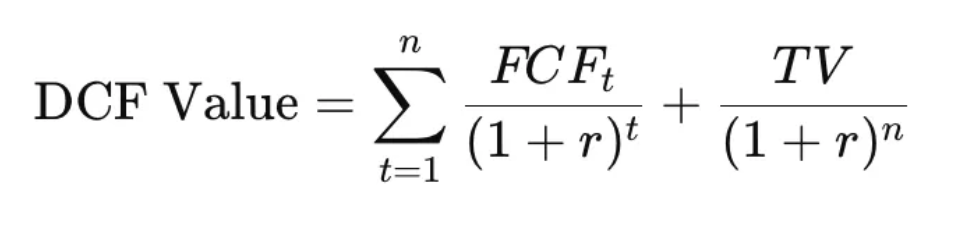

Among them, FCFt is the free cash flow (Free Cash Flow) in the tth year, r is the discount rate, n is the forecast period, and TV is the Terminal Value.

This valuation method determines the current value of the Token by anticipating future returns of the DeFi protocol.

Take RAY as an example

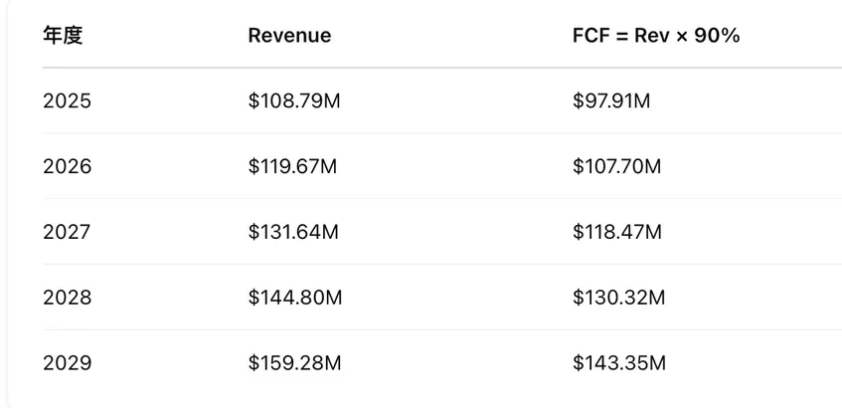

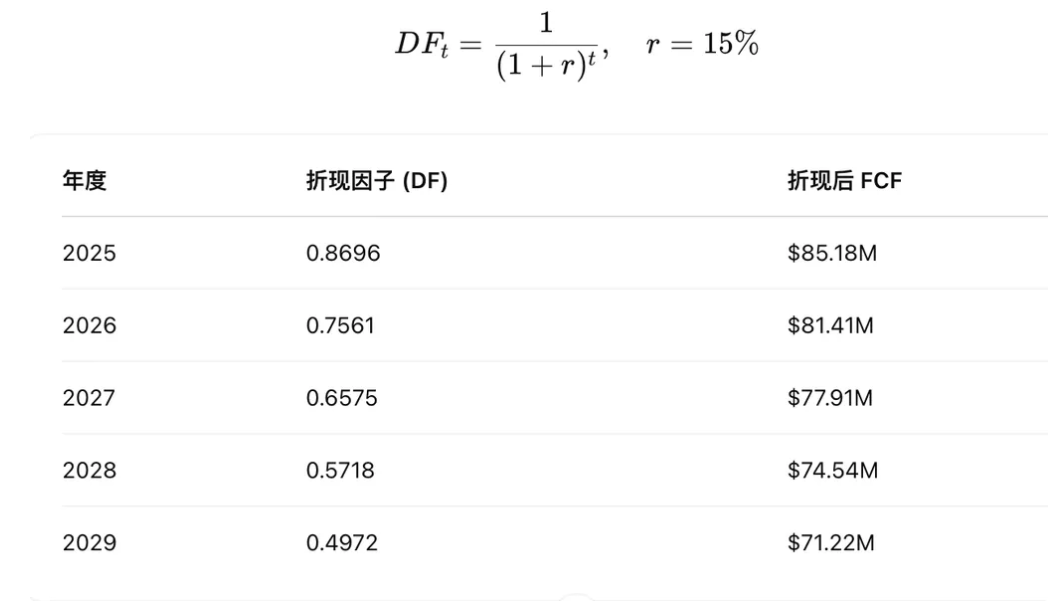

In 2024, Raydium's revenue will be 98.9 million. Assuming an annual growth rate of 10%, a discount rate of 15%, a forecast period of 5 years, a perpetual growth rate of 3%, and an FCF conversion rate of 90%.

