In March 2025, Optimism launched a landmark on-chain governance experiment. Through the Futarchy mechanism, 500,000 OP tokens were distributed as incentives. This 21-day social experiment not only tested the feasibility of the prediction market in the governance of the public chain ecosystem, but also revealed the complex tension in the evolution of decentralized decision-making mechanisms.

01. Futarchy Governance Experiment

Optimism launched a very novel Futarchy governance experiment in March. Futarchy literally means prediction experiment. In blockchain, Futarchy is a governance model that guides decision-making through prediction markets, using the prediction power of financial markets and the real money input of participants to encourage more accurate predictions and analysis. In this experiment, Optimism used Futarchy to distribute a total of 500k OP (100k * 5) incentives to explore a new incentive distribution model for public chain parties to stimulate ecological development. Most of the progress of the experiment has been completed. As one of the participants in the experiment, LXDAO member Loxia expressed cautious optimism about the future of this governance method.

Futarchy proposed by MetaDAO simply means that when someone proposes a governance purpose (such as "airdropping tokens to incentivize users"), Futarchy will define two conditional token markets: "pass" and "reject". Participants need to pledge real assets in exchange for corresponding tokens for trading - if they are optimistic that the proposal will push up the token price, they will buy the "pass" market tokens; otherwise, they will bet on the "reject" market. Ultimately, the fate of the proposal is determined by comparing the weighted average prices of the two markets. At the same time, participants can redeem their pledged assets, but the decision-making results directly affect the value of their holdings. This design cleverly binds personal interests with collective goals:

If you want to make a profit, you must deeply study the long-term impact of proposals on the price of the organization's tokens, rather than voting on intuition or following the crowd. MetaDAO's practice shows that even if malicious proposers try to manipulate the market, they will lose more than they gain because they need to buy "passed" tokens at a high price. MetaDAO believes that when every decision is tempered by real money and silver games, collective wisdom has a chance to overcome human weaknesses.

02. The Origin of Futarchy

Futarchy is a form of government proposed by economist Robin Hanson. In this governance model, elected officials define the measure of national well-being, and prediction markets are used to determine which policies will have the most positive impact. The New York Times listed "Futarchy" as a buzzword in 2008. Later, the concept was also introduced into the discussion of blockchain and DAO.

Futarchy’s slogan is:

"Vote on values, bet on beliefs." This sentence means:

Citizens should use democratic procedures to express “what we want” (i.e. “values”).

Prediction markets are then used to determine what policies are most likely to achieve those goals (i.e., “beliefs” — judgments about causality).

Economist Tyler Cowen said: "I am not optimistic about the future of futarchy, or whether it will be successful once implemented. Robin said, 'Vote on values, bet on beliefs', but I don't think values and beliefs can be separated so easily."

Cowen believes that human values and beliefs are highly intertwined, and it is difficult to completely separate "goals" from "the way to achieve them." For example, a person may claim that he pursues social equality (value), but his support for certain policies (beliefs) is actually based on ideological preferences rather than rational predictions of policy effects.

In other words, the prediction market cannot completely block out the interference of human emotions, cognitive biases, and value orientations, so the operating mechanism of Futarchy may not be able to achieve its theoretical rationality and efficiency.

03. Futarchy for Optimism

The designers of the Futarchy governance experiment believe that:

- When decision makers are rewarded or penalized for their accuracy (accurate → reward, inaccurate → penalty), they tend to make more thoughtful, non-biased decisions;

- At the same time, a permissionless futarchy model can attract more people to participate (crowd wisdom) rather than being limited to centralized decision-making bodies.

At the same time, in order to make the experiment more open and to obtain more data for testing the experiment, the experimenter has opened up participation rights. Anyone with a Telegram account or a Farcaster account can participate. All predictors will receive 50 OP-PLAY entry chips (OP-PLAY, the token has no actual value and is a fake chip for experiments only), and the actual participants in OP governance will receive more OP-PLAY chips.

So what is the prediction problem that this round of Futarchy revolves around?

If a project gets 100k OP incentives, which protocol(s) will get the biggest TVL growth after three months?

There are 23 projects participating in Futarchy this time. Each participant in the experiment needs to predict the TVL increment of these 23 projects after "getting 100k OP incentives". At the beginning of the experiment, the initial predicted TVL of all projects is the same (the same starting line, as a reference in the project selection of the test experiment). As time goes on, users pledge OP-PLAY and buy call options (UP token) and put options (DOWN token) for different projects to start the game. The five projects with the highest prediction results will each receive 100k OP incentives.

