Original title: Tariffs and Turmoil

Original author: UkuriaOC, CryptoVizArt, Glassnode

Compiled by: Daisy, ChainCatcher

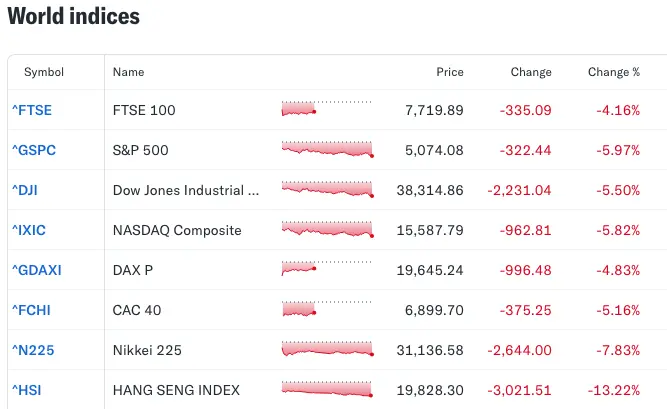

The Trump administration’s announcement of the “Liberation Day” tariff policy caused severe fluctuations in the financial market, with major macroeconomic indexes generally falling. The digital asset market was not immune and experienced an overall decline.

summary

- The news of the US's additional tariffs severely disrupted major financial markets around the world, with several markets experiencing one of their worst trading days since March 2020.

- The capital inflow of digital assets has almost stagnated, and liquidity has shrunk significantly, bringing strong downward pressure.

- However, judging from the price trends of Bitcoin and Ethereum, as prices fall, the scale of loss-making outflows gradually decreases, which may indicate that the selling pressure in the market is being exhausted in the short term.

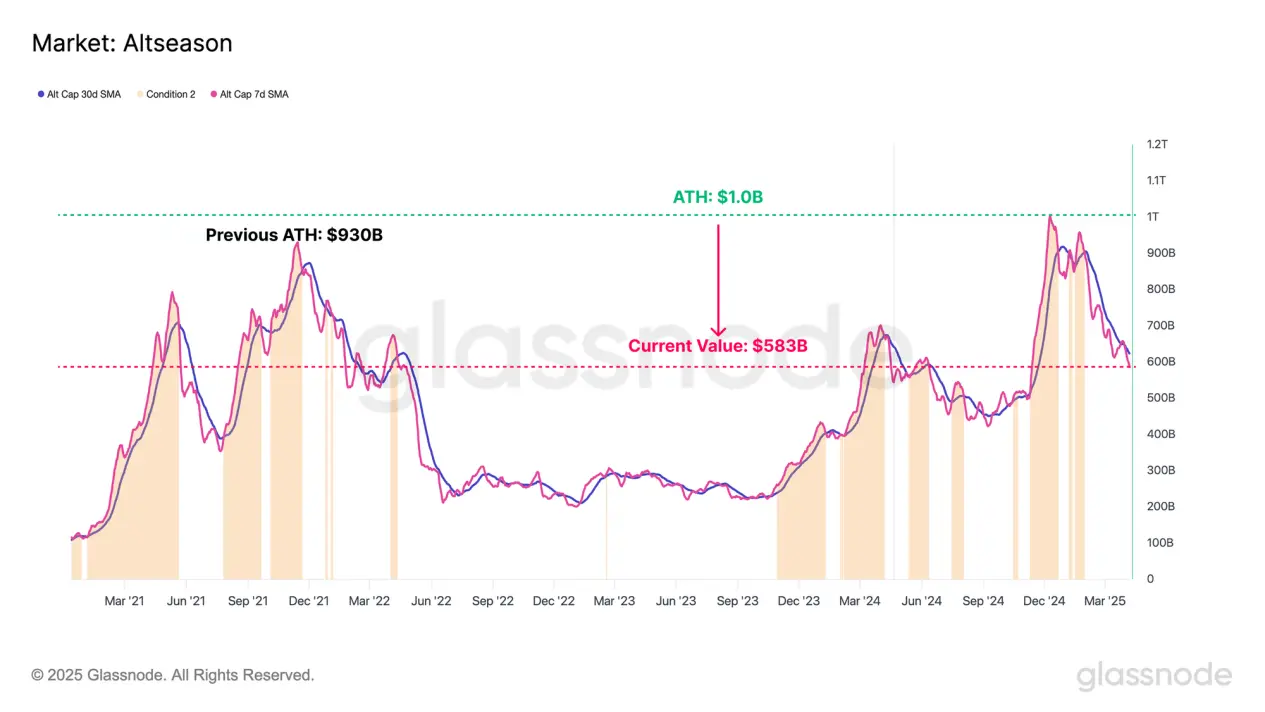

- The decline across the digital asset market is broad-based, with the altcoin market cap falling from $1 trillion in December 2024 to $583 billion today.

- A comprehensive analysis of the on-chain and technical models shows that to regain upward momentum, Bitcoin must re-enter $93,000. The $65,000 to $71,000 range below is the key support level that bulls must hold.

