TL,DR

In terms of macroeconomics, in March 2025, the United States will show a marginal decline in inflation, employment resilience, but intensified policy differences. Core inflation pressure will be partially relieved, the labor market will cool down moderately, the Federal Reserve will maintain a cautious stance, and tariff disturbances will continue to push up market uncertainty. In terms of policy and market game, the Federal Reserve emphasizes the "data-driven" path to balance inflation stickiness and interest rate cut expectations. Capital market volatility has intensified, and U.S. stocks have been under pressure to pull back. The subsequent trend is highly dependent on the implementation effect of tariff policies and the verification of the sustainability of inflation decline.

The overall trading volume of the crypto market continued to decline, with the average daily trading volume falling by 12%. The market activity weakened, and the market value failed to form a clear breakthrough direction. The popular tokens newly launched in March were mainly concentrated in ecological projects and BSC meme tokens. Among them, Mubarak soared due to CZ's Twitter mention, which promoted the continued popularity of BSC meme.

In March, BTC and ETH ETF funds experienced outflows, with BTC ETF outflows of $692 million and ETH ETF outflows of $410 million. At the same time, the stablecoin market continued to grow, with a total inflow of about $2.67 billion in March, mainly from the strong growth of USDC.

BTC rose 4.25% last week and received a net inflow of $744.4 million to the US spot BTC ETF, indicating a rebound in bullish sentiment, but faced strong resistance from the 50-day moving average. Crypto assets such as ETH and Solana also showed signs of rebounding. If they break through key resistance levels, they are expected to rise further, otherwise bears may regain market dominance.

The Trump administration announced that Bitcoin will be included in the U.S. strategic reserve, marking a historic turning point in cryptocurrency regulation and may trigger adjustments to global crypto policies. At the same time, Binance has driven the continued growth of the BNB ecosystem and MEME projects through strong marketing campaigns and innovative features, attracting a large number of users and investors. In addition, Trump-related tokens such as SOL, XRP and ADA may become the focus of future speculation, especially at key nodes related to ETF approval, which may trigger market fluctuations.

1. Macro perspective

In March 2025, the U.S. macro-economy presents a complex pattern of "relaxed inflation, employment resilience, widening policy differences and tariff disturbances". Although core inflation has shown signs of cooling, the overall price level is still high. The labor market remains solid, and although employment growth has slowed slightly, it has not shown signs of fatigue. The Federal Reserve faces more complex policy choices - it must pay attention to the easing of financial conditions and guard against the risk of resurgence of inflation. At the same time, changes in tariff policies continue to disturb market sentiment. Against this background, sentiment in the capital market has fluctuated, uncertainty in the economic outlook remains high, and the market is highly sensitive to key data and the implementation of tariff policies in the coming months.

1. Monetary Policy

The CPI data for February showed that inflation has cooled down, falling to 2.8% year-on-year (previous value: 3.0%, market expectation: 2.9%), and rising by 0.2% month-on-month (lower than the expected 0.3% and 0.5% last month), hitting the lowest growth rate in the past three months, easing market concerns about continued inflation. The core CPI also fell slightly to 3.1%, indicating that the pressure on service prices has eased.

Although the slowdown in inflation leaves room for policy, the Fed still maintains a cautious tone. The minutes of the March FOMC meeting pointed out that the members still have doubts about the "sustainability" of the decline in inflation, emphasizing that "no action should be taken prematurely before there is clearer evidence that inflation will return to the 2% target." The market's expectations for the first rate cut have gradually been brought forward to June, but the Fed still adheres to the "data-driven" stance, and future inflation and employment data remain the core of decision-making.

2. Labor Market

The labor market continues to show resilience. In February, 151,000 new jobs were created, slightly lower than market expectations, but higher than the adjusted 125,000 in January, and the overall employment situation remains solid. Compared with the average monthly increase of 168,000 in the past 12 months, the February data showed that the labor market is cooling moderately, reflecting the marginal slowdown in economic growth in recent times.

