The Sino-US trade war intensifies, funds are flowing back quickly, and the crypto market is recovering, but we need to prevent high-level fluctuations in the short term

- Macroeconomic situation: The Sino-US trade war continues to escalate and external risks increase, but it has not immediately hit market sentiment.

- Capital flows: Large net inflows into ETFs + strong issuance of stablecoins, on-site funds have rebounded, supporting the market in the short term.

- Market structure: BTC fluctuates at a high level, ETH rebounds weakly, and altcoins recover quickly but there is a risk of a pullback.

- Trading strategy: Maintain a high-level defensive mentality, pay attention to the BTC 9.16w defensive position, control positions, and select strong sectors (such as SOL).

1. Macro and market environment

The US trade war game

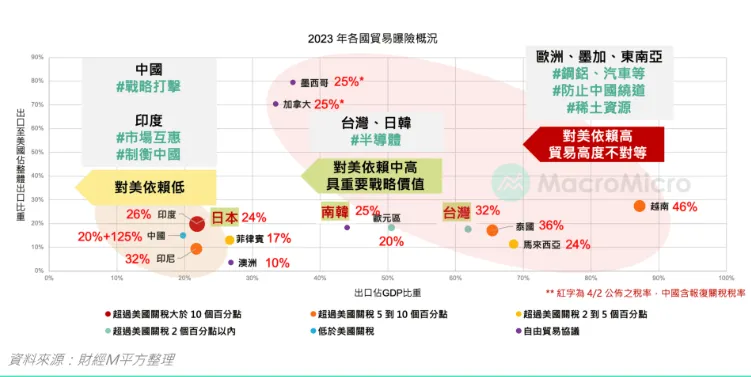

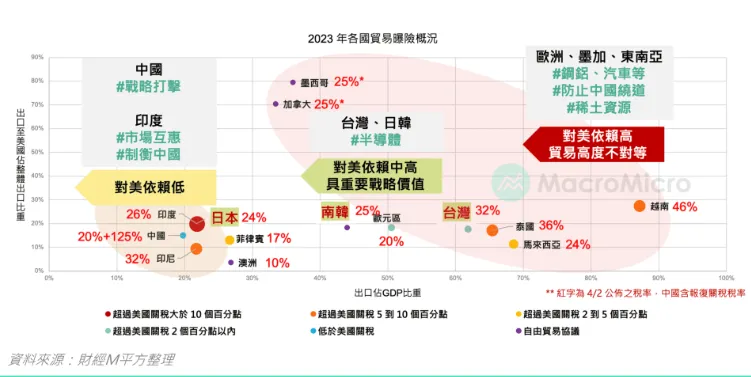

- China and the United States are in a stalemate: The current Sino-US trade war can be seen as a typical "chicken game", with neither side willing to make concessions first, resulting in the imposition of tariffs on each other and increasing economic losses. The final choice of both sides will have a far-reaching impact on the positions and stances of other countries in the world.

- The core of the global economic game: The attitudes of about 80 countries around the world will play a key role in the Sino-US game, especially in the escalation of the trade war and the reorganization of the supply chain. The position of global economies determines the dynamics and final outcome of the game between China and the United States.

- The transformation of the hawk-dove game: The game between China and the United States may shift from the current "chicken game" to the "hawk-dove game". The support of global economies will determine whether China and the United States can end the trade war through compromise or tough measures. Ultimately, the stability and development of the global economy may be profoundly affected by this game.

2. Analysis of capital flows & market structure of mainstream currencies

External Funding Flows

- ETF funds: This week's inflow was 3.014 billion, and the capital situation improved.

- Stablecoins: 2.17 billion new coins were issued this week, with a medium issuance level

Market sentiment indicators

- OTC premium surges: Stablecoin premium rebounds to above water, with only a slight premium

Bitcoin (BTC)

- Technical aspect: At the high point of the four-hour line segment, beware of the end after the surge

- On-chain chip distribution: The chip peak returns to around 9.3w

Ethereum (ETH)

- The trend is weaker than BTC. ETH/BTC maintained volatility and then broke down this week, and funds continued to flow back to BTC dominance.

- On-chain changes: The increase in active addresses may indicate that the staged bottoming out has been completed.

Macroeconomic Review

The US tariff war under game theory

1. Chicken Game

In game theory, the "chicken game" describes two players (or countries) trying to force the other to make concessions, but neither side wants to compromise first, resulting in an "over-confrontation" situation, which ultimately hurts both sides. The Sino-US trade war is currently in this game.

