The impact of reciprocal tariffs is more severe than expected.

On Monday, the global financial market was hit hard. The three major U.S. stock indexes continued to plummet, and stock markets in Europe, Asia and other regions plummeted. The commodity market was not immune, with crude oil and gold falling simultaneously. Cryptocurrency also had difficulty in showing resilience. Bitcoin fell by more than 10% in two days, and Ethereum fell by 20%. The global financial market showed a "green" scene.

In this regard, the culprit Trump expressed calmness, describing the current market reaction as "taking medicine when you are sick", but is this a cure or a temporary solution? When will the impact on the market be repaired? The haze of impending storm is shrouding the global market.

On April 2, US President Trump signed two executive orders on so-called "reciprocal tariffs" at the White House, announcing that the United States would establish a 10% "minimum base tariff" on its trading partners and impose higher tariffs on certain trading partners, officially kicking off the reciprocal tariffs.

If the world only used reciprocal tariffs as Trump's negotiating tool at that time, now we can probably get a glimpse of the tip of the iceberg of Trump's greedy ambition, because the price paid for this move is indeed not small.

After the reciprocal tariffs, my country took the lead in launching countermeasures. The State Council Tariff Commission, the Ministry of Commerce, and the General Administration of Customs successively issued a number of countermeasures against the United States, announcing that from 12:01 on April 10, the State Council Tariff Commission will impose an additional tariff of 34% on imported goods originating in the United States on the basis of the current applicable tariff rate. The signs of a global trade war have begun to emerge.

On April 7, the reciprocal tariff storm intensified, and the global financial market ushered in an epic plunge. U.S. stock futures continued the plunge last week, with Nasdaq futures falling more than 5% and S&P 500 futures falling more than 4%; the market value of U.S. stocks plummeted in two trading days, which was basically equal to the sum of Germany and South Korea's GDP in 2024. European stock index futures also fell sharply, with the European STOXX50 index futures falling more than 4% and the DAX index futures falling nearly 5%. The Asian market was not spared either. The Japanese and Korean stock markets collapsed again. The Korean Composite Index opened down more than 4%, and the Nikkei 225 Index fell nearly 2%. The Hang Seng Index closed at 19,828 points, down 3,021 points for the day, a drop of 13.2%, setting a record for a single-day drop since October 28, 1997.

The crypto market also ushered in a bloody storm. Bitcoin fell by more than 10% in two days, falling below $75,000 on the same day. The altcoins collapsed completely, Ethereum fell below $1,500, and SOL fell to a minimum of $100. According to Coinglass data, a total of 487,700 people were liquidated worldwide yesterday, with a liquidation amount of more than $1.632 billion, including $1.25 billion in long orders and $380 million in short orders.

It is clear that global confidence has dropped to a freezing point, panic has soared, and the US recession has once again become the center of public opinion. Canadian Prime Minister Carney said that the United States is in recession due to President Trump's radical tariff actions. Larry Fink, CEO of US asset management giant BlackRock, also agreed, emphasizing that many business leaders believe that the US economy may have fallen into a serious recession. The perception of companies is surprisingly consistent. According to a survey by the US media, 69% of business leaders expect a recession in the United States, and more than half of them said that the recession will come this year.

In fact, there are complaints all over the world, and some even joke that Trump is shorting the United States. If it is only used as a negotiating tool, it has already been too effective. U.S. government officials revealed that more than 50 economies are currently in contact with the United States on tariff policies. Vietnam even proposed a zero-tariff strategy to show weakness. The European Union also changed its tough stance and proposed a proposal for mutual exemption of tariffs. But Trump was not satisfied with this and once again said that "there will be no suspension of tariffs."

In terms of reasons, reciprocal tariffs undoubtedly have three main purposes. The first is to reverse the trade imbalance and trade deficit that the United States particularly emphasizes; the second is to increase U.S. fiscal revenue. In the current federal tax revenue structure, personal income tax and corporate income tax are the core components, and tariffs account for a very low proportion. Trump is trying to increase the tariff ratio to about 5%, which is expected to increase U.S. fiscal revenue by about $700 billion; the third is to serve as a diplomatic and negotiation tool.

But from the current perspective, the devastating blow seems to have already been dealt. Under the so-called fairness ambition of the United States, the global trade war has intensified. How it will evolve in the future has become a topic of global concern. Consultations and negotiations are expected to continue. In addition to my country's powerful counterattack, different voices have also emerged within the EU, and other Asian countries generally do not have a tough attitude. Overall, the tariff rate will not increase further, but will be reduced when the consultations are in agreement, thus achieving a balanced state.

On the other hand, the reciprocal tariffs are not about the tariffs themselves, the market is more concerned about the impact on the US recession. The first is inflation. According to the research of the New York Federal Reserve, US imported goods account for 28% of the consumption scale. Every 10% increase in the import tariff rate will affect the short-term inflation by 0.4 percentage points. According to this theory, in the short-term scenario, due to the substantial increase in import tariffs, short-term inflation is inevitable. Research institutions generally estimate that the new tariff policy will push up the US price level by 1-2.5%. However, due to the characteristics of tariffs showing "whoever is weak pays the bill", consumer demand is also showing a downward trend, especially for non-essential consumer goods. From the perspective of the path, inflation will rise first and then fall.

