In the spring of 2005, the crypto market was in a chill, and the price of Bitcoin fell all the way from $109,000 at the beginning of the year to a low of $75,000.

The sluggish trading volume is accompanied by market fluctuations. Various tracks have been shut down one after another, the sector effect has disappeared, and only sporadic currency movements have captured the market's short-term attention.

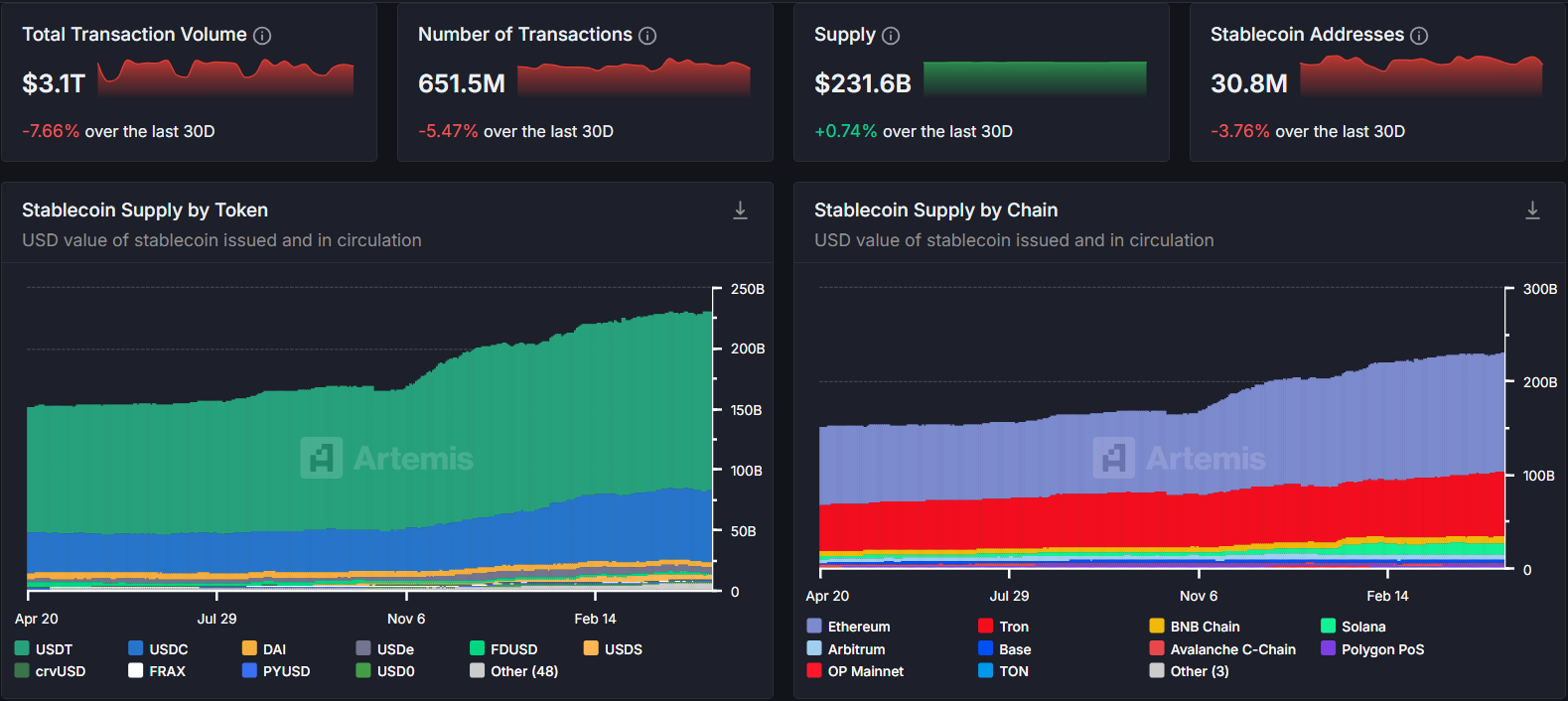

However, in such a sluggish market, the stablecoin market presents a completely different picture: according to data from Artemis, as of April 2025, the total market value of stablecoins has reached US$231.6 billion, a significant increase of 51% compared to US$152.6 billion in the same period of 2024.