3. Inflation

The CPI data for February was lower than expected across the board, with the year-on-year growth rate falling to 2.8% and the core CPI at 3.1%, the lowest in nearly four years. Although overall inflation has fallen, housing costs rose by 0.3%, accounting for nearly half of the CPI increase that month, still supporting inflation. The growth rate has slowed down compared to the 0.4% growth rate last month, indicating that some price pressures are dissipating. The decline in energy and transportation costs is the main driving force behind the decline in core CPI.

Overall, the weaker-than-expected inflation data provides breathing space for the market and the Federal Reserve, and leaves room for responding to a potential inflation rebound caused by tariffs. Although the downward trend is clear, inflation is still "sticky" and the path of interest rate cuts cannot be taken lightly.

4. Capital Markets

Since March, the sentiment of the US stock market has fluctuated. After the release of inflation data, the Nasdaq and S&P 500 rose in the short term, but then the gains were given up, and the overall rebound was weak. As of March 28, the S&P 500 fell 4.4% in the month, and the Nasdaq fell 5.5%. Large technology stocks have seen a significant correction. Changes in tariff policies continue to disturb market sentiment.

Summarize

Overall, the US economy still shows some resilience in the short term, but the risk of nonlinear shocks under the background of limited policy space needs to be vigilant. The Fed's trade-off between fighting inflation and stabilizing growth is becoming increasingly delicate, and the market also needs to be prepared for potential "volatility repricing". If the actual situation after the tariff policy is implemented in early April is slightly better than expected, the US stock market is expected to recover marginally.

