Source: Cailianshe

Author: Xiaoxiang

After our early morning article mentioned that the "trillion-dollar U.S. Treasury mine" (basis trading liquidation) was completely detonated, the sell-off of U.S. Treasury bonds further intensified during the Asian session on Wednesday...

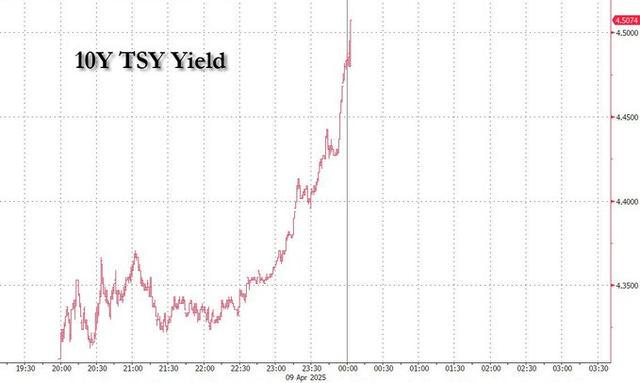

Market data shows that the 30-year U.S. Treasury yield has now soared to "break 5", and at one point it soared 25 basis points to 5.010% during the day, setting the highest level since the end of 2023.

The 10-year U.S. Treasury yield, known as the "anchor of global asset pricing," rose 21 basis points to 4.503%.

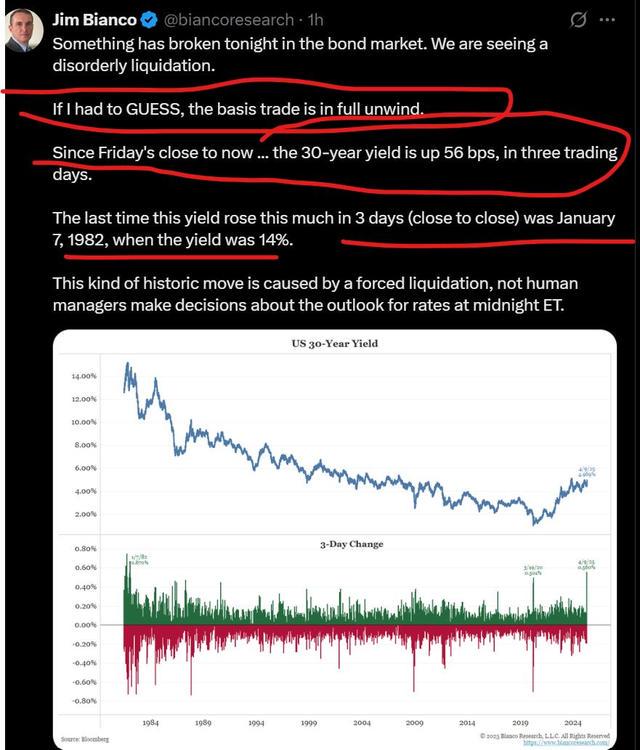

According to Jim Bianco, founder of the famous research institution Bianco Research, since last Friday, the 30-year US bond yield has risen by 56 basis points in less than three trading days. The last time the yield rose so much in three days was on January 7, 1982. But you have to know that the US bond yield was as high as 14% at that time (56 basis points was nothing at the time). Bianco said that this historic market was obviously caused by forced liquidation.

It can be said that this round of U.S. bond plunge has completely deviated from the normal market fluctuation range. The current focus of industry insiders has been completely on two main speculations: ① How big is the impact of the U.S. bond basis trading explosion? ② Are there really overseas "creditors" selling U.S. bonds?

Regarding the topic of the collapse of U.S. Treasury basis trading, we have fully explained it in our article this morning, and investors can check it out for themselves.

