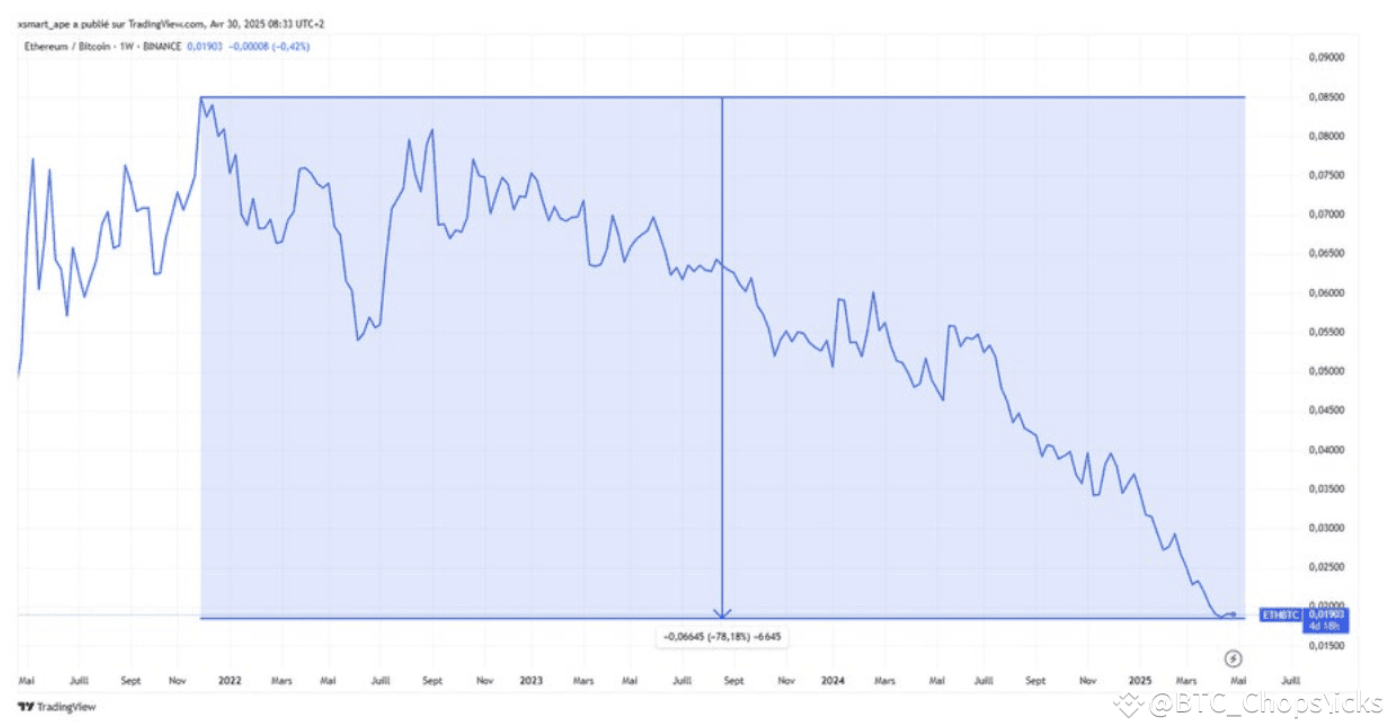

But the reality is: ETH has depreciated by more than 80% against BTC since its 2021 high .

Faced with this performance, the market is full of pessimism, doubts and even "FUD" (panic, uncertainty and doubt) about ETH .

