Since the beginning of 2025, the international gold price has continued to set new historical records, approaching $3,000, with a year-to-date increase of more than 11.7%. However, Bitcoin, known as "digital gold", has performed weakly, continuing to fluctuate downward, and its performance this year is far inferior to that of gold. This rise and fall is not just a simple fluctuation of the prices of the two assets, but also reflects their unique positioning in the market.

Why has the price of gold continued to rise to new highs this year?

From a macro perspective, the global central bank's gold buying spree since Q3 2024, as well as the expectations of re-inflation and risk aversion brought about by Trump's policy uncertainty, are all conducive to the upward trend in gold prices, which is the fundamental support for the rise in gold prices.

However, neither the scarcity of gold nor the central bank's gold purchasing behavior has changed significantly recently. The most direct reason for the recent rapid rise in gold prices comes from the technical level: cross-market arbitrage caused by tariff concerns has given rise to a large amount of gold purchasing demand.

Since Trump's victory, the expectation of tariff policy has intensified, exacerbating the market's concerns about the US's imposition of tariffs on precious metal imports, prompting US traders to rush to "stock up" spot gold, which led to the rise of COMEX gold futures and a large price gap with London gold. According to statistics, the spot gold price in London has been about $20/ounce lower than the New York market this year, and once exceeded $70/ounce at the end of January.

The widening price gap stimulated cross-market spot arbitrage. Arbitrageurs bought physical gold in London and shipped it to New York, while selling an equal amount of gold futures to lock in the price difference. Trump's tariff concerns greatly stimulated market sentiment. American traders and investors continued to buy gold futures to hedge against possible future cost increases out of risk aversion. This strong buying offset the selling pressure of arbitrageurs and even pushed COMEX futures prices higher, ultimately technically driving up gold prices in both places.

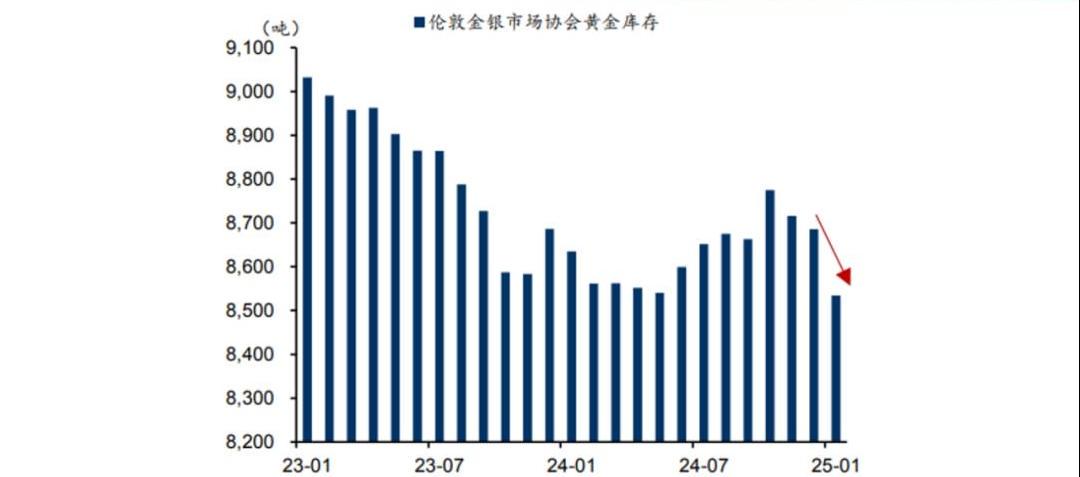

According to Wind data, gold stocks at COMEX (New York Mercantile Exchange) began to increase rapidly from November 7, 2024, from about 17.2 million troy ounces at the beginning of November 2024 to 34.6 million troy ounces at the beginning of February 2025, an increase of more than 101% in three months. In contrast, gold stocks in London have decreased significantly.

The rise in gold prices and the sharp increase in COMEX gold inventories occurred simultaneously

The rise in gold prices and the sharp increase in COMEX gold inventories occurred simultaneously

Why doesn't Bitcoin follow gold?

Bitcoin is regarded as 'digital gold' because of its rapid development in the past decade or so, with its price constantly breaking milestones, and its similarities with gold in terms of scarcity, medium of exchange, inflation hedging and value reserve.

However, according to historical data, the value correlation between Bitcoin and gold is not obvious. When Bitcoin hit record highs in 2017 and 2021, the price of gold was at a staged low. Starting in 2024, the two rose simultaneously due to factors such as the central bank's gold purchases and the approval of the Bitcoin ETF. It can be seen that the correlation between the two is driven by staged events, rather than the inevitable connection of intrinsic value logic. Recently, gold and Bitcoin have also been affected by the uncertainty caused by Trump's tariff policy, but they have indeed taken completely different trends, which once again confirms this point.

This contradiction stems from the differences in the properties of the two: gold's safe-haven function relies on its physical properties and historical consensus, while Bitcoin's digital gold narrative relies more on market sentiment and technical expectations under decades of continuous rise.

However, Bitcoin is not without the safe-haven attribute of "digital gold". When some extreme events occur, such as the rapid depreciation of currencies in some countries such as Turkey, the Middle East conflict, the Russia-Ukraine conflict, etc., BTC has risen a lot, which is a reflection of this safe-haven asset attribute.

The reason behind this is that under the expectation of severe inflation, the common way for ordinary citizens to protect their property is to choose gold hard currency, but the government may strictly control the economy, restrict or even confiscate gold and foreign currency, etc. Only the value and transmission network of Bitcoin do not rely on the government's financial institutions, and it has no physical existence. Ordinary people can take it anywhere without being controlled. Especially in the face of war scenarios, BTC is actually the best asset that is better than gold and strong currencies.

Bitcoin's correlation with U.S. stocks surges

More often, Bitcoin is often classified as a "risk asset", and its price trend shows a significant positive correlation with US stocks, and is often regarded as a large-scale technology stock. This correlation reached its peak in 2021. The two hit historical highs simultaneously and then pulled back. At the end of 2022, they bottomed out and rebounded simultaneously. In 2023, they fluctuated and then rose. In 2024, they rose sharply and pulled back and continued to break new highs. The consistency shown is particularly obvious.

This also reflects the changes in the capital structure of the crypto market: before 2020, the main participants in the market were mainly Chinese money, and the correlation with U.S. stocks was not that high; afterwards, a large number of American institutions began to enter the market, giving the cryptocurrency circle a U.S. stock paradigm. It can be simply assumed that the money in the cryptocurrency circle now is mainly money overflowed from the U.S. stock market.

Although the current Bitcoin price is weak and has failed to set a new record high in sync with gold, this stage of shock adjustment does not mean the end of its highlight moment. On the contrary, it is in a critical period of transformation. Bitcoin is gradually evolving from a high-risk speculative asset to an important part of global asset allocation. The continued buying actions of institutional investors, Trump's crypto-friendly policies, and the active promotion of Bitcoin national reserves have jointly built Bitcoin as an asset allocation option that cannot be ignored by sovereign wealth funds and more large institutional investors.