Written by: fejau

Compiled by: Luffy, Foresight News

I wanted to write down some of my thoughts that I have been thinking about, which is how Bitcoin might behave when it experiences a major shift in capital flows that has never been seen in its history. I think that once the deleveraging process is over, Bitcoin will usher in a great trading opportunity. In this post, I will elaborate on my thoughts.

What are the key drivers of Bitcoin price?

I will draw on the work done by Michael Howell on the historical drivers of Bitcoin price action and then use this work to further understand how the intertwined factors may evolve in the near future.

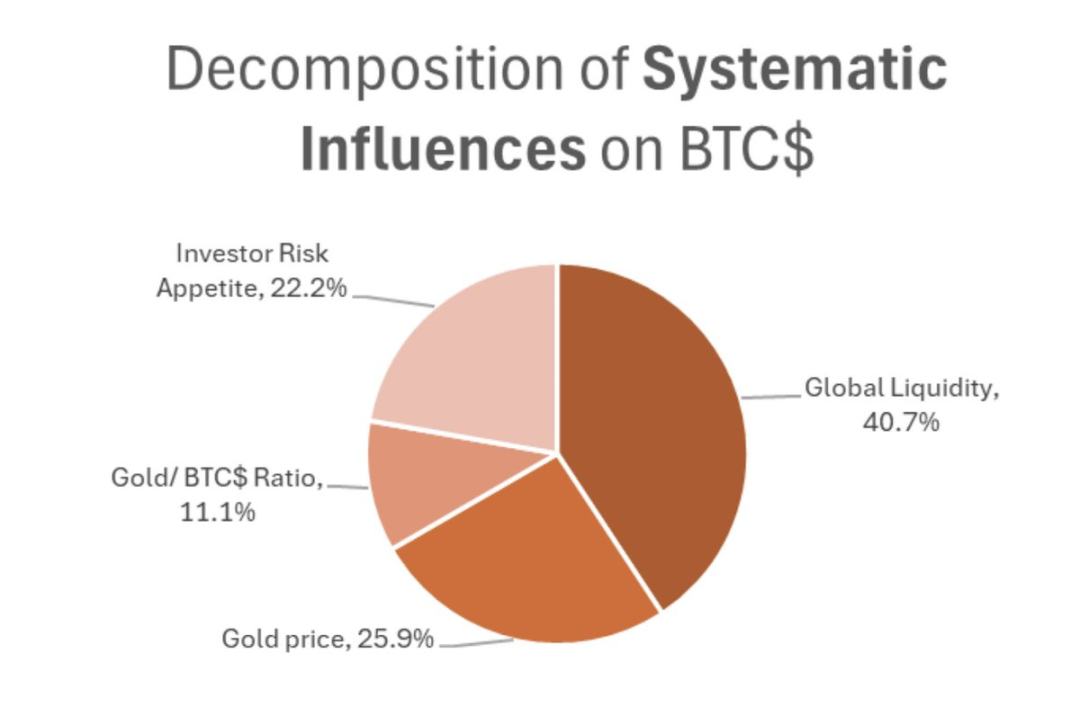

As shown in the above chart, Bitcoin price is driven by these factors:

- Investors’ overall preference for higher-risk, higher-beta assets

- Bitcoin and Gold Correlation

- Global liquidity

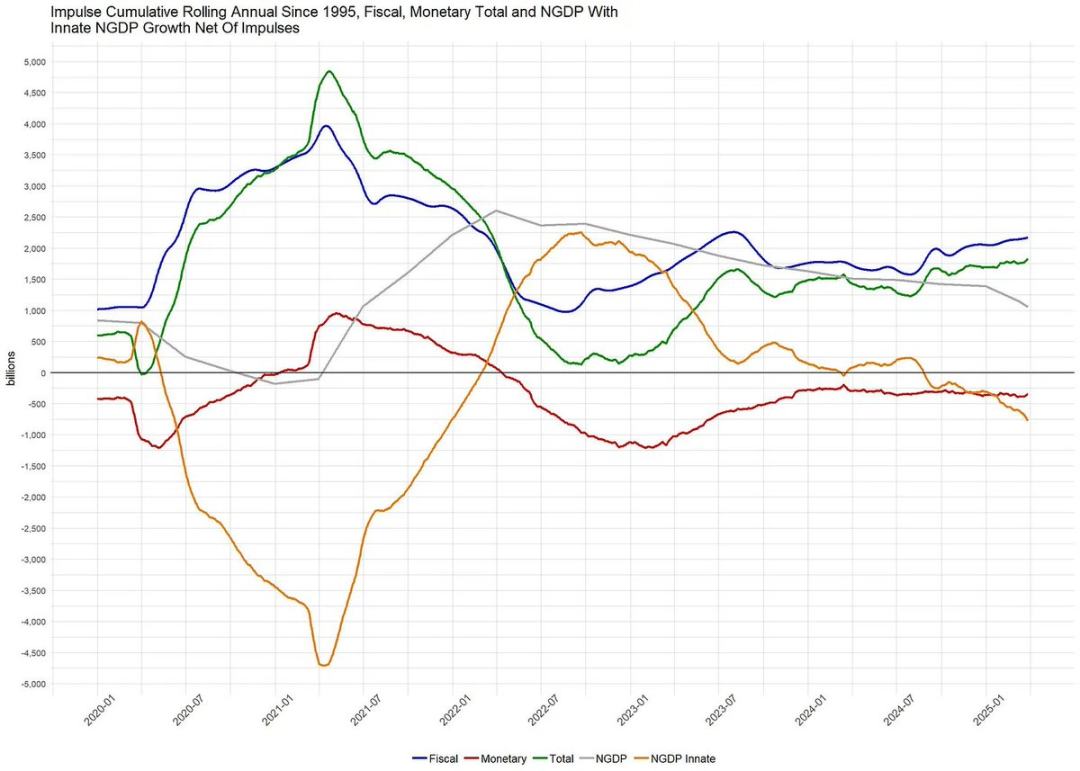

My simple framework for understanding risk appetite, gold performance and global liquidity since 2021 is to use the fiscal deficit as a percentage of gross domestic product (GDP) as a quick look at the fiscal stimulus that has dominated global markets since 2021.

Mechanistically, a higher fiscal deficit as a percentage of GDP will lead to higher inflation and higher nominal GDP, so for companies, since revenue is a nominal indicator, their revenue will also increase. For companies that can enjoy economies of scale, this is a positive for their profit growth.

Monetary policy has largely taken a backseat to fiscal stimulus, which has been the primary driver of risk asset activity. As this frequently updated chart from George Robertson shows, monetary stimulus in the US has been very weak compared to fiscal stimulus, so I will leave it out of this discussion.

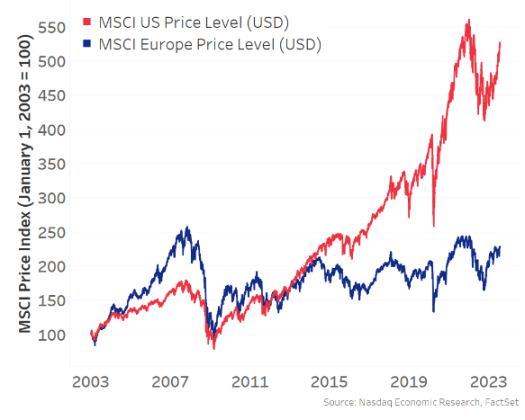

From the chart below of major Western developed economies, we can see that the US fiscal deficit as a percentage of GDP is much higher than that of other countries.

Because the US has such a large fiscal deficit, revenue growth dominates, which has caused the US stock market to outperform relative to other economies:

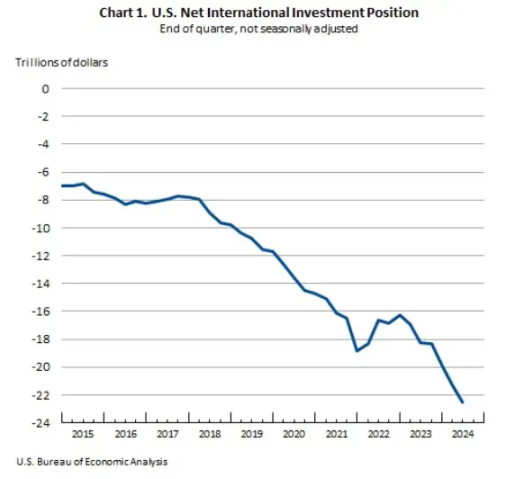

The US stock market has been the main marginal driver of risk asset growth, wealth effects, and global liquidity, and therefore has become the gathering place for global capital, because capital is treated best in the US. Due to this dynamic of capital inflows into the US, coupled with a large trade deficit, which results in the US exchanging goods for foreign holdings of US dollars, which these foreign countries reinvest in US dollar-denominated assets (such as US Treasuries and the "Big Seven" technology stocks), the US has become the main driver of all risk appetite in the world:

Now, back to the research of Michael Howell mentioned above, risk appetite and global liquidity have been driven primarily by the United States over the past decade, and this trend has accelerated since the COVID-19 pandemic, as the US fiscal deficit is extremely large compared to other countries.

