Author: Jianguang Shen, Chief Economist of JD.com; Taihui Zhu, Senior Research Director of JD.com

Introduction

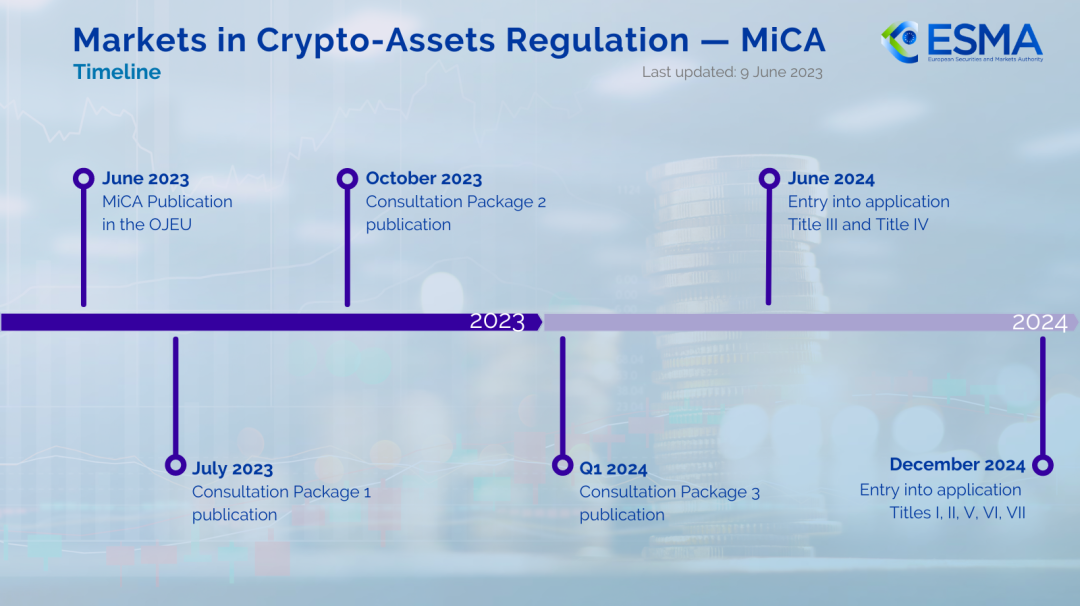

In June 2023, the European Union officially released the "Markets in Crypto-Assets Act" (MiCA), which will come into full effect on December 30, 2024. It applies to the 27 EU member states and another three European Economic Area countries (Norway, Iceland, and Liechtenstein). It solves the fragmentation and regulatory arbitrage problems in crypto asset regulation in the EU and European Economic Area countries, and is the world's most widely applicable cryptocurrency regulatory law.

In accordance with the idea of classified supervision, MiCA has made detailed provisions on the definition and use of crypto assets, the access permits for crypto asset issuers and service providers, the operation and management of crypto asset issuers and service providers, the reserve and redemption management of crypto asset issuers, and the anti-money laundering supervision of crypto asset trading activities. It is the most comprehensive crypto asset regulatory law in the world to date.

MiCA has seen the role of crypto asset development in improving financial service efficiency, improving financial inclusion and promoting economic growth, and has also paid attention to the challenges that crypto asset development brings to the operation of the payment system, the stability of the financial system and the transmission of monetary policy (monetary sovereignty), and has taken a balanced path between supporting financial innovation and fair competition, and maintaining financial stability and consumer rights. Starting from 2025, as MiCA gradually takes effect in European countries, it will greatly promote the compliance development of the global crypto asset market, and will also lead the formulation of crypto asset regulatory policies in other countries and the construction of a global governance coordination system.

