Author: Samuel|OKG Research

Two days after Trump was sworn in as the 60th President of the United States, he signed the executive order "STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY" on January 23, 2025. This policy is seen as a strong support for crypto asset innovation and economic freedom in the United States, marking a policy adjustment in the field of digital financial technology. In particular, the document clearly mentions the importance of maintaining the right to self-custody of digital assets, showing the United States' determination to lead in the field of Web3 and crypto economy.

At the same time, the memecoin launched by the Trump family on the eve of his coming to power became a hot topic in the market. Among them, $TRUMP was the first to be issued on the Solana chain. It is not only an ordinary cryptocurrency issuance, but also an "experiment" around the conversion of personal influence into capital, defining a new on-chain gameplay. This token quickly set off a phenomenal craze by combining identity, community and market demand.

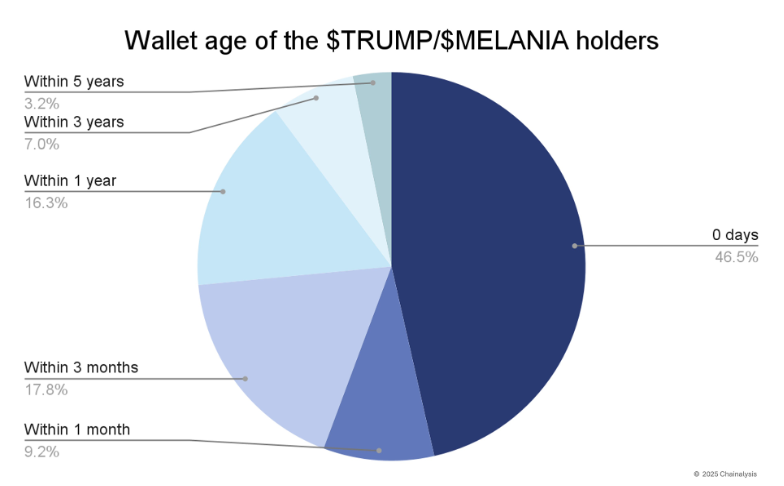

Interestingly, on-chain data shows that nearly half of the wallet addresses that purchased Trump family memecoin were newly opened wallets . In addition, this sale not only supports cryptocurrency trading pairs, but also allows users to purchase directly through bank cards, greatly reducing the threshold for participation. For many new users who have not previously been involved in on-chain transactions, this provides an opportunity to enter the crypto field with a lower cost of understanding.

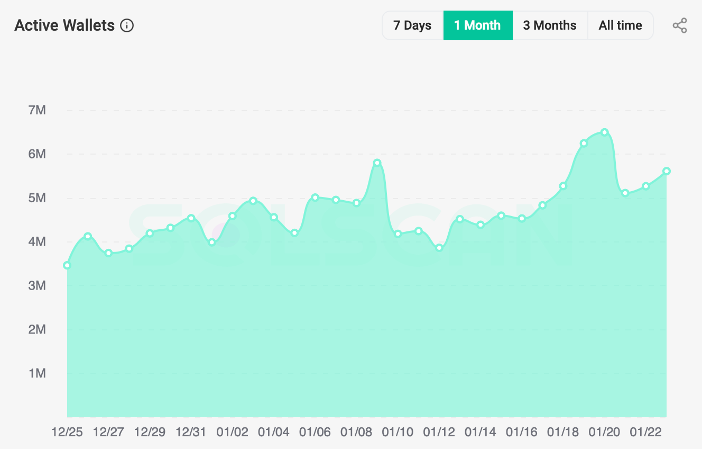

But whether this craze has really injected new liquidity into the crypto market is still debatable. Judging from the market performance, almost all other on-chain projects have experienced varying degrees of decline in a short period of time. In contrast, Solana has bucked the trend due to strong trading demand, and its price has broken through a record high. At the same time, the number of active wallets on the chain reached a peak in nearly a month on January 19. This polarization phenomenon shows the fragility of market liquidity in the face of a single hot spot, and also exposes some deep-seated problems in the on-chain ecology.

This memecoin craze is not only an opportunity for the Web3 ecosystem, but also a "stress test", revealing the three core contradictions that exist on the current chain: liquidity barriers, ecological fragmentation, and the conflict between user behavior and market structure .

In this context, whether Web3 can move from "bubble carnival" to "sustainable value creation" depends not only on the evolution of technology and protocols, but also on how to reconstruct the rules of user participation and the internal logic of the ecosystem. The answer to this change will determine the future direction of Web3.

On-chain liquidity: from boom to crisis

Trump's coin issuance event not only ignited the market, but also revealed the fragility of the on-chain ecological liquidity system. In the short term, a large influx of funds has driven a surge in on-chain wallet activity and transaction volume, but the subsequent "local overheating" phenomenon has exposed structural problems on the chain.

1. Liquidity concentration and market fragility

There is a lack of a decentralized mechanism for on-chain liquidity. When phenomenal opportunities such as $TRUMP emerge, funds quickly concentrate on hot assets, causing other projects to fall sharply due to capital outflows, and the market pricing mechanism is almost ineffective in the short term.

2. CEX’s “control effect”

Although DEX has become an important tool for on-chain transactions, centralized exchanges (CEX) still control the main liquidity hubs. The operating strategy and liquidity allocation model of CEX have a profound impact on the on-chain ecology. For example, during the Trump coin issuance period, the user demand for Solana assets surged, but due to the limited transfer efficiency between CEX and the chain, some users faced certain challenges in fund allocation. This reliance on centralized infrastructure means that the current on-chain market still relies heavily on the liquidity of CEX.