While the overall crypto asset market is weak, stablecoins continue to expand. So the question is: if the constantly issued stablecoins do not flow into cryptocurrency investment, where do they go?

Beyond encryption, stablecoins are quickly taking root in the real world

As the infrastructure of the blockchain world, stablecoins not only dominate on-chain transactions, but are also the core tools for crypto users to exchange tokens, perform DeFi operations, and transfer money.

However, its influence has long surpassed the boundaries of encryption and is taking root and growing in the real world.

In terms of market capitalization, stablecoins directly account for 5% of the total market capitalization of cryptocurrencies. If companies that manage stablecoins and blockchains whose main business is stablecoins (such as Tron) are included, this proportion reaches 8%.

It is worth noting that mainstream stablecoin issuers adopt an operating model similar to MasterCard, reaching end users through intermediaries such as exchanges and payment service providers.

Take Argentina as an example. Although local crypto exchanges LemonCash, Bitso, and Rippio are not well-known globally, their user base has reached an astonishing 20 million, equivalent to half of Coinbase's user base, while Argentina's population is only one-seventh of that of the United States. Lemon Cash alone generated about $5 billion in trading volume last year, mainly in stablecoin-related transactions.

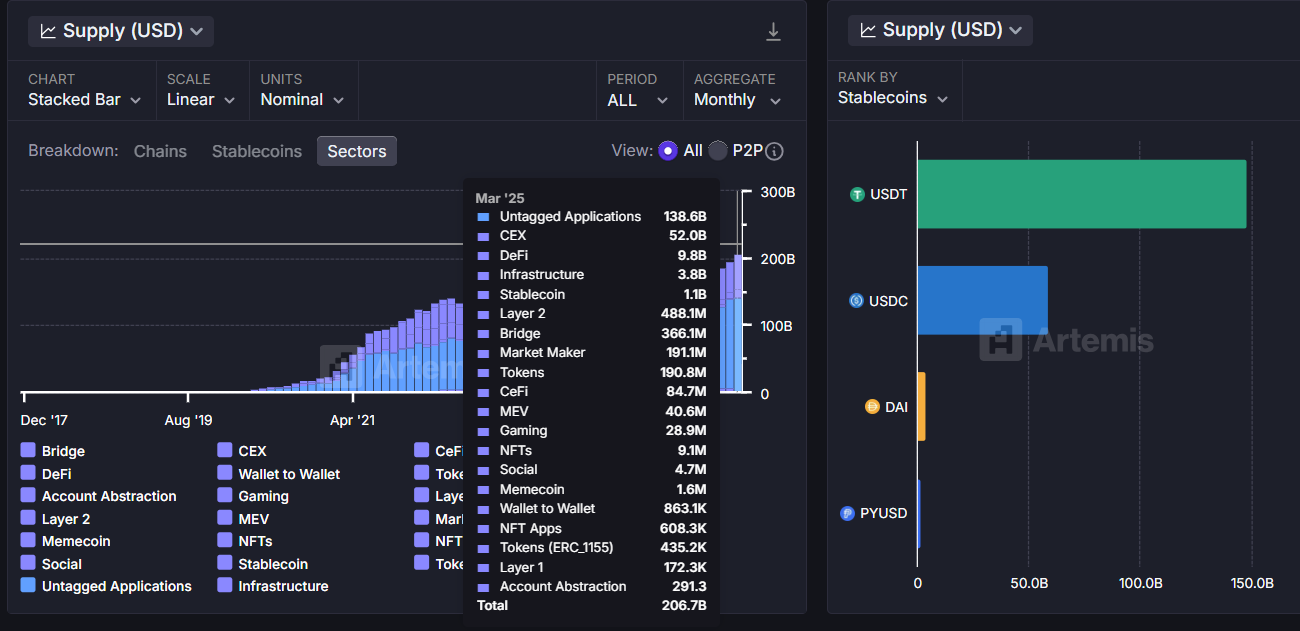

What is even more thought-provoking is that according to Artemis data, of the total stablecoin circulation of US$206.78 billion as of March 2025, traditional CEX, DeFi and other encryption scenarios only account for a small share, and as much as 67% (US$138.6 billion) of stablecoins flow into the "unclassified application" field.

Most stablecoins flow in data blind spots that are not clearly tracked, and their secrets are kept in black boxes outside of encryption.

In the black and gray trade, stablecoins are circulating "stably"

On the dark side of social rules, stablecoins are weaving a huge black and gray industry network.

