In March, the global market was deeply mired in policy uncertainty and was eager to find a new anchor. The valuation of U.S. stocks accelerated, and the crypto market was inevitably fluctuating with the situation. With the new tariff bomb dropped on April 2, the global trade order is facing a deep reshaping, and economic policies of various countries are forced to adjust urgently. Especially at such times, patience is more important. Once the new order is gradually reshaped, market sentiment will also pick up.

In March, the global market was deeply mired in policy uncertainty and was eager to find a new anchor. The valuation of U.S. stocks accelerated, and the crypto market was inevitably fluctuating with the situation. With the new tariff bomb dropped on April 2, the global trade order is facing a deep reshaping, and economic policies of various countries are forced to adjust urgently. Especially at such times, patience is more important. Once the new order is gradually reshaped, market sentiment will also pick up.

Trump's tariff policy has undergone several adjustments in March. On April 2, the Trump administration officially announced the implementation of the "comprehensive reciprocal tariff" policy - imposing a basic tariff of at least 10% on all goods exported to the United States, and imposing additional taxes and fees on about 60 countries with significant trade deficits (such as China 34%, Vietnam 46%, Cambodia 49%) - the global trade order has ushered in the most drastic wave of reshaping since World War II.

Once the news was announced, the market fluctuated violently.

U.S. stocks and the U.S. dollar fell sharply, with the U.S. dollar index falling below the 104 mark; Nasdaq index futures plummeted by more than 4%, and S&P 500 index futures fell by 3.5%. The stocks of the seven major U.S. technology giants fell particularly sharply, with Apple falling 7.5% after the market. Funds poured into safe-haven assets crazily, and the spot gold price soared, breaking through $3,160 per ounce in one fell swoop, setting a new historical high. The high rate and wide range of tariffs imposed this time far exceeded Wall Street's previous estimates. Investors are worried that the tariff war will eventually impact the foundation of U.S. economic growth. The first is the risk of supply chain disruption. Targeted tax increases on automobiles, steel, aluminum, and technology products (some tax rates are 25%-50%) have forced companies to accelerate the regional reorganization of supply chains, and the cost of the industrial chain has increased sharply. The second is the hidden worry of inflation spiral. JPMorgan Chase's calculations show that after the superposition of countermeasures, the U.S. CPI may be pushed up by 2-2.8 percentage points.

