By Alex Liu, Foresight News

Neutrl, a stablecoin protocol

On April 17, synthetic dollar stablecoin project Neutrl announced the completion of a $5 million seed round of financing, led by digital asset private equity market STIX and venture capital firm Accomplice, with participation from angel investors including Amber Group, SCB Limited, Figment Capital, Nascent, and Ethena founder Guy Young and Joshua Lim, a derivatives trader at Arbelos Markets (recently acquired by FalconX).

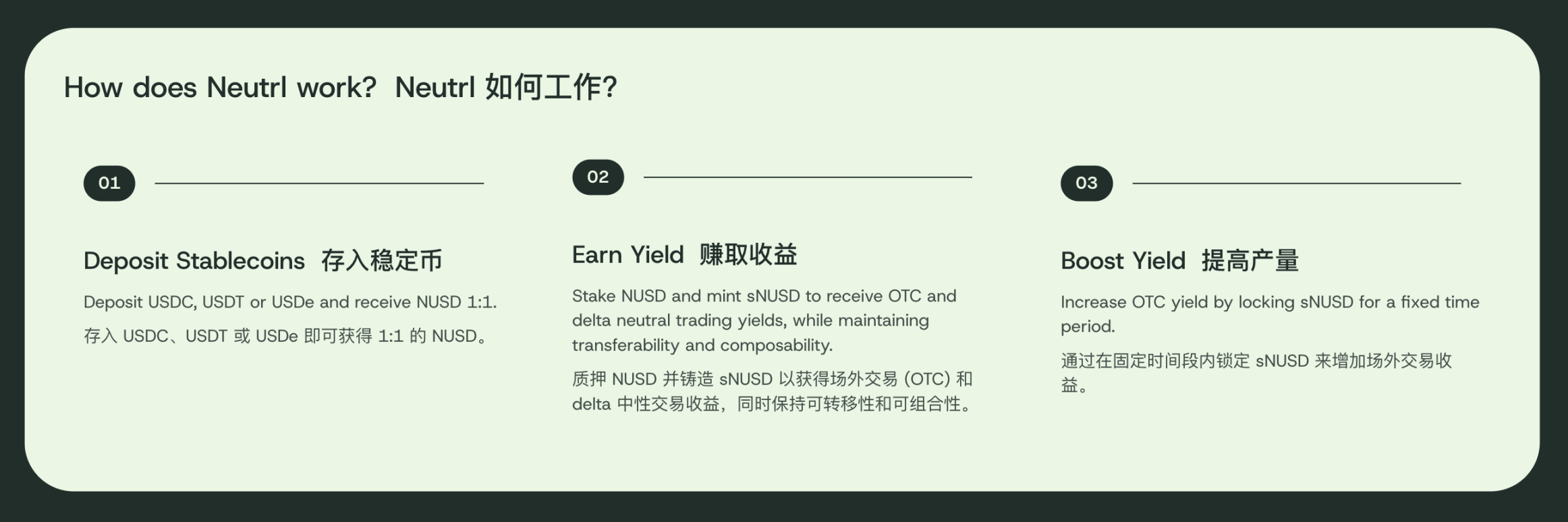

Neutrl's product model is similar to the leader in the field, Ethena, with synthetic stablecoin NUSD anchored 1:1 with the US dollar and interest-bearing asset sNUSD, which correspond to USDe and sUSDe respectively. The difference lies in the source of income. Ethena's income comes from funding rate arbitrage in the crypto perpetual contract market, while Neutrl's income source is more radical: discount arbitrage of OTC tokens.

Source of income: OTC discount arbitrage

VCs (venture capital) and other institutions can obtain project tokens at low valuations that retail investors cannot access, and these tokens will also have more stringent unlocking conditions. Generally speaking, tokens will have a lock-up period of six months to one year and a linear release cycle of two to four years.

Lack of cash flow but the tokens have not been unlocked yet? Afraid that the value of the tokens will drop significantly when they are unlocked? Simply want to cash out as soon as possible and enjoy life in your yacht villa? OTC (Over The Counter) provides such an option: sell the tokens that have not been unlocked at a discount in advance. The discount and the quality of the project are related to the unlocking conditions, but it is usually higher. If a token is unlocked after one year, the current OTC discount may be more than 50%.

Neutrl uses the deposited assets of users to purchase discounted locked VC coins, and at the same time shorts an equal amount of tokens to hedge to achieve neutral risk (returns have nothing to do with token price fluctuations.)

For example, before the collapse of Mantra project token OM, you bought tokens unlocked one year later at a 60% discount, assuming you bought $400,000. At the same time, you used the contract to short $1 million of OM tokens. Without considering the contract funding rate and other complex factors, it is equivalent to locking in $600,000 in profits after one year.

Even if the OM token crashed 90% overnight, the value of the $400,000 worth of tokens bought through OTC is close to zero, but the short position made a profit of $900,000, and the direct closing of the position shortened the profit realization cycle. If OM did not crash, and rose 50% after one year, the short position would lose $500,000, but the unlocked tokens would be worth $1.5 million, so the $600,000 profit would be locked.

Potential risks: Is it a “stablecoin”?

This strategy seems perfect, but there are problems. Why don’t VCs short this part of the position to hedge themselves, but choose to sell it at a discount?

First, it is not ruled out that some VCs do operate in this way. But the reality is that VCs are usually required to disclose to LPs and investors which projects they have invested in and the purpose of the funds. Investment institutions may lose their goodwill by shorting their positions. Secondly, VCs may own more than 10% of the tokens of a project, and the contract market cannot bear such a large amount of short selling, so they can only choose to sell at a discount.

Moreover, such a strategy faces two major risks: abnormal funding rates and sharp increases in token prices.

In terms of funding rates: if there are too many short sellers, short sellers will continue to pay funding rates to long sellers. In extreme cases where the negative rate is fully reached, the funding rate for one day may be as high as 10% of the principal. For an OTC lock-up period of one or even four years, the funding rate paid may be higher than the income from the OTC discount. Of course, if it is in the context of a bull market, positive rates can also bring additional income.

If the token price rises sharply, more than doubles, you need "unlimited margin" to hold on until the OTC token is unlocked to realize the profit. Otherwise, the short position will be liquidated midway, and the token price will fall again afterwards, leaving only the actual loss of the short position. Not everyone can short to the smooth decline of "W" and "MOVE". If you short "TIA" and it is liquidated midway, it will not be worth it in the end.

in conclusion

Behind Neutrl is a high-risk strategic arbitrage. They may be more professional than ordinary investors in risk management, but the potential risks cannot be ignored.

This high-risk arbitrage fund absorbs user deposits in the name of stablecoins, which seems inappropriate and needs to emphasize risks more. However, Ethena is essentially an arbitrage fund in the shell of stablecoins. Without Ethena and Neutrl, retail investors will hardly have the opportunity to access the strategic returns behind them. This can be regarded as an innovation and progress in the CeDeFi field, opening up more income options for users.

Neutrl has not yet been officially launched. You can go to the official website to submit a waitlist to apply for early access.