After the experiment, participants selected five projects through OP-PLAY prediction market. For comparison, the Grants Council also selected five funded projects:

The top five 100K OP funding projects selected by Futarchy during the 21-day ups and downs game are:

- Rocket Pool: $59.4M

- SuperForm: $48.5M

- Balancer & Beets: $47.9M

- Avantis: $44.3M

- Polynomial: $41.2M

At the same time, the Grants Council selected five funded projects (if there is overlap, only one grant is issued):

- Extra Finance

- Gyroscope

- Reservoir

- QiDAO

- Silo

04. Limitations of the Futarchy Model in Governance

Limitations of this TVL judgment indicator:

“If the price of ETH goes up, protocols that have a lot of ETH locked up will look like they have a big increase in TVL, even if they haven’t done anything.” — @joanbp, March 13

“We seem to be using Futarchy to decide who gets grants, but if TVL growth is just a reflection of market price changes, then this metric doesn’t reflect whether projects are making good use of grants.” — @joanbp, March 13

The angle from which the indicators of the prediction experiment are set is also very important:

“We should choose indicators that – even if actors want to ‘manipulate’ – can only ‘win’ by doing what’s good for the ecology.” — @Sky, March 17

Bias caused by simulated tokens (which can also occur if real tokens are undervalued)

“This is ‘fake money’, not ‘real money’. Many people will double bet at the last minute just to avoid losing money.”

— @thefett, March 19

*41% of participants hedged their bets at the end (betting on both sides to avoid losses)

“I felt like I wasn’t bringing any special insights, and was diluting the influence of the people who really understood the project.”

— @Milo, March 20

The user experience is not good and affects the effectiveness of the game:

The success of the prediction market depends largely on the depth of user participation. However, the threshold for this experiment was high, the information was opaque, and the operation was cumbersome, which greatly affected the judgment and participation of the participants.

Common user feedback includes:

- It is not known how many tokens there are in total.

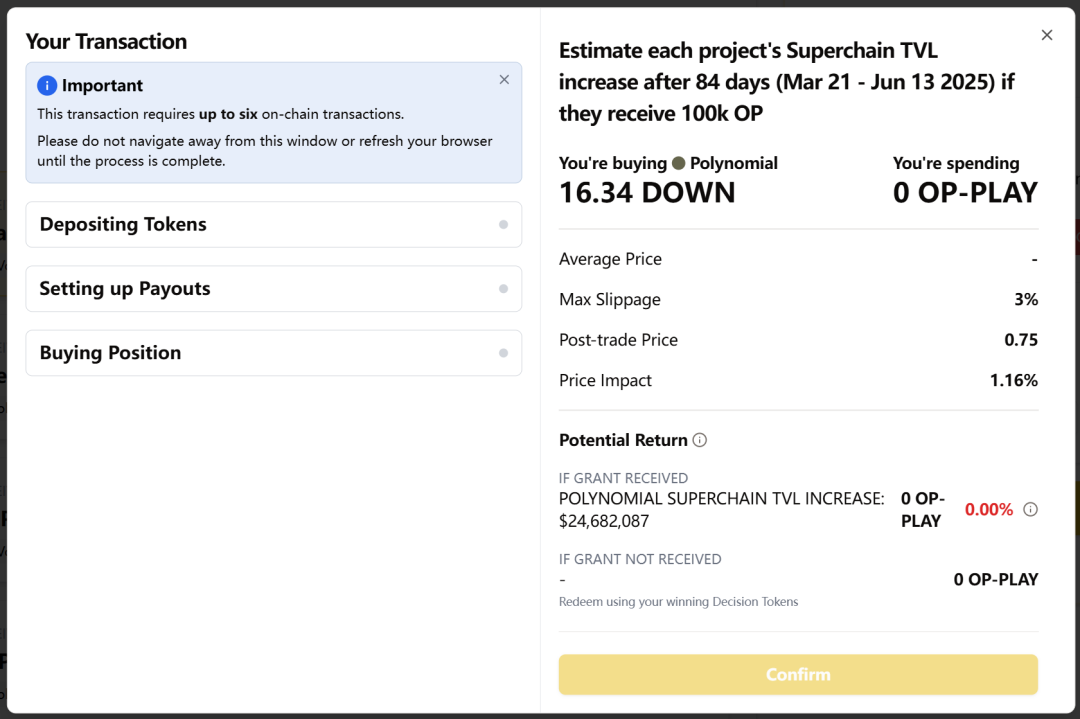

- A single bet requires 6 on-chain interactions. (I didn’t make many transactions in this experiment because the interface was too complicated.)

- It is unclear whether betting on the wrong project will result in losses.

- The profit and loss logic of the ranking list is incomprehensible.

“I thought PLAY was used up at first, but it reset for each project and I can’t figure out how much I spent in total.” — @Milo, March 20

"Six trades for one prediction is a bit much." — @Milo, March 20

“I don’t understand the rankings. Sometimes I feel like I should be making a profit, but the results show a 46% loss.” — @joanbp, March 19

The data report officially issued by Butter shows that in this experiment:

- The total transaction volume is 5,898, but 41% of the addresses participated in the last three days, indicating that the user learning cost is too high.

