Hong Kong, a world-renowned free port and international financial center, has a thriving crypto-economic ecosystem long before the official preferential policies were introduced. Among them, virtual asset over-the-counter trading service providers (VAOTC) operating in the form of offline stores and online groups, together with native and overseas virtual asset trading service providers (VATP), provide investors with token exchange and deposit and withdrawal services, forming a unique market landscape.

However, the high anonymity and borderless nature of virtual assets under blockchain technology have also opened the door to illegal and criminal activities. A large number of crime-related cryptocurrencies, especially stablecoins, have quietly flowed into the Hong Kong encryption ecosystem, bringing many problems such as capital pollution and legal and compliance risks to operators and ordinary investors.

This article takes the recent experience of mainland college students going to Hong Kong to help others run errands and exchange U as the starting point, and deeply explores the damage caused by the Southeast Asian fraud industry to Hong Kong's crypto economy industry.

Author of this article:

Bitrace & Shao Shiwei Lawyer

The incident: A college student went to Hong Kong to run errands to buy USDT and accidentally became a "money laundering tool" for a fraud gang

College student Xiao Wang thought that trading virtual currencies in Hong Kong was legal and there was no problem, but recently he found that his bank card, WeChat and Alipay were all frozen by the mainland police. It turned out that he had been staying in Hong Kong recently and met someone on the Xianyu platform by chance. The other party asked him to help buy "U" and could give him errand fees.

The specific process is that the other party transferred RMB to his bank card in the mainland, and after he exchanged it for Hong Kong dollars at a local fiat currency exchange shop, he went to a cryptocurrency exchange shop in Hong Kong to buy USDT and asked the clerk to transfer the virtual currency to the wallet address specified by the other party. But not long after the transaction, the police informed him that he was suspected of fraud . He was confused, how could he be suspected of fraud? So, is there any risk in going to Hong Kong to help people run errands to buy and sell USDT virtual currency?

It turned out that each time the other party transferred money to him, it was from a different victim.

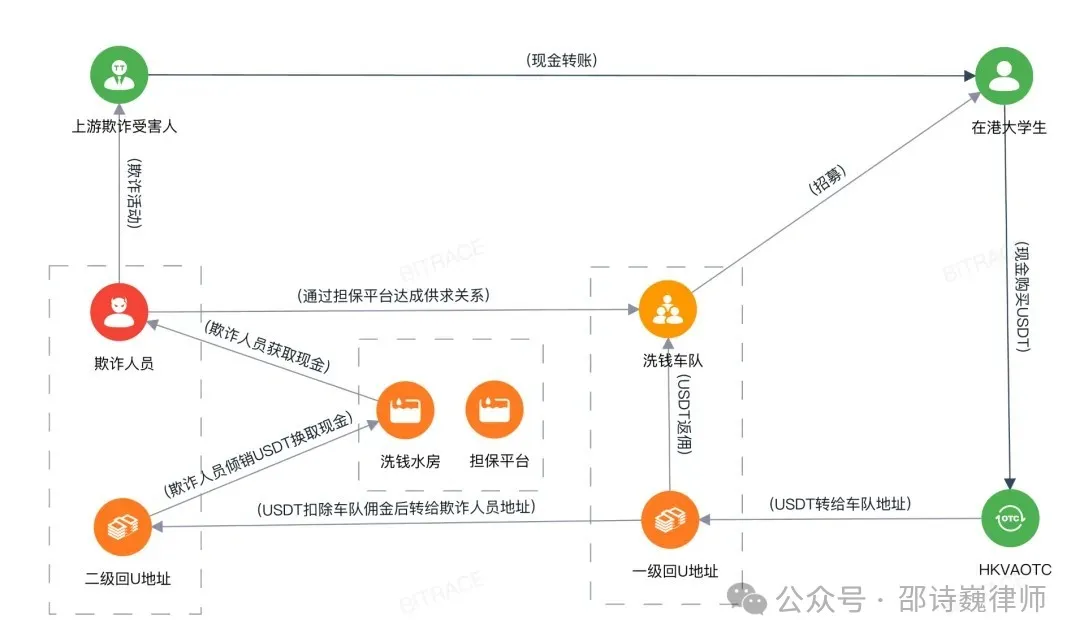

In essence, this is a typical "card back to U" money laundering method, which is closely related to the organized crime network in Southeast Asia.