Liu Ping (pseudonym), who works in cross-border e-commerce, said that although regular USD payment platforms such as Airwallex, Payoneer, and PingPong all require strict qualification review and real order data, "someone always needs other solutions", especially those merchants who sell counterfeit goods, infringing goods, or arms contraband. These illegal merchants either purchase the platform's "black and gray backdoor" account opening rights at a high price, or directly use USDT to receive and pay.

As Liu Ping explained, the corresponding industrial chain grows in the dark. After illegal merchants receive payments through the platform's "black and gray backdoors", they quickly exchange them for USDT with the help of underground banks and withdraw. "This is equivalent to those who open backdoors for illegal merchants eating the losses of their own company."

In the field of advertising, she also mentioned some more covert operations: "There are black and gray accounts that specialize in placing illegal advertisements on platforms such as Facebook, such as guns and ammunition. Most of the funds for advertisers to recharge are stolen credit cards. Some people specialize in purchasing stolen credit card limits, recharging them into advertising accounts, and then selling them at a discount with USDT. An advertising account worth $2,000 may only cost $1,500 to $1,700 using USDT."

"Cross-border merchants actually want to use USDT for settlement because it is flexible, has no price difference, and can avoid asset risks to a certain extent. However, formal platforms have licenses, accept US dollars, and exchange rates must also comply with regulations," Liu Ping said frankly.

"But formal platforms have licenses, they accept U.S. dollars, and exchange must comply with regulations. The essence of the black and gray backdoor is to leave a time window for scammers to find an opportunity to use USDT to run away." Small amounts are directly withdrawn, and the platform suffers; "Sometimes the scammers who use the backdoor share the profits with the platform salesperson. For example, if the scammer receives 3 million and can eventually withdraw 2 million, the 1 million difference may be divided between the platform and the salesperson who opened the backdoor in proportion."

