By ChandlerZ, Foresight News

Dashan, partner of Waterdrop Capital, admitted in a recent Space that the four projects he invested in recently have all been listed on Binance, but none of them issued tokens to investors according to the original investment agreement. Although the terms of issuing tokens were clearly written in the contract, the project could modify the agreement at will after it was launched, and investors could hardly take any effective countermeasures.

He said that the change of the agreement was not the will of the project party, but the unspoken rule of Binance, so he did not blame the project party, because they were also weak in front of Binance. The current strategy is very clear, which is to persuade and help the truly high-quality project parties not to issue coins, but to go public directly, and change to a relatively clean and regulated market to reflect their own value.

The contract-based rights protection in traditional VC investment does not have the same actual binding force in the crypto token investment structure. Since the circulation rules of tokens are dominated by exchanges after they are launched, the allocation of assets on the chain is not subject to immediate constraints from the traditional legal system, and investment agreements often lose their enforceability at key points. In the current market environment, whether a project can obtain access to the top exchanges is directly related to its overall survival, and the importance of the terms of the agreement is marginalized in the face of actual interests. In order to go online, the project party has to cooperate with the exchange to redesign the release rhythm, lock-up rules, token ratios, etc., while investors are in a de facto disadvantaged position in terms of rights due to the lack of on-chain governance rights and circulation discourse power.

This statement reveals a deep-seated crisis that the current crypto VC investment system is facing, namely a dilemma in which contract effectiveness, liquidity control and exit mechanisms are completely malfunctioning.

The balance of power is tilted: the new relationship between VCs, projects and exchanges

In the past few years of industry development, the model with "project narrative construction - multiple rounds of VC financing - token generation event (TGE)/listing on top exchanges" as the main line has gradually become mainstream. The characteristics of this model are that the project relies on capital injection, resource docking and credit endorsement from professional VC institutions in the early stage, and completes financing through gradually rising valuations. The ultimate goal is usually to achieve the initial issuance and circulation of tokens on large centralized exchanges, providing exit channels for early investors.

In previous bull markets, crypto VCs, as core resources, controlled the initial financing and coin issuance design, and this process played an important role in promoting the rapid expansion of the industry and incubating projects. In the last bull market, the status of project parties has improved, but VCs still have a certain dominance due to their large capital and liquidity empowerment such as Launchpad.

However, when the market entered a new adjustment cycle, the liquidity of the copycat dried up, and the interest structure between investors and project parties changed accordingly. The power of the exchange increased unprecedentedly, and it became the absolute controller of the liquidity switch. The key links such as online approval, token distribution, and circulation strategy were concentrated in the hands of the exchange, which put the project party in an extremely weak position in the negotiation. Even if a detailed investment agreement was signed, it was difficult for the project party to refuse the circulation condition adjustment proposed by the exchange, and finally had to violate the original agreement with the investor.

Exchanges have become controllers of scarce resources, VCs have been gradually marginalized, and their actual control capabilities have been greatly reduced.

The Prisoner's Dilemma under Liquidity Tightening

The current difficulties faced by "VC coins" are not caused by a single factor.

After multiple rounds of financing, the public market valuation of a project at the time of TGE is often at a high level. This directly leads to a high initial purchase cost for secondary market investors, and also means that early investors, including VCs, teams, and early supporters, hold a large number of low-cost chips and have a strong potential motivation to sell.

This expectation gap makes the token face natural selling pressure after it goes online, and market participants may form a consensus that "selling is the best strategy", thus triggering a negative feedback loop.

Looking further, the token economy itself is also exacerbating the plight of VC coins.

During the bull market, the token issuance model of a large number of projects follows the high expected growth assumptions of the bull market, such as the market value going up all the way and sufficient liquidity to support gradual unlocking. However, in actual operation, many projects lack real income support. DeFi's annualized income relies on Ponzi, GameFi relies on subsidies, and NFT relies on FOMO. Tokens have completely lost their endogenous growth momentum.

