Recently, the gold market has ushered in a new round of explosive growth, with gold prices hitting new highs. As of February 11, spot gold stood at $2,911 per ounce, rising for six consecutive weeks, up more than 11% this year, and up an astonishing 43.89% from the same period last year. This round of epic market conditions has once again made the "gold myth" a hot topic in the market.

The tariff storm has given rise to risk aversion

Trump has recently made frequent tough remarks on trade policy, making it clear that he will take more aggressive tariff measures against allies and competitors. This has significantly increased uncertainty in the global market and has become the key driving force behind the second round of gold price gains.

Under Trump's policy advocacy, the United States announced last week that it would impose a 10% tariff on Chinese goods and threaten trade relations with Mexico and Canada. This week, it signed an executive order again to impose a 25% tariff on all steel and aluminum imported into the United States, and plans to further expand the scope of commodity tariffs, threatening to impose tariffs on major economies including Europe and Japan.

Trump's "America First" tariff policy is causing structural shocks in the global trade system. The practice of imposing tariffs to force trading partners to make concessions has further escalated global trade tensions and exacerbated investors' concerns about future economic growth slowdowns. Against the backdrop of increasing uncertainty in global financial markets, gold's natural attribute as a safe-haven asset has become the first choice for investors.

In addition, tariff policies may trigger upward inflationary pressure. If the US government continues to implement stricter tariff policies, commodity and raw material prices may rise, pushing up overall inflation. This will put the Federal Reserve in a policy dilemma - it is difficult to choose between rising inflation and slowing economic growth. If the Federal Reserve chooses to raise interest rates to curb inflation, it may further increase the risk of recession, which in turn will increase the market's demand for safe-haven assets and further push up gold prices.

Global central banks continue to increase their holdings

Since the Russia-Ukraine conflict, the United States has frozen the assets of the Russian Central Bank, which seems to be a warning to central banks around the world. Central banks around the world have begun to deliberately move away from US dollar reserves and shift their attention to assets that no one can freeze - gold. Since 2022, demand from central banks has been rising steadily. Data from the World Gold Council shows that global central banks' net gold purchases reached 1,173 tons in 2024, breaking the 1,000-ton mark for the third consecutive year, with 333 tons of gold purchased in the fourth quarter alone, the fastest growth rate in 20 years. IMF data shows that the share of US dollar reserves has dropped from 73% in 2001 to 58%, and emerging market central banks are replacing the US dollar with gold as a reserve asset. The unipolar status of the US dollar is accelerating.