On-chain analysis: How to identify the Hong Kong OTC money laundering chain through on-chain data?

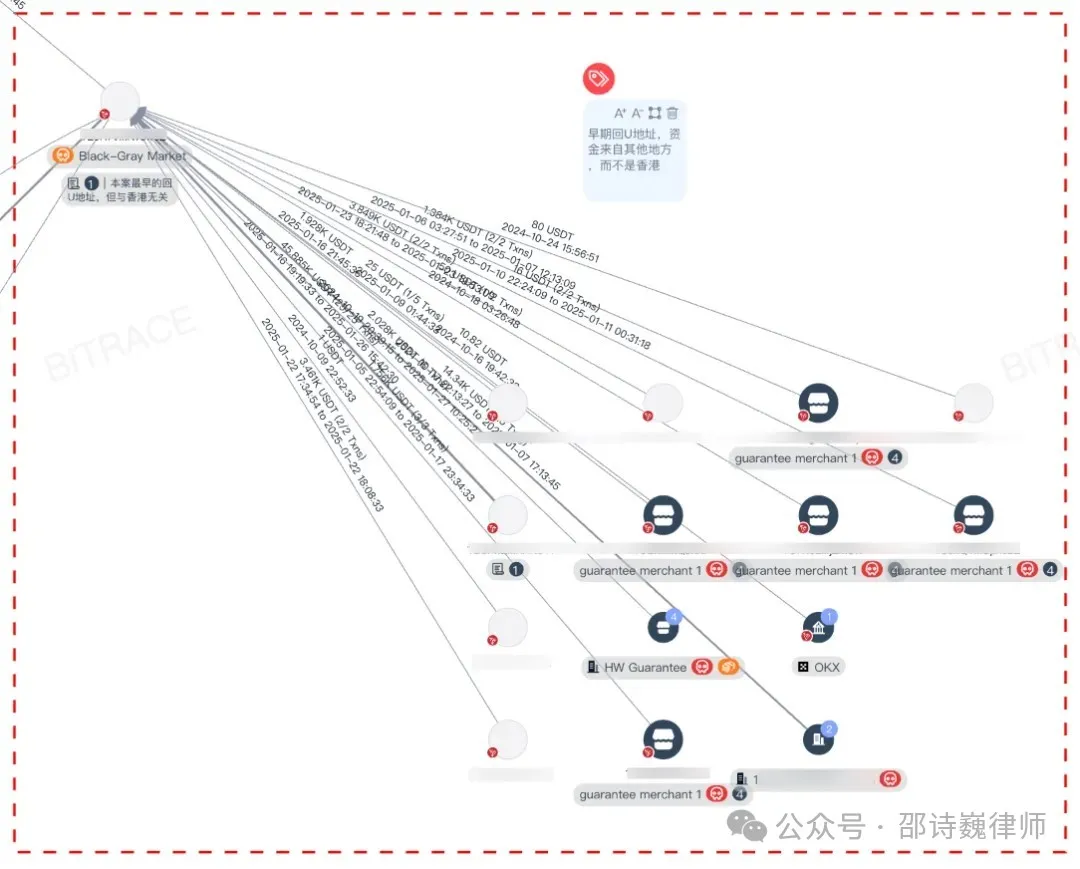

Lawyer Shao Shiwei and Bitrace team (cryptocurrency security service platform) jointly conducted an in-depth investigation. After Bitrace team conducted a fund analysis on the designated receiving address TTb8Fk, it was found that the college student purchased 2,396 USDT from the designated money exchange shop, and the funds subsequently flowed into the guarantee platform merchant address TKN5Vg, which has long-term business ties with HuioneGuarantee and NewcoinGuarantee in Southeast Asia.

(Bitrace tracks the Hong Kong VAOTC transaction path on the chain, the same below)

These two guarantee platforms have long provided services to the organized crime industry in Southeast Asia, including illegal online gambling, black and gray industries, money laundering, fraud, etc. In this incident, they played the role of helping to deal with upstream fraud funds.

