Author: Luke, Mars Finance

From peak to trough: a year of extremes

Looking back to the spring of 2024, the Bitcoin ecosystem was like a dazzling supernova. The rise of the BRC-20 token standard, relying on the inscription craze of the Ordinals protocol, ignited the market's enthusiasm. Inscriptions - the innovation of embedding unique data directly into Bitcoin's smallest unit, the "satoshi" - made on-chain activities take off like a rocket. The prices of tokens such as ORDI skyrocketed, and some assets doubled or even multiplied their market value in just a few weeks. Projects such as SATS and RATS also joined the carnival, bringing astonishing returns. Bitcoin on-chain transaction volume surged, gas fees soared, and miners' income rose. This is a golden moment, where innovation, speculation and enthusiasm intertwined, as if heralding a new era for Bitcoin - not only as digital gold, but also as a vibrant decentralized finance (DeFi) platform.

However, the craze in the crypto world is often short-lived. By mid-2024, the narrative of the Bitcoin ecosystem has fallen from heaven to the bottom. The prices of those tokens that once soared - ORDI, SATS, etc. - plummeted, retracing more than 95% from their highs. On-chain activity has shrunk sharply, inscription transaction volume has continued to decline, and the pace of new project releases has slowed to a near standstill. Community sentiment has turned from high to low, the long-awaited airdrop has been disappointing, and the Runes protocol - the highly anticipated evolution of BRC-20 - has cooled rapidly after a brief craze. By early 2025, the Bitcoin ecosystem is no longer the darling of the market, but has become a "reverse indicator" of sector rotation, symbolizing unrealized potential and investor fatigue.