1. Classify and define crypto assets and clarify usage and trading requirements

1. In terms of asset definition, MiCA divides regulated crypto assets into three categories

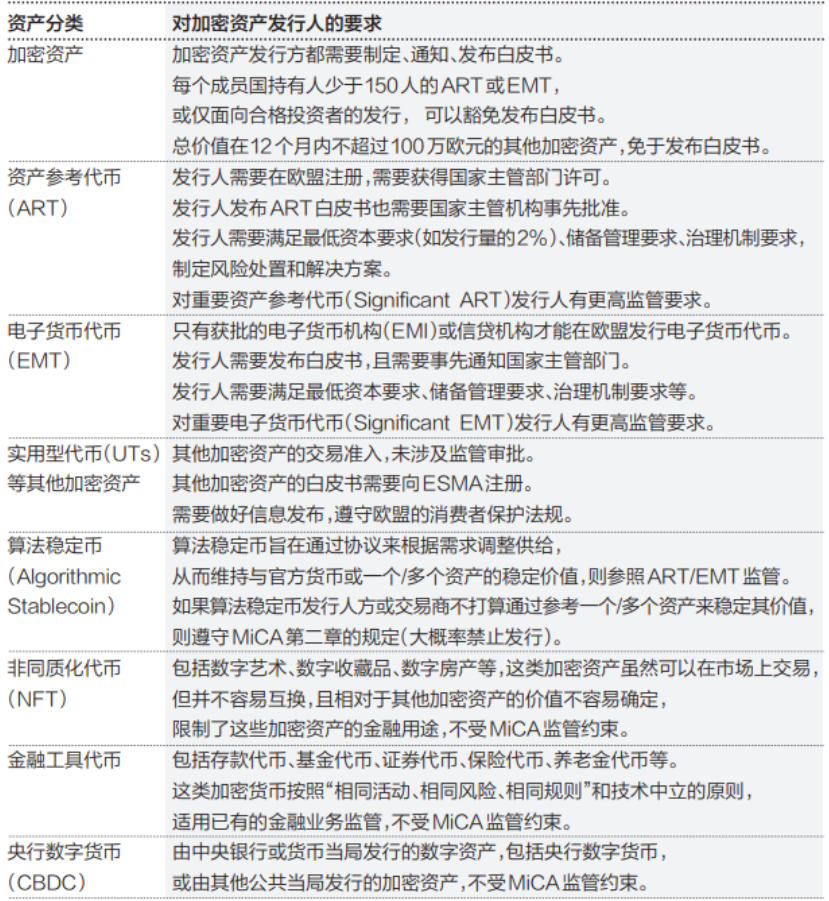

Depending on whether the crypto assets attempt to stabilize their value by referring to other assets, MiCA divides the regulated crypto assets into three categories: Electronic Money Tokens (EMT), Asset-Referenced Tokens (ART), "Utility Tokens" (UTs) and other crypto assets, while fully decentralized crypto assets are not regulated by MiCA.

Among them, EMT maintains the value of assets by referring to an official currency (i.e., a stablecoin backed by fiat currency) and is a means of payment. The issuer of EMT is prohibited from paying interest on EMT (including compensation, discounts, etc., similar to domestic requirements for non-bank payments).

ART maintains a stable value by reference to another value or right or a combination of the two, including one or more values or rights, commodities, legal tender or crypto assets. It is a means of transaction and an investment tool. Issuers and service providers should not pay interest to holders related to the length of time ART is held when providing services related to ART.

The difference between EMT and fiat-currency-backed ART lies in the claim right. EMT holders can and have the right to redeem EMT at face value at any time, while the redemption time and redemption value of ART holders are not so strongly guaranteed.

Other crypto assets such as UTs provide digital access to a certain good or service, are provided on distributed ledger technology, and are only accepted by the issuer of the token. They have non-financial purposes related to the operation of digital platforms and digital services and are a specific type of crypto asset. In addition, non-fungible tokens (NFTs) and central bank digital currencies (CBDCs) are not within the regulatory scope of MiCA, and security tokens are not regulated by MiCA, but are regulated in accordance with securities regulations.

Table 1: MiCA’s regulatory requirements for crypto assets and their issuers

2. In terms of usage and trading, daily trading volume of crypto assets and usage limits of foreign currency stablecoins are set

MiCA requires that the daily trading volume of a single ART or EMT shall not exceed 5 million euros, and when the market value of ART or EMT exceeds 500 million euros, the issuer must report to the regulator and take additional compliance measures.

