How Tariffs and Other Major Events Could Impact Bitcoin, S&P 500, and Gold in 2025

Since Trump returned to the White House in 2025, the global macro environment has entered a new cycle of uncertainty . At the same time, crypto assets have also undergone a major structural transformation: from a relatively closed, self-driven industry, it has gradually been introduced into the broader traditional financial market by ETFs and Trump's advocacy.

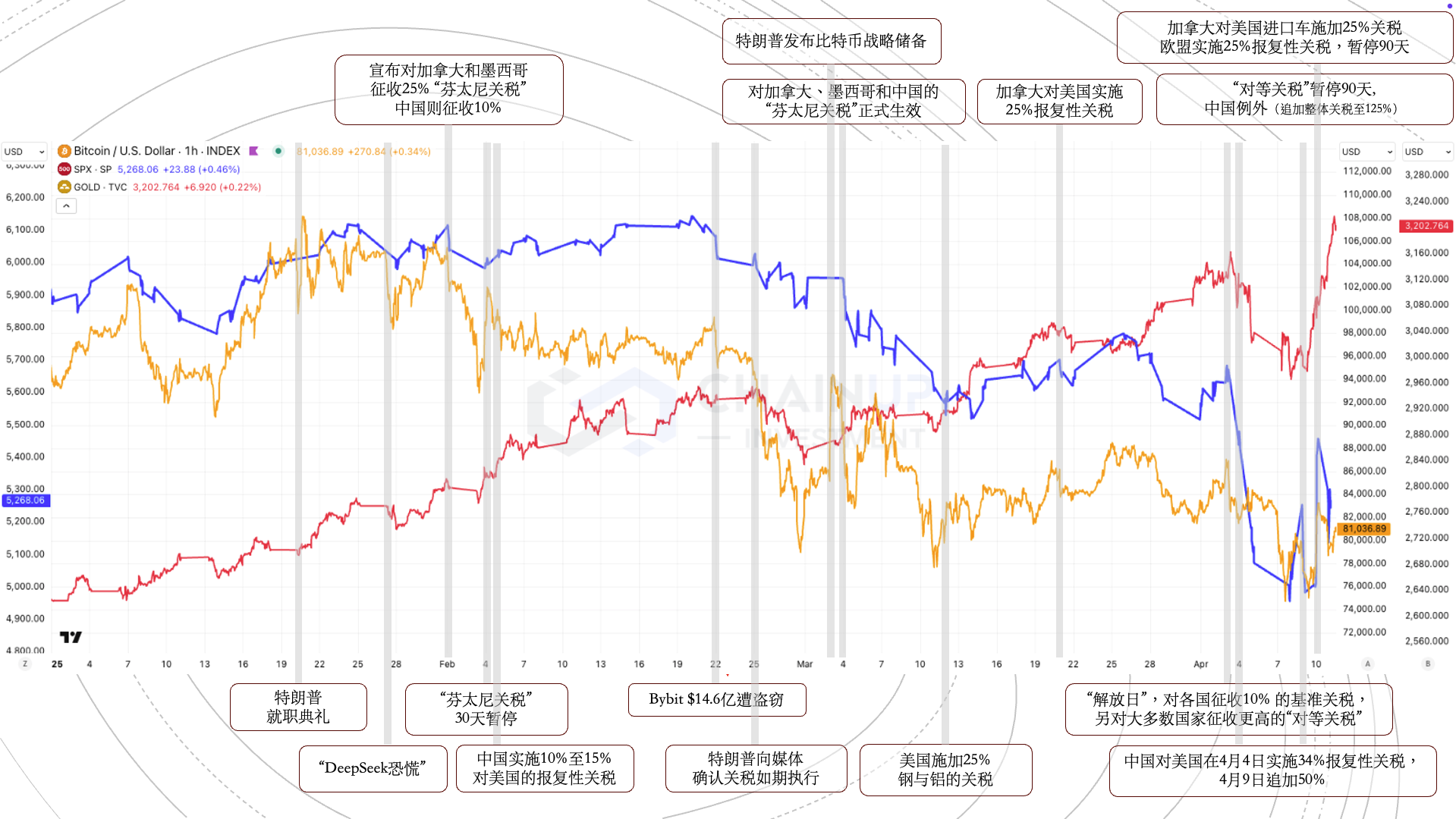

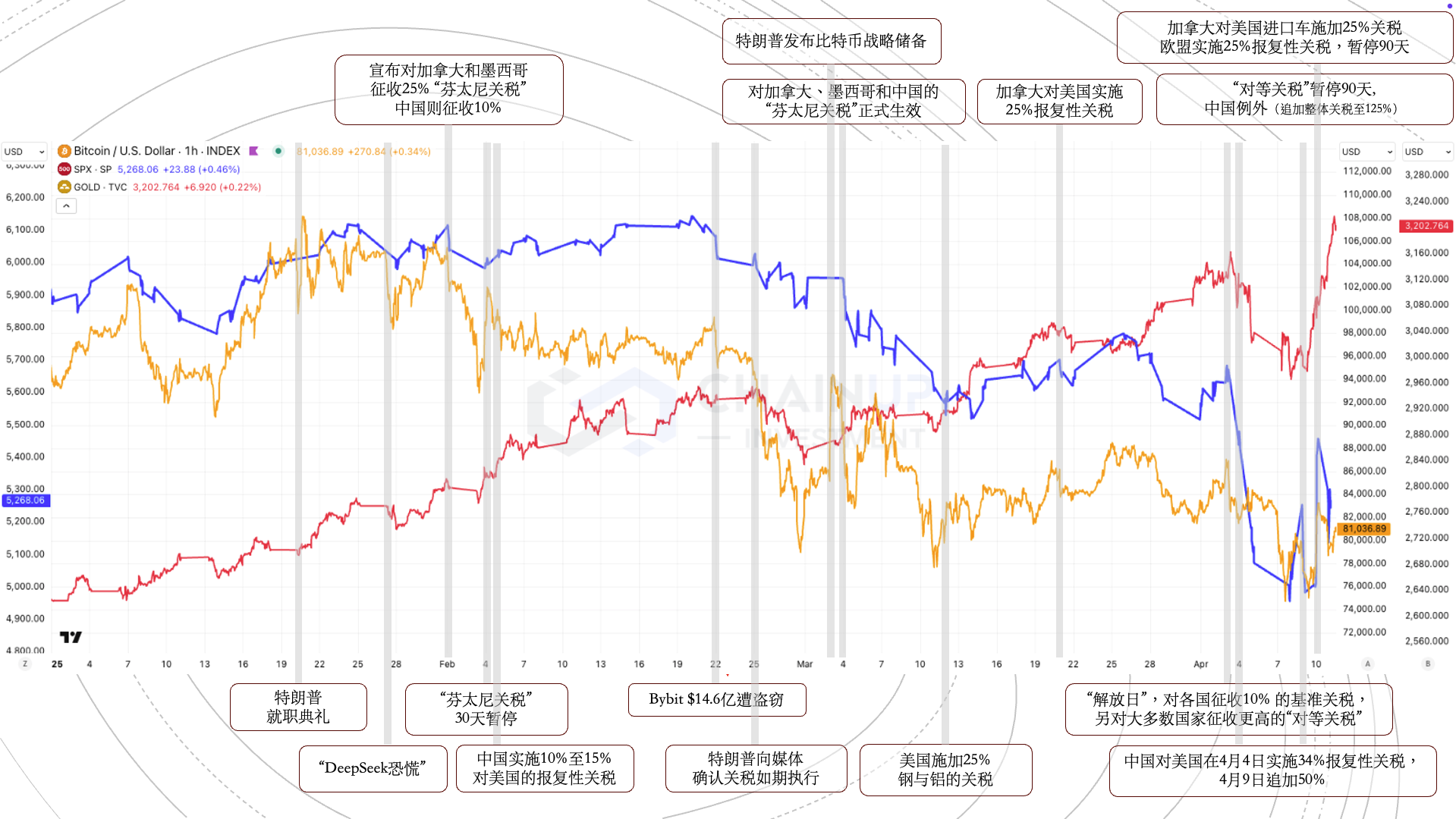

The crypto market participants in 2025 are completely different from those in 2022-2023. Trading behaviors in the crypto market are increasingly affected by macro policies , such as monetary policy adjustments since the end of last year, and the changes in the global trade pattern that can be called a century-long change, especially the escalation of the tariff war . If the crypto market in 2022-2023 was mainly driven by internal industry events, then the main driving factors from 2024 to 2025 have shifted more to institutionalization and compliance . This trend makes the price changes of crypto assets increasingly affected by macroeconomic variables, showing a higher positive correlation with other risky assets , but at the same time still retaining higher volatility and Beta characteristics, and often taking the lead in responding to risk events.

The core reason behind this high volatility is the lack of fundamental support under the traditional financial framework, or the "fundamentals" of current crypto assets have not yet been accurately identified, quantified or consensus-based. Such high volatility will outperform other risky assets when risk events occur, so cryptocurrencies naturally become high-risk assets that investors tend to sell first. Since the beginning of this year, the negative feedback of crypto assets to macro risks such as tariffs and trade wars has been ahead of traditional risk assets such as the S&P 500 and Nasdaq . As more traditional financial practitioners include crypto assets in their investment portfolios, the crypto industry will inevitably experience the impact of macro market fluctuations. However, it is worth noting that the volatility of Bitcoin has converged compared to the S&P 500 , showing a change in the market's risk appetite for the crypto market and the stock market.

The core variables of the current market are still the progress of the trade war and policy responses. From the trend point of view, trade issues will eventually usher in some form of "certainty", but the process may be accompanied by a short-term economic downturn or rising employment pressure. Therefore, the market's expected probability of four interest rate cuts this year has risen to 56% . Once monetary policy compromises, the crypto market is often one of the asset classes that responds first and benefits first . In general, volatility and risks always exist, but it is also at these stages that real opportunities are brewing . It's just that it takes more patience and higher judgment to wait for the market to give a more appropriate entry time.