Cash flow in the next five years:

Total discounted FCF for the next five years: 390.3m

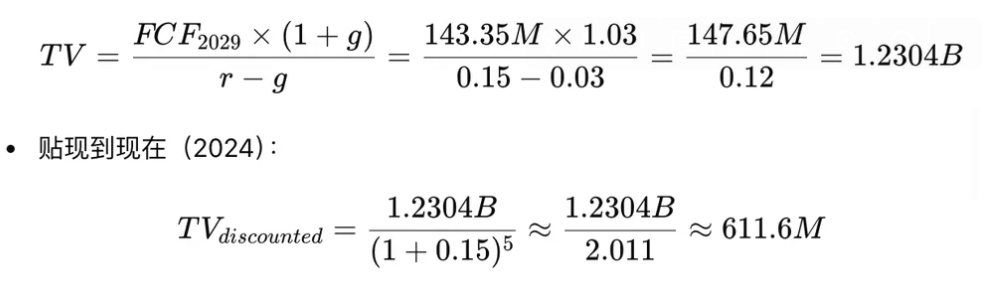

Terminal Value Discount is 611.6m

Total DCF valuation = TV + FCF = 611.6m + 390.3m = 1.002B

RAY's current market value is 1.16B, which is similar overall. Of course, this valuation is based on a 10% annual growth rate in the next five years. In fact, Raydium is likely to have negative growth in a bear market, and the growth rate may exceed 10% in a bull market.

Limitation Analysis

There are several major challenges in the valuation of DeFi protocols: First, governance tokens generally do not capture the revenue value of the protocol. In order to avoid the risk of being judged as securities by the SEC, dividends cannot be distributed directly. Although there are ways to avoid this (staking rewards, repurchase and destruction, etc.), DeFi protocols lack the motivation to feed profits back to tokens; second, it is extremely difficult to predict future cash flows because the market switches rapidly from bull to bear, the cash flow of DeFi protocols fluctuates greatly, and the behaviors of competitors and users are changeable; third, the determination of the discount rate is complex, and it is necessary to comprehensively consider multiple factors such as market risk and project risk. The choice of different discount rates will have a huge impact on the valuation results; fourth, some DeFi projects have adopted a profit repurchase and destruction mechanism. The implementation of such a mechanism will affect the circulation and value of the tokens. DeFi tokens with such mechanisms may not be suitable for the discounted cash flow valuation method.

4. Bitcoin - Comprehensive Consideration of Multiple Valuation Methods

Mining cost valuation method

According to statistics, in the past five years, the time when the price of Bitcoin was lower than the mining cost of mainstream mining machines was only about 10%, which fully demonstrates the important role of mining costs in supporting the price of Bitcoin.

Therefore, the cost of Bitcoin mining can be regarded as the floor of Bitcoin price. There are only a few times when the price of Bitcoin is lower than the cost of mining by mainstream mining machines, and judging from past experience, these times are excellent investment opportunities.

Gold Substitute Model

Bitcoin is often regarded as "digital gold" and can replace some of the "value storage" functions of gold. At present, the market value of Bitcoin accounts for 7.3% of the market value of gold. If this ratio is increased to 10%, 15%, 33%, and 100%, the unit price of Bitcoin will reach US$92,523, US$138,784, US$305,325, and US$925,226, respectively. This model is based on the analogy between the two in terms of value storage properties, and provides a macro reference perspective for Bitcoin valuation.

However, there are still many differences between Bitcoin and gold in terms of physical properties, market perception, and application scenarios. Gold has become a globally recognized safe-haven asset over thousands of years, with a wide range of industrial uses and physical support; while Bitcoin is a virtual asset based on blockchain technology, and its value is more derived from market consensus and technological innovation. Therefore, when using this model, it is necessary to fully consider the impact of these differences on the actual value of Bitcoin.

Summarize

This article aims to promote the search for valuation models for Crypto projects in order to promote the steady development of valuable projects in the industry and attract more institutional investors to allocate crypto assets.

Especially when the market is bearish, we must use the most stringent standards and the simplest logic to find projects with long-term value. Through a reasonable valuation model, just like Google and Apple caught the "bubble burst" in 2000, we can dig out the "Google and Apple" in the Crypto field in the bear market.