Macroeconomic impact: trade structure, capital flows, and supply and demand of U.S. debt

At 4 a.m., when Trump came up with the new tariff list with high spirits, the world was caught off guard. I believe everyone has witnessed what happened last night. Trump once again wielded the tariff stick, intending to reverse the long-term trade imbalance. This tariff strategy may reshape the US trade structure and capital flows in the short term, but it also hides a new impact on the US Treasury market. The core is that the tariff policy may lead to a decline in foreign demand for US bonds, and the Federal Reserve may need more monetary easing policies to maintain the operation of the Treasury market . So, can everything that has been hit by the tariff policy be saved? How to save it? How to look at it?

Specifically, there are probably several aspects:

- Trade structure : High tariffs are intended to reduce imports, encourage domestic production, and thus narrow the trade deficit. However, this approach of "treating the symptoms rather than the cause" often comes with side effects: rising import costs may push up inflationary pressure, and retaliatory tariffs imposed by other countries will also weaken US exports. The trade imbalance may be temporarily alleviated, but the pain of supply chain restructuring and price increases is inevitable. As the saying goes, if you suppress the gourd of trade deficit, inflation may rise again.

- International capital flows : When US imports decrease, it means that less US dollars flow overseas - "no exports, no US dollars" has caused concerns about a dollar shortage around the world. As overseas trading partners' dollar reserves decrease, emerging markets may face tight liquidity, and the global capital flow pattern will change. When there is a shortage of US dollars, funds tend to flow back to the United States or hide in safe-haven assets, impacting overseas asset prices and exchange rate stability.

- Supply and demand of US debt : For many years, the huge US trade deficit has led to a large amount of US dollars held overseas, which often flowed back to the United States through the purchase of US debt. Now that tariffs have reduced the outflow of US dollars, foreign investors have insufficient "ammunition" to buy US debt . However, the US fiscal deficit is still high, and the supply of national debt has increased. If external demand weakens, who will take over the emerging US debt? The result is likely to be an upward trend in US debt yields, higher financing costs, and even the risk of insufficient liquidity. Trump is trying to balance the trade account, but he may be robbing Peter to pay Paul in the US debt market, burying new hidden dangers.

In general, the tariff policy is like drinking poison to quench thirst in the macro sense: it repairs the trade imbalance in the short term, but weakens the momentum of the global circulation of the US dollar. This shift in the balance sheet is tantamount to shifting the pressure from the trade item to the capital item, with the US Treasury market bearing the brunt. A blockage in the macro capital flow will soon burst out in another place - the Federal Reserve has to prepare a fire hose to put out the fire.

Dollar liquidity: Export reduction triggers dollar shortage, Fed restarts "Brrrr"

When the supply of overseas dollars tightens due to the cooling of trade, the Federal Reserve will inevitably have to help the liquidity of the US dollar . As the above logic indicates, foreigners cannot buy US bonds if they do not earn US dollars. Arthur Hayes mentioned that "the only thing that can fill the gap is the US central bank and banking system" ( Arthur Hayes: Tariff policies may lead to a decline in foreign demand for US bonds, and the Federal Reserve may need more monetary easing policies to keep the Treasury market running-PANews ). What does this mean? In the words of the currency circle, it means that the Federal Reserve's printing press will sound " Brrrrr " again. https://x.com/CryptoHayes/status/1907698822752694342

In fact, Fed Chairman Powell has hinted in a recent meeting that quantitative easing (QE) may soon be restarted , with a focus on purchasing U.S. Treasury bonds. This statement proves that the authorities are also aware that maintaining the operation of the Treasury market is inseparable from the additional injection of U.S. dollar liquidity. Simply put, the dollar shortage can only be solved by "flooding the market with money." The Fed is ready to expand its balance sheet, lower interest rates, and even use the banking system to jointly buy bonds.

