Author: Fairy, ChainCatcher

Internet brokerages are "accepting coins" and crypto exchanges are also "breaking the circle".

Yesterday, Futu Securities announced the launch of Bitcoin, Ethereum and USDT top-up services, allowing users to transfer crypto assets directly into their accounts, opening up a funding channel from the cryptocurrency world to the stock market. On the other hand, crypto exchanges are no longer limited to the ecosystem within the circle, and are planning payment scenarios. Some platforms have even included traditional assets such as U.S. stocks and gold in their trading landscape.

On one hand, brokerage firms are opening up the crypto portal, and on the other hand, exchanges are integrating resources and expanding payment and compliance channels. Will 2025 be a new starting point for the circulation of crypto assets?

Futu’s Crypto Ambition

Futu Securities has long been at the top of the Hong Kong stock app download list, with more than 25 million registered users worldwide and customer assets of up to HK$743.3 billion. Now, it is accelerating into the fast lane of crypto assets.

As early as 2023, Futu had already begun to lay out the crypto track. Its virtual asset platform PantherTrade submitted an application for a virtual asset trading platform license to the Hong Kong Securities Regulatory Commission in November of that year. On August 1, 2024, Futu officially launched the cryptocurrency trading function, opening spot trading pairs such as BTC and ETH.

Yesterday, Futu went a step further and opened recharge services for Bitcoin, Ethereum and USDT. Qualified users can transfer crypto assets directly into Futu accounts and freely switch between diversified investment portfolios such as Hong Kong and US stocks, ETFs, funds, bonds and virtual assets.

According to Futu's official website, the current minimum deposit thresholds for BTC and ETH are 0.0002 BTC and 0.001 ETH respectively, and USDT deposits are only open to professional investors. Some users reported that Futu's deposit speed is comparable to that of mainstream exchanges, and the experience is smooth.

Image source: Futu official website

"Securities firms accepting coins" is the trend

Futu is not an isolated case. It has become a global trend for traditional brokerages to accelerate their embrace of crypto assets. In the Hong Kong market, Victory Securities took an earlier step. In May 2024, it opened the VictoryX APP for users to deposit and withdraw USDT and USDC, and this year proposed to take "virtual asset full ecosystem service provider" as the core of its development in the next three years.