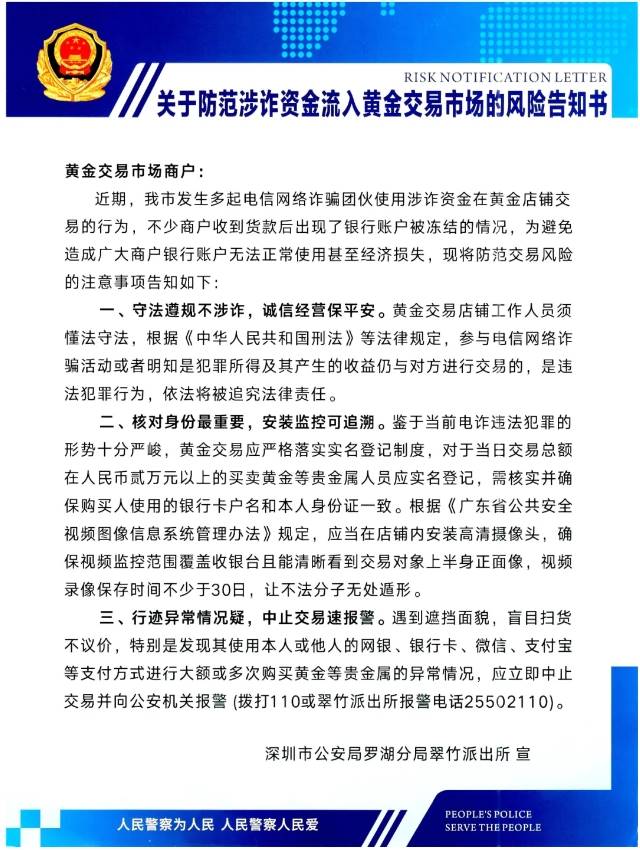

This situation extends to the domestic market. Shenzhen Shuibei Market, China's largest gold and jewelry trading center, has tens of thousands of gold merchants gathered in one square kilometer, accounting for 75% of the Chinese market share. Stablecoins have become a hidden tool for gray foreign exchange transactions.

In 2024, the Luohu Branch of the Shenzhen Public Security Bureau issued a risk notification, requiring real-name registration for gold transactions with a total daily transaction amount exceeding 20,000 yuan, targeting Shuibei's underground transactions.

Industry insiders revealed that Shuibei's currency exchange transactions are "mature and convenient". Customers contact "currency exchange service providers" through acquaintances, and the latter arrange the transaction process.

In some inconspicuous stalls in the market, a large amount of money flows every day. "Regular customers" buy gold bars with cash or credit cards, and the clerk delivers the real gold according to the real-time gold price, all in one go.

In order to avoid risks, exchange service providers usually have "henchmen" handle small transactions (less than 10 million yuan). Large transactions are completed through member seats at gold exchanges. Compared with offline stalls, exchanges are more suitable for short-term and large-amount fund transfers, and of course the corresponding handling fees will be higher.

Between the purchase and sale, the customer's RMB is converted into an anonymous gold entity.

Of course, the most critical step in currency exchange is to exchange the gold in hand for stablecoins such as USDT. The service provider will assist customers in installing cold wallets (such as imToken), converting gold into USDT and depositing it. If customers want to exchange currency immediately, they can also directly exchange for foreign currencies such as US dollars and euros. The entire transaction can be completed in as fast as one day, and the commission is usually within 6% of the transaction amount.

Such transactions are not foolproof. Although the new real-name registration rules are not yet enforced, regulators are already targeting large transactions.

Industry insiders said that the risk of "black eating black" has always existed in gold exchange transactions. Illegal merchants may forge certificates and run away with the money. As the price of gold continues to soar, this risk of default will also increase accordingly.

Local "currency exchange service providers" help customers convert RMB into anonymous gold entities through a complex gold trading network, and then exchange them into USDT or other foreign currencies. The entire process can be completed in as fast as one day, and the commission is usually controlled within 6% of the transaction amount.

Although this operation involves the risk of "black eating black", it is still a typical epitome of stablecoins' involvement in illegal capital flows, reflecting that a larger underground money laundering network is operating globally.

The stablecoin money laundering chain worth hundreds of billions

Underground banks are an inevitable link in the stablecoin money laundering chain.

Underground banks, also known as "underground banks", are illegal financial service institutions that conduct cross-border remittances and fund transfers mainly through informal channels. Most of these illegal financial service institutions are located in East Asia and Southeast Asia and are the core role of the overall money laundering network. Usually, they quickly launder illegal funds through collaboration with casinos, online gambling platforms and transnational criminal groups, embedding themselves in the shadows of the global economy.

USDT has become the tool of choice for money launderers due to its stability pegged to the US dollar - in 2023 alone, illegal crypto transactions involving USDT in Southeast Asia exceeded US$5 billion.

Criminals usually exchange their illegal proceeds for USDT through the over-the-counter market, and then convert them into cash or deposit them into cold wallets to anonymize and transfer funds across borders.