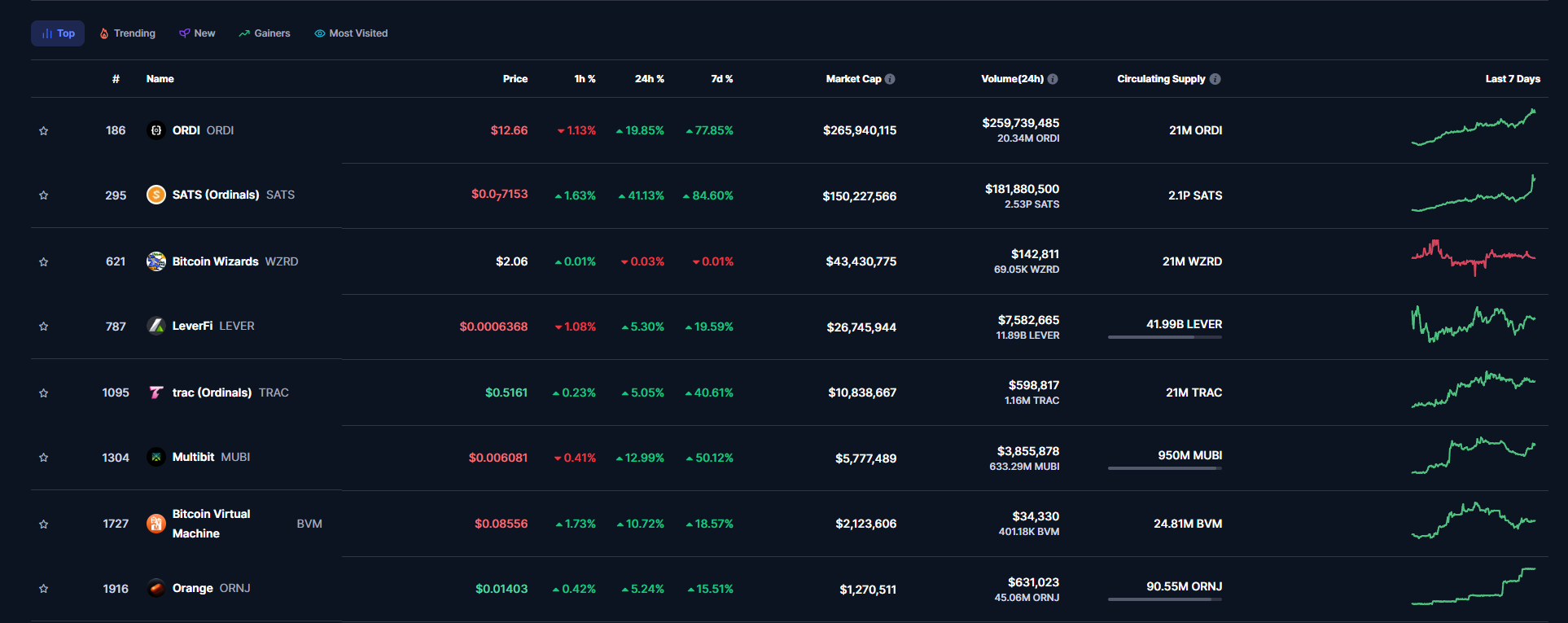

At this time of depression, the Bitcoin ecosystem suddenly rejuvenated in the past week. ORDI soared nearly 97% in six days, PUPS became the vanguard of the rebound with a 127% increase, and SATS almost doubled from its low point this year, up 87%. Tokens such as NALS, BANK, and BounceBit (BB) rose between 40% and 80% per week, and mainstream assets such as BRC-20 and Runes collectively ushered in a recovery. The inflow of funds on the chain has increased significantly, and the market's attention has once again focused on this long-dormant field. Is this a short-lived flash of light, or the starting point of a greater recovery? To answer this question, we need to analyze the driving force of the rebound, the structural dilemma of the ecosystem, and the conditions required for a lasting revival.

The logic of the rebound: sentiment repair and capital rotation

Market Style Switch: The Forsaken Strikes Back

The crypto market has always been known for its cyclicality. This rebound in the Bitcoin ecosystem perfectly fits the classic logic of "low-expectation reversal". After a year of continuous selling, the valuations of most tokens in the ecosystem have been compressed to the extreme. Head assets such as ORDI and SATS have fallen more than 90% from their highs and are regarded by the market as abandoned children with "no trading logic". However, it is in this mood of despair that the spark of rebound often ignites quietly.

The trigger for this wave of market movement came largely from the switching of market styles. Ethereum previously rebounded 50% amid huge doubts from the community, proving the explosive power of undervalued assets when sentiment reverses. This phenomenon encourages funds to flow to sectors with lower valuations and more adequate corrections, and the Bitcoin ecosystem, which has been neglected by the market for a long time, has become a natural rotation target. Since these tokens have low liquidity and historically low valuations, a small amount of buying can trigger drastic price fluctuations, creating amazing short-term elasticity.

Speculative carnival: the charm of marginal assets

Another driver of the rebound is the inherent speculative nature of the crypto market. Compared with the steady trend of blue-chip assets such as Bitcoin and Ethereum, niche tokens such as PUPS and BSSB attract short-term funds with high volatility. These projects often rely on niche protocols or meme narratives, lack solid fundamentals, but become a paradise for speculators due to their high-risk and high-return characteristics. PUPS's recent 127% increase is an example: a little-known token quickly became the focus of capital chasing by igniting market sentiment. This phenomenon is not new in the crypto market, but it explains why the Bitcoin ecosystem - with a large number of low-market-cap tokens - can become a hot spot for speculation in a short period of time.

The recovery of on-chain data

On-chain data also adds evidence to the rebound. The trading volume of BRC-20 and Runes tokens showed signs of stabilization after months of decline, and the scale of capital inflows into related protocols has rebounded. Although it is far from returning to the peak in 2024, this trend shows that some investors are retesting the waters, perhaps attracted by the potential of undervalued assets. As the vane of the ecosystem, ORDI and SATS have further strengthened market confidence and led to a wider return of funds.

The lingering shadow: the structural dilemma of ecology

Although the recent rally is exciting, a sober look shows that this is more of a sentiment-driven correction than a signal of a fundamental reversal. Deep-seated problems in the Bitcoin ecosystem remain, limiting its potential for sustained performance.

Development progress stalled

The core dilemma of the Bitcoin ecosystem is slow progress. Since the Ordinals protocol set off the inscription craze in 2023, the vision of "Bitcoin native DeFi" has been exciting, but the actual delivery has been lackluster. Although the BRC-20 standard has triggered a craze, its design is rough and transaction efficiency is low, resulting in network congestion without bringing real functional breakthroughs. The Runes protocol was highly anticipated when it was launched in April 2024, and once accounted for more than 60% of Bitcoin's on-chain transactions, but the complex distribution mechanism and poor user experience caused its popularity to quickly fade, and currently the transaction share is only in the single digits.