Game settings:

- Players: United States and China

- Strategic choice: The two countries can choose to "stand firm" or "compromise". "Stand firm" means maintaining a high tariff policy, while "compromise" means lowering tariffs and negotiating.

- Payment Matrix: If both countries choose to "stand firm", both economies will suffer great losses, because the imposition of tariffs will lead to rising prices, weak consumption, global supply chain disruptions and other problems. If one of the two countries chooses to "stand firm" and the other chooses to "compromise", the firm party can gain economic benefits (through a tough negotiating position), while the compromise party will suffer losses. If both sides choose to "compromise", the trade situation will be eased and both sides will benefit, but the benefits are less at this time.

Game ending:

- If both countries take a tough stance (“hardline”), economic losses will be the worst outcome for both sides.

- If one of the parties chooses to compromise, the stronger party will gain an advantage, but the compromising party will lose something.

- If both sides choose to compromise, the trade war can be eased and economic growth can be restored, but this is usually a situation where neither side fully achieves their best interests.

The current situation shows that both China and the United States hope that the other side will make concessions first, but because both sides are waiting for the other side to compromise first, the current deadlock has occurred. The final outcome will depend on the attitude of external countries and whether each side is willing to make adjustments in trade negotiations.

2. Hawk-Dove Game

Hawk-Dove Game is a typical game model, in which "Hawk" represents a tough stance, while "Dove" represents compromise. When players choose "Hawk" or "Dove", they are faced with a game of power and interests. If both sides choose "Hawk", the final result may be a lose-lose situation. If one side chooses "Dove" and the other side chooses "Hawk", the tough side will win.

Game settings:

- Players: China, the United States, and other countries around the world (such as the European Union, Vietnam, etc.).

- Strategic Choices: China, the United States, and other economies around the world can choose to be either “hawkish” (tough stance) or “dovey” (compromise). For example, the United States may ask global allies to take sides and continue to impose tariffs on China; while China may choose to win support among some key economies, compromise, and reduce tariffs.

- Payment Matrix: If both the United States and China choose "Hawk", the trade war will escalate and the economies of both sides will suffer. If the United States chooses "Hawk" and other economies choose "Dove", the United States may gain more support and exert greater pressure on China.

Game ending:

- If both the United States and China choose a tough stance ("hawkish"), it could lead to disruptions in global supply chains, rising prices, and a global economic downturn.

- If both the United States and China choose to compromise ("dove"), the trade war may be eased, but this requires the other economies in the world to take sides and the joint efforts of both China and the United States.

- If one side chooses "hawk" and the other side chooses "dove", the country that chooses "hawk" will gain more economic advantages and bargaining chips.

The choices of other countries around the world (such as the European Union, Vietnam, etc.) will play a key role in this game, especially in global supply chains and economic dependencies. Ultimately, whether global economies stand on the right side will have a profound impact on the game between China and the United States.

3. Multi-Player Game

The Sino-US trade war is not just a confrontation between the two countries, but also involves the game of other countries in the world. This is a multi-party game, in which the choice of each country will affect the interests of other countries.

Game settings:

- Players: China, the United States and other economies around the world (such as the European Union, Vietnam, India, Southeast Asia, etc.).

- Strategic choice: The sides countries take between China and the United States determine the final outcome of the negotiations. Global economies can choose to stand on the side of the United States and support its high tariff policy against China, or support China and oppose the United States' trade protectionism.

Game ending:

- Global alliance: If most economies stand on the side of China or the United States, it will affect the game strategies of both China and the United States. For example, Vietnam, as a "beneficiary" of the Sino-US trade war, may continue to maintain a "balance between China and the United States", but its choice will affect whether the United States can gain support. If more economies support China, then the United States may take a more dovish stance in future negotiations.

- Impact on global supply chains: The choices made by global economies will have a significant impact on the final outcome of the Sino-US trade war. If the global supply chain is deeply reconfigured, there may be a trend of "deglobalization", and countries may rely more on regional economic and supply chain cooperation.

4. Game Conclusion

1. China and the United States are in a stalemate: The current China-US trade war can be seen as a typical "chicken game". Neither side is willing to make concessions first, resulting in the imposition of tariffs on each other and the gradual increase in economic losses. The final choice of both sides will have a far-reaching impact on the positions and stances of other countries in the world.

2. The core of the global economic game: The attitudes of about 80 countries around the world will play a key role in the Sino-US game, especially in the escalation of the trade war and the reorganization of the supply chain. The position of global economies determines the dynamics and final outcome of the game between China and the United States.