This phenomenon is particularly common in Southeast Asia’s gaming industry. According to a UNODC report by SlowMist Technology, there are currently more than 340 licensed and illegal casinos in the region, mainly distributed in the border areas of the lower Mekong River.

The relationship between casinos and underground money houses can best be described as "mutually beneficial symbiosis."

Casinos in Southeast Asia conceal the source of funds through "custody" transactions and "investment", forming a complex money laundering chain. The anonymity and non-face-to-face transaction characteristics of online gambling platforms further increase the difficulty of fund tracking.

Gambling intermediaries are at the center of the entire money laundering chain. The founders of the world's two largest gambling intermediaries, Suncity and Tak Chun, were sentenced to 18 and 14 years in prison respectively for money laundering and organized crime. They handled more than $100 billion through casinos, online gambling platforms and underground banks. These intermediaries use stablecoins to transfer funds, circumvent capital controls, and rely on unregulated payment companies to complete transactions.

Huione Group is a Cambodian financial entity that provides fund transfer services for online gambling and fraud in Southeast Asia through guarantee business. Huione Pay, the group's payment platform, is deeply involved in money laundering activities.

In July 2024, Tether froze the TRON wallet associated with Huiwang, involving 29.62 million USDT, but despite the freezing of Huiwang's account, they continued to operate through a new address.

Due to insufficient regional regulation and the proliferation of unauthorized virtual asset service providers (VASPs), underground money laundering continues to expand, resulting in an estimated economic loss of US$18 billion to US$37 billion in East Asia and Southeast Asia due to cyber fraud in 2023.

Stablecoins in geopolitical context

Stablecoins are also playing an increasingly important role in geopolitical conflicts.

Since Western sanctions cut off Russia's SWIFT channel in 2022, cryptocurrencies, especially stablecoins, have become an important alternative channel for Russian cross-border settlements. Russian companies pay overseas suppliers by exchanging rubles for USDT to bypass the US dollar settlement system.

To adapt to this situation, the Russian government has taken active measures and decided to allow the use of digital currency in cross-border transactions from September 1, 2024, and began to legalize cryptocurrency mining in November, allowing legal entities and individual entrepreneurs registered with the Ministry of Digital Development of the Russian Federation to legally engage in crypto mining business.

At the same time, a large number of Russian wealthy people chose to transfer their assets in the UAE, which has not joined Western sanctions, cashing out through cryptocurrencies in Dubai or directly purchasing real estate.

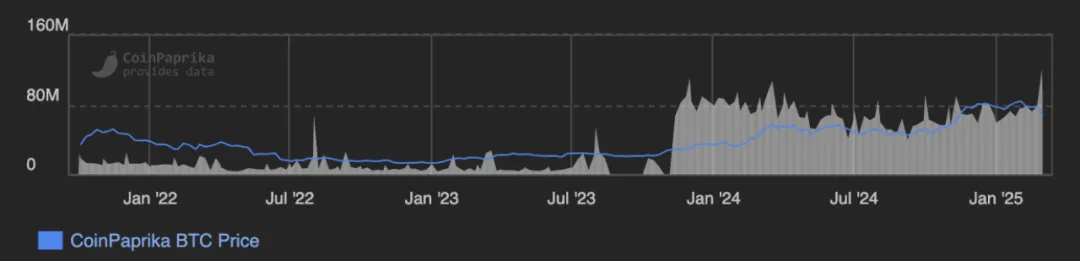

However, the United States has also taken corresponding countermeasures. The Russian crypto exchange Garantex is a typical case: despite being sanctioned by the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) in April 2022, the exchange's daily trading volume has increased instead of decreasing, soaring from about $11 million in March 2022 to $121.6 million in March 2025, an increase of more than 1,000%.

The good times did not last long. As the regulatory intensity increased, the EU issued the 16th round of sanctions against Russia in February 2025, and included Garantex on the sanctions list.