The well-known financial blog zerohedge also recently summarized the context of the development of the situation that may need to be cautious in the future:

① The trillion-dollar U.S. Treasury bond basis trade is exploding, and countless funds and banks may be closing their positions;

②The liquidity in the system is far from enough;

③ The shock wave of insufficient liquidity may sweep across all markets, causing stock market crashes (liquidation panic), bond collapses (yields continue to be protected), and foreign exchange safe havens (the yen soars... and at some point, the turning point will come and the dollar will be in serious shortage);

④ Investors may encounter key liquidity depletion events today and tomorrow (10-year U.S. Treasury auction on Wednesday, followed by 30-year U.S. Treasury auction on Thursday). If there is not enough liquidity in the system, we may have an informal auction failure - yes, although failure is impossible - primary dealers who have the obligation to purchase all unsold Treasury bonds to prevent auction failures will provide a bottom line, but if the primary dealers' allocation ratio is as high as 40% or 50%, it is almost equivalent to an auction failure.

Zerohedge believes that the results of the two U.S. Treasury auctions in the next 48 hours and whether the Federal Reserve will intervene urgently may be the most important moments in the fate of the U.S. financial system in modern history.

Nomura interest rate trader Ryan Plantz also warned in an internal memo that "in the Treasury space, swap spreads and basis trades are melting. The U.S. Treasury market is experiencing a large-scale liquidation that has not been seen in my career, and a liquidity vacuum has formed."

According to Plantz, the Fed must step in now, and while Powell may be reluctant to appear to be offering relief to Trump’s trade war, he may have no choice. Plantz noted:

The so-called "quiet mode" of the Trump administration is working - they are letting the market pain spread. The panic caused by the US government's tough stance on trading partners has caused a real buyer strike and has left the US Treasury market in a demand vacuum. The spectacular collapse of US Treasuries at the close of Tuesday has left many practitioners (including myself) questioning the rationality of the market - the yield curve has steepened sharply in a bear market, and various spreads, basis and other indicators have collapsed across the board.

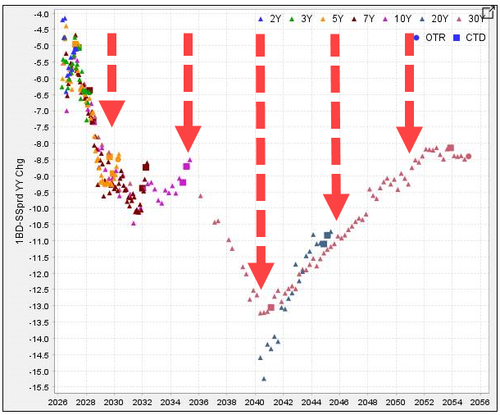

The daily volatility of asset swap spreads is amazing (note that this is a 24-hour change), which is at least one of the most dramatic fluctuations I have witnessed in my career. The current market has completely fallen into a liquidity vacuum:

The market conversation quickly turned to an intensive discussion of "when will the Fed come to the rescue?" We emphasized on Tuesday that unless the following signals appear: a surge in funding pressure in the repo market and large-scale financing by banks through institutions such as Fannie Mae (similar to the banking crisis a few years ago), the current turmoil is still a market sentiment and confidence issue - only when these thresholds are reached can the Fed's "emergency rate cut" be put on the agenda.

However, we now feel that the next shoe may be about to drop. Recalling that the core goal of quantitative easing in 2020 is to maintain market liquidity and function, if the gap-up volatility on Wednesday reappears on Tuesday, measures such as the activation of the Standing Repurchase Facility (SRF) and the termination of quantitative tightening (QT) may be quickly put on the table. I even mentioned "twist operation" (OT) today... This is where we are now. But it should be clear that the financing market has not yet reached a critical point.

It is worth mentioning that according to the suggestions made by four scholars including Anil Kashyap of the University of Chicago and former Federal Reserve Board member Jeremy Stein in a report from the Brookings Institution last month, if the Federal Reserve wants to solve the problem of the collapse of U.S. Treasury basis trading, adopting "hedged bond purchases" is a relatively better way of intervention, that is, selling an equal amount of Treasury futures contracts to hedge while purchasing Treasury bonds.