However, this liquidity firefighting is doomed to be accompanied by a dilemma: on the one hand, timely injection of US dollar liquidity can stabilize treasury bond interest rates and alleviate the risk of market failure; on the other hand, flooding will sooner or later breed inflation and weaken the purchasing power of the US dollar. The supply of US dollars has changed from a partial emergency to an overflow, and the value of the US dollar is bound to fluctuate violently. It can be foreseen that in the roller coaster of "draining first and then releasing water", the global financial market will experience a sharp swing from a strong (shortage) to a weak (excessive issuance) US dollar. The Federal Reserve has to walk a tightrope between stabilizing the bond market and controlling inflation, but at present, it seems that ensuring the stability of the treasury bond market is a top priority, and "printing money to buy bonds" has become a politically inevitable choice. This also heralds a major turning point in the global US dollar liquidity environment: from tightening to easing. Historical experience has repeatedly proved that once the Federal Reserve opens the floodgates, the flood will eventually flow to every corner - including the risky asset field including the crypto market.

Impact on Bitcoin and Crypto Assets: Inflation Hedging and the Rise of “Digital Gold”

The signal of the Federal Reserve restarting the money printing press is almost a blessing for crypto assets such as Bitcoin. The reason is simple: when the dollar is flooding and the expectation of credit currency depreciation is rising, rational capital will look for a reservoir to resist inflation, and Bitcoin is the highly anticipated "digital gold". The limited supply of Bitcoin has greatly increased its appeal in this macro context, and its value support logic has never been so clear: when legal currency continues to "become lighter", hard currency assets will "become heavier".

As Arthur Hayes pointed out, the price of Bitcoin "depends entirely on the market's expectations of future fiat money supply" ( Bitcoin price can hit $250K in 2025 if Fed shifts to QE: Arthur Hayes ). When investors expect the supply of US dollars to expand significantly and the purchasing power of paper money declines, safe-haven funds will flock to assets such as Bitcoin that cannot be over-issued . Looking back at the situation in 2020, the rise of Bitcoin and gold after the Fed's large-scale QE is a clear proof. If the floodgates are opened again this time, the crypto market is likely to repeat this scene: digital assets usher in a new wave of valuation increases. Hayes boldly predicted that if the Fed shifts from tightening to printing money for treasury bonds, Bitcoin is expected to bottom out at about $76,500 last month, and will continue to rise, hitting a sky-high price of $250,000 before the end of the year. Although this prediction is radical, it reflects the strong confidence of KOLs in the "inflation dividend " in the currency circle-the additional money printed will eventually push up the price of scarce assets such as Bitcoin.

In addition to the expectation of price increases, this round of macro changes will also strengthen the narrative of " digital gold ". If the Fed's monetary easing leads to market distrust of the fiat currency system, the public will be more inclined to view Bitcoin as a means of value storage against inflation and policy risks, just as people embraced physical gold in the past turbulent times. It is worth mentioning that people in the crypto circle have long been accustomed to short-term policy noise. As investor James Lavish sharply sarcastically said: "If you sell Bitcoin because of the 'tariff' news, it means you don't understand what you have in your hands" ( Bitcoin (BTC) Kurs: Macht ein Verkauf noch Sinn? ). In other words, smart holders know that the original intention of Bitcoin's birth is to fight against excessive issuance and uncertainty; every time the printing of money and policy mistakes, it further proves the value of holding Bitcoin as an alternative asset insurance . It can be foreseen that as the expectation of US dollar expansion heats up and safe-haven funds increase their allocation, the image of Bitcoin as "digital gold" will become more deeply rooted in the minds of the public and institutions.

Potential impact on DeFi and stablecoin markets: Stablecoin demand and yield curve under US dollar fluctuations

The sharp fluctuation of the US dollar not only affects Bitcoin, but also has a profound impact on the stablecoin and DeFi fields. As a substitute for the US dollar in the crypto market, the demand for stablecoins such as USDT and USDC will directly reflect the changes in investors' expectations of US dollar liquidity. In addition, the on-chain lending rate curve will also change with the macro environment.