3. Cross-ecological liquidity islands

The gap between EVM and non-EVM ecosystems such as Solana further amplifies the hotspot concentration effect. Although some cross-chain protocols are improving this problem, the current cross-chain experience is still fragmented and the user operation cost is high.

Future Outlook

The chain needs more diverse asset-carrying forms and channels. Self-custodial wallets and their derivative functions will become an important part of the liquidity system, providing support for applications such as transactions, cross-chain and financial management, and upgrading the on-chain wallet from a security tool to the core hub of the Web3 ecosystem.

From “ Hosting Fear ” to “ Self-Hosting Revolution ”

The trust crisis of centralized custody is reshaping user behavior. Events such as the collapse of FTX have triggered a profound industry reflection on the CEX model. Self-custodial wallets are no longer just the choice of veteran players, but a "must-have tool" for more users. However, there are still challenges behind this trend. Users are afraid of the complexity of private key management, and the wallet operation interface is still cumbersome.

But at the same time, we can also see that more and more institutions are beginning to seek the middle ground increment generated by the combination of CEX + self-hosted wallets. Aggregating exchange liquidity and integrating self-hosted wallets to simultaneously manage personal Web3 assets has become an irresistible industry trend. Recently, Hong Fang, President of OKX, said in an interview with Coindesk that the total assets held in the self-hosted wallets of the OKX platform are currently nearly US$50 billion, which has exceeded the total assets of its centralized exchanges of US$30.8 billion. This transformation is not only a change in user behavior, but also an industry innovation driven by market demand.

In the $TRUMP craze, the advantages of on-chain wallets are particularly prominent . Data shows that many X platform users shared their experience of quickly participating in this memecoin "PVP" war through OKX Web3 Wallet. The exchange of exchange assets to the chain, as well as the management, trading and exchange of on-chain assets across ecosystems through one application not only makes the operation experience smoother, but also significantly reduces the technical threshold. Tools like OKX Web3 Wallet are becoming an important entry point for users' on-chain activities.

In addition to the demand for asset autonomy, market hotspots are also driving changes in user behavior. The meme craze on Solana, which began in 2024, provides users with a simpler path to participation and high-return opportunities. This "yield-oriented" trend is attracting more "risk taker" investors to actively go on-chain. Unlike traditional Web3 users who focus more on long-term value, these new users pay more attention to the immediacy and rate of return of on-chain transactions. The meme craze has made on-chain projects no longer seem high-threshold, but within reach, further accelerating the popularization of the on-chain economy.

This shift is not just a short-term phenomenon, but also a key driving force for the on-chain ecosystem to move towards mainstream . Users have moved from "custody fear" to "self-custody revolution", showing the awakening of asset sovereignty awareness, and also reflecting that the market is looking for a more efficient and convenient asset management model. Driven by CEX and on-chain self-custody tools, the future of Web3 is building a more decentralized and dynamic economic system.

AI Interaction: From Tool to Participant

Another core driver of large-scale on-chain adoption is the introduction of AI. Compared with the simple "auxiliary tool" role in the past, AI is now becoming an active participant in the on-chain ecosystem, redefining user experience and protocol functions. It not only helps users complete complex transaction operations, but is also likely to dominate decentralized governance in the future.

1. Lower the user threshold

AI is bringing unprecedented operational convenience to ordinary users through large language models and natural language interaction. For example, users only need to issue a simple instruction, and AI can automatically complete complex cross-chain asset transfers or LP parameter settings. This simplification not only lowers the technical threshold, but also opens the door to the on-chain world for more users.

2. Dynamic Optimization and Autonomy

AI's capabilities are not limited to auxiliary functions, but also demonstrate a high degree of autonomy. For example, in liquidity pool management, AI can dynamically adjust capital deployment according to market fluctuations to maximize returns. In addition, AI's real-time return prediction and risk warning functions also allow users to respond to market changes more calmly.

3. Protocol layer updates

The introduction of AI not only changes the way users operate, but also injects more flexibility into the protocol itself. For example, AI can dynamically adjust the parameters of the DeFi protocol through in-depth analysis of on-chain data, thereby improving the adaptability and stability of the protocol. In the future, we may see decentralized protocols that are fully driven by AI, which will become the new driving force of the on-chain economy.

From fragmentation to integration

Although the current on-chain adoption still faces problems such as liquidity fragmentation and insufficient self-custody education, the trend is irreversible. The continuous maturity of cross-chain technology, the increasing popularity of AI tools, and users' increasing attention to asset sovereignty are all driving the on-chain economy towards full integration.

Education and tools: making self-hosting accessible to everyone

In the future, users will need not only tools but also knowledge. The combination of education and tooling to enable every user to easily manage on-chain assets is the key to achieving large-scale adoption.

Cross-chain technology: breaking ecological barriers

Through the wallet's built-in aggregation chain function, users will be able to seamlessly transfer assets between different ecosystems, and the liquidity of the entire chain will become smoother.

AI : Unlocking the potential on-chain

AI will no longer be just a tool, but a core component of the on-chain ecosystem. From user interaction to protocol design, AI will be deeply involved in every aspect of the on-chain economy.

In this era of network transformation, on-chain is no longer just a concept, but the main battlefield for the further extension of application types and scenarios. The Web3 era will not be a return to centralization, but the rise of on-chain applications .