On March 6, Tether directly froze approximately $28 million worth of USDT, involving multiple Garantex-related wallets, forcing the exchange to suspend all trading and withdrawal operations and issue asset risk warnings to Russian users.

Stablecoins have entered the arena of international geopolitical games.

Latin America's Safe Haven of High Inflation

In Latin America, stablecoins are becoming an important safe haven against high inflation and currency devaluation.

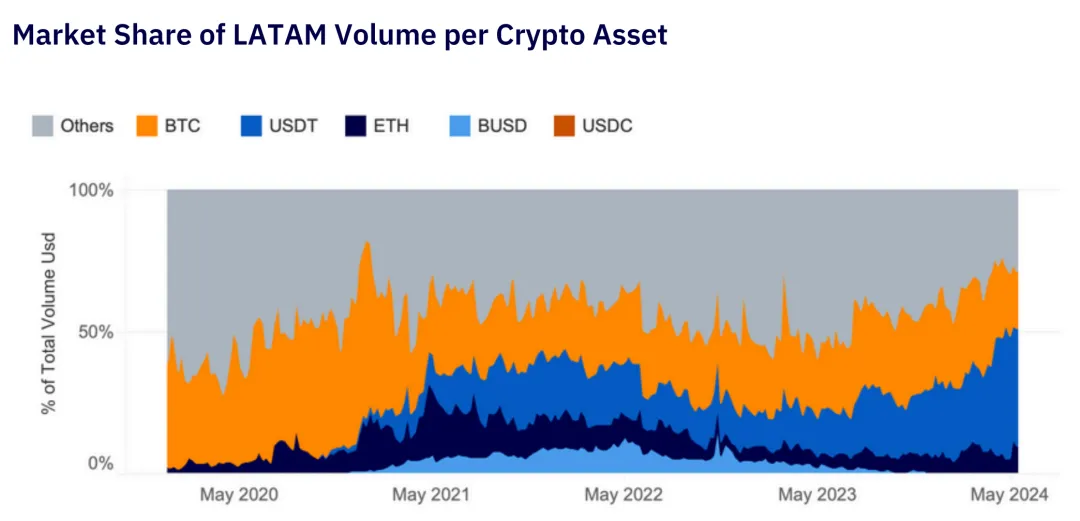

According to the LATAM Market Report released by Aiying Compliance, political instability and economic crisis in the region have driven the popularity of cryptocurrencies, especially in countries such as Argentina, Venezuela and Brazil. In 2024, the total volume of cryptocurrency transactions in Latin America reached US$16.2 billion, of which USDT-related transactions accounted for more than 40%.

Cryptocurrency trading volume in Latin America continues to grow, especially stablecoins

Image source: LATAM Market Report, author Aiying Compliance

Take Argentina as an example. In 2024, Argentina’s inflation rate exceeded 200%, and the peso continued to depreciate. “Yesterday’s peso cannot buy today’s things” is the daily life of Argentine people under the economic crisis.

A Chainalysis report states that in response to the economic crisis, some Argentines have turned to the black market to buy foreign currency, most commonly the U.S. dollar (USD).

These so-called “blue dollars” are traded at an informal parallel exchange rate and are typically obtained at underground exchange points “cuevas” located throughout the country.

In addition, stablecoins pegged to the US dollar have also become an option for Argentine residents to preserve their assets and fight inflation.