- Demand for stablecoins : When the U.S. dollar is in short supply, the offshore market often uses stablecoins to "save the country in a roundabout way". When it is difficult to obtain U.S. dollars overseas, USDT often trades at a premium in the OTC market, because everyone is scrambling for the digital dollar. Once the Federal Reserve releases money in a big way, some of the new U.S. dollars are likely to flow into the crypto market, pushing USDT/USDC to issue large amounts of new coins to meet trading and hedging needs. In fact, the issuance of stablecoins in the past few months has shown that this process has actually begun. In other words, whether the U.S. dollar strengthens or weakens, the rigid demand for stablecoins will only increase: either they seek a substitute for the U.S. dollar because of a lack of U.S. dollars, or they move their funds to the chain to avoid depreciation of fiat currencies. Especially in emerging markets and regions with strict supervision, stablecoins play the role of a substitute for the U.S. dollar , and every fluctuation of the U.S. dollar system strengthens the presence of stablecoins, the "💲crypto dollar". It can be imagined that if the U.S. dollar enters a new round of depreciation cycle, investors may rely more on stablecoins such as USDT to circulate in the currency circle in order to preserve their assets, thereby pushing the market value of stablecoins to a new high.

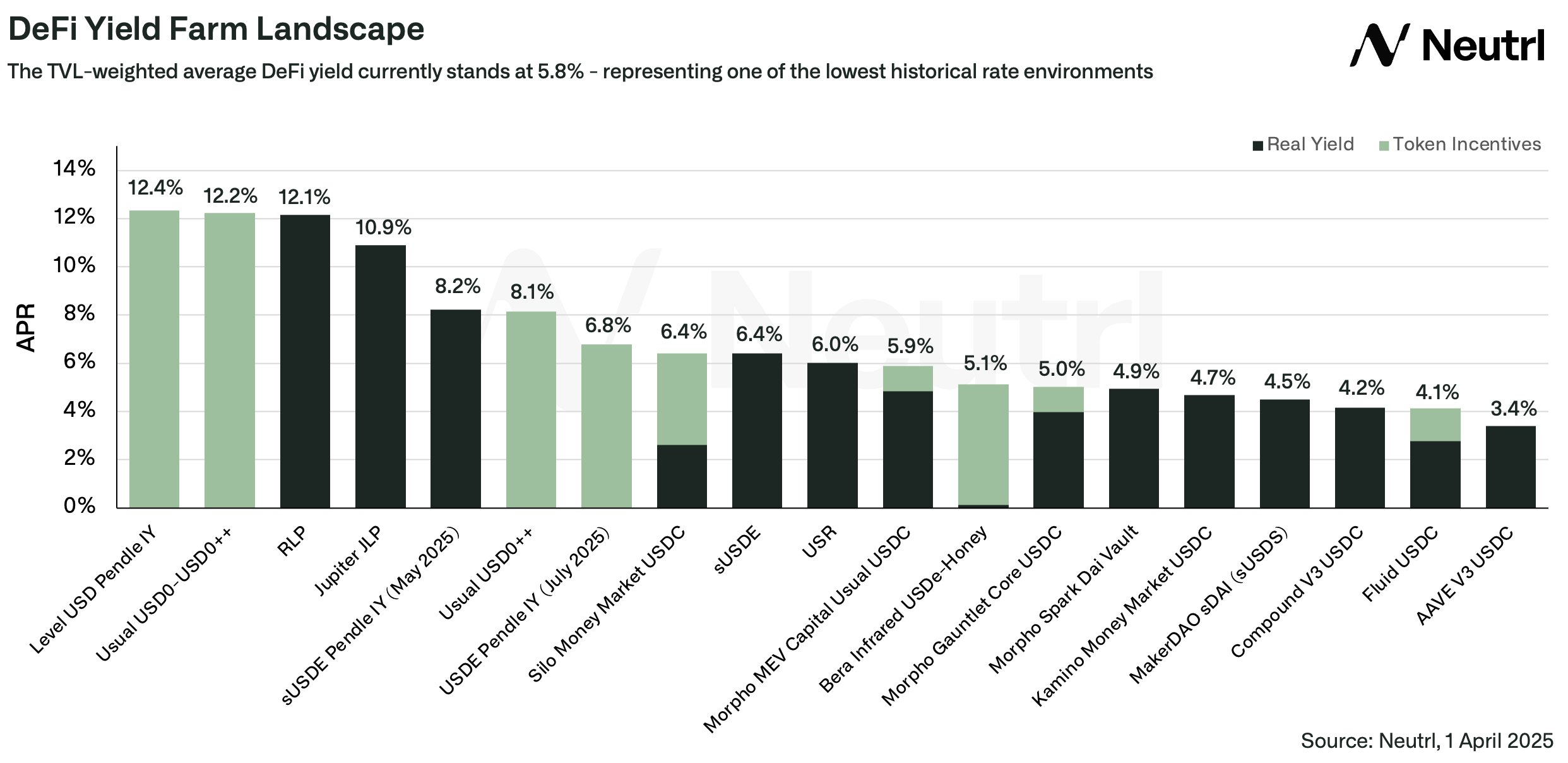

- DeFi yield curve : The tightness of US dollar liquidity will also be transmitted to the DeFi lending market through interest rates. During the dollar shortage period, the dollar on the chain became valuable, and the interest rate for borrowing stablecoins soared, and the DeFi yield curve rose steeply (lenders demanded higher returns). On the contrary, when the Fed's loosening led to an abundance of US dollars in the market and a decline in traditional interest rates, the interest rate of stablecoins in DeFi became relatively attractive, thereby attracting more funds to flow into the chain to obtain returns. An analysis report pointed out that under the expectation that the Federal Reserve would enter the interest rate cut channel, DeFi returns began to become attractive again, and the size of the stablecoin market