2. Crypto Market Overview

Currency data analysis

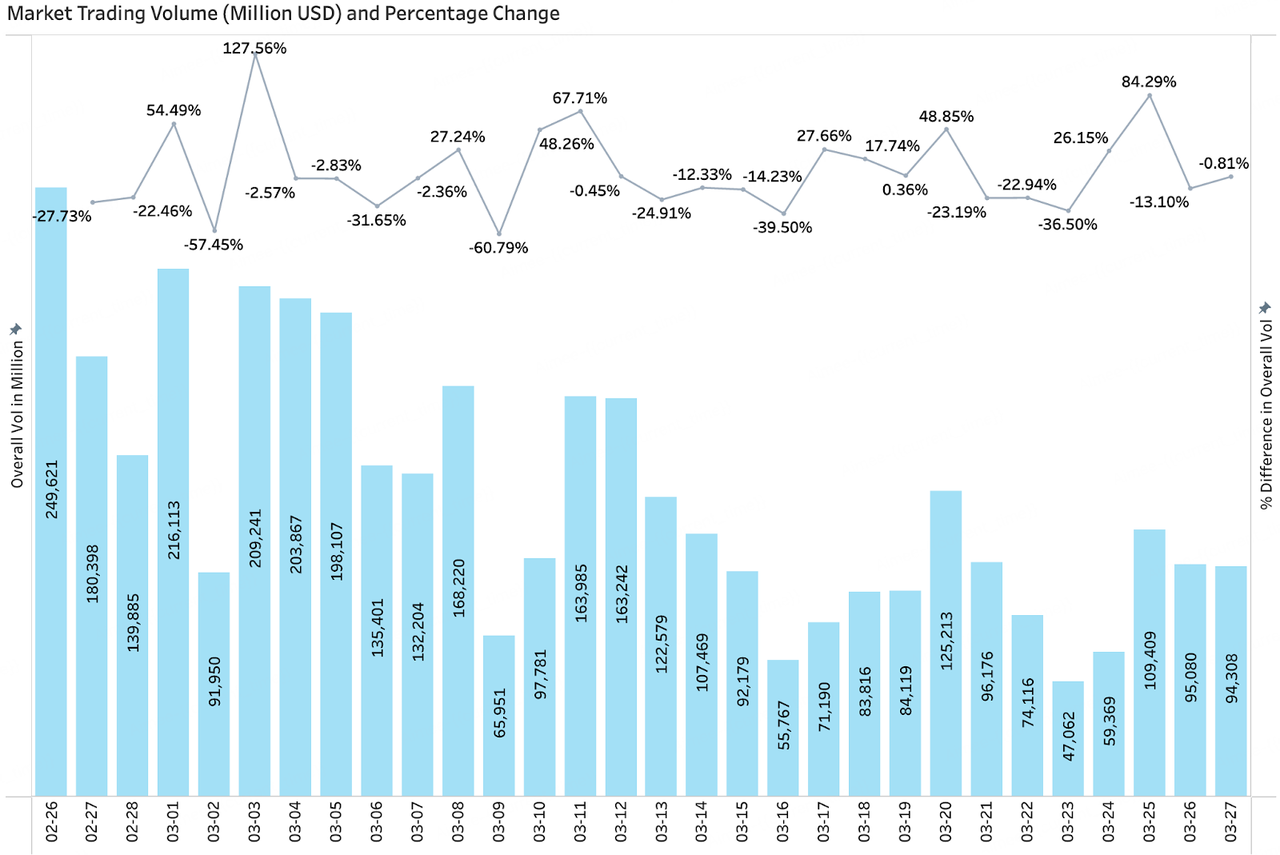

Trading volume & daily growth rate

According to Coingecko data, as of March 27, the overall daily trading volume of the crypto market showed a downward trend, and market activity continued to weaken. The current average daily trading volume is $124.5 billion, down 12% from the previous cycle. There was a short-term capital inflow on March 20, which promoted a rebound in trading volume, but failed to form a sustained growth momentum. Subsequently, the market trading volume remained at a low level.