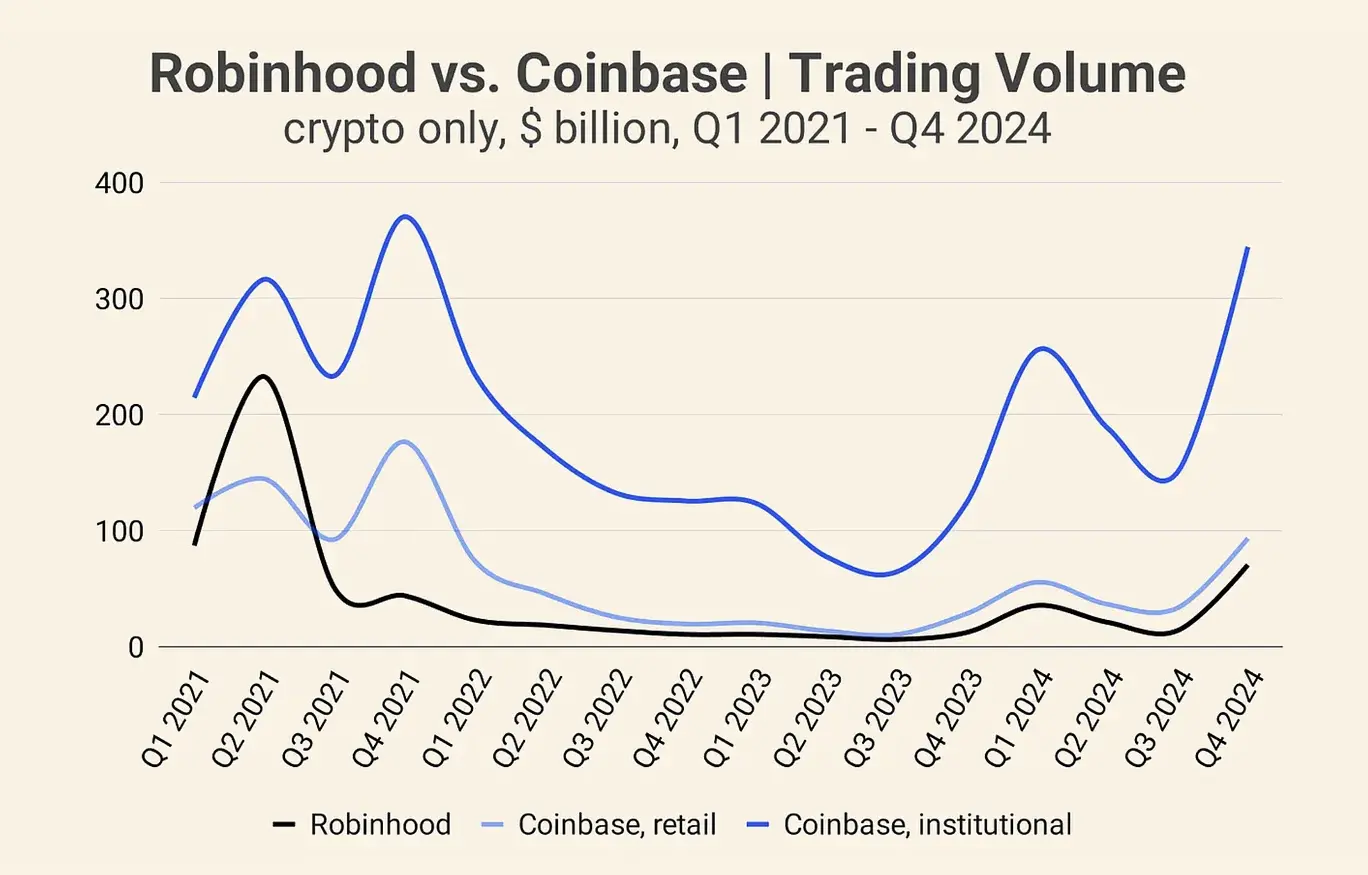

In the global battlefield, the US brokerage Robinhood is one of the earliest representatives of "accepting coins". In 2024, its crypto trading volume soared to US$143 billion, a year-on-year surge of 259%, approaching two-thirds of Coinbase's retail trading volume. Robinhood is not satisfied with this. By acquiring Bitstamp, it plans to launch crypto services in Singapore by the end of 2025 to accelerate its beachhead in the Asia-Pacific market.

Coinbase and Robinhood crypto trading volumes, source: insights4.vc

Players are increasing their investment, and onlookers are catching up. Charles Schwab expects to open spot trading of BTC and ETH within the year, and Morgan Stanley's E*Trade also plans to launch encryption services by 2026.

Encryption platform "breaks the circle" upgrade

Not only are traditional brokerages moving closer to crypto assets, crypto platforms are also "breaking the circle" in the opposite direction and actively connecting with traditional financial markets.

Bybit recently revealed that it will launch trading functions for traditional assets such as U.S. stocks, and plans to enable direct trading of U.S. stocks, stock indexes, gold, crude oil and other products on the platform within the year to further expand its asset coverage.

At the same time, crypto platforms are accelerating the integration of payment and consumption scenarios. OKX launched OKX Pay, the "Yu'ebao of the Coin Circle", allowing users to convert idle assets into stable income tools; Bitget, Coinbase and other platforms have launched crypto cards, and OKX and Kraken's crypto cards are also in preparation. Digital assets are seamlessly integrated into online and offline consumption life in the form of payment.

The layout of the "crypto card" has expanded from point to surface. The exchange's move not only expands the application boundaries of crypto assets, but also strengthens the platform's ecological closed loop, improves user stickiness, and becomes a new business growth curve.

From starting with crypto assets to connecting global mainstream investment products and payment channels, the boundaries of crypto platforms are being reshaped. Crypto KOL Rocky asserted: "In the future, there will only be two types of exchanges, one is a comprehensive platform that integrates RWA, and the other is a traditional exchange that still sticks to the pure crypto asset position."

Perhaps the next generation of exchanges is being redefined.

The exchange of coins and stocks has become an inevitable trend

The trend of coin-stock interoperability is accelerating, which brings both opportunities and challenges. In the future, crypto projects will compete head-on with the global capital market for liquidity and attention. At the same time, more investors may begin to evaluate crypto assets from the perspective of US and Hong Kong stocks. Low-quality tokens will be eliminated faster, pushing the market towards high-quality targets. The adoption rate of stablecoins will continue to rise, and the crypto market will move towards the mainstream financial system.

From a global perspective, the regulatory framework is becoming increasingly clear and compliance thresholds are rising, providing a path for stable development for traditional securities firms and mainstream encryption platforms; on the other hand, listing, mergers and acquisitions and cross-border integration are becoming normalized, and the integration of traditional financial capital and encryption infrastructure is reshaping the market landscape.

Crypto assets are crossing ecological silos and moving towards broader circulation and application scenarios.