But the truly rational approach is to figure out why ETH is performing poorly. Here are the top ten reasons why ETH prices are under pressure in the short term:

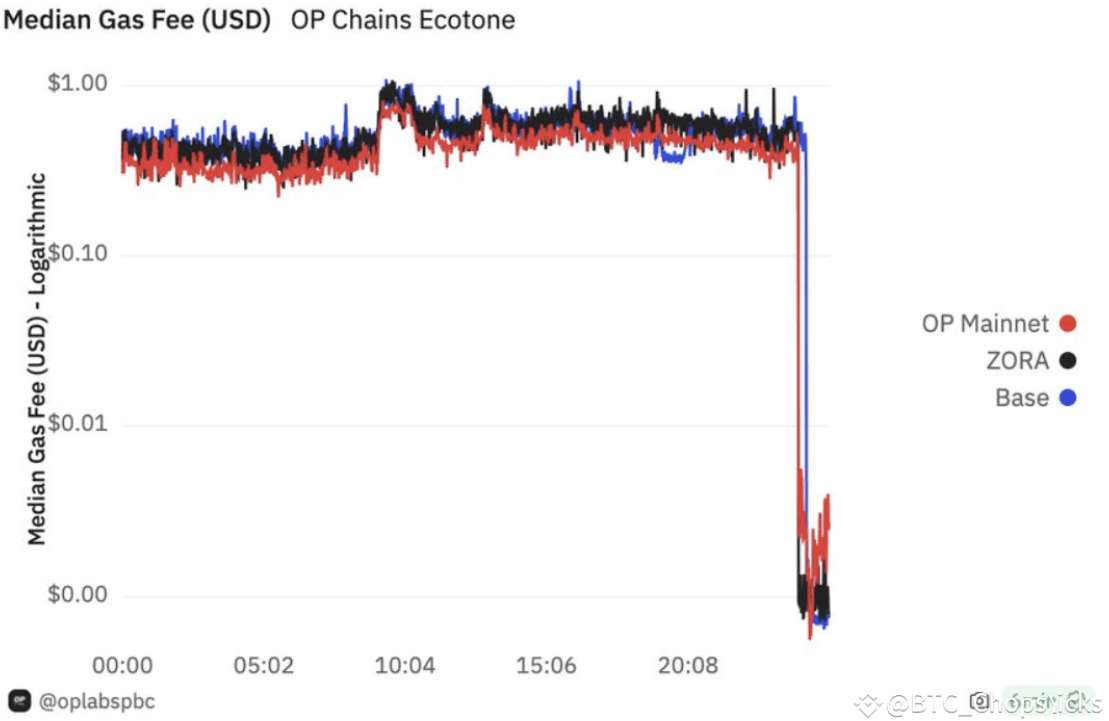

1. Dencun upgrade: technological progress and value spillover

Dencun (EIP-4844) introduces "blobs", which greatly reduces the data cost of the L2 chain.

L2’s transaction fees dropped by 98%, and the user experience improved significantly, but this also brought side effects:

Mainnet transaction fees decreased, and the amount of ETH destroyed decreased

L2 absorbs more value than Ethereum main chain

As a result, the “ultrasonic currency” narrative weakened and ETH prices came under pressure.