Markets fell across the board

The Trump administration announced the "Liberation Day" tariff policy, which triggered a violent shock in the financial market and a general decline in major stock indexes. The US policy stance has shifted to promote a weaker dollar, lower interest rates, lower oil prices and a contraction in fiscal spending. The combination of these factors may lead to a significant slowdown in the US economy and a significant contraction in overall liquidity.

The uncertainty brought about by tariffs has become the fuse for the rising "risk aversion" sentiment in the market, triggering a large-scale sell-off, and several major financial indexes recorded their worst performance since March 2020.

Source: Yahoo Finance

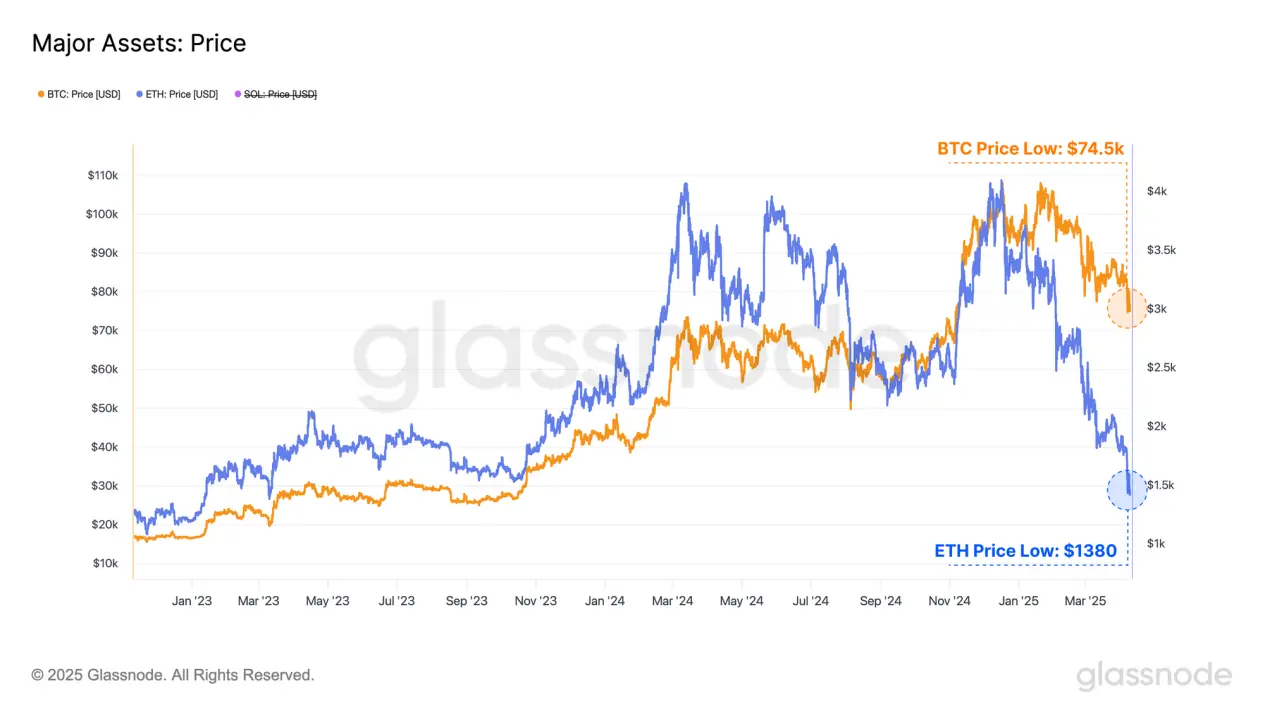

The digital asset market is particularly sensitive to changes in global liquidity and was not immune to this round of decline, with the prices of many crypto assets falling by double digits.

The price of Bitcoin, the dominant asset, fell from $83,500 to $74,500, wiping out about $150 billion in market value.

Ethereum, the second-largest crypto asset, saw an even more dramatic drop, with its price falling from $1,800 to $1,380 and its market capitalization decreasing by about $40 billion.

