Author: beincrypto

Compiled by: Blockchain Knight

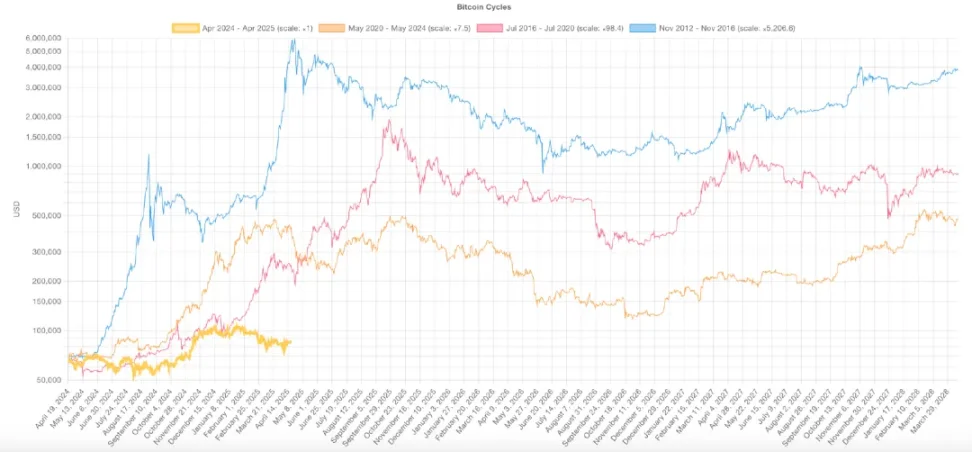

It has been a year since BTC’s last halving, and this cycle is showing a completely different trend from the past. Unlike previous cycles that saw explosive increases after halving, BTC’s current increase is relatively modest, rising only 31%, while the previous cycle saw an increase of 436% in the same period.

At the same time, long-term holder metrics such as the MVRV ratio show a sharp decline in unrealized profits, suggesting that the market is maturing and upside is compressed. Taken together, these changes suggest that BTC may be entering a new era, characterized less by parabolic peaks and more by incremental growth driven by institutions.

One Year After the BTC Halving: A Cycle Unlike Any Other

The development of this round of BTC cycle is significantly different from previous cycles, which may indicate a shift in the way the market reacts to halving events.

In earlier cycles (particularly from 2012 to 2016, and from 2016 to 2020), BTC tended to see strong rallies during this phase. The post-halving period is often accompanied by strong upward momentum and parabolic price action, driven primarily by retail enthusiasm and speculative demand.

However, the current cycle has taken a different path. Instead of accelerating after the halving, prices began to surge in advance as early as October and December 2024, followed by consolidation in January 2025 and a correction in late February.

This pre-money rally behavior is in stark contrast to historical patterns, where halvings typically act as catalysts for large upticks.

There are multiple factors contributing to this shift. BTC is no longer just a speculative asset driven by retail investors, it is increasingly being viewed as a mature financial instrument. The growing participation of institutional investors, coupled with macroeconomic pressures and market structure changes, has led to a more cautious and complex market response.

BTC Cycles Comparison. Source: Bitcoin Cycles Comparison

Another clear sign of this evolution is the weakening intensity of each cycle. As BTC's market value grows, the explosive gains of the early years are becoming increasingly difficult to replicate. For example, in the 2020-2024 cycle, BTC rose 436% one year after the halving.

By comparison, this cycle's gain over the same time frame was a much more modest 31%.

This shift could mean that BTC is entering a new chapter characterized by lower volatility and more stable long-term growth. Halving may no longer be the main driver, and other factors such as interest rates, liquidity, and institutional funds are playing a bigger role.

The rules of the game are changing, and so is the trend of BTC.

That said, it is worth noting that past cycles have also had a period of consolidation and correction before resuming the uptrend. While this phase may feel slower or less exciting, it may still represent a healthy correction before the next leg up.

That said, there is still a chance that this cycle will continue to deviate from historical patterns. It may not see a dramatic top bubble burst, but instead present a more persistent and structurally sound uptrend that is driven more by fundamentals than hype.

Long-term holder MVRV ratio reveals BTC’s mature market

The market value to MVRV ratio of long term holders (LTH) has been a reliable indicator of unrealized profits. It shows the profits that long term investors have made before they start selling. But this value is declining over time.

In the 2016-2020 cycle, the LTH MVRV ratio peaked at 35.8, indicating huge book profits and a clear top in the making. By the 2020-2024 cycle, this peak dropped sharply to 12.2, even as BTC prices hit all-time highs.

In this cycle, the highest value of the LTH MVRV ratio so far is only 4.35, which is a huge drop. This shows that the returns received by long-term holders are much lower than in previous cycles, despite the sharp rise in BTC price. The trend is clear: the return multiple is decreasing in each cycle.

BTC’s explosive upside is being compressed and the market is maturing.

Now, the highest reading of the LTH MVRV ratio so far in this cycle is 4.35. This significant decline shows that long-term holders are receiving a much lower multiple of returns compared to previous cycles, even with the significant rise in BTC price. This pattern points to one conclusion: BTC's upside is being compressed.

BTC long-term holder MVRV. Source: Glassnode

This is no accident. As markets mature, explosive gains naturally become harder to come by. The era of extreme, cycle-driven profit multiples may be fading, replaced by more modest or more stable growth.

The growing market size means that exponentially more capital is required to significantly drive prices up.

However, this does not confirm that the cycle has peaked. Previous cycles have typically included long periods of consolidation or minor corrections before reaching new highs.

As institutional investors play an increasingly important role, the accumulation phase may last longer. As a result, the sell-off at peak profits may not be as sudden as in earlier cycles.

However, if the trend of falling MVRV ratio peaks continues, it could reinforce the view that BTC is shifting from wild, cyclical surges to a more modest but structured growth pattern.

The most dramatic gains may be over, especially for investors who entered the market late in the cycle.