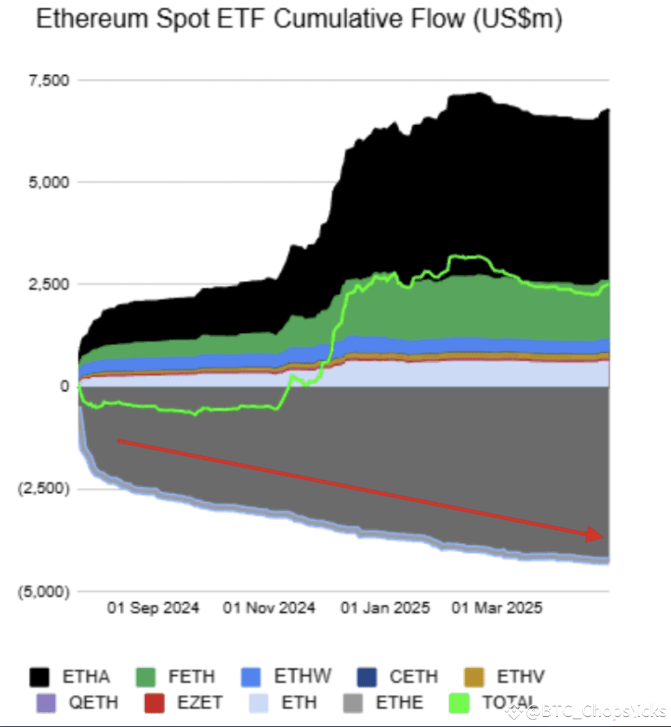

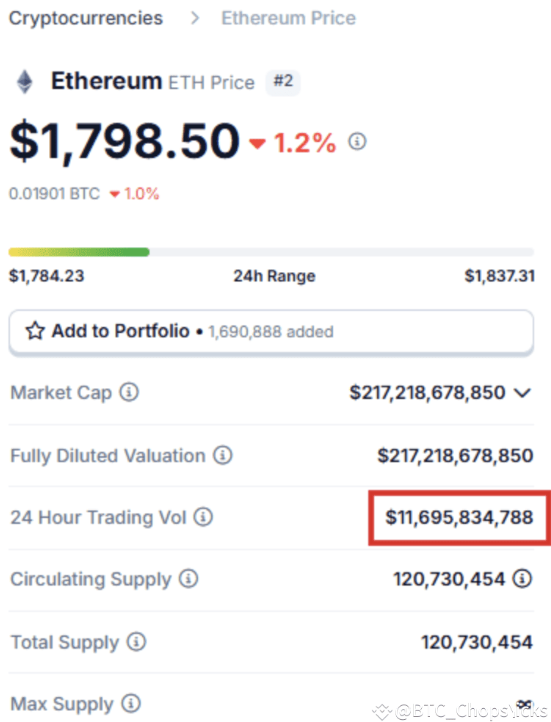

2. ETF effect fails

BTC spot ETF attracted over $40 billion, while ETH ETF only received $200 million in inflows.

One of the reasons is that Grayscale held 3 million ETH in advance, which released huge selling pressure when these assets were convertible into ETF shares.

3. Emotional collapse + whales leave the market

Many whales exited their positions after ETH weakened and began to “FUD” Ethereum on social media.

This is classic psychological behavior: sell → bearish → market falls → self-validation.

4. Ethereum Foundation’s “coin sale controversy”

Every time the foundation sells a small amount of ETH (usually only a few hundred), the market will speculate: Is Vitalik losing confidence? Is it about to peak?

Although these sales are routine, they have exacerbated volatility in market sentiment.

5. Vitalik’s Personal Image

When investors lose money, their emotions are further amplified when they see Vitalik dancing and acting funny in public.

Whether it’s fair or not, Vitalik’s image as the face of the project can sometimes affect public confidence.