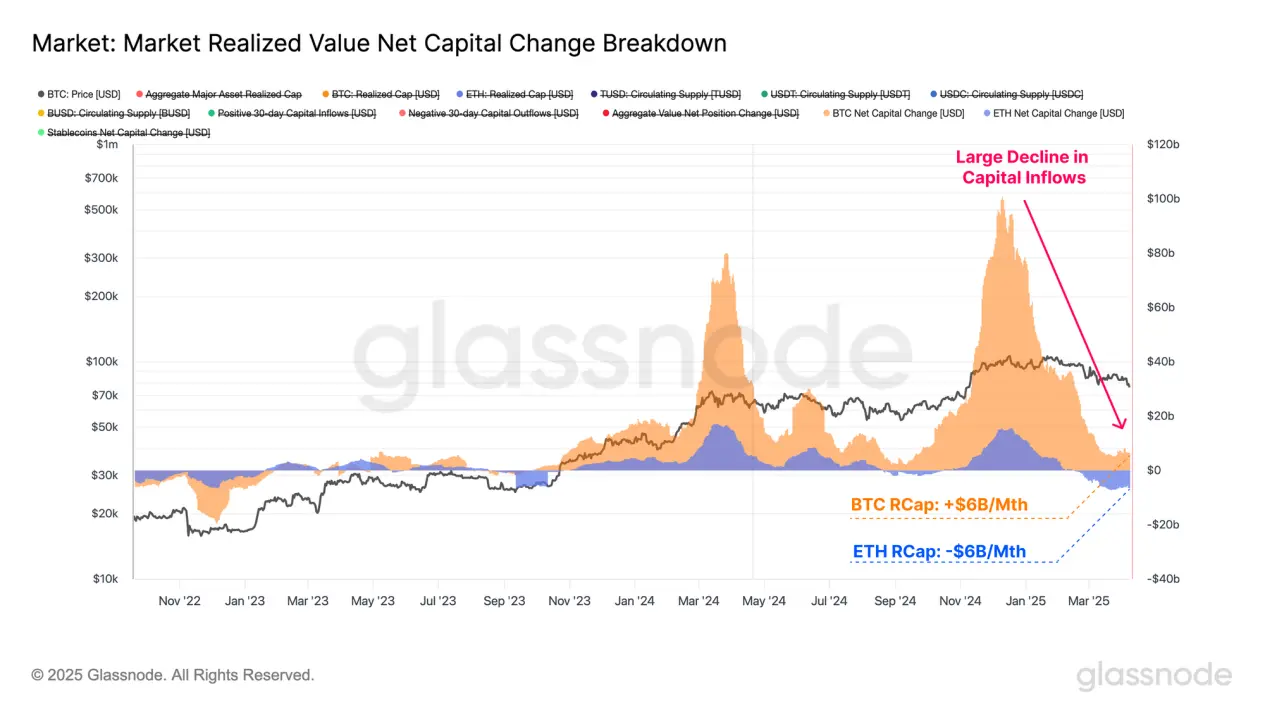

Since the beginning of the year, net inflows into the two major crypto assets have significantly decreased. This trend is mainly reflected in the 30-day "realized market value" change, which measures the change in the monthly net capital flow of assets.

- Bitcoin’s monthly inflows peaked at $100 billion and have now shrunk to around $6 billion;

- Ethereum's monthly capital inflow peaked at $15.5 billion and has now turned into a net outflow of $6 billion.

The inflow of funds to the Bitcoin network is gradually stagnating, indicating that the market lacks new incremental funds to support higher prices. The outflow of funds from Ethereum is mainly due to the fact that ETH bought at high prices is spent at low prices, thus realizing capital losses. This also shows that Ethereum is currently facing greater resistance than Bitcoin, and its market performance is relatively weaker.

