Author: Liu Xiaofan: Assistant Professor of the Department of Media and Communication at City University of Hong Kong, Chief Scientist of Eurybia

Bitcoin: The embryo of a new world

From 2008 to 2009, Bitcoin was born as a native Internet currency, laying the foundation for a series of future technological innovations. In the context of the time, Bitcoin was a rebellion against the traditional financial oligarchic system, attempting to depict a utopian society where everyone is equal. The decentralized concept it upholds deeply reflects the core spirit of Cypherpunk culture, which is to protect personal privacy through encryption technology and give individuals economic autonomy. However, these ideas were initially spread mainly in a small circle of a few technical elites.

Satoshi Nakamoto "retired" and became a spiritual leader

In 2011, a landmark event occurred in this field: Satoshi Nakamoto, the author of the Bitcoin white paper, completely disappeared from the Internet. The anonymous founder was thus shaped into a mysterious hero, a symbol of freedom and decentralization that transcends specific individuals. Satoshi Nakamoto's "retirement" not only made the concept of Bitcoin appear more pure, but also made him almost like a religious leader.

Cryptocurrency: Bubble, Stigma, and Trends

Since the value of Bitcoin was gradually discovered by the market in 2010, a series of other cryptocurrencies built on the same technical framework have been born, such as Litecoin launched in 2011. However, the early application scenarios of cryptocurrencies were quite embarrassing. They were often used for illegal transaction payments, such as circulation in darknet markets, and seemed to represent a "gray area."

Interest groups stand behind nouns

Over time, cryptocurrencies have become increasingly associated with market bubbles. In 2015, the Ethereum system went online, greatly reducing the cost of creating cryptocurrencies, while also giving rise to a speculative bubble market. In 2018, the cryptocurrency market experienced its first major crash. In 2021, the wave of decentralized finance (DeFi) and non-fungible tokens (NFTs) swept the market, setting off an investment frenzy again, but it collapsed again in 2022. With the attention and intervention of global regulators, cryptocurrencies face increasingly severe compliance pressures, further exacerbating their market stigmatization.