Because of this, despite Bitcoin being a globally liquid asset (and not just relevant to the US), it has a positive correlation with the US stock market, and this correlation has been increasing since 2021:

Now, I believe this correlation between Bitcoin and the U.S. stock market is spurious. When I use the term “spurious correlation,” I mean it in a statistical sense, meaning that I believe a third causal variable that is not shown in the correlation analysis is the true driver. I believe that factor is global liquidity, which, as we said earlier, has been dominated by the United States for nearly a decade.

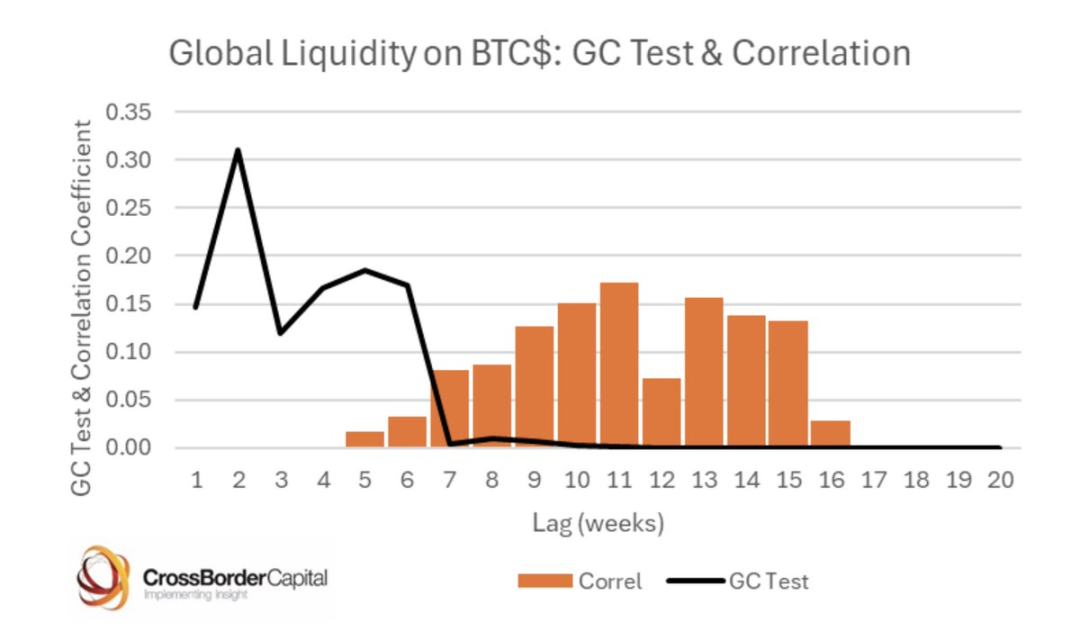

When we dig deeper into statistical significance, we must also determine causality, not just positive correlation. Fortunately, Michael Howell has also done some excellent work in this regard, where he has established a causal relationship between global liquidity and Bitcoin through a Granger Causality test:

What conclusions can this allow us to draw as a baseline for our further analysis?

Bitcoin prices are primarily driven by global liquidity, and since the U.S. has been the leading factor in global liquidity growth, a false correlation has emerged between Bitcoin and the U.S. stock market.

Over the past month, as we have all speculated on Trump’s trade policy objectives and the restructuring of global capital and commodity flows, a few key insights have emerged. I summarize them below:

- The Trump administration wants to reduce trade deficits with other countries, which mechanically means fewer dollars will flow to foreign countries that would otherwise be reinvested in U.S. assets. If this is to be avoided, the trade deficit cannot be reduced.

- The Trump administration believes that foreign currencies are artificially depressed and the dollar is artificially overvalued, and it wants to rebalance that situation. In short, a weaker dollar and stronger currencies in other countries will lead to higher interest rates in other countries, which will encourage capital to flow back to their home countries to capture those interest rate gains, which will be better from a foreign exchange adjusted perspective, while also boosting their own stock markets.

