1. BTC’s “safe haven” attribute : digital gold narrative and market truth

In April 2025, Bitcoin broke through $95,000 against the trend, but the deviation from the traditional "safe haven asset" gold became more and more obvious.

Correlation contradiction : Bitcoin's correlation with the Nasdaq index rose to 0.5, while its correlation with gold fell to -0.3

Institutional control intensifies : BlackRock IBIT and other Bitcoin ETFs hold more than 1.1 million Bitcoins, accounting for 5.2% of the circulation. MicroStrategy's holdings account for 21.8% of the Bitcoin market value, forming an "oligopoly pricing" pattern.

Safe-haven labeling as a tool : BlackRock CEO Larry Fink claims that Bitcoin is a "safe-haven asset for global pessimism," but in reality it is attracting sovereign fund allocations (such as 2%-5% of assets) to pave the way for ETF inflows

Liquidity siphon effect : Bitcoin ETFs with a net inflow of $1 billion per week can push up prices by 7%-12%, while gold ETFs with a net outflow of $2.3 billion during the same period form a capital migration

2. Institutional Harvesting

Policy rumors pull the market : In March, Bitcoin rose 9% in a single day due to the "Trump Crypto Reserve Plan", and then plummeted 9% due to tariff panic. The whale took the opportunity to complete the high-selling and low-buying

Media cooperates with shipments : After JPMorgan Chase and other institutions released the "safe haven asset" report, BlackRock IBIT's holdings increased simultaneously, forming a closed loop of "research report-fund-price"

Fake order induction : The giant whale "Spoofy" placed and withdrew fake orders at $83,000, creating a false technical breakthrough and triggering retail investors to follow suit with leverage

Volatility harvesting : Institutions take advantage of the implied volatility (IV) peak in the options market to sell straddles for arbitrage, and retail investors become the "fuel" for volatility premium

III. Market structure differentiation: institutional “buying spree” and retail investor “liquidity trap”

Institutional hoarding strategy

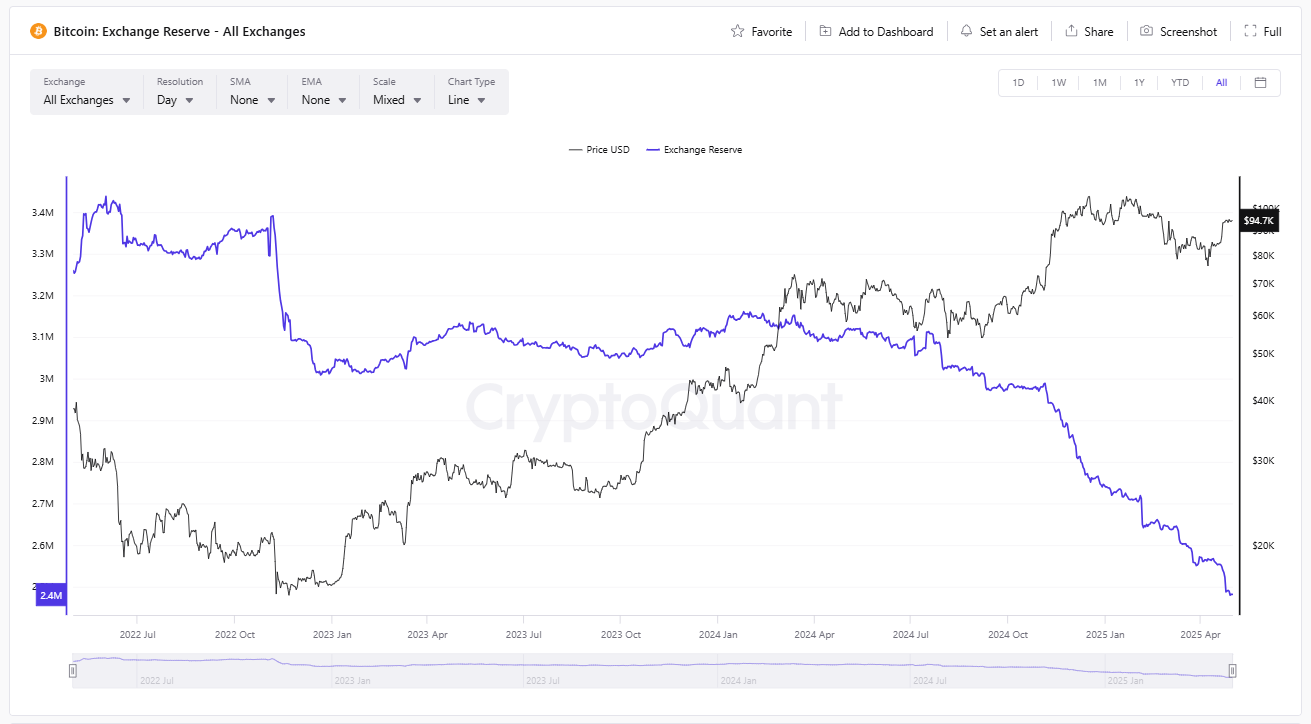

ETF siphon effect: In 2025, institutions purchased 520,000 BTC through ETFs, Fidelity purchased $253 million in a single transaction, and the exchange's BTC reserves decreased by 500,000 year-on-year

Anti-inflation narrative strengthens : Bitcoin's annualized deflation rate is 2.5% vs. the US dollar M2 growth rate of 4.8%, attracting sovereign funds to hedge against currency depreciation risks

The dilemma of retail investors: the collapse of altcoins and reliance on leverage

Altcoin liquidity is drying up : total market value has shrunk 78% from its 2021 peak

High leverage suicide rate : The leverage utilization rate of retail investors exceeds 80%, but only 3% can generate stable profits, and most of them become the "nutrients" of exchange fees and liquidation.

4. Survival Guide for Retail Investors: From FOMO to Rational Defense

Reserve Risk Index : When it is below 0.012 (currently 0.008), it indicates that long-term holders are confident.

Coinbase premium : When institutional buying strength exceeds retail selling pressure, the premium turns positive, indicating a rebound . Derivatives tools are used flexibly

Panic buying signal : When the daily decline of Bitcoin exceeds 8% and the panic greed index is below 30, open positions in batches

Narrative countermeasures : Beware of the institutional interests behind labels such as “safe haven assets” and “digital gold”, and independently verify on-chain data

Bitcoin’s breakthrough of $95,000 is not only a victory for institutional narratives, but also the starting point of a cognitive revolution for retail investors. When “safe haven assets” become a tool for capital manipulation, only by penetrating the label fog, mastering the on-chain language, and building a hedging system can we capture excess returns under the institutional scythe.