This shows that this was a vicious incident in which a Southeast Asian fraud group used Hong Kong's cryptocurrency money changers to launder funds.

The model is the common "Crypto-based money laundering" method, which means that after the money launderers receive the stolen money in fiat currency from the victims of fraud, they quickly go to the over-the-counter market to exchange it for USDT, and then transfer it back to the blockchain address of the fraudsters, and get commissions from it. Since the purchase of USDT requires a large number of bank cards and real-name information, money launderers will recruit a large number of part-time workers in advance to form a "Crypto Laundering Syndicate", and these part-time workers are called "cannons" or "drivers".

In this incident, mainland college students became money launderers without knowing it, and worked with Hong Kong virtual asset over-the-counter trading service providers (VAOTC, commonly known as cryptocurrency exchange shops ) to help money launderers complete the conversion of funds. The USDT obtained first entered the team address, and after deducting the commission (the calculated rebate ratio is 33% ), the team transferred the funds to the guarantor merchant, and finally settled the funds through the guarantee platform.

The secret of the “money laundering team”: Hong Kong VAOTC was used by Southeast Asian fraud gangs to launder USDT funds

Behind these types of cases, a mature black and gray production line has been formed. The fraud gangs remotely control the operations in Southeast Asia, using "Canon" to transfer money and "driver" to exchange U to disguise illegal funds as compliant transactions.

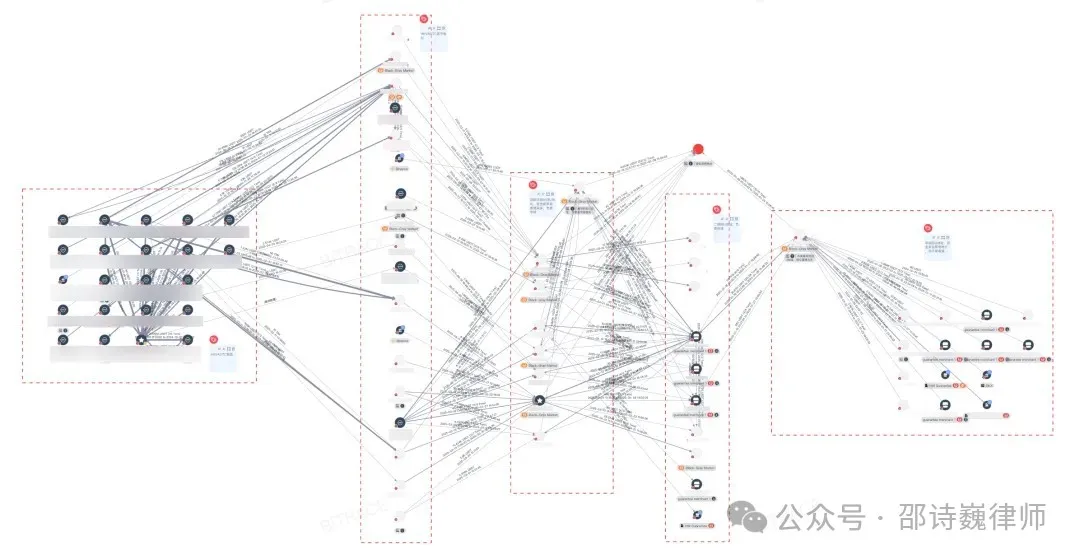

By further expanding the rebate address TGeZzC of the money laundering team, we found that this money laundering incident was not an isolated case, but the tip of the iceberg of a highly industrialized large-scale money laundering gang.

Tracing the source of funds of the rebate address, we can find 7 other first-level rebate U addresses (third from left). These addresses are at the same level as TTb8Fk. They all received varying amounts of USDT from Hong Kong money changers (first from left, second from left, HKVAOTC), of which 33% was transferred to the rebate address (marked in red) and 67% was transferred to the second-level rebate U address (second from right). They were then dumped through the guarantee platform. The whole process has a very clear division of labor.

Analysis shows that this batch of addresses has been active since 2024. The initial source of funds has nothing to do with Hong Kong, but a large number of Southeast Asian black and gray risk addresses. This further indicates that behind this case is a gang closely related to the Southeast Asian organized crime network.