MiCA allows the use of EMT (stablecoins) for cryptocurrency transactions and decentralized finance (DeFi) activities, but places different restrictions on the use of EMT for payment of goods and services. Only euro stablecoins can be used for daily payment of goods and services to protect the monetary sovereignty of the EU and prevent the development of foreign currency stablecoins from affecting the EU monetary system.

In addition, MiCA has also imposed strict restrictions on the daily usage of ART. When the daily usage in the single currency area exceeds 1 million transactions or the transaction amount is 200 million euros (quarterly average), the issuance of ART must be stopped.

2. Clarify the licensing requirements for crypto asset issuers and service providers, and implement categorized supervision

1. Implement different access and licensing requirements for the issuance of different types of crypto assets

MiCA believes that ART may be widely used by holders to transfer value or as a means of exchange. In order to protect the interests of holders (especially retail holders) and market integrity, it has put forward stricter requirements for ART issuers.

MiCA clarifies the access authorization requirements for ART issuers: ART issuers must be established as legal entities in the EU, must first obtain authorization from the designated regulatory authority in their home country, and such assets must be traded on crypto asset trading platforms. However, access authorization can be exempted in cases where the ART issuer is already a credit institution, the outstanding ART is less than 5 million euros, and the ART is issued to qualified investors.

MiCA requires EMT issuers to be authorized as credit institutions or electronic money institutions and comply with the requirements of the Electronic Money Directive (EMD2) on electronic money institutions. In cases where the amount of EMT does not exceed 5 million euros, EMT issuers can also obtain access authorization exemptions, but they need to publish a white paper in accordance with regulations.

For issuers of crypto assets other than ART and EMT, MiCA’s requirements mainly focus on disclosure rules, but the white papers of these crypto assets need to be registered with the European Securities and Markets Authority (ESMA).

2. Clarify the scope of crypto asset services and licensing requirements for crypto asset service providers

MiCA defines the scope of crypto asset services relatively broadly, mainly covering the following ten business activities: providing custody and management of crypto assets on behalf of clients, operating crypto asset trading platforms, exchanging crypto assets for legal currencies, exchanging crypto assets for other crypto assets, executing crypto asset orders on behalf of clients, placing crypto investments, receiving and transmitting crypto asset orders on behalf of clients, providing advice on crypto assets, providing crypto asset portfolio management, and providing crypto asset transfer services on behalf of clients.

On this basis, MiCA will classify any individual or entity that provides crypto asset services in a commercial manner as a crypto asset service provider (CASP). Service providers that intend to provide crypto asset services need to register their offices in one of the EU member states and apply for CASP authorization from the competent authority of the member state where their registered office is located. It should be noted that crypto asset services provided in a completely decentralized manner without any intermediaries are not within the scope of MiCA supervision.

3. Clarify the operating requirements for crypto asset issuers and service providers, with capital supervision being the focus

1. Capital supervision is the top priority for the operation and supervision of crypto asset issuers

MiCA has made clear requirements on information disclosure and honest operation, corporate governance mechanism, internal control mechanism, risk management procedures, reserve asset management and redemption of ART issuers, and requires all types of crypto asset issuers to publish white papers (except UT and small cryptocurrencies). For EMT issuers, they need to meet the operating supervision requirements of electronic currency and payment instrument institutions.

At the same time, in order to cope with the impact that the widespread issuance of ART may have on the stability of the financial system, MiCA has put forward specific capital requirements for ART issuers (essentially following the principle of proportionality with the scale of ART issuance), requiring them to always have at least the higher of the following amounts of own funds: one is 350,000 euros, two is 2% of the average amount of reserve assets/issued tokens as described in Article 32 of MiCA, and three is one quarter of the fixed indirect costs of the previous year (if the ART issuer is a credit institution, it shall comply with the capital regulatory requirements of the credit institution); the capital requirement for EMT issuers is not less than 2% of the scale of EMT issuance and circulation, and must also meet the capital regulatory requirements of credit institutions or electronic money institutions.

In addition, MiCA also refers to the supervision of "systemically important financial institutions" to evaluate whether ART and EMT are "important crypto assets" in terms of the number of customers, market capitalization, transaction size, and correlation with the traditional financial system, and imposes additional risks and equity requirements on issuers of important crypto assets.