has rebounded to a high of about US$178 billion, and the number of active wallets has stabilized at more than 30 million, showing signs of recovery. As interest rates fall, more funds may turn to the chain to gain higher returns, further accelerating this trend. Bernstein analysts even expect that as the demand for crypto credit grows, the annualized yield of stablecoins on DeFi is expected to rise to more than 5%, surpassing the return rate of US money market funds. This means that DeFi has the potential to provide relatively better returns in a low-interest macro environment, thereby attracting the attention of traditional capital. However, it should be noted that if the Fed's easing eventually triggers rising inflation expectations, stablecoin lending rates may also rise again to reflect the risk premium. Therefore, DeFi's yield curve may be repriced in a "first down and then up" fluctuation: first it will flatten due to abundant liquidity, and then steepen under inflationary pressure. But overall, as long as the US dollar liquidity is flooded, the trend of a large amount of capital pouring into DeFi in search of returns will be irreversible , which will not only push up the prices of high-quality assets, but also lower the risk-free interest rate level, causing the entire yield curve to shift in a direction that is beneficial to borrowers.

In summary, the macro chain reaction caused by Trump's tariff policy will profoundly affect all aspects of the crypto market. From the macro economy to the liquidity of the US dollar, to the Bitcoin market and the DeFi ecosystem, we are witnessing a butterfly effect: the trade war has aroused a currency storm. As the US dollar fluctuates violently, Bitcoin is ready to go, and stablecoins and DeFi are facing opportunities and challenges in the cracks. For crypto investors with a keen sense of smell, this macro storm is both a risk and an opportunity - as the popular saying in the currency circle: "The day when the central bank prints money is the day when Bitcoin ascends the throne." Objectively, the violent tariff model actually promotes this process. Maybe QE is getting closer and closer. Although I don't like to tell narratives like "a big game of chess", it seems that this is the most positive and clear angle at present.