In April 2025, the Trump administration's tariff stick once again shocked the global market. U.S. stocks plummeted, crypto assets were bleeding, Bitcoin fell more than 10% in two days, Ethereum once plunged 20%, and the 24-hour liquidation amount reached 1.6 billion U.S. dollars. Investors were panicked and turned their attention to the Federal Reserve, expecting it to cut interest rates to save the market. However, the silence of the Federal Reserve is disturbing: where is the critical point of interest rate cuts? Under the double pressure of inflation concerns and economic pressure, when will the Federal Reserve loosen its policy? This is not only a data game, but also a contest between market confidence and macro game.

Historical Mirror: The Trigger Code for Rate Cuts

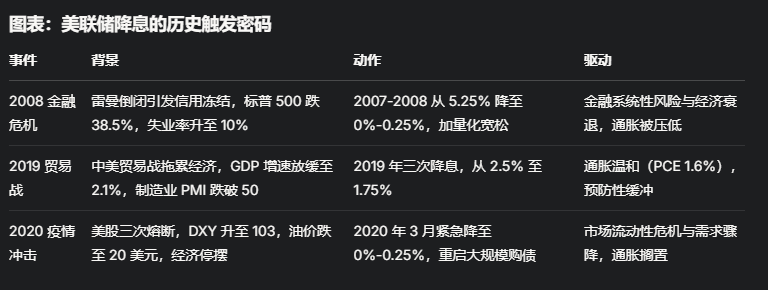

The Fed's interest rate cut decision is never a random move, but a well-thought-out choice in times of crisis or economic inflection. Looking back at the key moments in recent years, we can extract the triggering logic of interest rate cuts from historical scripts, which can provide a reference for the current tariff crisis. The following is a detailed analysis of three iconic interest rate cuts, revealing the environment and motivations behind them.

2008 Financial Crisis

- Emergency rescue of systemic collapse Background : In September 2008, the collapse of Lehman Brothers ignited the global financial tsunami, and the subprime mortgage crisis exposed the fragility of the US real estate bubble. The interbank credit market froze, the S&P 500 fell 38.5% throughout the year, and the Dow Jones Index plunged 18% in October. The unemployment rate surged from 5% at the beginning of the year to 7.3% at the end of the year, and climbed to a peak of 10% in the following year. The VIX panic index soared to more than 80, and the US dollar LIBOR-OIS spread soared from 10 basis points to 364 basis points, indicating that interbank trust was almost collapsed.

- Interest rate cuts : The Federal Reserve first cut interest rates by 50 basis points in September 2007, from 5.25% to 4.75%. It then accelerated its actions in 2008, cutting interest rates twice in October by a total of 100 basis points, and in December it further lowered interest rates to an ultra-low range of 0%-0.25%. At the same time, it launched quantitative easing (QE) to inject trillions of dollars of liquidity into the market.

- Trigger code : financial systemic risk (bank failure, credit freeze) and economic recession (continuous negative GDP growth). Inflation pressure was quickly covered up at the beginning of the crisis, and core PCE fell from 2.3% to 1.9%, making room for interest rate cuts. The Federal Reserve prioritizes financial stability and employment, and interest rates "returning to zero" have become inevitable.

Trade Wars in 2019

- Background of the buffer strategy for preventive interest rate cuts : From 2018 to 2019, the Sino-US trade war intensified, the United States imposed tariffs on Chinese goods, and the global supply chain was under pressure. The US GDP growth rate slowed from 2.9% in 2018 to 2.1% in mid-2019, and the manufacturing PMI fell below 50 to 47.8, indicating a contraction in economic activity. The S&P 500 fell 19% at the end of 2018, and the 10-year and 2-year US Treasury yield curves inverted, issuing a recession warning. Corporate investment confidence declined, but the unemployment rate remained stable at a low of 3.5%.

- Interest rate cuts : In July 2019, the Federal Reserve cut interest rates by 25 basis points, from 2.25%-2.5% to 2%-2.25%. In September and October, the Fed cut interest rates by another 25 basis points each, ultimately reducing them to 1.5%-1.75%, a total reduction of 75 basis points for the whole year.

- Trigger code : signs of economic slowdown (shrinking manufacturing, declining investment) and global uncertainty (trade war), rather than a full-scale recession. Mild inflation, core PCE maintained at around 1.6%, below the 2% target, provides room for preventive rate cuts. The Fed intends to cushion external shocks and avoid a hard landing of the economy.