In less than three months, this money laundering team alone has illegally laundered more than 310,000 US dollars in Hong Kong using the same method. Considering that there are still other addresses that have not been expanded or other gang addresses that have not been detected in this case, the actual scale of this type of illegal industrial money laundering activity using HKVAOTC may be even larger.

Hong Kong VAOTC Money Exchange: A Gray Area Before Compliance Policies Are Released

Shao Shiwei, a lawyer at Shanghai Mankiw Law Firm, pointed out that the virtual asset over-the-counter (VAOTC) industry in Hong Kong is still in an imperfect regulatory stage, and many platforms have become an important channel for fraudulent funds to launder money due to the lack of effective compliance mechanisms. Looking around the world, the regulatory frameworks of various countries for cryptocurrencies and OTC services have not yet been fully unified, but major virtual asset trading markets such as Hong Kong, the European Union, and the United States have begun to promote the construction of a licensing system and anti-money laundering (AML) regulatory system for virtual asset service providers.

Taking Hong Kong as an example, the Financial Services and Treasury Bureau (FSTB) issued a legislative consultation document on virtual asset over-the-counter (OTC) services in February 2024. An important suggestion was made in the document, namely, to introduce a licensing system for OTC traders with the help of the Anti-Money Laundering and Terrorist Financing Ordinance (AMLO). According to this proposal, Hong Kong plans to establish a licensing management system for OTC traders through the Anti-Money Laundering and Terrorist Financing Ordinance (AMLO), the core purpose of which is to ensure that these companies can meet compliance requirements such as anti-money laundering (AML) and customer identity verification (KYC).

This means that all companies that provide virtual asset OTC trading services, including OTC dealers, must apply for the corresponding license from the Hong Kong Customs and Excise Department (CCE) and strictly abide by relevant legal provisions. However, as of now, the legislation is still in the consultation stage, and the specific implementation details and effective time are still to be officially announced by the government.

How do VAOTC merchants deal with Hong Kong’s virtual currency compliance regulation?

As Hong Kong is about to introduce regulatory policies for virtual asset over-the-counter (OTC) transactions, OTC service providers are facing unprecedented compliance pressure. Currently, virtual asset over-the-counter trading services (VAOTC) have become a key link in the cryptocurrency market, providing users with efficient access channels for deposits and withdrawals, but their high degree of anonymity also makes them prone to becoming downstream links for money laundering and telecommunications fraud.

In this context, VAOTC operators urgently need to systematically sort out the customer due diligence (KYC) process and the fund source review mechanism (AML) to comprehensively investigate the potential illegal fund risks in their business. If they fail to fulfill their due compliance obligations, they are likely to face criminal liability if they are found to have assisted in handling illegal funds.

In order to actively respond to the upcoming OTC licensing system, industry participants must not only take the initiative to understand the compliance requirements that will be implemented by the Hong Kong Customs and Excise Department (CCE) and the Financial Services and Treasury Bureau (FSTB), but also establish a sound internal risk control system to ensure that all trading activities comply with anti-money laundering and terrorist financing prevention and control standards.

In addition, OTC platforms should strengthen communication with regulatory agencies and industry self-regulatory organizations, keep abreast of policy trends, and strengthen transaction monitoring through technical means to identify suspicious behavior in a timely manner. At the same time, platforms should strictly refuse to associate with any suspected black and gray funds, and cut off the possibility of illegal funds being laundered through OTC channels. This not only helps to maintain the good reputation of the company itself, but is also an important manifestation of the company's fulfillment of its social responsibility.

In general, the upcoming OTC compliance policy in Hong Kong is an important opportunity for the virtual asset OTC industry to achieve standardized development. Operators in the industry should firmly grasp this opportunity, actively adapt to changes in the regulatory environment, and continuously improve their compliance level to enhance their competitiveness. Only in this way can they be invincible in Hong Kong, a market with a prosperous crypto economy, and achieve long-term and stable development.

This article is an original article by lawyer Shao Shiwei. It only represents the author's personal views and does not constitute legal consultation or legal opinion on specific matters. For article reprint, legal consultation, and peer communication, please add: sswls66.

Recommended Reading

The 924 Notice is not a law, so why do you say that I have committed a crime?