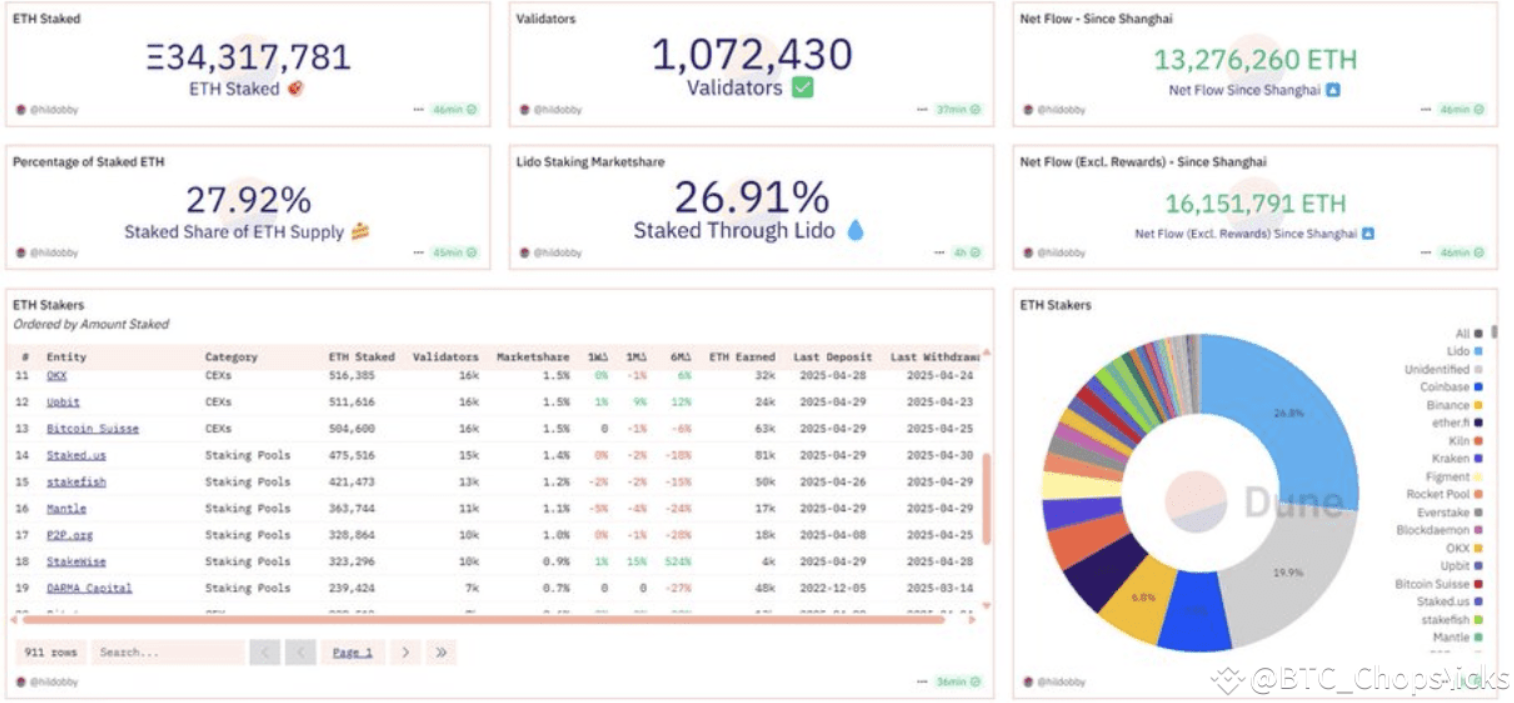

6. Centralized staking structure

Although Ethereum has over 1 million validators, the top 10 coin holding addresses control more than 80% of the staked ETH.

In addition, only 28% of ETH is staked, reflecting that the threshold for participation for ordinary users is still high.

7. PECTRA Upgrade (EIP-7691): Further Fee Reduction and Reduction of Burning

The upgrade increases the number of Blobs from 3 to 6, further reducing L2 fees.

Efficiency is improved, but it also means that less ETH is destroyed, which suppresses prices.

8. EIP-7762: Stabilize Gas Fees and Suppress Price Elasticity

The upcoming EIP-7762 will prevent L2 transaction fees from surging during peak periods and improve user experience.

But the problem is: low transaction fees = low destruction = not conducive to the performance of ETH price in the short term.

9. Narrative transformation and loss of direction

Ethereum is transforming from the "main stage" of the DeFi ecosystem to the "settlement layer + security layer".

Although the technical route is clear, there are differences within the community on future positioning, making ETH's medium- and long-term vision somewhat vague.

10. The rise of L2 and the diversion of value

L2s such as Base, Arbitrum , and Optimism are gradually absorbing main chain ecological resources.

In the past year, L2's total revenue was $140 million, of which Base alone contributed $80 million.

Ethereum actively empowers L2, sacrificing the value of the main chain in the short term in exchange for overall scalability.

Summarize:

Ethereum 's technological development has never stopped, and its ecological construction has continued to advance.

But in the short term, these upgrades and transformations are mostly beneficial to users, but unfriendly to ETH prices:

Fees decrease → Destruction decreases

L2 value enhancement → main chain income transfer

ETF effect is weak → investors’ expectations are not met

However, in the long run, ETH is still one of the crypto assets with the strongest fundamentals. If the future value capture mechanism is linked to ecological use, the price of ETH is expected to rebound strongly.

📌 Short-term pain, long-term faith.