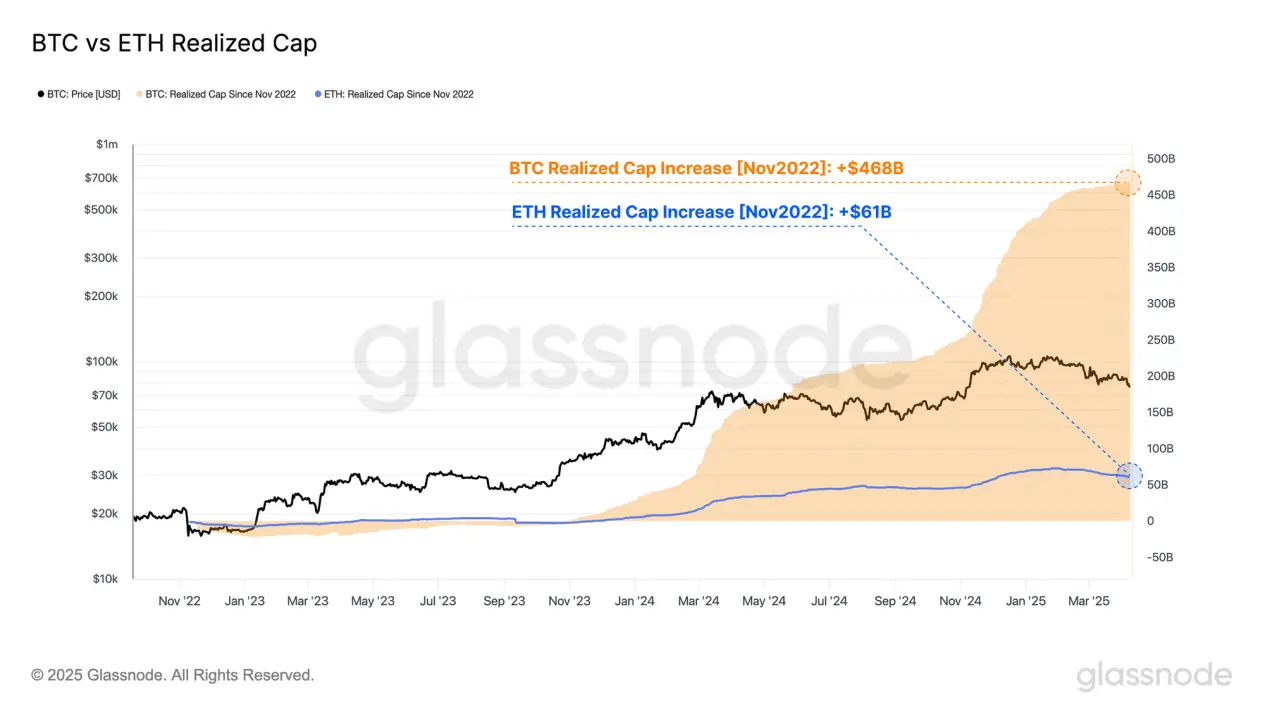

If we use the FTX crash at the end of 2022 as the starting point to observe the overall changes in the "realized market value" of Bitcoin and Ethereum, we can quantify the scale of capital absorbed by these two assets since the low point of this cycle.

- Bitcoin’s realized market capitalization grew from $402 billion to $870 billion, an increase of $468 billion, or 117%;

- Ethereum’s realized market capitalization grew by $61 billion, or 32%, from $183 billion to $244 billion.

The gap in capital inflows between the two partially explains the divergence in the performance of the two major asset markets since 2023. Ethereum has attracted significantly less capital and new demand than Bitcoin in this cycle, resulting in relatively weak price gains and failure to set new highs, while Bitcoin has broken through the $100,000 mark in December 2024.

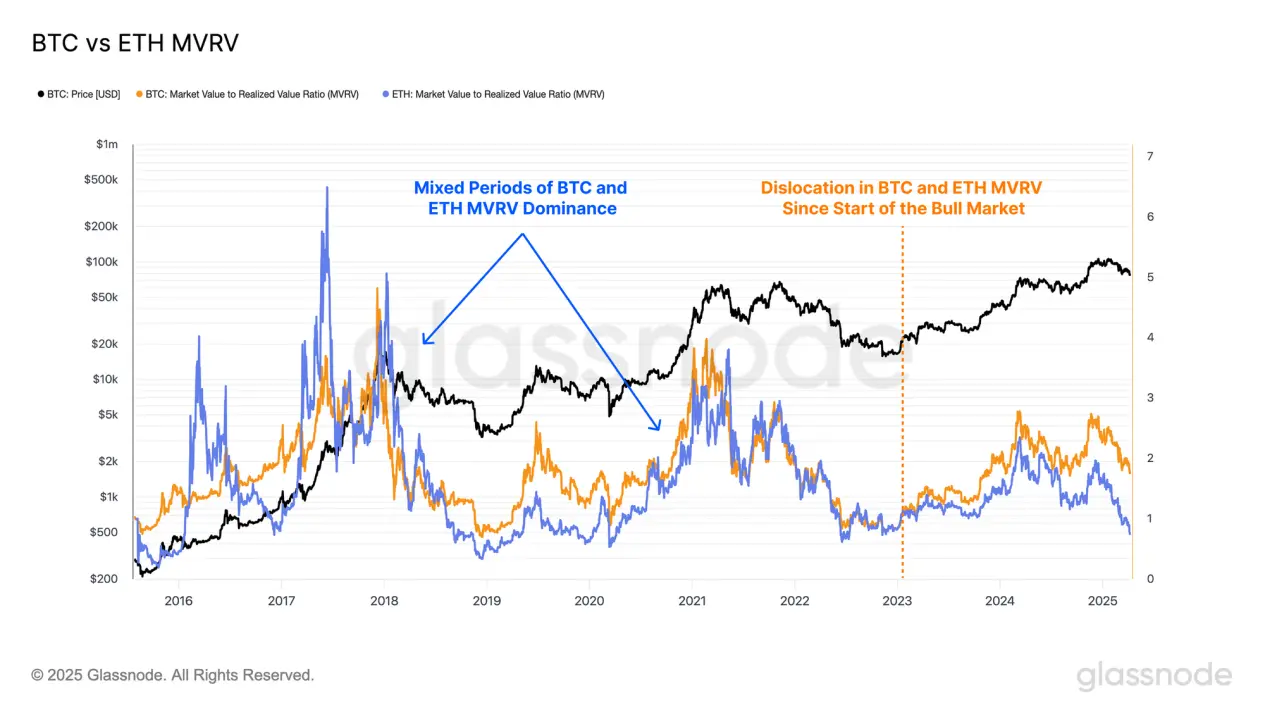

The MVRV ratio is used to measure the relationship between spot prices and realized prices, reflecting the average floating profit or loss of each asset holder. When the MVRV ratio is higher than 1, it means that the average is in a state of floating profit; if it is lower than 1, it means that it is in a state of floating loss.

Since the start of this bull market in January 2023, the MVRV ratios of Bitcoin and Ethereum have diverged again. Bitcoin investors have always held higher floating profits, while Ethereum's MVRV ratio has fallen below 1.0 again in March this year, indicating that most holders have entered a loss range.

