Written by Trend Research

Trend Research Since the research report was issued on April 24, 2025, ETH has risen from $1,800 to around $2,400, an increase of about 30% in one month . The prediction before the writing of the research report started at $1,450. As an asset target of hundreds of billions of dollars, it is a rare opportunity for large funds to achieve high returns in the short term. The main reasons for the firm bullish view at that time include: ETH still has stable financial data, and its status as an important infrastructure for encryption has not changed; the huge adjustment range of short-term highs (a drop of more than 60% in 4 months); the scale of short positions in the derivatives market is huge, and the bottom spot volume has climbed to an important support swap area after the increase, and the continuous layout of traditional finance and the gradual inflow of ETFs. At present, our forecast for ETH is that it can break through $5,000 in the long term. In an optimistic situation, if BTC rises to $300,000+ in this cycle, ETH is expected to rise to $10,000 , and will capture opportunities for related targets in the ETH ecosystem in the long term.

1. Valuation prediction for ETH

An important background for the new valuation of ETH is the capture of the trend of integration between key digital assets and traditional finance . We note that BTC, as the most important digital asset, has opened the prelude to being included in the strategic reserve assets of various US states after the approval of the spot ETF, and has gradually become the scale expansion and a certain degree of strategic replacement of US dollar assets. It is currently ranked sixth in the global asset market value. The US BTC spot ETF currently manages approximately US$118.6 billion in assets, accounting for approximately 6% of the total market value of Bitcoin. The trend of integration between crypto assets and traditional finance is beyond doubt. In an interview in Dubai in May, CZ said that the price of Bitcoin in this round of market cycle may reach US$500,000 to US$1 million.