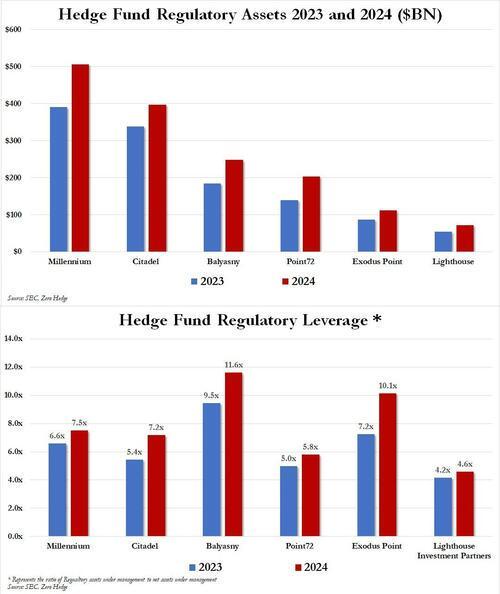

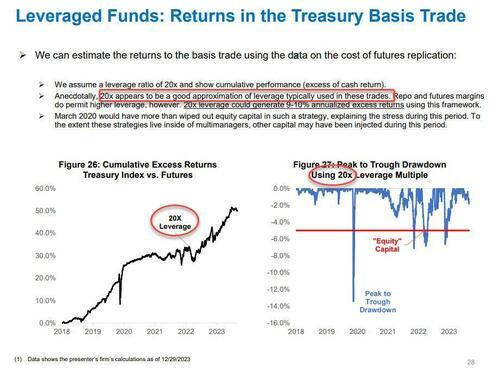

At present, although the scale is as high as one trillion US dollars, the main positions of US bond basis trading are actually concentrated in the hands of less than 10 hedge funds, represented by Millennium, Citadel, Balyasny, Poin72, ExodusPoint and Lighthouse. The industry expects their average leverage to be 20 times. This also means that as long as the loss of related basis trading reaches 5%, they may be wiped out and have to add margin.

Note: The above picture is a comparison of the asset size of the six major hedge funds in the previous year and last year, and the picture below is a comparison of leverage multiples

In the past few years, the worst loss in related transactions was in March 2020, at the beginning of the epidemic. At that time, foreign central banks and bond funds that encountered redemptions launched a "cash scramble" and were forced to sell the most liquid assets - US Treasury bonds. This in turn hit hedge funds that established huge leveraged basis trades hard, and almost turned the chaotic Treasury bond selling wave into a catastrophic financial crisis. In the end, the Federal Reserve's "massive water injection operation" of expanding its balance sheet by $1.6 trillion in a single month calmed the disaster.

Note: The right chart shows the retracement rate during the bond market sell-off in March 2020

Of course, one thing that is troubling the market right now is whether there are other forces selling in addition to the explosion of basis trading. More and more investment banks are suspecting that Trump's retrograde actions on the issue of tariffs may trigger more US overseas creditors to sell US debt.

Steve Sosnick, chief strategist at Interactive Brokers, said on Tuesday that “due to the tariff friction with China, they may stop buying and boycott U.S. bonds. Japan has the largest reserves of U.S. Treasury bonds, but China is also the second largest overseas creditor of the United States. What happens if this source of foreign demand shrinks or dries up completely?”

In that case, the U.S. Treasury would have to issue bonds at higher interest rates to make up for the losses, Sosnick said: “Supply isn’t going to go down anytime soon, right? But you have to do something about demand.”

Currently, Japan, the largest "overseas creditor" of the United States, has stated that the recent sell-off of U.S. debt was not done by it - Japanese Finance Minister Katsunobu Kato on Wednesday ruled out the possibility of using Japan's holdings of U.S. Treasuries as a bargaining chip to counter Trump's imposition of tariffs on Japanese imports.