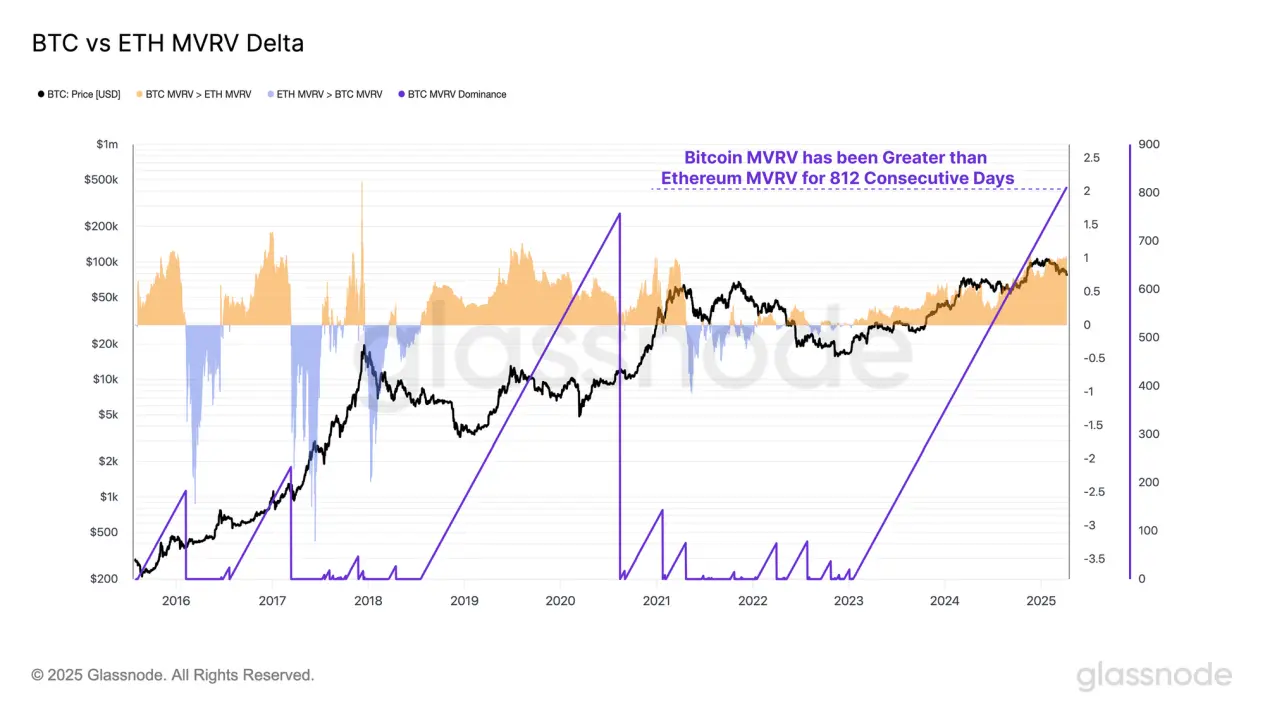

By calculating the difference between the Bitcoin and Ethereum MVRV ratios, we can identify whether, on average, Bitcoin holders have had better or worse paper returns than Ethereum holders during certain periods.

- A positive difference means that Bitcoin investors hold more unrealized profits on average than Ethereum investors;

- A negative difference indicates that Ethereum investors have stronger average profitability.

As mentioned earlier, since the start of this bull run, the average profit level of Bitcoin investors has been higher than that of Ethereum investors.

As of now, the trend has continued for 812 days, the longest duration on record.