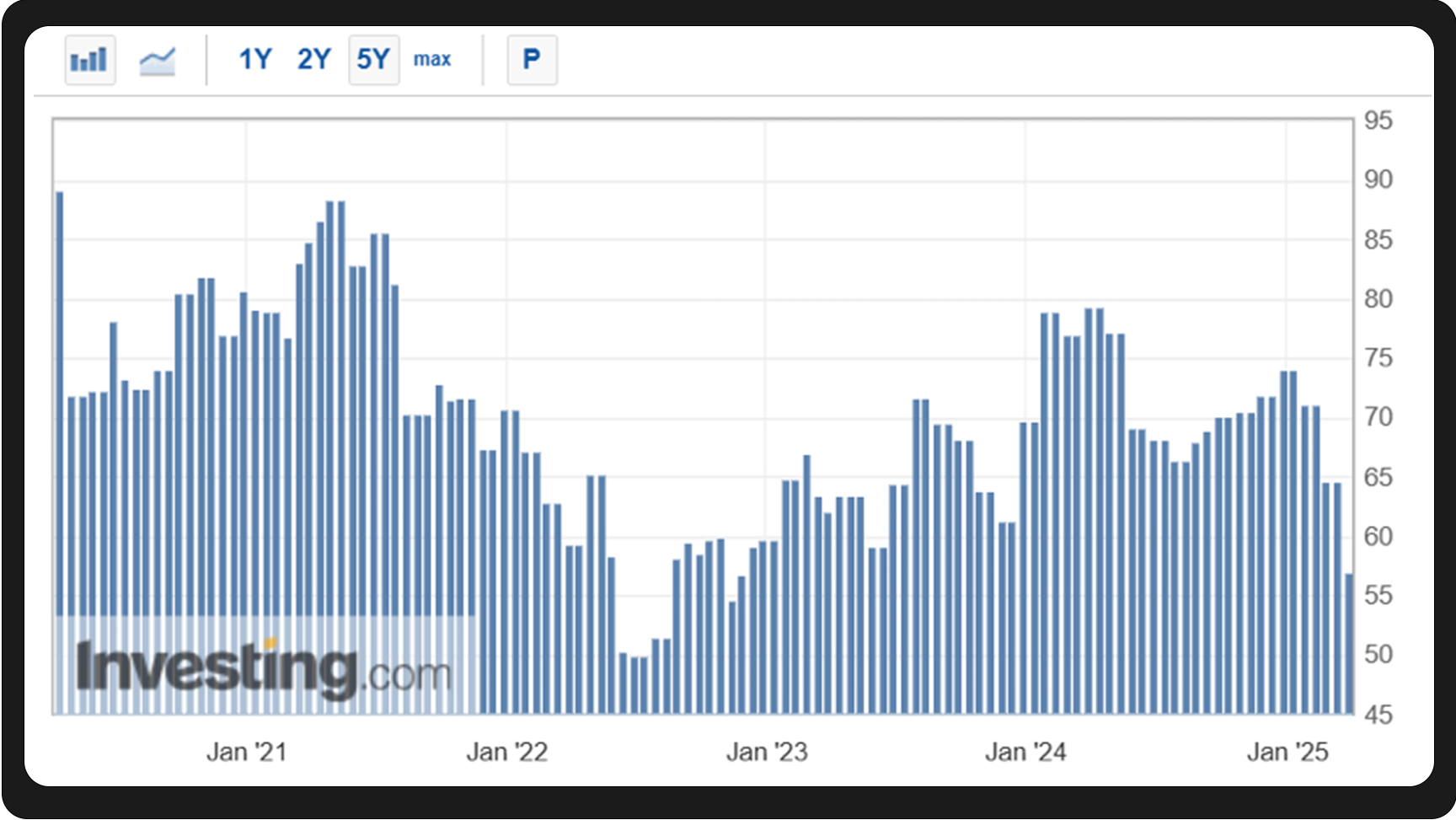

US Consumer Confidence Index (Source: investing.com)

US Consumer Confidence Index (Source: investing.com)

Moody's Chief Economist Mark Zandi has significantly raised the probability of a US recession this year from 15% at the beginning of the year to 40%, and the Goldman Sachs economist team has also raised the probability of a US recession within 12 months to 35%. In March, some US economic data indicators declined. Although the non-agricultural data at the end of March showed that the current US unemployment rate was 4.1%, the final value of the consumer confidence index in March fell from 64.7 in February to 57, a decline from the initial value of 57.9, lower than the median estimate of economists. At the same time, the core PCE price index still reached 2.8% year-on-year, confirming the dilemma of "slowing economic growth and stubborn inflation".

The Federal Reserve expressed its concern about economic uncertainty at its March interest rate meeting. On the one hand, economic growth is slowing down, and the GDP forecast for 2025 has been lowered from 2.1% to 1.7%; on the other hand, inflation is highly sticky. In this case, if interest rates are cut, it may further stimulate price increases; while maintaining high interest rates will increase corporate debt pressure, which makes the Federal Reserve, which is standing in the triple storm of inflation, politics, and globalization, caught in a dilemma in policy decision-making, and it is impossible to move.

Therefore, we also saw that in March, the Fed decided to keep interest rates unchanged at 5.5%. After the new tariff policy was announced on April 2, traders increased their bets that the Fed would start cutting interest rates in June and cut interest rates by three 25 basis points (or 0.75 percentage points) by October. According to Reuters, the probability of a rate cut at the Fed's June meeting has risen to about 70%, while the probability was about 60% before the tariff announcement. At the same time, the impact of tariff policies goes far beyond the US domestic economy and the Fed's monetary policy. Trump's "reciprocal tariff" plan not only wants to increase fiscal revenue through tariffs, but also attempts to use it as a bargaining chip to force other countries to lower tariffs or make other policy changes. Are other countries willing to cooperate in the negotiations? How much concessions can Trump make in the negotiations? At present, the world's major economies are formulating counter-measure lists. Some analysts believe that global trade frictions are evolving from "point conflicts" to "systemic confrontations." In the future, the global economy and financial markets will still need to bear the pressure of this uncertainty.