Impact of the 2020 Pandemic

- Decisive intervention in liquidity crisis Background : In March 2020, the COVID-19 pandemic spread globally. The U.S. stock market was halted three times on March 9, 12, and 16. The S&P 500 experienced its largest daily decline of 9.5%, and the VIX panic index soared to 75.47. The U.S. dollar liquidity crisis emerged, and investors sold assets for cash. DXY rose sharply from 94.5 to 103, a three-year high. Crude oil prices collapsed, WTI fell below $20, and the global economy faced the risk of shutdown.

- Interest rate cuts : On March 3, 2020, the Federal Reserve urgently cut interest rates by 50 basis points to 1%-1.25%; on March 15, it again urgently cut interest rates by 100 basis points to 0%-0.25%, and restarted large-scale QE, with the scale of bond purchases rapidly expanding to hundreds of billions of dollars.

- Trigger code : Financial market liquidity is exhausted (US Treasury bond selling, credit market freeze) and the risk of economic shutdown (lockdown measures lead to a sharp drop in demand). Inflation was ignored in the early stages of the crisis, with core PCE falling from 1.8% to 1.3%. The Federal Reserve prioritized stabilizing the market and preventing a systemic collapse.

These cases reveal that the Fed’s interest rate cuts usually revolve around three core conditions:

- Low inflation may be manageable : Inflation was pushed down by the crisis in 2008 and 2020, and inflation was below target in 2019, paving the way for interest rate cuts.

- The economy is under significant pressure : Whether it is a recession (2008), a slowdown (2019), or a shutdown (2020), economic weakness is the key driver.

- Financial market collapse : Systemic risks such as credit freeze (2008) and liquidity crisis (2020) forced the Federal Reserve to take decisive action.

Current dilemma: the tug-of-war between inflation and turbulence

On April 7, 2025, the global market fell into panic due to Trump's tariff policy. U.S. technology stocks plummeted, and the S&P 500 fell by more than 4.7% during the session. The crypto market also fell. However, Fed Chairman Powell expressed calmness last Friday: "The economy is still in good shape, and we will not rush to respond to market turmoil." The core PCE inflation rate remained at 2.8%, above the 2% target, and tariffs may further push up prices, which casts a shadow on the prospect of interest rate cuts.

At the same time, market signals are exacerbating tensions. According to Tradingview data, the bond volatility index (MOVE Index) broke through 137 points on April 8, hitting a "seven-day winning streak" and approaching the 140-point "critical line" predicted by Arthur Hayes. Hayes once warned: "If the MOVE Index rises, leveraged Treasury and corporate bond traders will be forced to sell due to increased margin requirements. This is a market that the Federal Reserve is determined to defend. Breaking through 140 is a signal of post-crash easing." The current index is only one step away from this threshold, suggesting that pressure in the bond market is accumulating.

Goldman Sachs analyst Lindsay Matcham pointed out that the widening of credit spreads may be another trigger for the Fed to take action. If the high-yield bond spread rises to 500 basis points, corporate financing difficulties and a weak job market may emerge one after another, forcing Powell to turn to easing as he did in 2018. At present, the high-yield bond spread has reached 454 basis points, not far from the warning line, and the market has smelled the breath of risk.

External Voices: Consensus Amid Disagreement

The market has significant differences in its judgment on the timing of the Fed's interest rate cut. BlackRock CEO Larry Fink, however, poured cold water: "The possibility of the Fed cutting interest rates four or five times this year is zero, and interest rates may rise instead of falling." He believes that Powell's tough attitude is due to the stable non-farm data and inflation concerns, and it is difficult to use up policy "bullets" in the short term. On the other hand, Goldman Sachs predicts that if there is no recession, the Fed may cut interest rates three times in a row from June to 3.5%-3.75%; if a recession is triggered, the reduction may reach 200 basis points.

The Federal Reserve also revealed anxiety. On April 8, Chicago Fed President Goolsbee said: "The hard data of the US economy has performed unprecedentedly well, but tariffs and countermeasures may cause supply chain disruptions and high inflation again, which is worrying." This uncertainty puts policymakers in a dilemma: cutting interest rates may fuel inflation, while waiting and watching may miss the window to rescue the market.

The critical point of interest rate cut: signal and timing

Based on historical experience and current dynamics, the Fed's interest rate cut may require one of the following conditions to emerge:

- Inflation eased: core PCE fell back to 2.2%-2.3%, and the tariff effect proved to be controllable.

- Economic weakness: unemployment rises to 5% or GDP growth slows significantly, and tariff impacts become apparent.

- Financial turmoil intensifies: MOVE Index breaks through 140, or high-yield bond spreads exceed 500 basis points, accompanied by a stock market decline of more than 25%-30%.