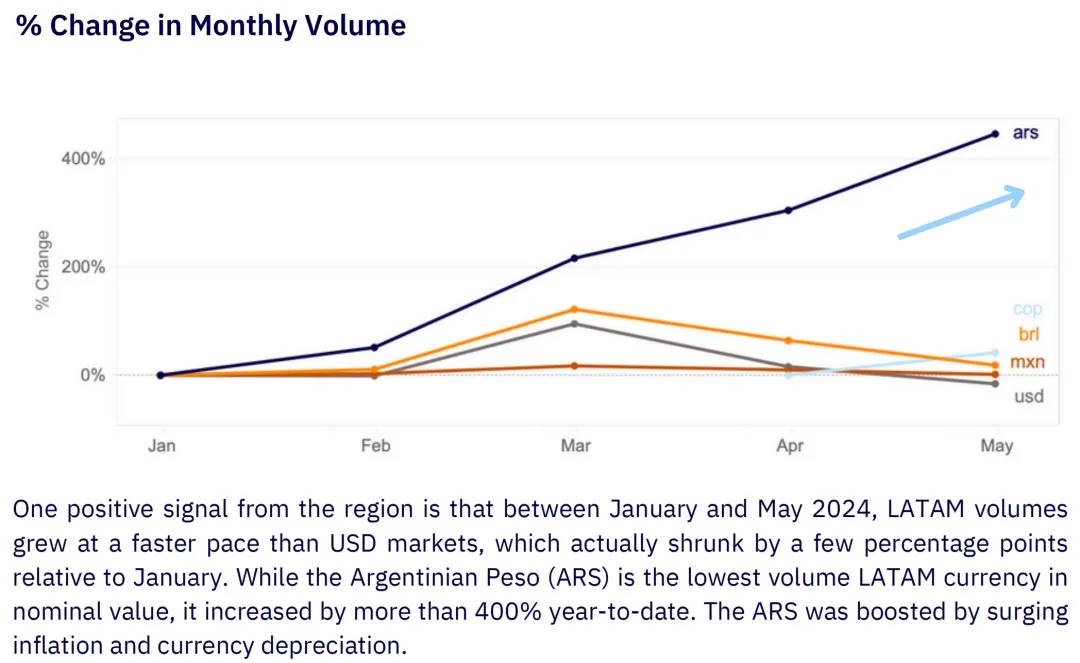

Argentina's stablecoin market leads the Latin American region, with a stablecoin trading volume of 61.8%, slightly higher than Brazil's 59.8% and well above the global average of 44.7%. Between January and May 2024, Argentina's cryptocurrency trading volume increased by more than 400%.

Argentina's cryptocurrency trading volume to grow 400% in January-May 2024

Image source: LATAM Market Report, author Aiying Compliance

The popularity of stablecoins not only provides a solution to combat inflation, but also opens up new economic channels for tens of millions of unbanked people in Latin America.

In Latin America, tens of millions of people rely on smartphones and USDT wallets to trade due to lack of banking services. Bitso, the largest exchange in Mexico, accounts for 99.5% of the local crypto market share. USDT trading volume has been growing steadily in the daily savings and transfers of Latin Americans.

A future of light and darkness

The continued expansion of stablecoins flows to both the light and dark sides of the world’s financial system.

On the surface, stablecoins take on the important task of crypto asset trading and circulation, providing users with a sense of peace away from asset fluctuations; on the dark side, stablecoins build a more covert channel for profit transfer for the black and gray industrial chain.

Stablecoins are independent of the crypto market and are penetrating into every crevice of the global economy.

In 2025, the total market value of stablecoins is close to 250 billion US dollars. Behind this figure is a multi-layered game between encryption and reality, order and violation, freedom and regulation.

Perhaps, stablecoin has not yet had a very direct impact on the world like Bitcoin, but it is undoubtedly changing the rules of capital flow in a more covert and subtle way, becoming an important part of the global financial system that cannot be ignored.

On the one hand, it provides a stable value anchor for the digital economy and serves a large user group including tens of millions of unbanked people in developing countries; on the other hand, its anonymity also provides a more covert channel for cross-border capital flows, which has attracted the continued attention of global regulators.

While providing price stability to users, "stablecoins" are also quietly shaking the foundation of the traditional financial system. This seemingly contradictory yet unified characteristic may be a new key to understanding the new landscape of the future financial world.