The most important thing is that the tokens invested by VCs in the past can eventually be sold to new retail investors in the secondary market, forming a complete escape route. However, there are very few new retail investors on the chain and in exchanges, and the incremental funds are exhausted, so it has become normal for VCs to smash each other.

In essence, early investors, project owners, market makers, and early users have become a zero-sum game within a closed loop, and exit is becoming increasingly difficult.

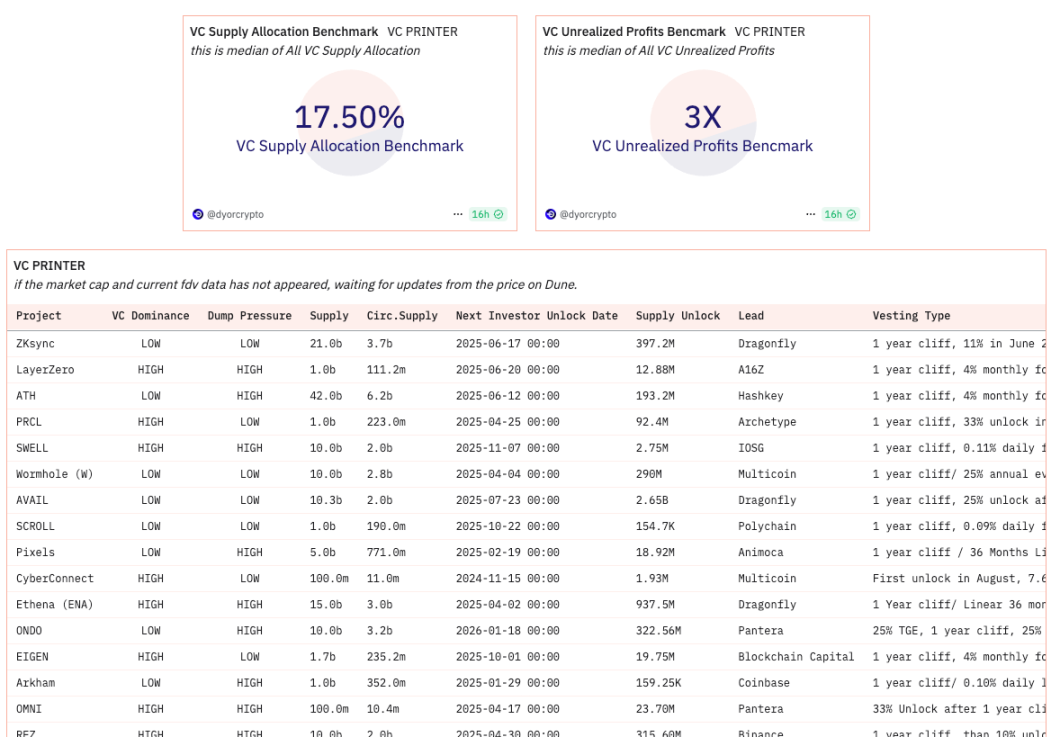

VC returns in the last bull market cycle

VC returns in this cycle

For VC institutions, the traditional strategy of relying on fast TGE to achieve high-multiple exits faces challenges, and the realization cycle of investment returns may be extended, with increased uncertainty. This may prompt VCs to pay more attention to the long-term fundamentals of projects, sustainable business models, reasonable valuations, and healthier token economic models when making investment decisions. Its role positioning may also need to extend from focusing on early-stage investment and promoting listing to deeper post-investment management, strategic empowerment, and ecosystem construction.

For project owners, they need to re-examine their token issuance strategies and community relations. After the high-profile model is questioned, it may be more worthwhile to explore starting with a lower valuation, a fairer issuance mechanism, a token economics that can better incentivize long-term holders, and improving operational transparency and strengthening accountability.

From a more macro perspective of industry development, the current challenges can be seen as an adjustment in the process of market maturity. It exposes the problems accumulated in the past rapid development and may promote the formation of a more balanced and sustainable financing and development ecosystem. This requires all market participants, including VCs, project parties, exchanges, investors and even regulators, to adapt to changes and seek to establish a new balance between innovation incentives and risk control, efficiency and fairness.