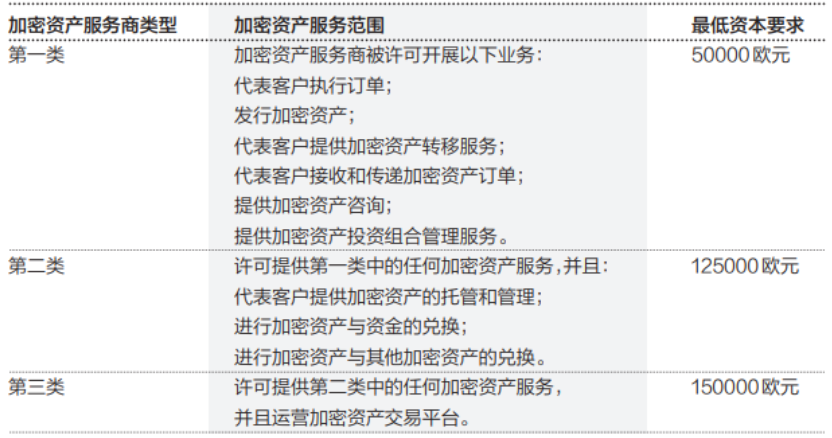

2. Implement differentiated regulatory requirements for crypto asset service providers of different scopes

MiCA sets differentiated minimum capital requirements for different types of crypto asset service providers, which are implemented at no less than the following standards or one-quarter of the fixed management expenses of the previous year: trading platforms need to maintain a minimum permanent capital (own capital) of 150,000 euros; crypto asset custodians and brokers need to maintain a minimum permanent capital of 125,000 euros; CASPs providing other services need to hold a minimum permanent capital of 50,000 euros, and regulatory requirements are reviewed annually.

At the same time, MiCA also puts forward targeted regulatory requirements for the implementation of different CASPs. For example, MiCA requires crypto asset custodians to formulate clear custody policies, regularly communicate asset status to customers, and be responsible for customer asset losses caused by network attacks/failures, etc. Trading platforms need to implement market manipulation monitoring, public buying and selling prices and trading depth, etc. Trading brokers need to formulate non-discriminatory policies, etc. Advisors and portfolio managers need to evaluate whether to invest in crypto assets based on customer risk tolerance and knowledge.

Table 2: MiCA’s differentiated capital requirements for crypto asset service providers

IV. Strengthen the supervision of the issuer's reserve asset management, with isolated custody and timely redemption as the key points

1. Clear requirements for the custody and investment of reserve assets

In order to protect ART's reserve assets from claims by creditors of the issuer and custodian, MiCA requires that ART's reserve assets are always completely isolated from the issuer's own assets. The issuer must hand over the reserve assets to qualified credit institutions, investment companies or crypto asset service providers for separate custody, and the reserve assets may not be used as collateral or as collateral by the issuer. In the event of a loss, the custodian must return the crypto assets of the same type or value as the lost assets to the ART issuer, unless the custodian can prove that it can be exempted from repayment liability.

When the issuer is unable to fulfill its obligations to the holders due to bankruptcy, the reserve assets should be used first to guarantee the redemption payment to the ART holders. However, MiCA has not yet given specific requirements on the principles for guaranteeing the redemption rights of all holders when the reserve assets cannot guarantee the redemption of all holders at par value.

Regarding the management of EMT's reserve assets, MiCA requires issuers to comply with the safeguard requirements of the EU Electronic Money Directive (EMD2) and the Payment Services Directive (PSD2): reserve assets must not be mixed with the funds of any natural person/legal person other than payment service users at any time; reserve funds should be invested in assets denominated in the same currency as the currency referenced by the electronic money token to avoid cross-currency risks; and if the funds are held by a payment institution and are not used for payment at the end of the next business day, they should be deposited in a separate account of a credit institution or invested in safe, liquid, low-risk assets determined by the competent authorities of the member states of the country; EMT issuers must segregate reserve assets from the claims of other creditors and ensure that EMT holders are paid first in the event of the issuer's bankruptcy.