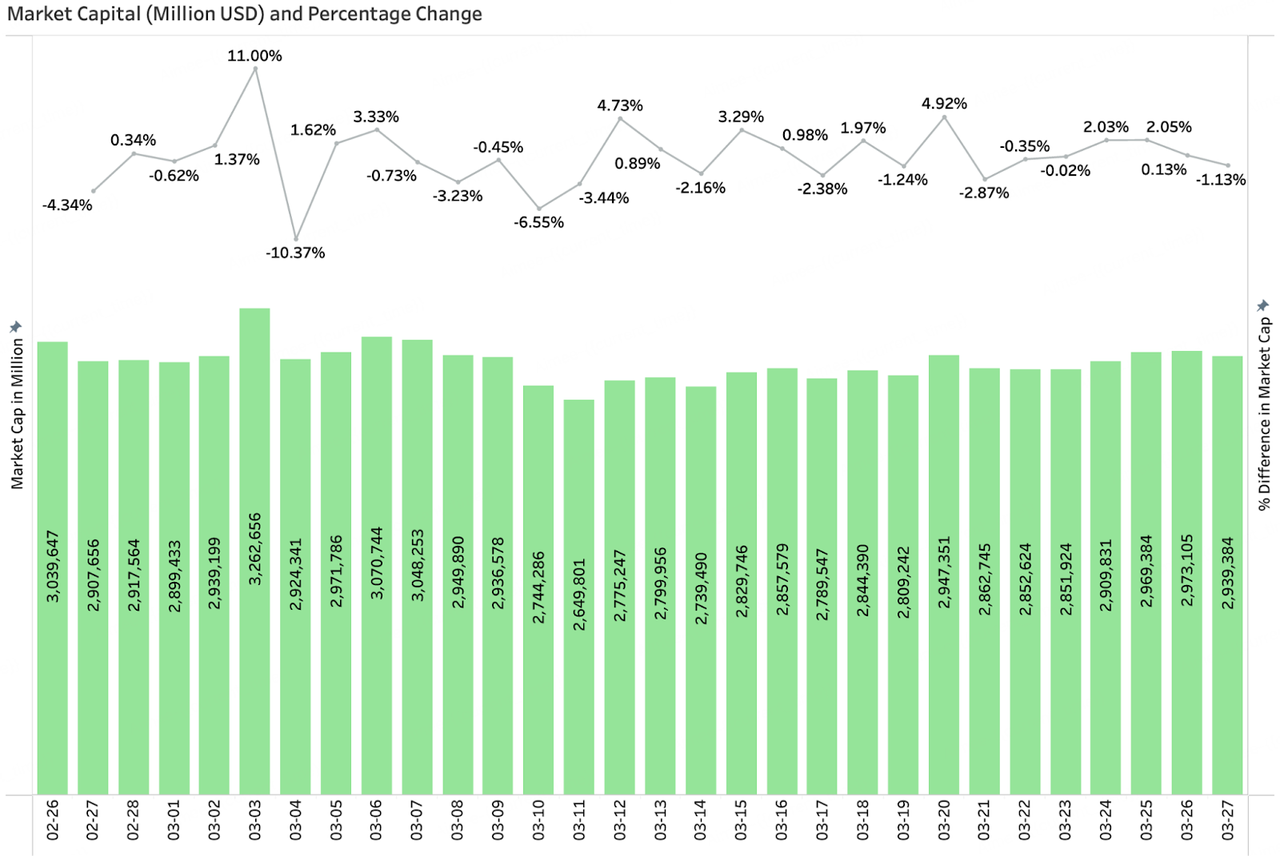

Total market value & daily growth

According to Coingecko data, as of March 27, the total market value of cryptocurrencies was $2.94 trillion, down 4.85% from the previous month. Among them, BTC accounted for 60.8% of the market, ETH accounted for 8.5%, and ETH's market share continued to decline. Overall, the market value fluctuated between $2.7 and $3.2 trillion, and no clear breakthrough direction was formed. In addition, the daily fluctuations in market value were mostly between 1% and 3%, and market sentiment remained cautious.

