Author: Lawyer Xu Qian

According to NetEase Qingliu Studio, Wang Shuiming, who was arrested in connection with the largest money laundering case in Singapore, has been arrested in Montenegro and may be extradited back to China. Wang Shuiming's partner Su Weiyi was confirmed to be the mastermind of the Hong Kong cryptocurrency platform scam AAX. In July 2024, Su Weiyi was arrested by the Hong Kong police.

AAX Platform Events

Atom Asset (AAX) is one of the largest cryptocurrency exchanges in Hong Kong, with more than 2 million users. On November 13, 2022, just two days after cryptocurrency exchange FTX filed for bankruptcy, AAX also stopped withdrawals and cleared all social channels due to counterparty risk exposure. Initially, AAX attributed the freeze to security measures against suspected malicious attacks.

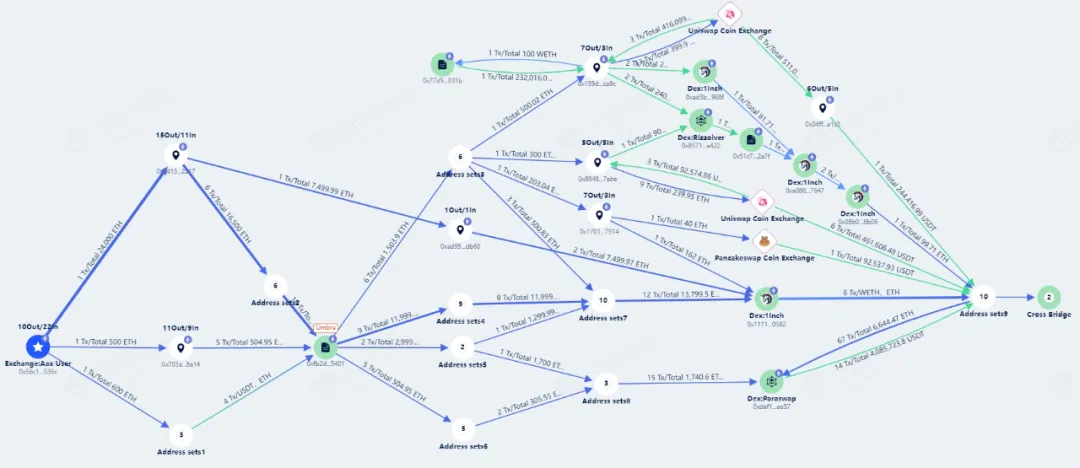

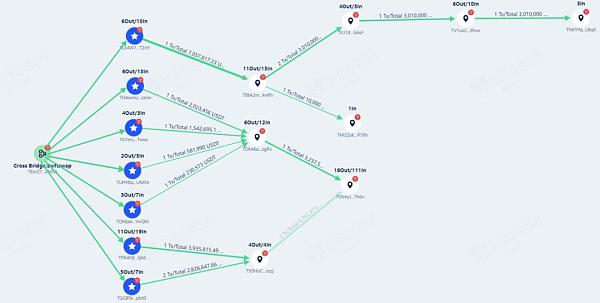

On November 15, 2022, AAX exchange issued a statement saying that its platform needed maintenance. In addition to suspending withdrawals, derivatives would be automatically liquidated. Since then, AAX has stopped platform operations and social media updates. An anti-money laundering analysis platform conducted an in-depth study of the on-chain activities of the AAX exchange wallet and found that all 25,100 ETH had been transferred, part of the ETH was exchanged for USDT , and then the funds were transferred to different blockchains through the Cross Bridge cross-chain bridge. According to some media reports, the founder of the exchange holds the private key to user funds and exchange wallet access rights.

*The picture comes from Beosin KYT Anti-Money Laundering Platform

Wang Shuiming’s arrest seems to be the largest money laundering case in Singapore. So why does cryptocurrency frequently become a tool for “money laundering”?

Why has cryptocurrency become a tool for money laundering?

The reason why cryptocurrency is used as a tool for money laundering is inseparable from its technology (decentralization, anonymity), on-chain tools (mixers, cross-chain bridges) and value (convertibility with legal currency, purchasing power).

1. Technical features such as decentralization and anonymity facilitate money laundering

Cryptocurrencies are usually not managed by central banks or government agencies, but rather maintain transaction records through distributed networks. This decentralized nature excludes the involvement of third parties, especially government agencies, making cryptocurrency transactions more convenient and flexible. However, this also weakens the supervision of traditional financial institutions and facilitates money laundering activities.