3. The transformation of the hawk-dove game: The game between China and the United States may shift from the current "chicken game" to the "hawk-dove game". The support of global economies will determine whether China and the United States can end the trade war through compromise or tough measures. Ultimately, the stability and development of the global economy may be profoundly affected by this game.

Key data to watch next week

On-chain data analysis

1. Changes in short- and medium-term market data that affect the market this week

1.1 Stablecoin Fund Flow

This week, the total amount of stablecoins increased to 207.83 billion US dollars, with an increase of 2.17 billion US dollars in a single week and an average daily increase of 310 million US dollars, which is between the neutral level (US$200 million) and the higher level (US$450 million), reflecting that the current market has a stable inflow of funds, but has not yet reached the stage of strong long positions. Overall, the sentiment of funds is mild and bullish, and the market is transitioning from wait-and-see to active allocation.

Mainstream currency prices gain financial support

Although the current issuance volume has not reached an extremely hot level, it can provide basic capital momentum for mainstream currencies such as BTC and ETH, supporting their slow rise, especially providing buying support during the correction phase.

Sentiment is in the stage of "warming up but not overheating"

The issuance of new stablecoins is in a medium to strong range, indicating that the market risk appetite is recovering, but it has not yet entered the frenzy of FOMO (fear of missing out) or full-scale increase in positions. The market rhythm may be mainly "steady and rising".