- Trump’s “shoot first, ask questions later” approach to trade negotiations is pushing the rest of the world to get out of their tiny fiscal deficits relative to the U.S. and invest in defense, infrastructure, and generally protectionist government investments to make themselves more self-sustaining. Whether or not tariff negotiations ease (like with China), I think the “genie is out of the bottle” and countries will continue this effort and won’t turn back easily.

- Trump wants other countries to increase their defense spending as a percentage of GDP because the U.S. bears a lot of the costs in this regard. This will also increase the fiscal deficit.

I will leave aside my personal opinions on these points, as many people have already expressed their opinions on them, and simply focus on the possible impact of these points if they are developed according to their logic:

- Money will leave dollar-denominated assets and flow back home. This means that U.S. stocks will underperform the rest of the world, bond yields will rise, and the dollar will weaken.

- The fiscal deficits of the countries to which these funds flow back will no longer be restricted, and other economies will begin to spend heavily and print money to fill the growing fiscal deficits.

- As the United States continues to shift from a global capital partner to a protectionist role, holders of dollar assets will have to increase the risk premium associated with these previously considered high-quality assets and will have to set wider safety margins for these assets. When this happens, it will cause bond yields to rise, and foreign central banks will be interested in diversifying their balance sheets away from relying solely on US Treasuries and towards other neutral assets, such as gold. Similarly, foreign sovereign wealth funds and pension funds may also make such diversification adjustments to their portfolios.

- The counter-argument to these views is that the US is the epicenter of innovation and technology-driven growth and no one else can take that place. Europe is too bureaucratic and too socialist to develop capitalism the way the US has. I understand this view and it probably means this won’t be a multi-year trend but more of a medium-term one.

Going back to the title of this article, the first trade is to sell USD assets that are overweight globally and avoid the ongoing deleveraging process. Since the global allocation to these assets is seriously overweight, the deleveraging process may become messy when large money managers and more speculative players with strict stop loss settings such as multi-strategy hedge funds hit their risk limits. When this happens, there will be days like margin calls, and a large number of assets need to be sold to raise cash. At present, the key is to survive this process and keep enough cash reserves.

However, as the deleveraging process stabilizes, the next round of trading begins. Diversify your portfolio into foreign stocks, foreign bonds, gold, commodities, and even Bitcoin.

We have already started to see this dynamic take shape during market rotations and days without margin calls. The US dollar index (DXY) has fallen, US stocks have underperformed those in the rest of the world, gold prices have surged, and Bitcoin has been surprisingly strong relative to traditional US tech stocks.

I think as this happens, marginal increases in global liquidity will shift to the exact opposite of what we are used to. The rest of the world will take up the mantle of increasing global liquidity and risk appetite.

When I think about the risks of this diversification in the context of a global trade war, I worry about the tail risk of being deeply invested in risk assets in other countries because there could be some negative headlines about tariffs that could impact these assets. So, in this shift, gold and Bitcoin become my top choices for global diversification.

Gold is currently performing extremely strongly, setting new all-time highs every day. However, while Bitcoin has been surprisingly resilient throughout this shift, its beta correlation with risk appetite has so far limited its gains and failed to keep up with gold’s outperformance.

So, as we move towards a global rebalancing of capital, I think the next round of trading opportunities after this round lies in Bitcoin.

When I compared this framework to Howell’s correlation research, I found that they fit in well:

- The U.S. stock market is not affected by global liquidity, only by liquidity measured by fiscal stimulus and some capital inflows. However, Bitcoin is a global asset and reflects the broad state of global liquidity.

- As this view gains currency and risk allocators continue to rebalance, I believe risk appetite will be driven by the rest of the world, rather than the United States.

- Gold couldn’t have performed better, and Bitcoin is partially correlated with gold, which is in line with our expectations.

Putting all of the above together, for the first time in my life, I see the possibility of a decoupling of Bitcoin from US tech stocks. I know, this is a high-risk idea and often marks local highs in Bitcoin prices. But the difference is that this time, there could be a significant and lasting change in capital flows.

So, for a risk-seeking macro trader like me, Bitcoin feels like the most worthy trade to be in after this run. You can’t impose tariffs on Bitcoin, it doesn’t care what country’s borders it is in, it provides a high beta return to the portfolio without the tail risk associated with US tech stocks, I don’t have to judge whether the EU can solve its own problems, and it provides exposure to global liquidity, not just US liquidity.

This market structure is exactly the opportunity for Bitcoin. Once the deleveraging dust settles, it will be the first to start and accelerate forward.