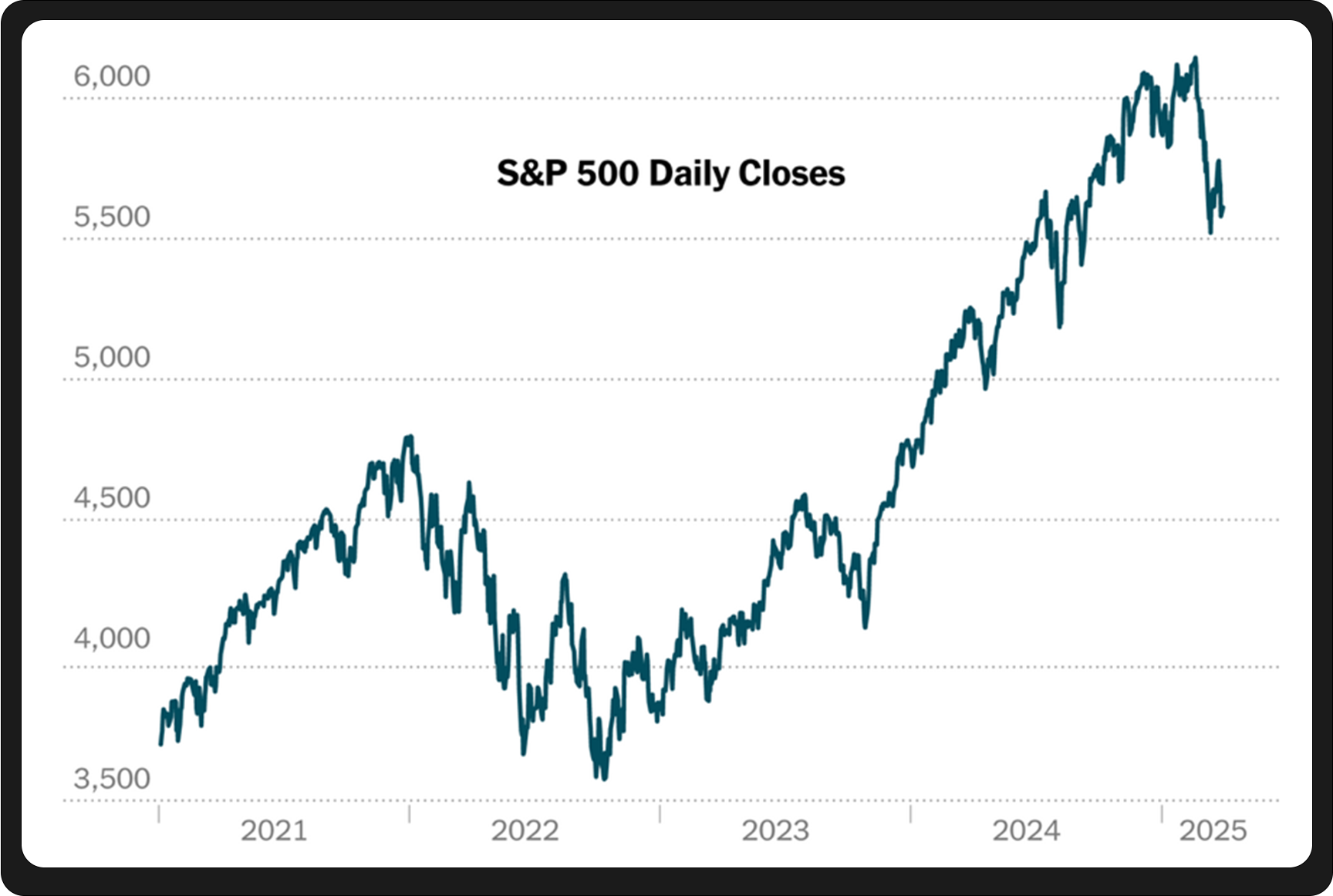

(Source: https://www.nasdaq.com/)

(Source: https://www.nasdaq.com/)