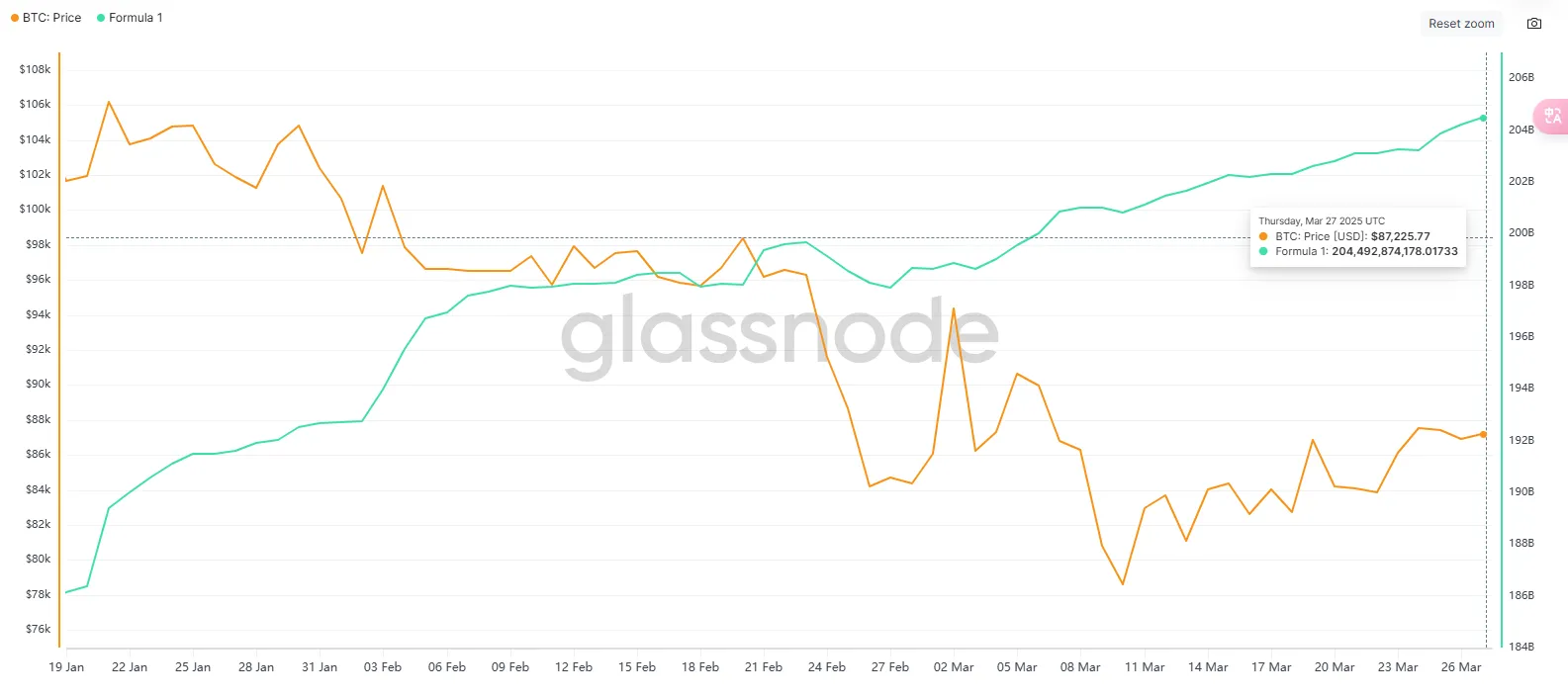

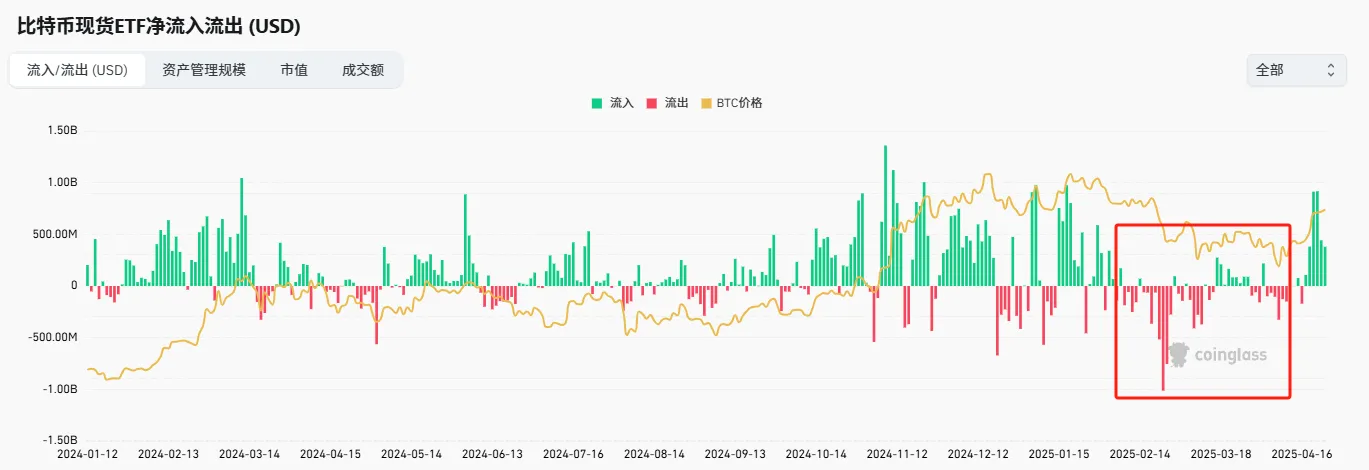

1.2 ETF Fund Flow

This week, ETFs saw a large net inflow of $3.014 billion.

Fund sentiment has undergone a fundamental turn, with institutional funds returning strongly, ending the weak state of net outflow since February. The strong inflow of ETF funds not only pushed the BTC price up to $93,500, but also strengthened the market's confidence in the medium- and long-term trend. The supply and demand relationship has tightened, and the willingness of institutions to go long has increased. The market is expected to enter a new round of rising cycle led by institutions.

A very strong signal of capital entry, strengthening the upward trend

As the main tool for institutional entry, the large inflow of ETFs this week indicates that mainstream financial funds are actively building or increasing positions, significantly raising market expectations for rising prices. BTC rose from around $84,000 last week to $93,500 this week, with ETFs absorbing nearly 30,000 BTC. Funding has become one of the core logics for price increases.

Institutional confidence returns, enhancing market trust

ETF inflows reflect the positive judgment of the U.S. stock market and compliant institutions on the future trend of Bitcoin, which will help stabilize the sentiment of medium- and long-term investors and enhance overall market confidence and anti-volatility capabilities.