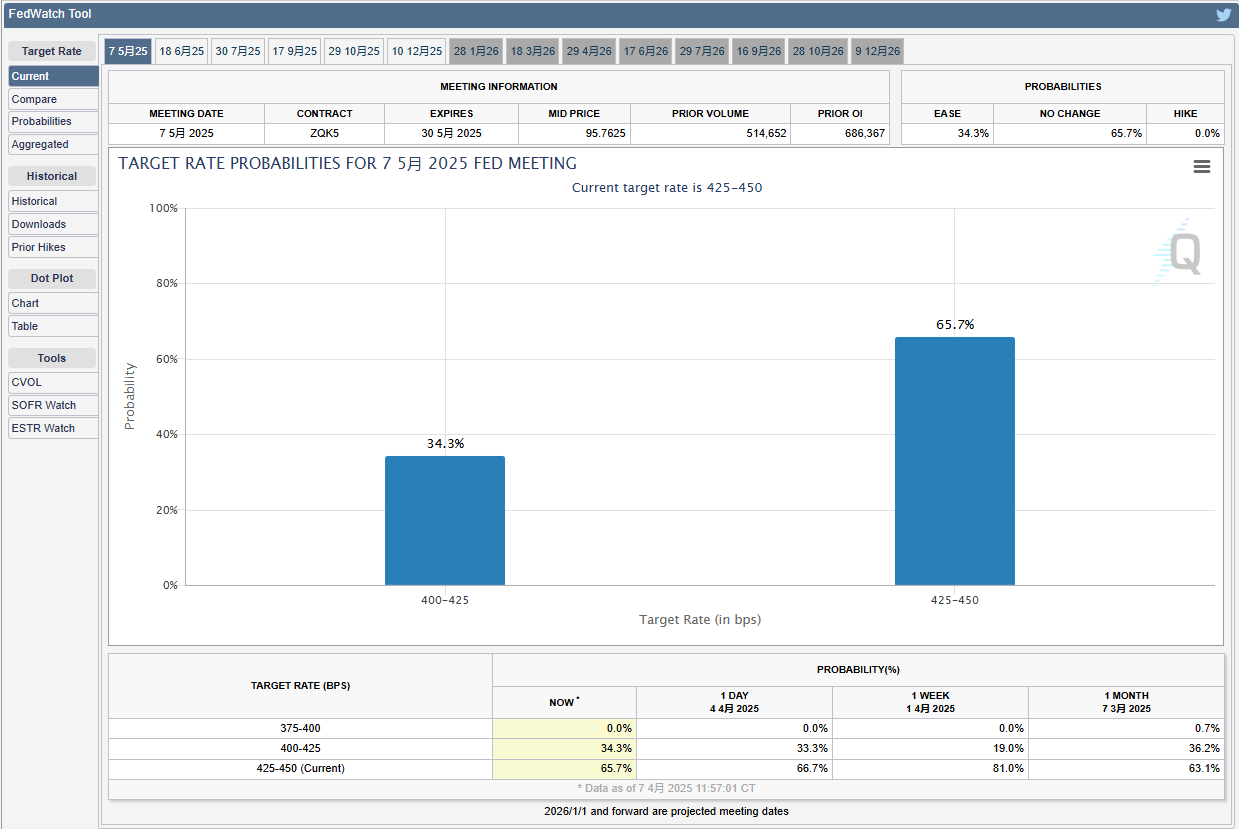

Currently (April 7, 2025), CME's "Fed Watch" shows that the probability of a 25 basis point rate cut in May is 54.6%, and the market expectation is slightly ahead. However, the bond market has not fully priced in a recession, and the 10-year US Treasury yield fluctuates between 4.1% and 4.2%. The liquidity crisis has not yet emerged. The Fed is more likely to use lending tools first rather than immediately cut interest rates.

Future point prediction:

- Short term (May): If the MOVE Index breaks through 140 or the credit spread approaches 500 basis points, coupled with a further decline in the stock market, the Federal Reserve may cut interest rates by 25-50 basis points ahead of schedule.

- Medium term (June-July): The effect of tariffs is evident in the data. If inflation falls and the economy slows down, the probability of a rate cut will increase, with a cumulative reduction of 75-100 basis points.

- Crisis scenario (Q3): If the global trade war escalates and markets fail, the Federal Reserve may urgently cut interest rates and restart QE.

The tariff crisis is like a stress test, testing the patience and bottom line of the Federal Reserve. As Hayes said, bond market volatility may be the "outpost" of interest rate cuts, while the widening of credit spreads may be the "trigger". At present, the market is swinging between fear and expectation, and the Federal Reserve is waiting for clearer signals. History has proven that every plunge is the starting point of reshaping, and this time, the key to interest rate cuts may be hidden in the next jump of the MOVE Index or the critical breakthrough of credit spreads. Investors need to hold their breath, because the storm is far from over.