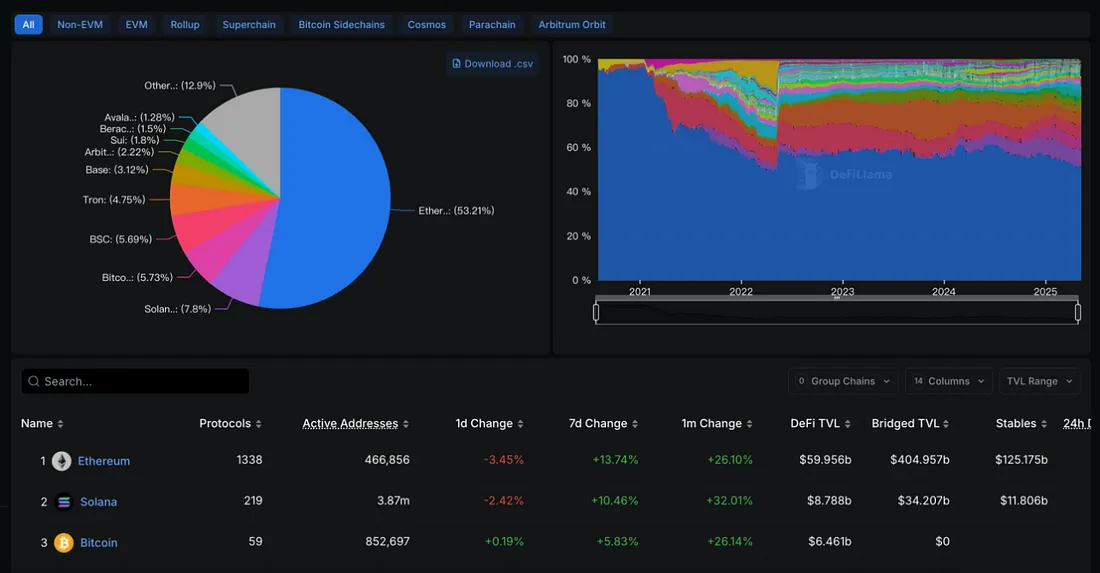

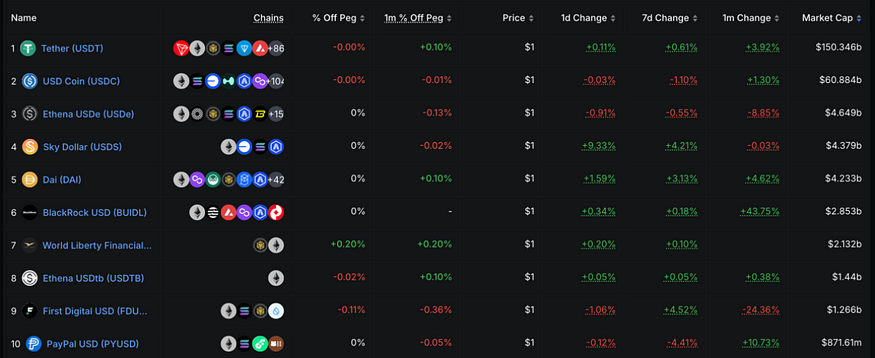

ETH still has robust financial data, and its status as the most important infrastructure of crypto finance has not changed . Ethereum DeFi's total TVL is about $60 billion, accounting for more than 53% of the global DeFi market, and the market value of stablecoins is $124 billion, accounting for more than 50% of the total market value of global stablecoins. The total AUM of Ethereum ETF is $7.2 billion, and BlackRock's tokenized money market fund BUIDL has invested about $2.7 billion in the Ethereum ecosystem, accounting for 92% of its total assets.

After reaching three peaks at $4,000 in 2024, ETH quickly fell to around $1,300, with an ATH of $4,800+. Based on the following potential factors, we predict that the ETH price will reach $5,000 in this cycle :

- The end of the US QT and the start of further rate cuts

- The new SEC chairman may bring breakthroughs in the promotion of tokenization on the ETH chain and pledge-related bills

- The management and route repair of the ETH Foundation maintains a certain degree of infrastructure innovation

- Maintaining a steady growth in the on-chain financial ecosystem

Under the long-term optimistic forecast, ETH is expected to hit $10,000 in the new cycle , and the following conditions need to be met:

- BTC rises to over $300,000

- ETH brings brilliant infrastructure innovation that benefits DeFi

- US institutions push ETH to become an important native venue for asset tokenization

- Demonstration effect drives global asset tokenization

2. Three ETH ecological projects that cannot be ignored

1. UNI (Uniswap): The largest DEX protocol in the crypto market

Uniswap is the earliest and largest Dex protocol in the crypto market, with a TVL of 4.7 billion US dollars, a daily transaction volume of more than 2 billion US dollars, and an annual income of 900 million US dollars. UNI is fully circulated, and about 40% of the lock-up is used for governance. The current circulation market value is 4 billion US dollars, and the FDV is 6.6 billion.

There is a certain decoupling between the current UNI token economics design and protocol revenue. The revenue generated by the protocol will not be automatically distributed to UNI token holders. UNI mainly acts as a governance token, which can control the use of the treasury through voting, and can indirectly have a positive impact on the UNI coin price through governance proposals. For example, in 2024, the DAO voted to repurchase 10 million UNI.

The decoupling between protocol revenue and token earnings is mainly due to the SEC's previous risk considerations for qualitative regulation of securities. Currently, with the gradual relaxation and regularization of crypto regulation in the United States, UNI's protocol distribution may be upgraded in the future.

The main progress of Uniswap in recent times is in the expansion of Uniswap V4 and Unichain, and the initial activation of the “Fee Switch” mechanism.

2. AAVE (Aave): The largest lending protocol in the crypto market

AAVE is the largest lending protocol in the crypto market, with a TVL of $23 billion, generating $450 million in revenue a year, 100% of its tokens in circulation, and a current market value of $3.3 billion.

Similar to UNI’s situation, the protocol revenue has no direct dividend relationship with AAVE, but is indirectly affected through governance.

Aave's major recent progress has been in the development of Aave V4, the cross-chain expansion of its native stablecoin GHO, and the promotion of the Horizon project to explore RWA business.

3. ENA (Ethena): The largest synthetic stablecoin protocol in the crypto market

Since 2025, Ethena's synthetic dollar USDe has become the third largest dollar-pegged asset in the crypto market, second only to USDT and USDC in terms of issuance scale. USDe is also the only synthetic stablecoin among them. In terms of revenue, Ethena is also a profitable Defi protocol, generating $315 million in revenue a year. ENA currently has a market value of $2.18 billion and a FDV of $5.6 billion.

Recently, Ethena has made comprehensive business progress: Ethena and Securitize will cooperate to launch the "Converge" blockchain network, aiming to bridge traditional finance and DeFi, and plan to launch iUSDe, a stablecoin product for traditional financial institutions, and integrate its stablecoin sUSDe into the Telegram application. It is also building an ecosystem based on its stablecoin sUSDe, including a perpetual and spot exchange Ethereal based on its own application chain and an on-chain options and structured product protocol Derive.