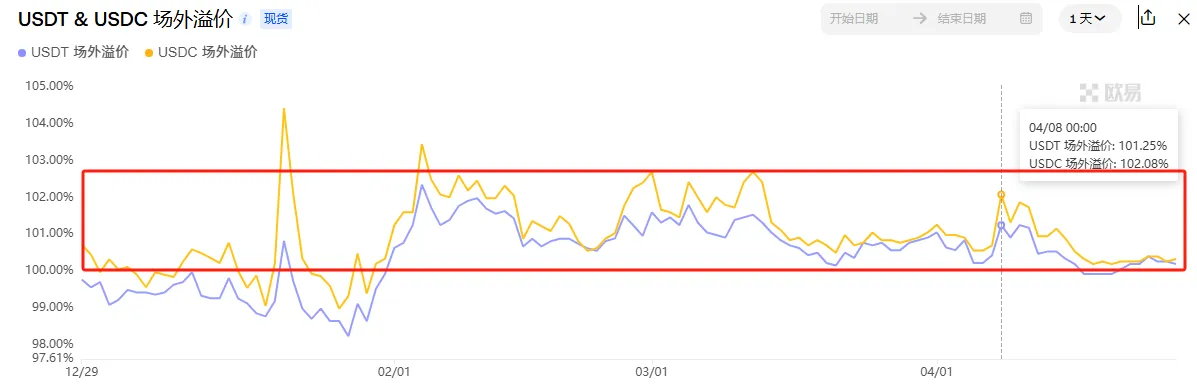

1.3 OTC Discounts and Premiums

This week, the OTC premium and discount rebounded slightly from underwater, and the overall change is not obvious at the surface level. From April 8 onwards, the rapid rise in premium levels shows that OTC fiat currency buying is very strong. Subsequently, the BTC price rose from 74,500 to 94,500, driven by high premium funds. At present, the OTC premium has fallen back to a micro-premium level, indicating that the momentum of new capital inflows has significantly weakened. The current high level of BTC is more supported by the internal rotation of existing funds. In the short term, although BTC is still strong, if the OTC premium continues to be sluggish or there is a discount, coupled with insufficient new funds, once market sentiment weakens, BTC will face the risk of a callback, and changes in the capital side need to be closely monitored.