- A single prediction requires 6 on-chain interactions (see interface screenshot), resulting in an average of only 13.6 transactions per person.

- Despite 2,262 visitors, the conversion rate was only 19%, and the participation rate of OP governance contributors was only 13.48%.

- 45% of the projects did not disclose their plans to the forecasters, and information asymmetry led to forecast bias (e.g. Balancer’s forecast value exceeded the project’s self-estimate by $26.4M)

05. Conclusion

1. The establishment of game indicators will have a decisive impact on the Futarchy experiment

A good indicator should have:

- Measurability: data is clear and easy to verify;

- Correct direction: It can guide participants to do things that "promote the positive development of the system even if it is just to win money";

- Not easy to gamify: It is difficult to be “made bigger and stronger” by simple financial techniques or price fluctuations.

For example, in this Futarchy experiment, TVL measured in US dollars is easily affected by price fluctuations of mainstream currencies such as ETH, making the prediction results more like "betting on coin prices" rather than evaluating who actually has the ability to grow.

The official report issued by Butter shows that the mid-term TVL data as of April 9, 2025 has exposed the limitations of the indicator:

- Rocket Pool (predicted TVL growth of 59.4M) Actual TVL growth is 59.4M, actual TVL growth is 0

- SuperForm (forecast 48.5M) actually fell 1.2M

- Balancer & Beets (predicted 47.9M) actual decrease 13.7M

The actual TVL of all Futarchy selected projects has dropped by $15.8M in total, while during the same period, among the Grants Council selected projects:

- Extra Finance (forecast 39.7M) actual growth 8M

- QiDAO (predicted 26.9M) actual growth 10M

This confirms the community's doubts that the TVL indicator is strongly correlated with market prices and fails to effectively reflect the project's true operational capabilities.

2. Futarchy’s “Best Forecaster” Results Are Not Completely Objective

- In this experiment, the participants’ OP-PLAY trading ability is more reflected than the “prediction ability”, because in this experiment, all the targets have large daily fluctuations, and the participants have considerable room for operation (the anonymous account @joanbp reached the top through high-frequency trading (406 transactions/3 days))

- In the final OP-PLAY trading win rate rankings, Badge Holders, recognized as OP ecosystem professionals, had the lowest group win rate.

- Only 4 of the top 20 forecasters hold OP governance identities (skydao.eth/alexsotodigital.eth, etc.)

3. The paradox of prediction affecting decision-making:

The characteristic of Futarchy is that prediction is decision-making, and collective expectations will directly affect the results (such as which project will receive the grant in this experiment). This is different from the general prediction market that purely predicts external events, and it creates some unique dynamic challenges. As discussed in the OP forum, a voter has two orientations in Futarchy:

First, follow the crowd and bet on popular projects to ensure that these projects receive grants (even if your predictions are correct, you may not get a high return because most people bet on the same thing);

Secondly, they choose undervalued projects to be different. If the minority is later proven to be right, their personal benefits will be the greatest. This mechanism, which has both voting and betting attributes, makes participants feel a little overwhelmed. At the same time, when the prediction itself shapes the future (because the flow of funds will affect the development of the project), Futarchy has a certain self-fulfilling or self-defeating cycle: everyone bets on a certain project, and resources are given to it, so it naturally has a better chance of success; on the contrary, even if it is not optimistic about the success, it will fail because it does not get resources. This closed loop requires Futarchy experiments to carefully interpret the accuracy of their predictions and consider how to mitigate the deviation of this self-proving cycle in design.

In this Futarchy experiment, we not only saw how the governance mechanism was "gamified", but also saw the potential of Degen in the prediction market - they are no longer just profit-seeking passers-by, but potential professional governors. Only when the institutional design can anchor the energy of Degen to public goals, make speculation a co-construction, and make betting a judgment, Futarchy has the opportunity to activate the regenerative governance spirit (Regen) belonging to Web3. This experiment awakened a possibility: governance does not have to be a Puritan-style rational negotiation, but can also be a deeply gamified consensus formation. Awakening the Regen bloodline of Degen may be the evolutionary direction of future DAO governance.

06. Quote

[1] https://en.wikipedia.org/wiki/Futarchy

[2] https://gov.optimism.io/t/experimenting-with-futarchy-for-optimism-grant-allocation-decisions/9678

[3] https://ggresear.ch/t/futarchy-vs-grants-council-optimisms-futarchy-experiment/57

[4] https://medium.com/@netrovert/futarchy-redefining-dao-governance-5f554d523dee

·END·

Content | Loxia

Editing & Formatting | Huanhuan

Design | Daisy