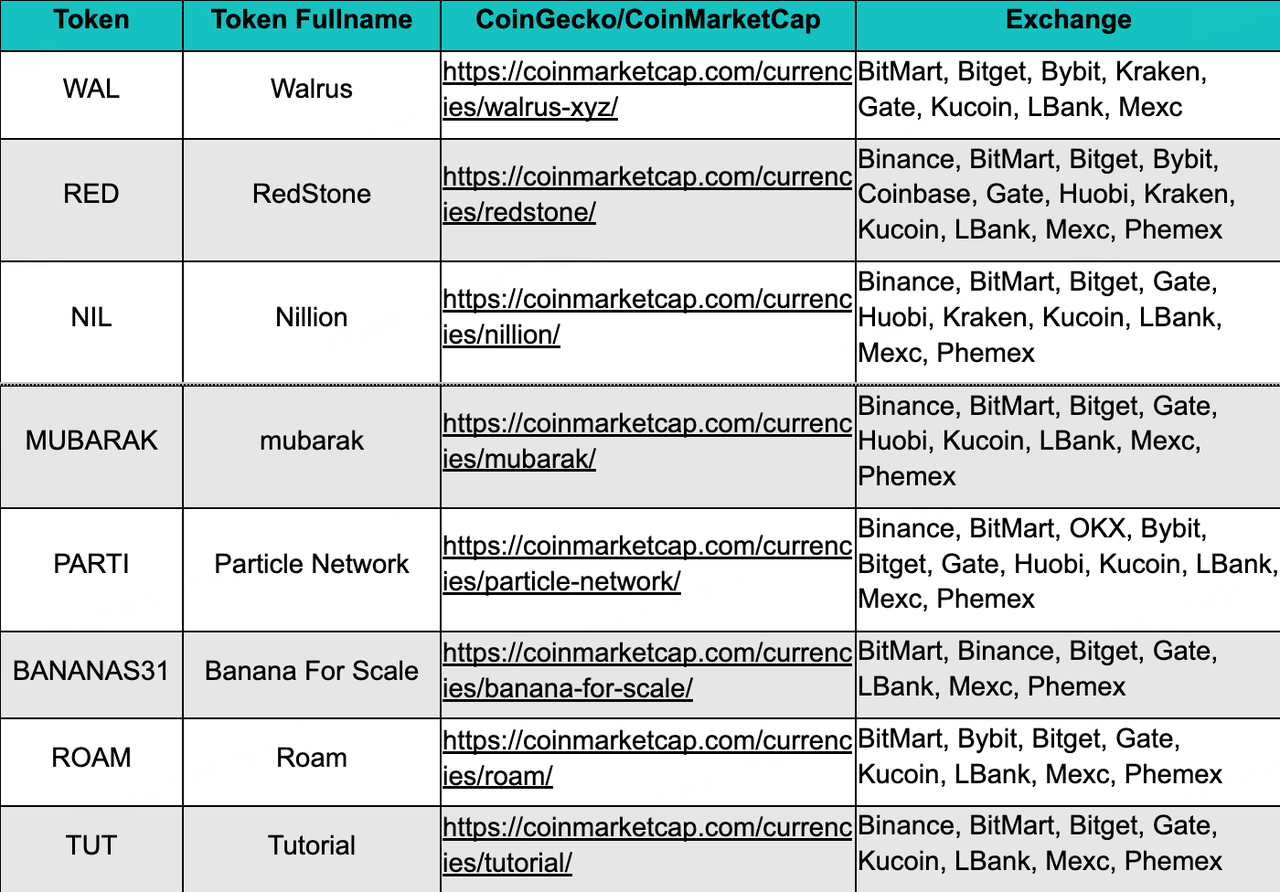

New popular tokens in March

Among the new popular tokens in March, the market focused on ecological projects and BSC meme. After Mubarak skyrocketed due to CZ's repeated mentions on Twitter, it once again started the popularity of BSC meme. The subsequent BSC meme still revolved around the CZ concept or relied on the interaction between CZ and his wife to gain market attention.