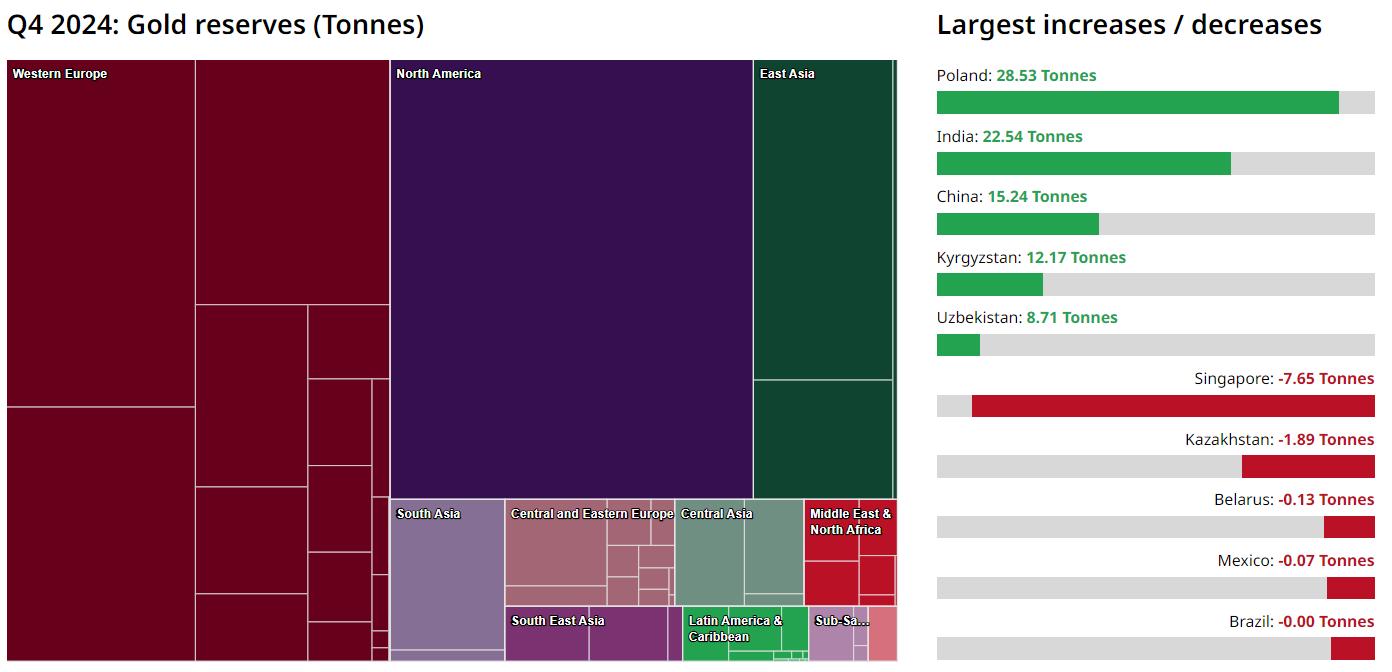

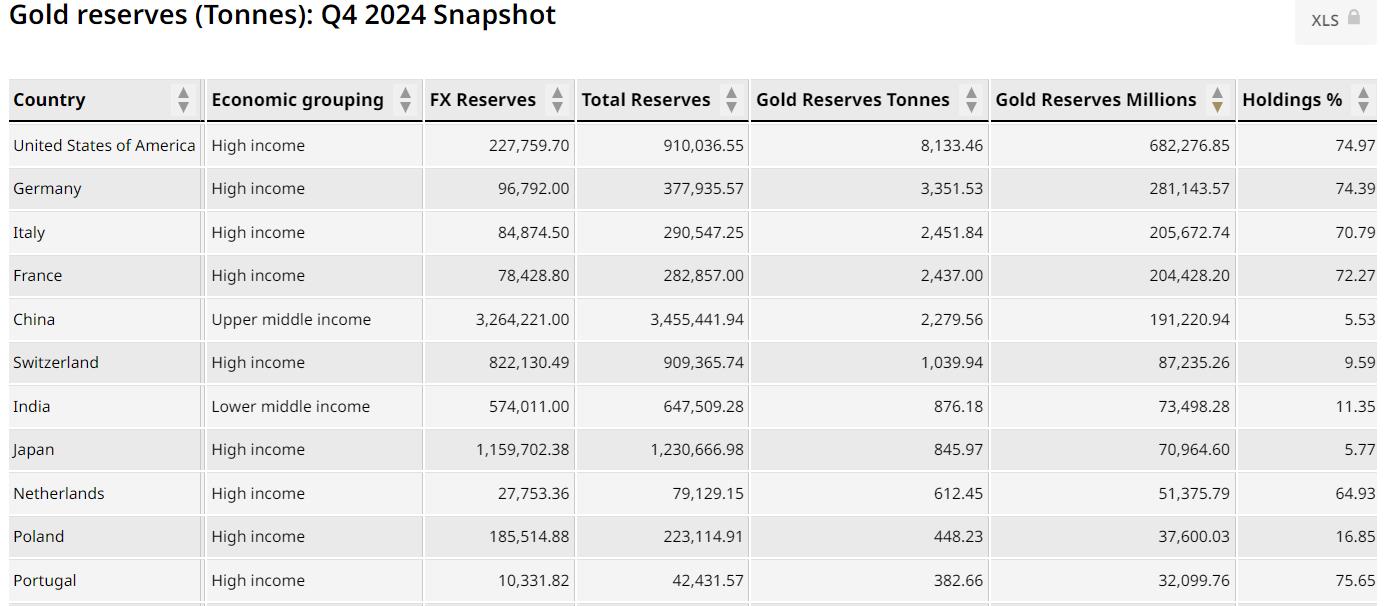

Global central bank gold purchase data in Q4 2024

Global central bank gold purchase data in Q4 2024

It is particularly noteworthy that the People's Bank of China stopped buying gold for six months after 18 consecutive months, and resumed buying gold after Trump won the election in November last year. The latest data released on February 7 showed that the People's Bank of China's gold holdings increased by 160,000 ounces in January, marking the third consecutive month of increase. The current gold reserves of the People's Bank of China are 73.45 million ounces (about 2,284.35 tons), and the proportion of gold reserves in official international reserve assets has risen to 5.53%, but it is still far below the global average of 15%.

From the perspective of optimizing the international reserve structure and promoting the internationalization of the RMB, increasing central bank holdings of gold will remain the general direction in the future.

Deepening geopolitical rifts push up gold prices from the risk premium dimension

The Trump administration continues to exert pressure on the global trade order, while also sending tough signals through diplomatic statements to threaten many countries, exacerbating global geopolitical tensions.

For a long time, the close connection of the global economy has been considered the key guarantee for maintaining international stability and preventing conflicts. However, Trump's behavior has disrupted the balance of the original economic order, and major economies are facing the risk of comprehensive decoupling, which has led to a trend of intensified geopolitical conflicts. In addition, the ongoing situation in the Middle East and Russia-Ukraine is also increasing the global risk premium. Investors are increasingly inclined to allocate traditional safe-haven assets such as gold in the complex international situation, further pushing up the price of gold.

Will the price of gold continue to rise?

The rising price of gold has irritated many investors. Gold is already at a historical high, is it still worth buying?

The latest data shows that market funds are accelerating into the gold market. According to the World Gold Council, global physical gold ETFs achieved a net inflow of US$3 billion in the first month of 2025. Among them, the European market dominated the inflow of funds, setting the largest monthly inflow since March 2022. As of the end of January, the total asset management scale of global gold ETFs rose to US$294 billion, a record high, and holdings increased by 34 tons. This to a certain extent reflects the defensive layout of institutional investors against the uncertainty of the global economic situation.

In addition, the trading activity of the gold market has also increased significantly. In January, the average daily trading volume of global gold reached US$264 billion, a month-on-month increase of 20%. The trading volume of the New York Mercantile Exchange (COMEX) surged by 60% month-on-month, driving the overall trading volume of global exchanges to increase by 39%. Against the backdrop of a strong gold price, market investors' demand for gold allocation has increased significantly.

There are signs that, against the backdrop of Trump's erratic policies, the rise of global trade protectionism, and the strategic adjustment of the reserve structure by central banks of many countries, the gold market is entering a new cycle dominated by risk premiums, playing the role of a safe haven in the ever-changing international economic and political game. Many market institutions generally expect that strong buying power may drive gold prices to continue to rise in the medium and long term. For example, CICC optimistically predicts that the gold price is expected to break through the $3,000/ounce mark in 2025.

In the grand narrative of changes in the global economic order and reconstruction of monetary credit, gold is writing a new chapter of its own.