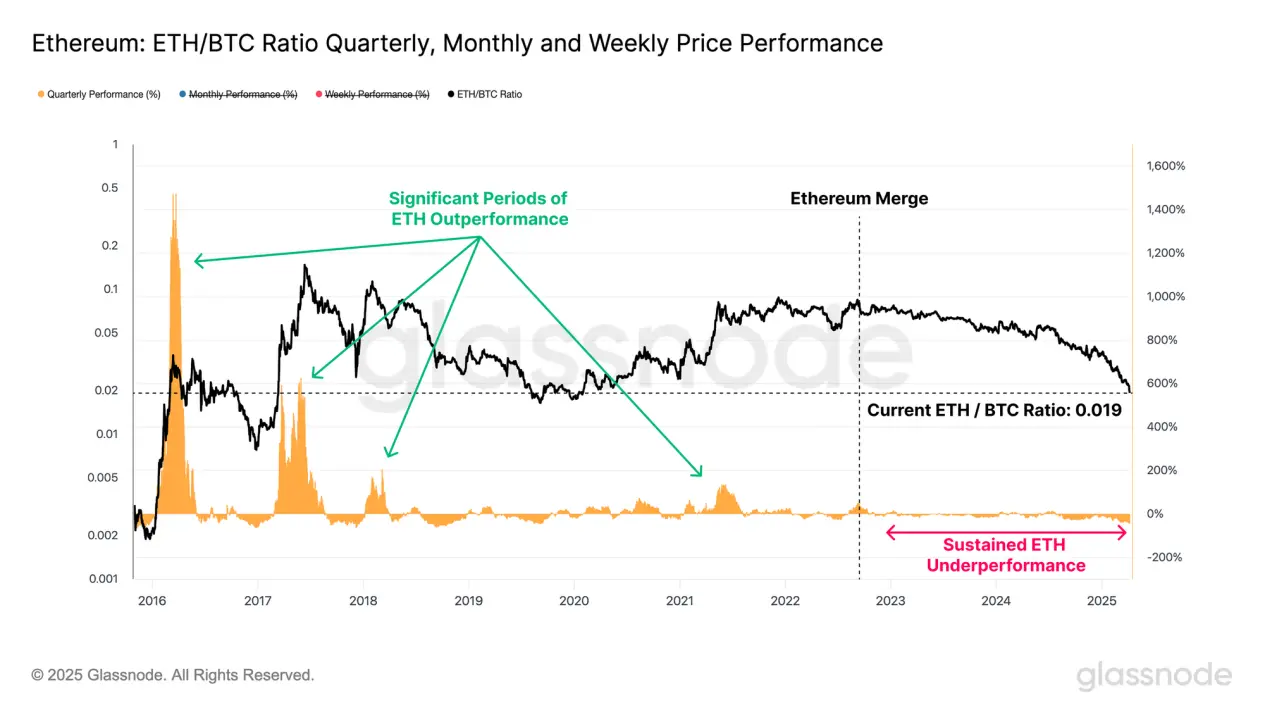

It can be seen that Ethereum's performance this round is relatively weak, mainly because the inflow of funds and investment demand is significantly smaller than that of Bitcoin. The differentiation trend between the two can be further reflected by the ETH/BTC price ratio.

Since the "merger" upgrade in September 2022, the ETH/BTC exchange rate has fallen sharply from 0.080 to the current 0.0196, a drop of 75%. This is the lowest level of the trading pair since January 2020, and only 500 days out of 3531 trading days have been lower than the current level.

In addition, there has been almost no stage in the current bull market where Ethereum has consistently outperformed Bitcoin, which is extremely rare in previous bull markets. This further illustrates that the market structure of this cycle has clearly deviated from the historical laws and performance patterns familiar to investors.

Review of losses

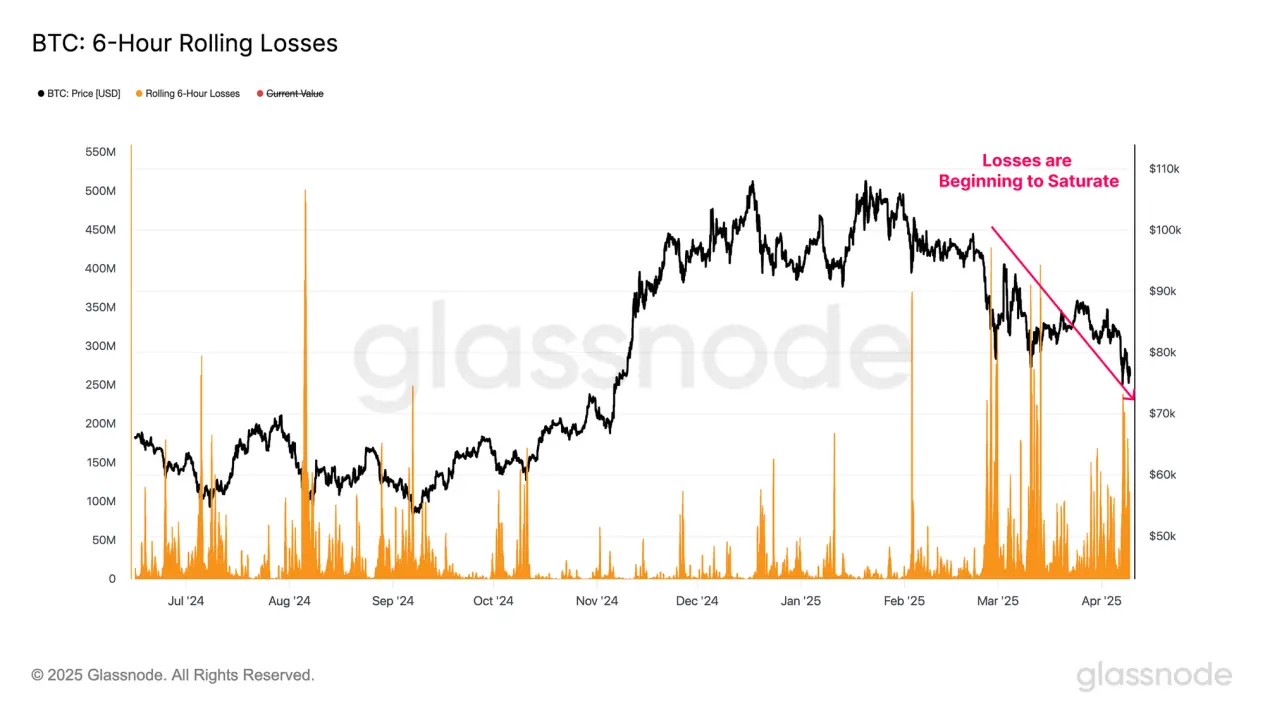

After big declines like this week, it’s important to examine how investors react, especially since bear markets are often sparked by rising fear and massive losses.