Although transactions on the chain are publicly traceable, the circulation of cryptocurrencies is completed through wallet addresses, without the need to bind real identities. If cryptocurrencies are obtained through non-KYC channels (such as over-the-counter transactions, cold wallet transfers, etc.), it is difficult to track the holders of cryptocurrencies. This anonymity feature makes it difficult to track the identities of both parties to the transaction, providing a natural concealment condition for money launderers.

2. Some on-chain tools help hide the source and destination of funds

Coin mixers (such as Tornado Cash, Blender.io, etc.) mix user funds and redistribute them, cutting off the source of funds. Cross-chain bridges (such as Axelar) transfer assets to different blockchains for asset transfer and exchange, such as transferring from one loosely regulated blockchain network to another and then using privacy protocols (such as Aztec) to hide transaction details, forming multiple anonymous barriers to evade tracking by regulators and law enforcement agencies. These tools make money laundering easier to conceal.

3. Cryptocurrency has the ability to be exchanged for legal currency

Some countries and regions recognize cryptocurrencies as legal means of payment, and there is currently no unified standard for their regulation worldwide. This allows cryptocurrencies to be traded freely across borders without the approval of a third-party agency. This allows cryptocurrencies to be transferred from one country to another at will (cross-border cashing), avoiding foreign exchange controls and exchange rate risks. Cryptocurrencies have the ability to be exchanged with legal currencies, which allows cryptocurrencies to be easily exchanged for legal currencies, thereby achieving the laundering and legalization of funds.

Cryptocurrency is easily exploited by money launderers due to its unique technical characteristics and operating mechanisms. In order to prevent and combat criminal activities, it is necessary to raise users' risk awareness, strengthen technical identification and prevention capabilities, and enhance international cooperation and supervision.