Developer activity—a key indicator of ecosystem health—is also declining. The frequency of GitHub updates for multiple core projects has dropped significantly, and the technical community is far less vibrant than Ethereum or Solana. Bitcoin's architecture is centered around security and simplicity, which limits its programmability, which has discouraged developers accustomed to Ethereum's flexibility. Without a strong developer base, it will be difficult for the ecosystem to transform from a speculative playground to a functional platform.

Protocol Splits and Heat Dissipates

The Bitcoin ecosystem also faces the problem of protocol fragmentation. BRC-20, Runes, Ordinals, and emerging standards such as BRC-2.0 and Alkanes compete with each other, distracting liquidity and user attention. This division weakens the network effect of the ecosystem and hinders long-term growth. The launch of Runes briefly ignited the market, but its complexity and inefficiency led to user loss. BRC-2.0, which will be launched on the test network in the first quarter of 2025, promises to bring smart contract functions, but its actual effect remains to be verified.

Community sentiment is also low. The poor airdrop effect and slow project progress have turned many investors from excitement to disappointment. On social media, discussions about ORDI and SATS have turned from bullish to cautious or even indifferent. The difference in token preferences between the Eastern and Western markets - ORDI is more popular in Asia, DOG and others are more appealing in the West - has further exacerbated the division of the community and weakened cohesion.

The unsolved mystery of Layer 2

Bitcoin's Layer 2 (L2) solution is seen as the key to expanding DeFi functionality, but it is currently underperforming. Over the past year, more than 25 L2 and sidechain projects have emerged, but most are idle, lacking mature products and user bases. Projects such as BitcoinOS and B² Network have locked up $110 million in DeFi assets in 2024 through zero-knowledge proof technology, but are still uncompetitive compared to Ethereum's Rollup ecosystem. If L2s fail to provide compelling use cases, they may become empty shells, further shaking market confidence.

The road ahead: the hope and challenges of rejuvenation

Can the Bitcoin ecosystem’s rebound evolve into a long-term trend? The answer depends on whether it can solve structural problems and deliver on its long-term promise. Here are the key elements for a resurgence.

Product landing: from vision to reality

The biggest shortcoming of the ecosystem is the lack of practical products. To achieve the goal of "Bitcoin native DeFi", developers need to build functional applications such as decentralized exchanges, yield farming protocols or stablecoin systems to compete with the Ethereum ecosystem. BitcoinOS's smart contract exploration and BRC-2.0's simplified token creation are both potential breakthroughs. But these projects must move from concept to actual implementation to attract users and funds.

Developer Revitalization

It is crucial to rekindle developer enthusiasm. Bitcoin's simplicity is both its strength and its limitation. Advances in zero-knowledge proofs and Rollup technology show that scalability and programmability are not mutually exclusive. Funding programs for projects such as Lightchain Protocol AI may encourage developers to return, but they need to be accompanied by better tools and documentation to lower the threshold for development. An active developer community not only drives innovation, but also conveys the long-term potential of the ecosystem to the market.

Community cohesion and narrative reshaping

The Bitcoin ecosystem needs a unified narrative to unite the community. The current competition between BRC-20 and Runes and the division between the Eastern and Western markets have weakened its appeal. A narrative focusing on Bitcoin as a secure foundation for DeFi and real-world assets (RWA) may rekindle enthusiasm. Community-driven meme activities - such as the revival of Dogecoin - can also help, but they need to be backed by real progress to avoid becoming empty hype.

Capturing market cycles

The crypto market is driven by emotions, and the low valuation of the Bitcoin ecosystem makes it explosive in a bull market. The recent rebound shows that funds are willing to bet on high-risk assets. If the price of Bitcoin continues to rise due to institutional adoption and ETF inflows, the ecosystem token may benefit from the "halo effect". The continued rise in the next few weeks will be key, and whether skeptics can be turned into believers depends on the continuation of market momentum.