3. On-chain data analysis

3.1 Analysis of BTC and ETH ETF inflows and outflows

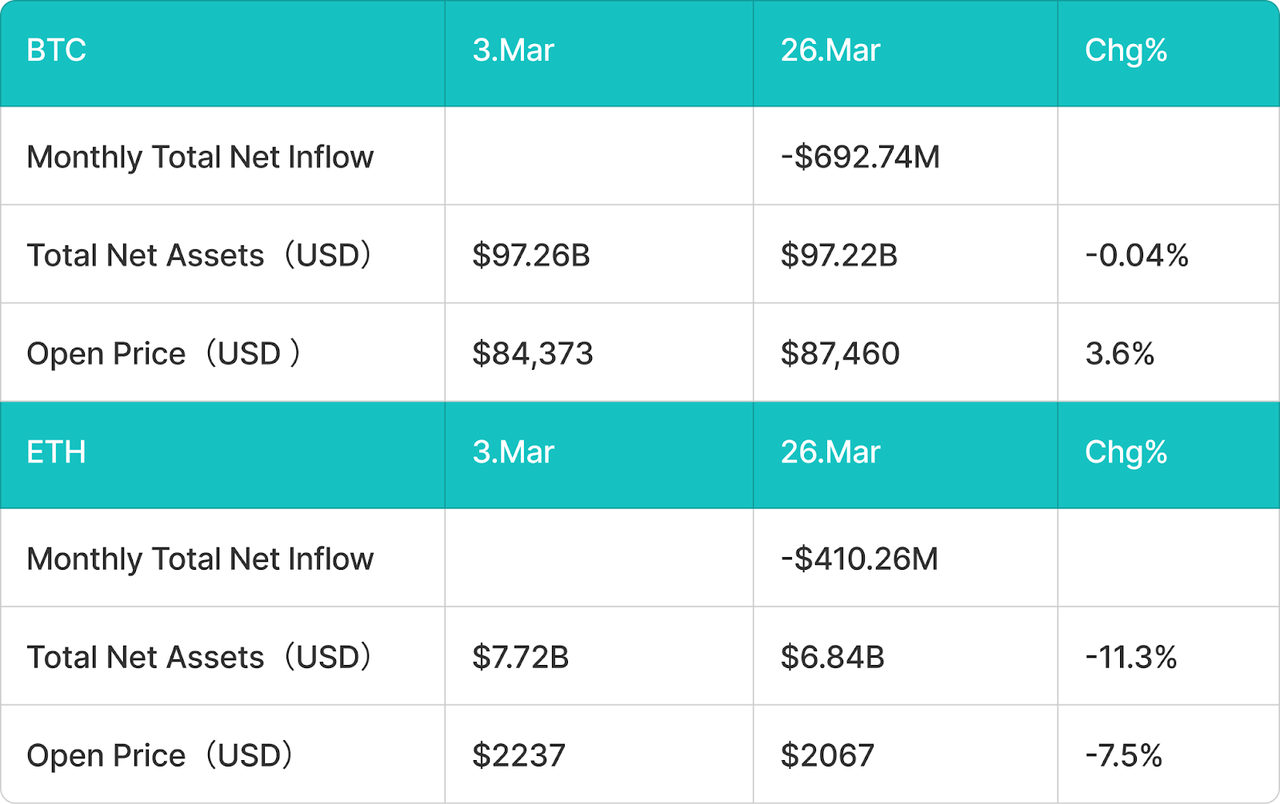

BTC ETF outflows in March - $692 million

In March, the price of BTC rebounded slightly. As of March 26, the price of BTC increased from $84,373 at the beginning of the month to $87,460, an increase of about 3.6%. In March, BTC ETF funds showed outflows, with a total outflow of approximately -692 million US dollars.

ETH ETF outflows in March - $410 million

In March, the price of Ethereum continued to fall. As of March 26, the price of ETH fell from $2237 at the beginning of the month to $2067, a drop of -7.5%. In March, ETH ETF funds showed an outflow, with a total outflow of approximately -410 million US dollars.