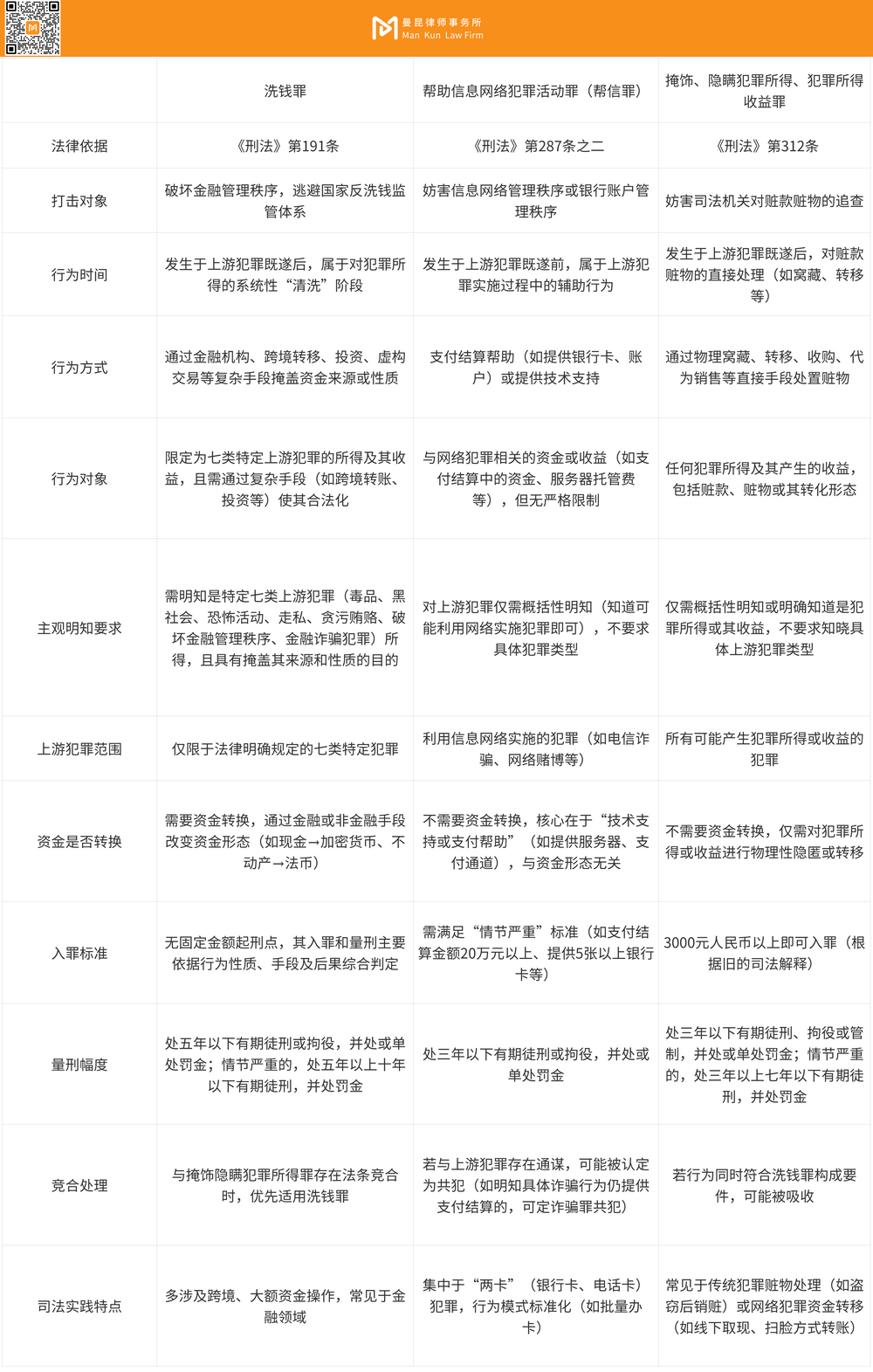

The difference between money laundering, facilitation and concealment of crime

In cryptocurrency transactions, if the perpetrator provides a wallet address to assist in the transfer, how to distinguish between the crime of aiding and abetting and the crime of concealing the proceeds of crime? If real estate is purchased with cryptocurrency obtained illegally, does it constitute the crime of money laundering? Because such behavior involves multiple elements of crime at the same time, it often causes the following disputes: At what stage of the criminal chain does the behavior occur (before/after completion)? What is the degree of awareness of the upstream crime (general knowledge/specific knowledge)? Does the nature of the funds belong to the proceeds of a specific upstream crime (such as the seven categories of money laundering)? From the perspective of my country's criminal law system, the three crimes are all acts of handling the proceeds of crime, and we can distinguish them from the following dimensions:

How can cryptocurrency service providers prevent legal risks of suspected money laundering?

1. Strictly fulfill KYC and anti-money laundering (AML) obligations

The real-name system requires effective identity verification of customers, including but not limited to verification of identity documents, contact information, transaction purposes, etc. Anonymous accounts are prohibited and privacy coin transactions are restricted. Strengthen due diligence is implemented for high-risk customers (such as large-value transactions and cross-border transactions), and complete records are retained.

(II) Transaction monitoring and reporting

Establish a real-time transaction monitoring system, such as integrating on-chain data (block browser API), off-chain data (user KYC information), third-party risk databases (such as Chainalysis, Elliptic) and other information; deploy multi-dimensional risk models such as anomaly detection (such as abnormal transactions such as frequent split transfers, etc.); graded early warning and trigger disposal (such as automatic account freezing, manual review, suspicious reporting, etc.), auditing and reporting (retaining complete operation logs, regularly preparing compliance reports, etc.).

(III) Strengthen internal compliance management and external cooperation and exchanges

Establish a compliance system, formulate an anti-money laundering internal control system, and clarify job responsibilities and operating procedures. Set up an independent compliance department to ensure the effective implementation of risk management measures and strengthen internal supervision. Regularly train employees on anti-money laundering laws and regulations to enhance and strengthen employees' anti-money laundering awareness.

Actively comply with and cooperate with the anti-money laundering requirements of regulatory authorities and law enforcement agencies, establish regular communication mechanisms, assist in data retrieval, account restrictions, etc.

Conclusion

Usually, cryptocurrency money laundering may be carried out through currency mixing services, false transactions, layered transfers, OTC transactions, forged identities, etc. Money laundering will disrupt the financial order and encourage criminal activities such as fraud and corruption. It will not only harm the interests of users and affect the reputation of the cryptocurrency industry, but may also involve national security issues. Both individual users and cryptocurrency service providers need to improve their risk awareness, fulfill KYC and AML obligations, monitor suspicious transactions, cooperate with regulators, and maintain transaction security through technical means and tools.