The birth of blockchain and the reconstruction of its meaning

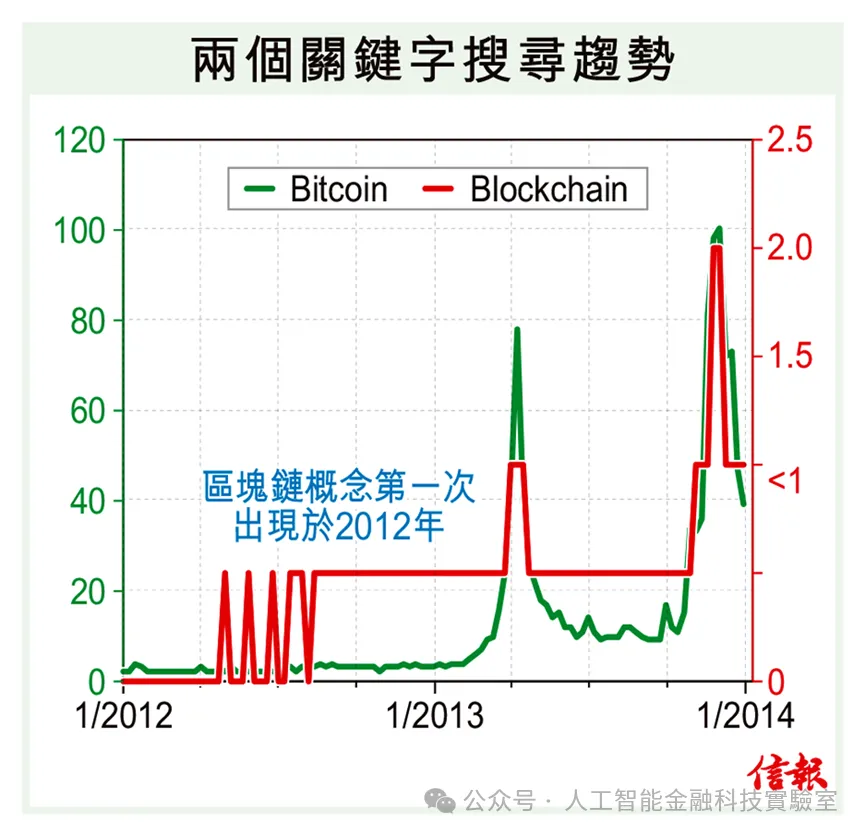

Many people believe that "blockchain" appeared almost at the same time as Bitcoin, or even earlier, but this is not the case. According to Google Trends data, the word Blockchain was not used to describe the distributed system technology behind Bitcoin until 2012-2013 [Figure]. This term was later translated into "blockchain" in mainland China. The emergence of the word blockchain as a symbol construction strategy has given a new symbolic meaning to a technology stack. From then on, technology was stripped away from the label of market speculation and shaped into a neutral and universal image: "trust machine". Technology companies have thus started to promote the market in a wider range of fields such as finance, supply chain, medical care, and government data management. Of course, whether the market has truly adopted this technology is not within the scope of this article.

Metaverse and Web3: Industry’s Self-Redemption

The cryptocurrency industry is not unaware of its own stigmatization. The industry has long been trying to reposition itself with new terms. The two most influential terms: Metaverse and Web3, are both examples of old terms being used in new ways.

The concept of the metaverse comes from the 1992 science fiction novel Snow Crash, which refers to a virtual world with entertainment and economic systems parallel to the real world. The cryptocurrency industry borrowed this concept to express its vision of rebuilding the economic system in the Internet world. The good times did not last long, and the traditional technology industry quickly discovered the charm of this word. When Facebook changed its name to Meta, the narrative of the metaverse was completely rewritten and turned into a vision of a digital world closely related to VR and AR. This process shows the struggle behind discourse manipulation: technology giants defeated upstarts.

When Facebook changed its name to Meta, the narrative of the "metaverse" was completely rewritten. This process demonstrated the struggle behind discourse manipulation and led to the defeat of the upstarts by the technology giants.

Web3 was proposed by Gavin Wood in 2014 to express the ideal of a user-sovereign Internet driven by cryptocurrency (perhaps you have also heard of the famous "read, write, own"). However, this concept has long been on the margins and was not rediscovered until 2021, and has been used to this day.

We need to see from these two words that the naming of technology and industry is actually a process of social construction. Behind each word stands an interest group, which exerts influence on society in various ways in order to achieve its own goals.

Local market: a policy-driven innovation path

Nowadays, there are countless nouns and terms derived from cryptocurrencies around the world, and each country and region has its own more popular usage. The Hong Kong government hopes to build a hub for the global digital economy and create a stable market through specific application scenarios and regulatory frameworks to maintain its status as an international financial center. At present, the most used words in Hong Kong should be Virtual Asset, Tokenized Asset, Real World Asset and Web 3.0. They all have one thing in common: trying to use neutral words to cut off from the speculative and bubble image of cryptocurrencies, hoping to reshape the market's trust and narrative.

Conceptual innovation is not necessarily technological innovation

I don’t intend to go into the subtle differences, interest groups, and conspiracies behind each term here. However, it is important to remind you that some of them reflect the cryptocurrency industry’s pursuit of legitimacy, some show the acceptance of technical narratives in the traditional financial industry, and some of the motivations are not entirely clear.

Conclusion: There is nothing new under the sun

As we can see, from Bitcoin to blockchain, from cryptocurrency to Web3 and tokenized asset markets, the birth of each new concept has its social construction logic behind it. Concept innovation is not necessarily a technological innovation, but may just be a discourse reshaping by different interest groups in order to respond to market changes and attract users and capital. The replacement of concepts does not mean the elimination of risks. While they bring new hope, they also hide risks in new mazes. No matter how the nouns change, we must clearly realize that human nature will not change.

Financial markets, whether traditional or emerging, are places where undercurrents surge - whether you are a novice or a veteran.