By evaluating realized losses over a 6-hour rolling window, we can better understand the behavior and emotional reactions of market participants in the current bearish trend.

The "capitulation" events among Bitcoin investors were large in scale, with peak losses reaching $240 million in a certain 6-hour window, approaching one of the largest loss events in this cycle.

However, the size of realized losses has been shrinking with each downward move, suggesting that the market may be experiencing short-term signs of selling exhaustion within the current price range.

Ethereum also showed a similar behavior pattern. During this round of decline, its single peak loss reached as high as US$564 million, making it one of the largest sell-off events since the bull market began in January 2023.

As prices gradually fall, the realized losses of Bitcoin and Ethereum are weakening, which may indicate that investors are gradually adapting to the lower price range and the current turbulent market environment.

Market contraction

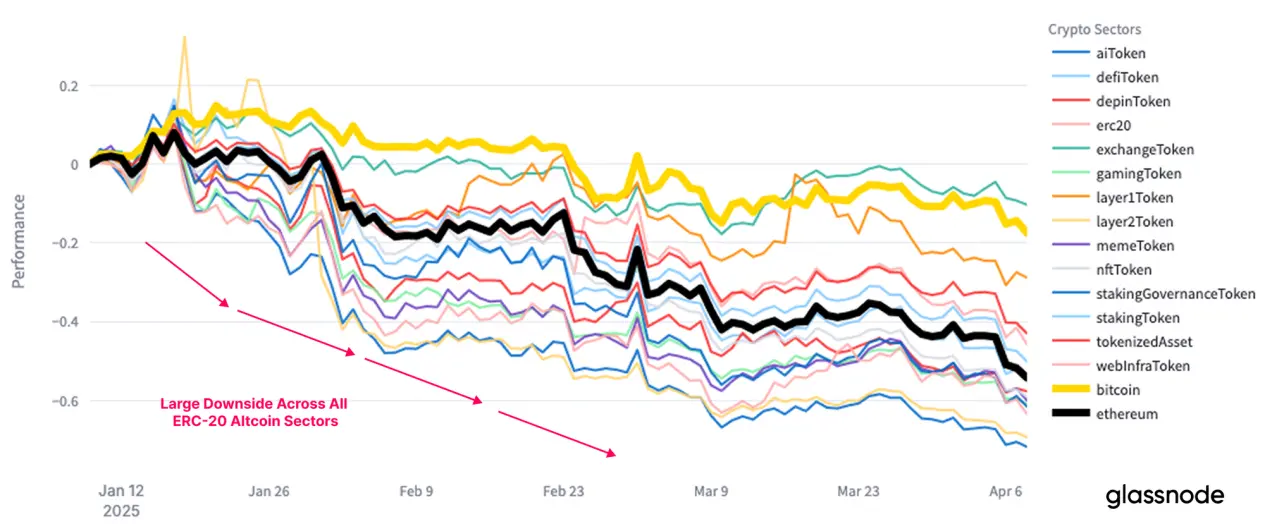

The continued tightening of current market liquidity has triggered a sharp depreciation of the entire altcoin sector. Assets further down the risk curve are particularly sensitive to liquidity shocks, which are usually accompanied by more dramatic price pullbacks.

As of December 2024, the total market value of altcoins (excluding Bitcoin, Ethereum, and stablecoins) peaked at $1 trillion in this cycle. Since then, the market value has retreated significantly and has now dropped to $583 billion, a drop of more than 40% in just a few months.

It is worth noting that in this round of correction, the altcoin sub-sectors did not show obvious differentiated trends. The overall decline was widespread, with all sub-sectors experiencing significant depreciation, and even Bitcoin recorded negative returns in the past three months.

Interval analysis

Finally, we will evaluate the market’s response to key technical indicators and on-chain cost ranges. These reference tools can help investors make judgments and decisions in a volatile and uncertain market environment.

Technical analysis has long been an important tool for investors, and Bitcoin investors often focus on a set of key moving averages. Among them, the 111-day, 200-day, and 365-day moving averages (111DMA, 200DMA, 365DMA) are commonly used indicators to measure Bitcoin market momentum.

The following technical framework can be used for analysis:

- Bitcoin’s first break below the 111-day moving average ($93,000) marked a major blow to market momentum, which was not followed by a valid rebound attempt.

- After the first decline, the price fluctuated around the 200-day moving average ($87,000), which is considered by most technical analysts to be the dividing line between long and short positions. The market showed obvious hesitation in this range, which eventually led to another downward trend and the start of a new round of price decline.

- Recently, the price fell below the 365-day moving average ($76,000) for the first time since the 2021 cycle. This key momentum support level has not yet been completely lost, and if it fails to hold continuously, it may trigger a further downward trend.