1.4URPD

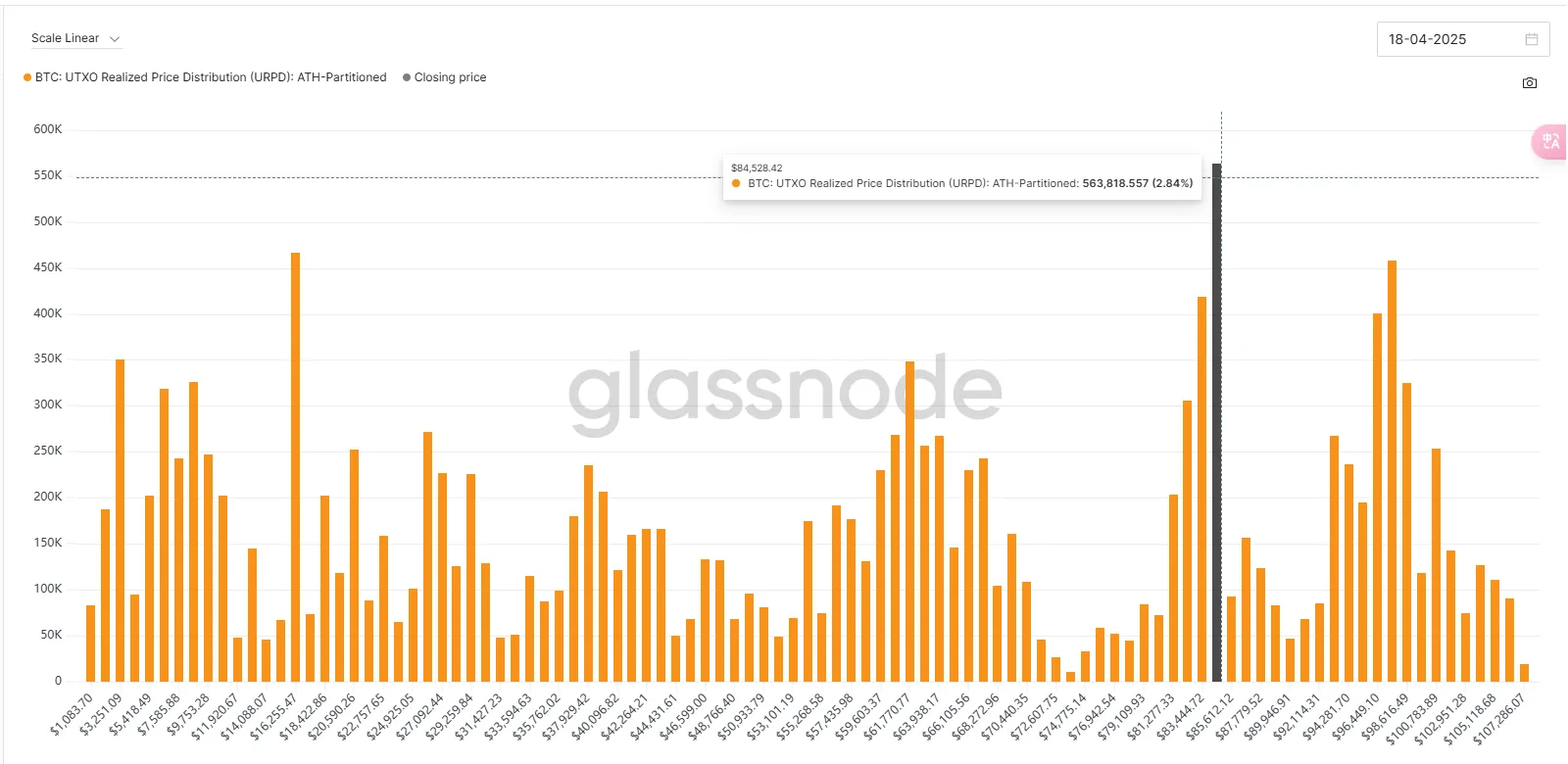

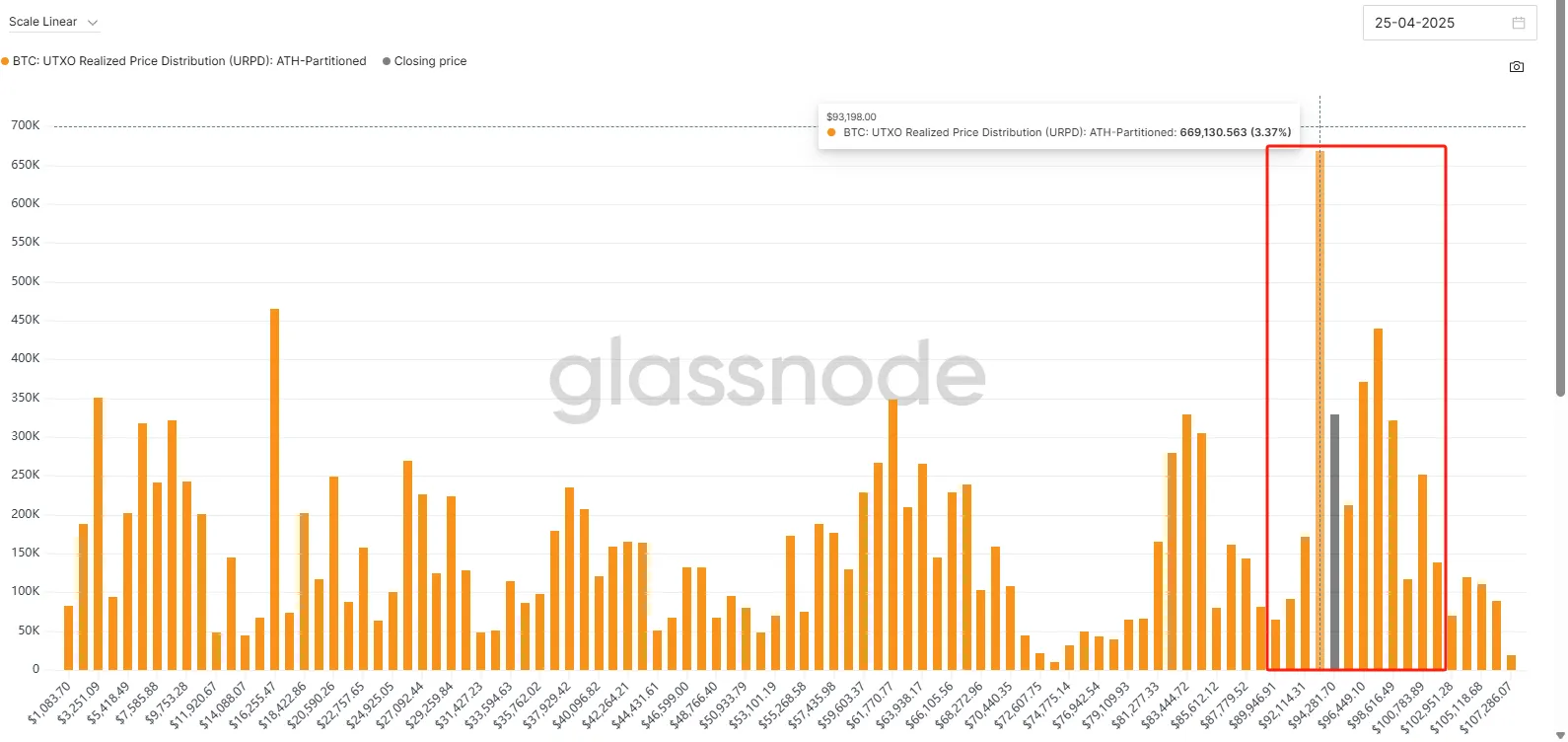

The left picture is the chip distribution chart on the 18th. It can be seen that the chip volume rose sharply at 8.45w, which was caused by the large-scale departure of chips near 9.7w. The right picture is the chip distribution chart on the 25th. As the price continued to rise, the chip peak reached 9.3w, returning to the previous chip range, reflecting the market's strong ability to withstand pressure. It can withstand nearly 1% of the chip volume in a short period of time. At the same time, it cannot be ruled out that the main force deliberately reshuffled the cards to create a stop-loss behavior for high-level chips, but pushed the price up all the way to collect more chips.