3.2 Analysis of Stablecoin Inflow and Outflow

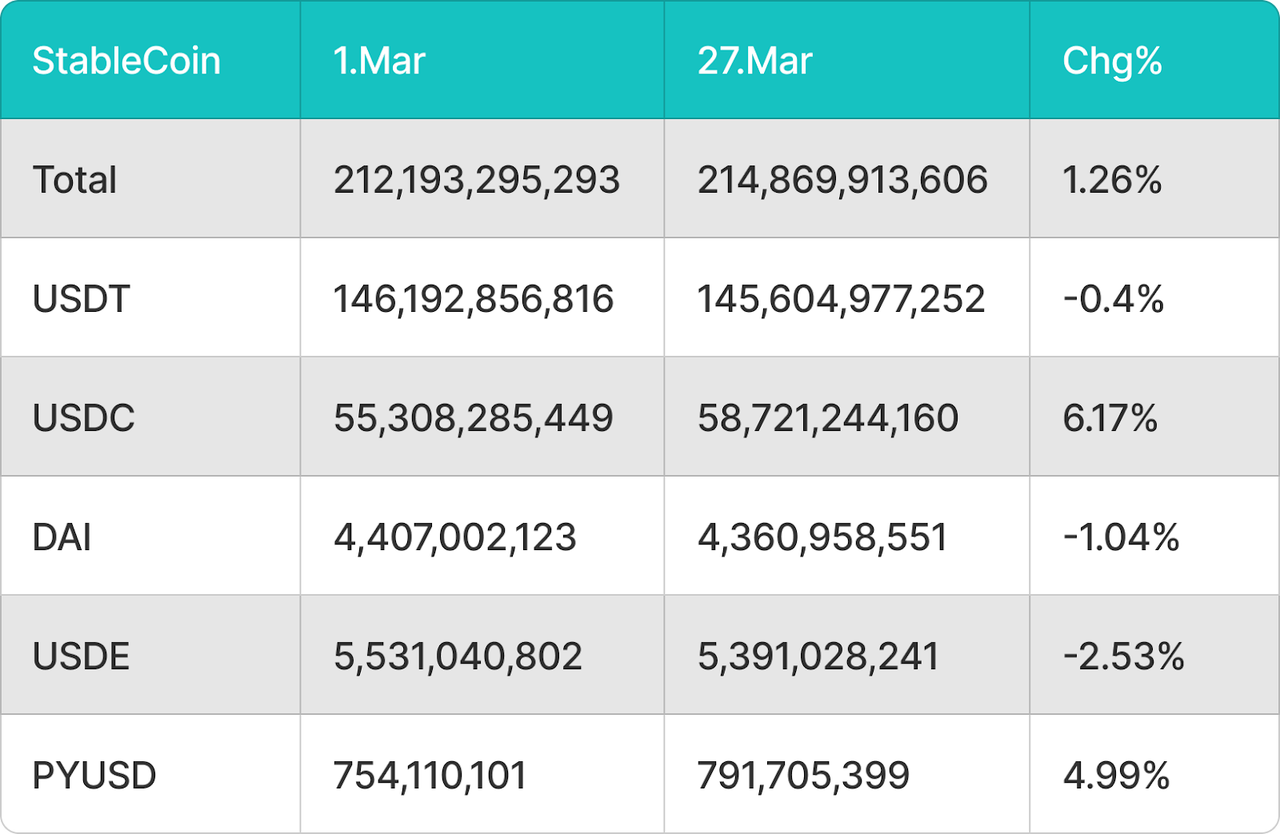

Stablecoin inflows in March were approximately $2.67 billion, mainly from USDC

In March, although the macro and cryptocurrency markets remained sluggish, the stablecoin market continued its strong growth momentum. Among them, USDC became the main driver of growth this month, with the circulation increasing by about 3.41 billion US dollars, accounting for an important share of the expansion of the stablecoin market. On the contrary, the circulation of USDT fell, with a circulation reduction of 597 million US dollars.

4. Price analysis of mainstream currencies

4.1 Analysis of BTC price changes

Bitcoin rose 4.25% last week to close above $86,000, and bulls extended the rally above $88,700 on March 24. Buyers appear to be returning to the market. According to SoSoValue data, U.S. spot Bitcoin ETFs saw net inflows of $744.4 million last week after five consecutive weeks of outflows.

The 20-day EMA has flattened out and the RSI has risen back into positive territory, suggesting that bulls have the upper hand for now. The rally is expected to face strong resistance at the 50-day EMA ($90,290). If the price turns down from the 50-day EMA but finds support at the 20-day EMA, it will be a positive sign and the price could hit $95,000 and move further towards $100,000. On the other hand, if the price turns down from the 50-day EMA and breaks below the 20-day EMA, it means that bears are still active at high levels. Below $83,000, the BTC/USDT pair could drop to $80,000.

4.2 Analysis of ETH price changes

Ethereum bulls are once again trying to push the price above the 20-day moving average ($2,057) and the critical breakout level of $2,111. If successful, it will indicate that the market has rejected the breakdown below $2,111 and the ETH/USDT pair may move up to the 50-day moving average ($2,356) and further challenge $2,550.

Time is running out for bears. To maintain their advantage, they must hold the $2,111 level and quickly push the price below $1,750 to resume the decline and test the $1,550 support level.

4.3 Analysis of SOL price changes

Solana broke above the 20-day EMA ($135) on March 24, which shows that bulls are attempting a counterattack. If the price can sustain above the 20-day EMA, the SOL/USDT trading pair could climb to the 50-day EMA ($158). The bears will try to frustrate the rebound at the 50-day EMA, but if the bulls break through this resistance, a further surge to $180 is possible, which would revalidate the large range of $110-260.

Conversely, if the price turns down from the current levels or from the 50-day SMA, it will suggest that the bears are still selling on rallies. The bears will start a fresh decline only if the price sinks below the $120-110 support zone.

5. Hot events of this month

5.1 The United States includes Bitcoin in its national strategic reserves

In March 2025, the Trump administration promoted major changes in the cryptocurrency field, announced that Bitcoin (BTC) would be included in the U.S. National Strategic Reserve, and signed the "Digital Assets Executive Order" to establish a digital assets working group in response to the Biden administration's strict regulatory policies, aiming to build the United States into the "global cryptocurrency capital". The plan triggered a warm response from the market, and Bitcoin broke through $95,000. Subsequently, Trump announced that 200,000 bitcoins confiscated by the federal government would be used as strategic reserves, managed by the Treasury Department, and promised never to sell them. However, the White House Cryptocurrency Summit held on March 7 failed to release substantive policies, causing market sentiment to turn to disappointment and Bitcoin prices to fall by 3%. Although the United States did not directly purchase Bitcoin in the short term, Trump's policy marked a historic turning point in U.S. crypto regulation, promoted crypto assets to obtain the status of legal financial instruments, and prompted other countries around the world such as Japan, Russia and China to reassess their cryptocurrency reserve strategies. Trump's move may trigger adjustments to crypto policies around the world and have a profound impact on the geopolitical competition landscape.