In addition to inflation, there is the economic impact. The Budget Lab estimates that the new tariff policy from 2025 to date has dragged down the US real GDP by -0.7%. The Tax Foundation estimates that Trump's new tariff policy will drag down the US GDP growth rate by about -0.87% in 2025. JPMorgan Chase has raised its forecast for a US recession in 2025 from 40% to 60%.

Unlike the reciprocal tariffs just proposed last week, recession expectations are becoming a global consensus, and recession plus inflation puts the Federal Reserve under great pressure. Overnight interest rate swap data shows that the market currently expects a 125 basis point rate cut by the end of the year, equivalent to five 25 basis point rate cuts, while last week, traders generally expected only three rate cuts. According to CME Fed Watch, the probability of a rate cut in May has risen to 57%. Trump also added fuel to the fire for the Federal Reserve. Yesterday, he said on the social platform Truth Social that "oil prices have fallen, interest rates have fallen, food prices have fallen, and there is no inflation", and reiterated that the "slow-moving" Federal Reserve should cut interest rates.

If this path is followed, the Fed is very likely to resume rate cuts in May to ease market panic and further become the last person to save the market. Overall, although there is a suspicion of killing one thousand enemies and hurting eight hundred of its own, with the support of a healthy and strong private sector balance sheet, the reciprocal tariffs will bring short-term sharp fluctuations, but with the progress of negotiations and the start of the rate cut cycle, the probability of triggering a long-term recession in the United States is not as high as imagined.

Looking at the global stock market, many countries have already started to take action to save the market. my country's national team Central Huijin entered the market and increased its holdings of 50.5 billion yuan of ETFs in a single day, saving the market from individual stocks to indexes. Japan and South Korea have taken frequent actions. After the opening of today's market, the Japanese and South Korean stock markets opened higher across the board. It is enough to see that yesterday's epic plunge was more of an emotional panic than a real recession.

The false news can also confirm this conclusion. Last night, CNBC reported that Trump was considering suspending tariffs for 90 days. After this news, all stock indexes quickly rebounded within seven minutes, and Bitcoin also rebounded to $80,000. However, even after White House Press Secretary Carolyn Levitt called it "fake news", the rise fell back, but the market did not fall further, and initially showed certain bottom characteristics. In this sense, the global financial market may rebound today.

The crypto market has already shown a similar trend. Although the crypto market has rebounded across the board, Bitcoin has returned to $80,000. Although the altcoin market is still tragic, Ethereum has risen above $1,500 again, and SOL has also rebounded to $110. Judging from yesterday's trading data, most holders remain on the sidelines, and the trading volume is not high. The reason for risk aversion seems to be greater than the selling pressure. In this context, if the tariffs are mediated, it is highly likely that the asset will stop falling and rise. After all, the 7-minute rebound has shown the interest of funds in the gold pit target. However, whether the reversal can be truly completed, as the saying goes, we must pay attention to recession and interest rate cuts, and the Fed's rescue is the core.

However, traders have very different views on how the market will go in the future. @AnnaEconomist believes that there is still room for this round of selling to go down because there is no possibility of "Federal Reserve support" or "Trump support". She believes that the Fed pays more attention to hard data, while Powell cares about his historical positioning. Therefore, the Fed will not easily rescue the market and must wait for clearer inflation signals. @Cato_CryptoM believes that the specific final version of Trump's reciprocal tariffs is on the 9th, so before the 9th, it is more of a negotiation period. It is too early to define the overall magnitude of this tariff and its impact on the economy at this time, let alone whether Trump will be impeached. The Kobeissi Letter analysis shows that if April 9 approaches and no trade agreement is reached between China and the United States, market sentiment may collapse again. Market sentiment is polarized, and panic has reached the level of March 2020, which means more volatility in the future.

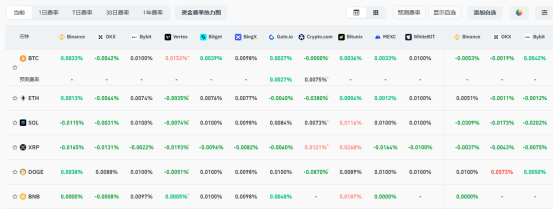

Technical traders seem to be more pessimistic. @market_beggar said the overall trend is downward, and @YSI_crypto also agreed that a slow rebound in the downward trend will only lead to a more drastic drop, saying that the price of Bitcoin may reach $66,000-72,000. At present, according to Coinglass data, the funding rates of mainstream CEX and DEX show that the market is bearish across the board.

As things stand, April 9 is just around the corner, and it is obviously unlikely to reach a complex agreement in a short period of time. US Treasury Secretary Scott Bessent also said that it is unlikely that a trade agreement will be reached before April 9. However, the United States is not a monolithic entity. In addition to Musk, Trump's right-hand man, who dissuaded reciprocal tariffs, Republican members were also pushed by donors to advise the president. Of course, Trump still showed a very firm attitude.

In this context, the Fed is facing a lot of pressure from both inside and outside. Fed President Goolsbee said calmly that Fed policymakers are feeling anxious. On Thursday, the Fed will release the minutes of its March monetary policy meeting, which may provide more clues. Whether the market will experience another roller coaster ride remains to be seen.