In addition, MiCA has strict requirements on the investment direction and structure of the reserve assets of crypto asset issuers: general ART and EMT issuers need to deposit 30% of their reserve assets as deposits in credit institutions (banking institutions), and important ART and EMT issuers need to deposit 60% of their reserve assets as deposits in credit institutions.

2. Focus on protecting the holders’ asset redemption rights

For ART, MiCA requires the issuer to establish a liquidity mechanism and formulate an orderly redemption plan for tokens to ensure asset liquidity and customer redemption requirements. If the market price of ART differs greatly from the value of the reserve assets, even if the issuer does not grant this right through the contract, the ART holder still has the right to redeem ART directly from the issuer. However, MiCA did not give specific requirements for the time limit for the holder to redeem the funds for ART, and it is necessary to follow up on the specific implementation requirements of the EU member states.

For EMT, MiCA requires that the issuer must be able to redeem at par at any time, redeem the monetary value of the EMT held in cash or credit transfer, the redemption conditions must be stated in the crypto asset white paper, and redemption should not be charged. If the issuer of the EMT does not meet the redemption request of the EMT holder within 30 days, the holder can turn to the custodian of the EMT assets and/or the distributor acting on behalf of the EMT issuer.

5. Implement strict anti-money laundering supervision of cryptocurrencies and improve the implementation standards of the travel rule

Crypto assets are issued and traded based on blockchain, and are characterized by decentralization, globalization, anonymity, convertibility (convertible into legal currency), and irrevocability of transactions. In addition, the chain bridge technology strengthens the interconnection of different blockchains, making the prevention of money laundering and terrorist financing risks of crypto assets more complicated. MiCA and the relevant EU regulations have made targeted requirements for this.

1. MiCA requires crypto asset transactions to accept comprehensive anti-money laundering regulatory requirements

MiCA attaches great importance to possible illegal and criminal activities in the stablecoin and crypto markets (such as insider trading, market manipulation, etc.), and requires all crypto asset service providers to implement comprehensive anti-money laundering and anti-terrorist financing measures, including strict KYC procedures and transaction monitoring, implement strict customer due diligence (CDD) procedures and monitor suspicious transactions, and report to relevant authorities to prevent money laundering and terrorist financing activities.

Although ART and EMT are tokens that operate on an open system without the need for a direct relationship with the issuer, MiCA still emphasizes that issuers should use chain analysis to understand the use of tokens, allowing issuers to view active wallets holding their tokens in real time, including holder behavior (i.e. exchanges vs. personal wallets, holding period), overall transaction volume across multiple blockchains, and transaction size involving sanctioned entities or jurisdictions, etc., to prevent the use of tokens for illegal activities.

2. MiCA increases anti-money laundering “travel rule” requirements for crypto assets

The Fund Transfer Regulation, which was adopted at the same time as MiCA, provides more targeted requirements for anti-money laundering and anti-terrorist financing actions for crypto assets, requiring crypto asset service providers to provide information about remitters and recipients when transferring crypto assets (i.e., the "travel rule" for anti-money laundering and anti-terrorist financing). Without personal identification information, no amount of cryptocurrency is allowed to be transferred between accounts on its crypto asset service provider (CASP). Compared with the 1,000 euro/dollar threshold set by FATF for the implementation of the "travel rule", the above requirements of the Fund Transfer Regulation are undoubtedly more stringent.

In addition, in December 2024, the European Banking Authority (EBA) officially announced that the EU's "Travel Rule Guidance" will be extended to crypto asset service providers and their intermediaries, with requirements including collecting and reporting information on user transfers of funds or crypto assets, determining whether transactions are related to the purchase of services, and monitoring suspicious crypto asset transactions; crypto service providers and intermediaries need to declare their multiple intermediaries and cross-border transfer policies.

VI. Impact on the development and regulation of global crypto assets

The implementation of MiCA marks the transition of the global crypto asset market from the stage of "free development" to the stage of "compliant competition", which will have an important impact on the structure of the global crypto asset market development, the direction of global crypto asset supervision and the construction of the global crypto asset collaborative governance system.