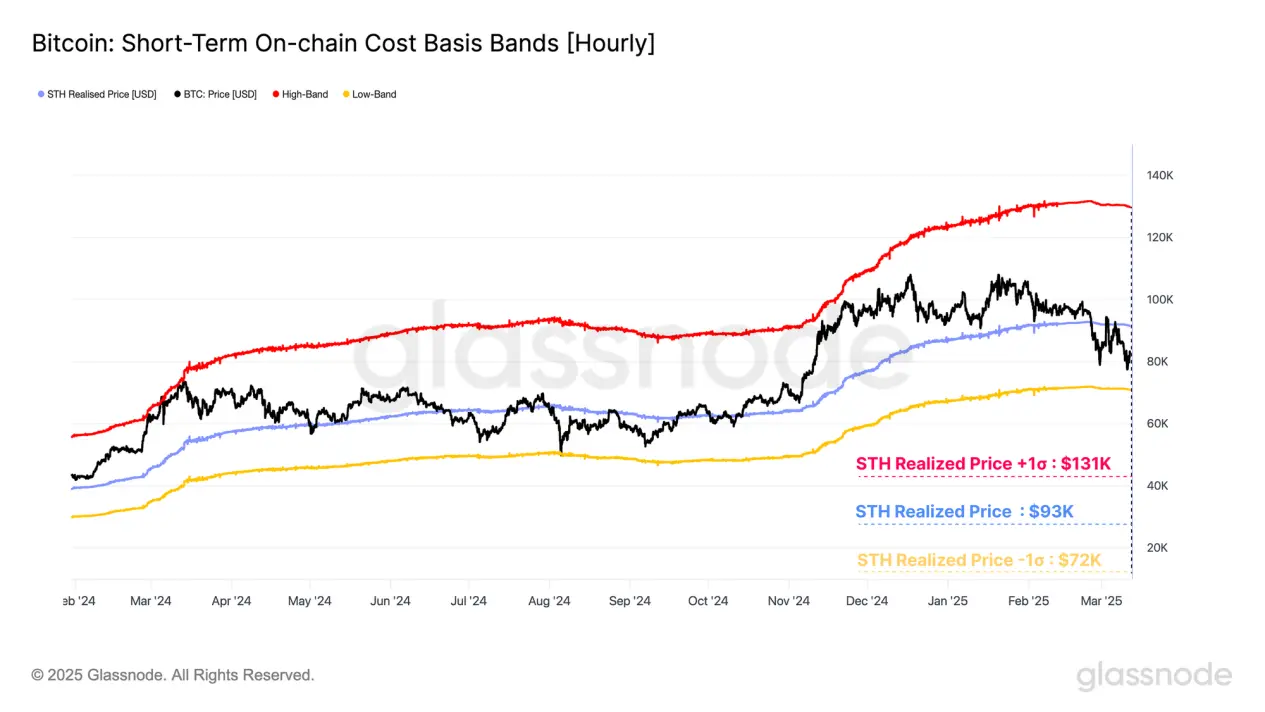

In the bull market, short-term holders (STH) are usually the group that bears the main losses in the panic selling of the market. The changes in their behavior and emotions can be used as an important reference indicator to assess the intensity of market corrections and how investors respond.

The short-term holder (STH) cost basis has always been regarded as a key reference level for judging market momentum during bull markets. A ±1 standard deviation range is constructed around this cost basis, which can usually be used as the upper and lower edges of local price fluctuations.

- Short-term holder cost basis + 1σ: $131,000

- Short-term holder cost basis: $93,000

- Short-term holder cost basis -1σ: $72,000

The first break below the short-term holder cost basis (STH-CB) signaled a weakening of market momentum (and also below the 111-day moving average). The subsequent rebound below the cost line and encountering resistance confirmed the turn in investor sentiment.

Currently, the spot price of Bitcoin has stabilized between the STH cost basis and -1 standard deviation below it, forming the upper and lower boundaries of the current trading range, which is US$93,000 to US$72,000.

Active Realized Price and True Market Mean are another set of price models that are usually located near the middle of Bitcoin cycles. These two models estimate the cost basis of active participants in the market by eliminating lost or long-unused supply.

From a statistical perspective, spot prices fluctuate above or below these two models on approximately 50% of trading days, so they can serve as important mean reversion references and are also used to divide the market state boundaries between bull and bear markets.

- Active Realized Price: $71,000

- True Market Mean: $65,000

The consensus of multiple on-chain price models shows that the $65,000 to $71,000 range is a key area for bulls to establish long-term support. If the price effectively falls below this range, it will mean that the vast majority of active investors are in a state of floating losses, and the overall market sentiment may be significantly affected.

in conclusion

Pressure on global financial markets continues to rise due to heightened uncertainty over U.S. tariff policies. This weakness has spread to almost all asset classes, as evidenced by the significant pullback in major macro indices.

The digital asset market was not immune, with all sub-sectors experiencing a comprehensive contraction. Bitcoin prices once dropped to $75,000, one of the largest retracements since the bull run began in January 2023. Ethereum fell even more severely, and many long-tail crypto assets are now deeply trapped in a bear market trend.

Combining multiple on-chain and technical price model analyses, the $65,000 to $71,000 range is seen as a key area for bulls to rebuild long-term support. If the price of Bitcoin falls below this range, market sentiment may suffer a major blow because the vast majority of active investors' positions will be in a floating loss state.