5.2 BNB Ecosystem MEME Craze Continues

In March 2025, Binance founders CZ and He Yi once again promoted the rapid growth of the BNB ecosystem through high-traffic, strong narrative marketing activities. The event began when Abu Dhabi technology investment company MGX invested $2 billion in Binance, setting a record for the highest single investment amount in the crypto industry to date. After that, Binance officially released a tweet on X, with a cartoon image wearing a Middle Eastern headscarf. CZ forwarded the tweet with the text "Mubarak". The word "Mubarak" carries a deep cultural and religious meaning in Arabic. It is widely used in names, holiday greetings and daily expressions to convey blessings and good wishes. The subsequent interaction of CZ and the launch of Binance contracts also prompted the market value of Mubarak tokens to exceed US$220 million. In the next few days, CZ and He Yi drove multiple BNB chain MEME projects through high-frequency interactions and forwarding of secondary creations about Binance. For example, Palu, mentioned in the organizational chart of the Binance Exchange posted by Binance Chinese X account, once exceeded US$70 million after He Yi's interaction. The content of CZ and He Yi's tweets has shifted significantly from original personal expressions to systematic market guidance, and every tweet can become an important indicator of market sentiment.

In addition, Binance continues to create market heat by launching new features and new activities. The Binance Alpha 2.0 function allows users to purchase Binance Alpha projects directly through the Binance app with zero handling fees. This move lowers the threshold for users to participate in BNB MEME transactions and optimizes the trading experience. Binance Web3 Wallet and Panckaeswap's exclusive IEO activities, with high returns, attract users to invest funds in Binance Wallet to achieve on-chain asset drainage. Binance's community voting mechanism for listing and delisting coins attracts users' attention by giving community users a certain degree of decision-making participation rights.

6. Outlook for next month

6.1 Progress of Bitcoin Reserve Bills in Various States of the United States

Since President Trump signed the Bitcoin bill, U.S. states have made significant progress in promoting Bitcoin-related legislation. As of March 2025, more than 20 states have proposed or are considering Bitcoin reserve bills, covering aspects such as public fund allocation, tax incentives, and regulatory frameworks. The passage of these bills will enable states to invest part of their public funds in digital assets such as Bitcoin, with total investments expected to exceed $23 billion. On March 6, the Texas Senate passed the Strategic Bitcoin Reserve Act by 25 votes to 5. The bill still needs to be passed by the House of Representatives and signed by the governor to become law. On March 25, the Oklahoma House of Representatives passed the Strategic Bitcoin Reserve Act by 77 votes to 15, which allows up to 10% of public funds to be invested in Bitcoin or digital assets with a market value of more than $500 billion. Oklahoma has thus become another state to pass such a bill in one chamber after Texas, Arizona, and Utah. However, not all states' Bitcoin reserve bills have been passed smoothly. For example, relevant bills in Wyoming, South Dakota, and North Dakota were rejected due to concerns about the compatibility of digital assets with the traditional financial system. In addition, the attitude of the governor also had a significant impact on the passage of the bill.

Overall, Trump's signing of the Bitcoin Act provides policy support and demonstration effects for the states, inspiring state legislatures to actively promote the Bitcoin Reserve Act. However, the passage of the bill is still affected by factors such as the political environment, financial situation and public opinion of each state. As more states review and vote on the Bitcoin Reserve Act, it is expected that more states will join the ranks of Bitcoin reserves, further promoting the growth and development of the United States in the field of digital assets.

6.2 Expected speculation on Trump-related tokens such as SOL, XRP, and ADA

Trump-related crypto assets are mainly divided into two categories: US strategic reserve assets and WLFI (World Liberty Financial)-related assets. US strategic reserve assets are projects that Trump personally supports to be included in the national asset reserve, which has a high political symbolism. WLFI is a DeFi project supported by Trump and his family, which holds a large number of altcoins and plans to launch WLFI asset reserves. Although at present, tokens such as SOL, XRP and ADA are likely to become the focus of Trump's attention during his term, they may attract attention through continuous hype and event promotion, especially at key nodes related to ETF approval.

Assets related to WLFI, such as TRX, ONDO, MOVE, ENA, LINK, and AAVE, have small market capitalizations and are highly volatile, showing a high degree of speculation. The dynamics of WLFI holdings often trigger violent fluctuations in the prices of these tokens, so the further development of such assets may become the focus of the future market.