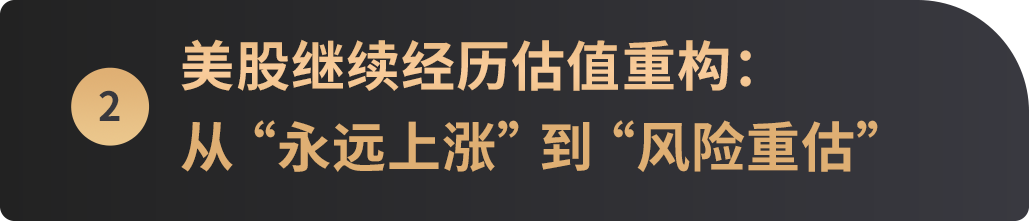

U.S. stocks continued to fall in March, causing the S&P 500 and Nasdaq to end the first quarter of 2025 with a drop of 8.7% and 12.3%, respectively, marking the largest quarterly decline since 2022. On a longer timeline, since Trump was elected as the U.S. President in November 2024, the S&P 500 index has fallen from 6,200 points to 5,572 points, a drop of more than 10%, evaporating $4 trillion from its peak.

(Photo source: The New York Times/Karl Russell)

(Photo source: The New York Times/Karl Russell)

In the past two years, the US stock market has attracted global funds due to "TINA" (There Is No Alternative to equities), and its market value accounts for more than 50% of the global stock market. During the market boom, investors' optimism about US stocks continued to push up stock prices, ignoring potential risks. However, as the economic cycle evolves, this high valuation that deviates from fundamentals is becoming increasingly difficult to maintain, and institutions are revising their optimistic expectations for US stocks: Goldman Sachs lowered its year-end target for the S&P 500 from 6,500 points to 6,200 points, citing "tariff risks and slowing earnings growth"; Morgan Stanley warned that 5,500 points may be the starting point for a technical rebound, but it needs to be supported by corporate earnings bottoming out. This adjustment reflects the market's doubts about the "earnings-driven" logic of US stocks - the earnings growth forecast for the S&P 500 in 2025 has been lowered from 11% to 7%, while the earnings growth advantage of the seven technology giants is narrowing, with the gap with the S&P 493 falling from 30 percentage points to 6 percentage points. At the same time, the confusion of US policy signals has further exacerbated market panic. While Trump urged the Federal Reserve to cut interest rates, he did not rule out the possibility of an economic recession; while White House officials downplayed the risk of recession, they acknowledged the pain of the transition period.

This contradictory statement made investors feel at a loss, market confidence was severely hit, and the market responded quickly to policy uncertainty. The "big 7" (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) were the first to encounter a sell-off. Tesla fell nearly 36% in the first quarter, and Nvidia fell nearly 20%. As an important component of the S&P 500, the market value of the "big 7" has evaporated by more than 2.5 trillion US dollars since Trump took office again. This is not only a correction to the previous valuation bubble (S&P 500 P/E ratio of 21 times), but also a "vote with feet" for policy uncertainty. By the end of March, the US stock market rebounded partially, and the S&P 500 rebounded to 5767 points, reflecting the market's expectation of a "softening" policy, that is, the White House may adopt a phased or exemption strategy instead of a comprehensive tax increase. However, it turned out that the market's optimistic expectations at the time were dashed.

It is worth mentioning that under the dynamic effects of interest rate cut expectations, tariff intensity, and recession risks, some institutions have clearly pointed out that the risk-return ratio of unilateral bets on US stocks has significantly deteriorated. For example, AQR Capital Management warned investors that in this environment, they need to rely more on diversified strategies than before and must not blindly bet on a unilateral rise in US stocks.

The S&P 500, Nasdaq and the "big 7" all fell in the first quarter. Bitcoin also suffered from the dual impact of market volatility and policy uncertainty. However, its performance was still strong amid the shock: after experiencing violent fluctuations at the end of February, Bitcoin did not fall unilaterally in March, but showed a "V-shaped" shock, first falling and then rising. The monthly decline narrowed to 2.09%, significantly better than the 8.2% decline of the Nasdaq index in the same period. For a long period of time in the past, the trend of Bitcoin and technology stocks was highly similar, often rising and falling together.

However, during this market turmoil, Bitcoin has developed an independent trend.