2. Changes in mid-term market data that affect the market this week

2.1 Proportion of coins held by coin holding addresses

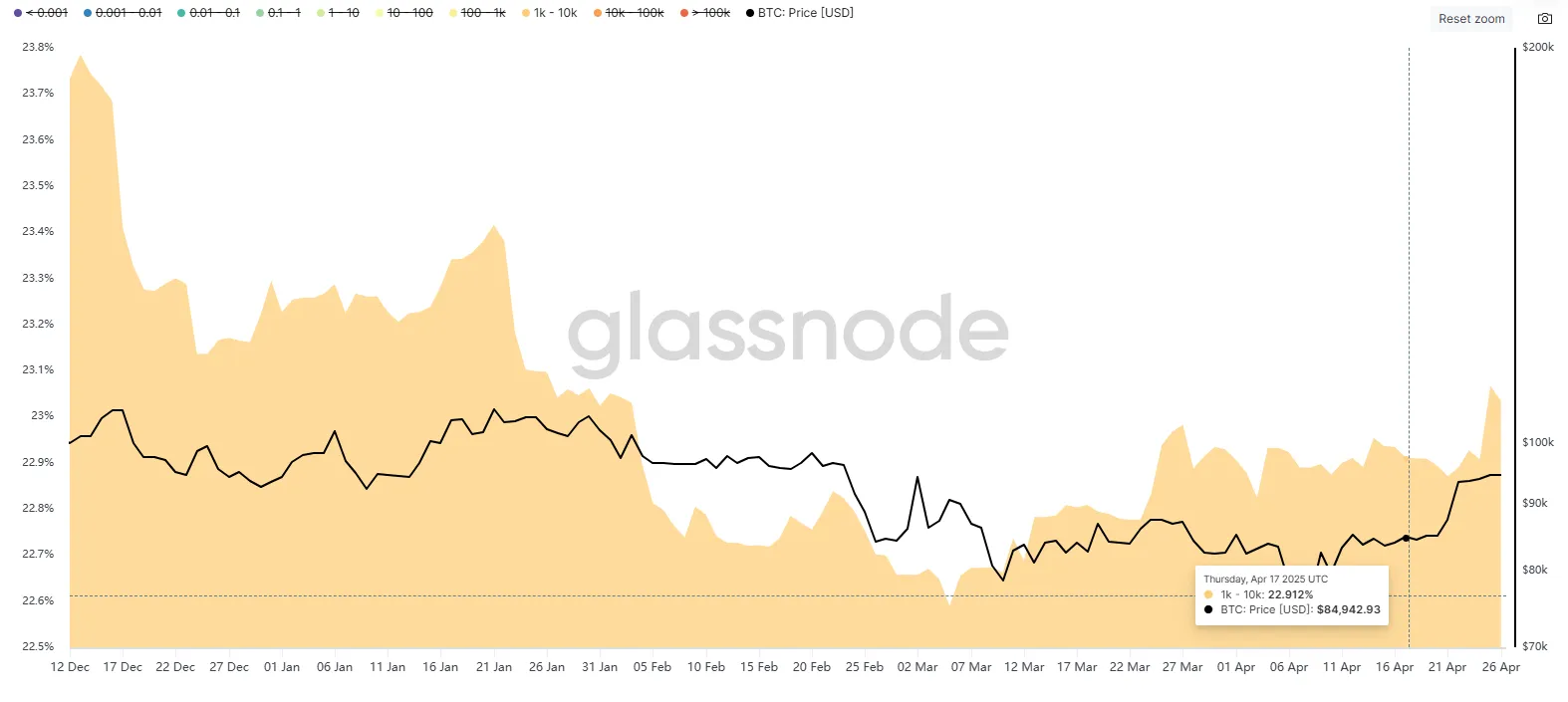

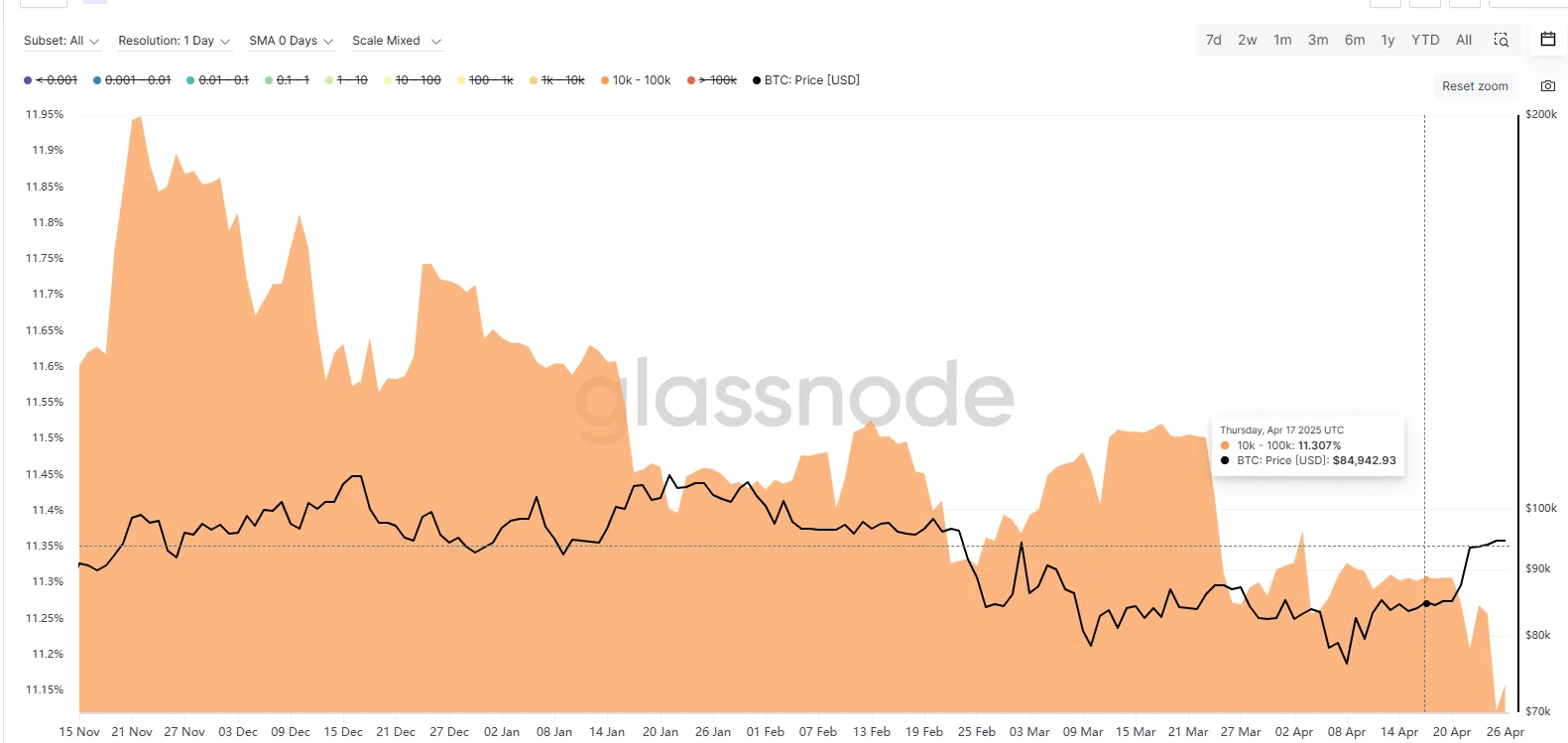

From the perspective of holding 10k-100k coins, the number of addresses holding coins has decreased as the price rises, while the number of addresses holding 100-1k and 1k-10k coins has increased significantly. This wider distribution of coins means that the supply of BTC is gradually becoming more dispersed and no longer extremely concentrated in the hands of super large holders. This structural change is conducive to price stability in the short term, but it also means that if you want to continue to push up prices in the future, you need more extensive financial support, rather than relying on a few whales to control the market.

2.2 Market Pattern Analysis

BTC also strongly broke through the 8.87w position this week. It is currently at a high level in the four-hour line segment. The macd indicator shows a high-level dead cross state, and there is a need for a pullback. However, the market is repairing the impact of the indicator by falling sideways, which shows a very strong state. After the four-hour indicator is repaired, the next wave of highs will need to be strengthened. The four-hour upward segment (daily line) may end here. From the one-hour chart, it may move out of a trading range. The black dotted line is a potential trend type. The defensive point below is 9.16w near the red circle. If it falls below and rebounds but does not break the high point, it should be noted that the pullback has begun.