1. MiCA will promote the standardization and stratification of the development of the global crypto asset market

MiCA implements differentiated licensing access and operational supervision for issuers and service providers of crypto assets based on the differentiation of crypto asset types, and proposes differentiated capital and liquidity requirements for different types of issuers and service providers, providing standardized code of conduct for the business activities of crypto asset market entities.

At the same time, considering that MiCA's regulatory requirements are relatively strict, such as high-standard supervision in terms of segregated custody of reserve assets, minimum capital requirements, anti-money laundering supervision, etc., it increases the compliance costs of operating in the crypto asset market, which is conducive to leading compliant issuers and service providers (such as Circle's USDC) to consolidate market share through licensing barriers, while accelerating the exit of non-compliant crypto asset issuers and service providers.

In addition, MiCA exempts fully decentralized crypto assets from regulation, but decentralized exchanges (DEX) that involve fiat currency exchange or custody services still need to be included in CASP regulation, forcing decentralized crypto asset trading platforms to restrict access to EU users and promote the marginalization of decentralized platforms. For the entire crypto asset market, these will ultimately increase the concentration of the entire market.

2. MiCA will become a “reference system” for the formulation of crypto asset regulatory policies in various countries

Judging from the policy recommendations of international regulatory organizations, in July 2023, the Financial Stability Board (FSB) issued the "High-Level Recommendations on the Regulation of Global Stablecoins" and the "High-Level Recommendations on the Monitoring, Supervision and Regulation of Crypto-Asset Businesses and Markets". The recommendations on the governance framework, risk management, information disclosure, reserve asset management and stablecoin redemption of stablecoin and cryptocurrency issuers and service providers, as well as the regulatory principles of "same activities, same risks, same rules" and technology neutrality are also requirements of MiCA, or the shadow of MiCA rules can be seen in them.

Judging from the regulatory practices of regulatory authorities in various countries, regulators in EU countries will formulate specific implementation policies based on the requirements of MiCA. MiCA's specific requirements on the classification and definition of crypto assets, access supervision and operating requirements for issuers and service providers, upgraded application of anti-money laundering regulatory "implementation rules", and restrictions on other countries' fiat-backed stablecoins in physical transaction payments have also become an important reference for the formulation of cryptocurrency regulatory laws and regulations in non-EU countries such as Singapore and Japan.

In this regard, MiCA has not only started the process of compliance for the development of the global crypto asset market, but also started the process of standardization for the regulation of the global cryptocurrency market. Of course, in this process, it is not ruled out that some countries will lower their regulatory requirements (regulatory competition) to promote the development advantages of their own cryptocurrency markets.

3. The construction of a coordinated global governance system for crypto assets is also expected to be accelerated

Crypto assets are global and cross-border in nature. Compared with traditional banking and financial markets, the crypto asset market is more globalized and more urgently needs to build a global regulatory governance system. Since the second half of 2023, the global stablecoin and cryptocurrency market has entered a rapid development track. According to Triple A's monitoring data, the number of global crypto asset holders exceeded 560 million in 2024, and the total market value of crypto assets has been above US$3 trillion most of the time since 2025. The integration of crypto assets with the traditional financial system and real economy transactions has been rapidly advancing, and the construction of a global cryptocurrency governance system has become more prominent.

At present, global cryptocurrency regulation is still in a fragmented state. International regulatory organizations have not yet issued stablecoin and crypto asset regulatory standards similar to the "Basel Accord", and there is no specific roadmap timetable for the construction of stablecoin and crypto asset regulatory systems in various countries. With the full implementation of MiCA in the EU, the United States is also accelerating the regulatory framework for stablecoins and crypto assets. It is expected that international regulatory organizations such as the FSB will accelerate the research and formulation of unified regulatory standards for global crypto assets and the construction of a collaborative governance mechanism for global cryptocurrencies. The MiCA Act also clearly states that the EU will continue to support the promotion of global collaborative governance of crypto assets and crypto asset services through international organizations or institutions (such as the Financial Stability Board, the Basel Committee on Banking Supervision and the Financial Action Task Force).