(Source: investing.com)

(Source: investing.com)

Especially in mid-to-late March, with the US SEC abolishing SAB 121 (allowing banks to custody crypto assets), BlackRock and other institutions increasing their holdings, and the Fed releasing a signal of "three rate cuts this year" on March 20, Bitcoin ushered in a strong rebound. Overall, Bitcoin's adjustment in March was more of a technical correction rather than a trend decline. Zach Pandl, head of research at Grayscale, believes that the market has partially "priced in" the negative impact of tariffs, and the worst selling phase may be over.

Although the current crypto market is still shrouded in the shadow of the latest tariff policy, the US government's recognition and regulatory process in the field of crypto assets has become increasingly clear, and a series of measures are paving the way for the long-term development of the industry: First, on March 6, Trump signed an executive order to formally establish the "Strategic Bitcoin Reserve" (SBR), which included approximately 200,000 BTC previously confiscated by the federal government into the reserve, and clearly stated that it would not be sold within four years. This is the first time that the US government has managed Bitcoin as a permanent national asset, marking its establishment as a "digital gold". Although the executive order is not legislation, it lays the foundation for subsequent policies. Secondly, the SEC is gradually relaxing its historically tough stance on cryptocurrencies. It has held its first cryptocurrency roundtable in March and plans to hold four more roundtables on trading, custody, tokenization and DeFi in April, May and June this year, clearly shifting from "law enforcement-oriented" to "cooperation and rule-making", which is seen as a key prelude to the implementation of the regulatory framework. In particular, the SEC announced the abolition of SAB 121, which means that banks can finally legally custody crypto assets. After the abolition of the SAB 121 policy, traditional financial institutions such as JPMorgan Chase and Goldman Sachs immediately launched crypto custody services. It is estimated that by Q2 2025, more than US$200 billion of institutional funds will enter the market through bank channels.

BlackRock CEO Fink's annual investor letter (Source: https://www.blackrock.com/corporate/investor-relations/larry-fink-annual-chairmans-letter)

BlackRock CEO Fink's annual investor letter (Source: https://www.blackrock.com/corporate/investor-relations/larry-fink-annual-chairmans-letter)

Institutional investors' enthusiasm for crypto assets, especially Bitcoin, continues to rise. On March 31, Larry Fink, CEO of BlackRock, a top global asset management company, issued a 27-page annual letter to investors. In the letter, Fink warned in an extremely rare serious tone: If the United States cannot effectively control its growing debt and fiscal deficit, then the "global reserve currency throne" that the US dollar has been firmly seated on for decades is likely to be replaced by emerging digital assets such as Bitcoin. It is worth mentioning that Fink mentioned Bitcoin 7 times and the US dollar 8 times in the letter, highlighting the importance of Bitcoin in the current financial context, and hinting at its potential key role in the evolution of the global economic landscape.

With the implementation of Trump's tariff policy on April 2, the outlook for the U.S. economy has become increasingly uncertain. If the U.S. economy does not fall into a deep recession under the tariff policy and the Fed cuts interest rates in June, Bitcoin is expected to see a trend reversal in the second quarter. In times of economic instability, the scarcity and safe-haven properties of Bitcoin will become increasingly prominent. Once market risk appetite picks up, Bitcoin, as an emerging asset class, meets the market's potential demand for new safe-haven and value storage methods, and is expected to be the first to break through key resistance levels and usher in a revaluation of value.

In March, the market repeatedly swung between "stagflation concerns" and "policy easing". In the long run, if the tariffs are implemented, inflation will rise and the credit of the US dollar will be eroded, which will force funds to turn to non-sovereign assets. In a letter to investors, BlackRock CEO Fink asked: "Will Bitcoin shake the hegemony of the US dollar?" This is not a random question. He reminded us that the most subversive variable in reshaping the new global financial order has already appeared.

In March, the market repeatedly swung between "stagflation concerns" and "policy easing". In the long run, if the tariffs are implemented, inflation will rise and the credit of the US dollar will be eroded, which will force funds to turn to non-sovereign assets. In a letter to investors, BlackRock CEO Fink asked: "Will Bitcoin shake the hegemony of the US dollar?" This is not a random question. He reminded us that the most subversive variable in reshaping the new global financial order has already appeared.