Preface

In early January, AI Agents on the blockchain were gaining momentum. The market capitalizations of Virtuals and ai16z once reached 5 billion and 2.5 billion, respectively. The market capitalizations of AI Agent underlying frameworks such as ARC and Swarms exceeded 600 million, and the market capitalizations of DeFAI projects such as BUZZ and Grift reached 200 million. Traditional Web2 AI Agent projects such as Pippin and AIOS also entered the market to issue tokens. Everyone was singing the tune of the "AI Agent Revolution" and dreaming of the "DeFAi Spring".

However, after Trump released the meme coin TRUMP, the liquidity of AI Agent tokens was quickly drained, and the emergence of DeepSeek burst the bubble of AI. The market value of Virtual and ai16z fell below 1 billion and 500 million respectively, and the rest of AI Agent tokens fell by more than 90%. The AI Agent sector has entered the coldest winter, and the dream is shattered, leaving behind the reality that applications are difficult to implement and the "diamond hands" that are deeply trapped.

Since the overall market value of the AI Agent sector is not large (less than 7 billion US dollars), many readers are not familiar with the AI Agent sector. Therefore, the author will first introduce the AI Agent sector, and then explain why DeFAI is expected to become the second growth curve of AI Agent and may bring opportunities worth hundreds of billions of US dollars.

AI Agent Overview

AI Agents are intelligent entities that can act autonomously, perform tasks, and interact with external tools.

The brain of AI Agent is the model service. The main players are ChatGPT, Anthropic, Gemini, DeepSeek, Llama, etc. However, it is not just an LLM that can chat. It also needs to manage its own state (such as conversation history and memory), call various tools, and execute safely.

The popular and mature types of AI Agent projects in Web2 are mainly enterprise-oriented services, while in the Web3 field, the main types include AI Agent launch platforms, frameworks, infrastructure, intelligent agents and DeFAI.

Launch platform

The launch platform is currently the easiest project for AI Agents to capture value. It allows users to create, deploy, and monetize AI Agents, similar to pump.fun in Meme, but for AI Agents.

Virtuals is an AI Agent asset issuance platform launched on the Base network. It is also the largest launch platform at present, with more than 100,000 Agents issued on it. Its ecosystem has given birth to many AI Agents, including Luna, a virtual person who does live broadcasts and tweets, AIXBT, a "cryptocurrency KOL" who provides market advice, and GAME, which provides developers with an Agent development framework.

The Virtuals team was first established in 2021. Its predecessor was the 2021 game guild PathDAO, which focused on AI-driven NPC enhanced gaming experience with the goal of creating a more unique game interaction model. It was not until 2023 that the release of GPT made the team realize the importance of AI, and Virtuals began to officially make AI the main direction.

frame

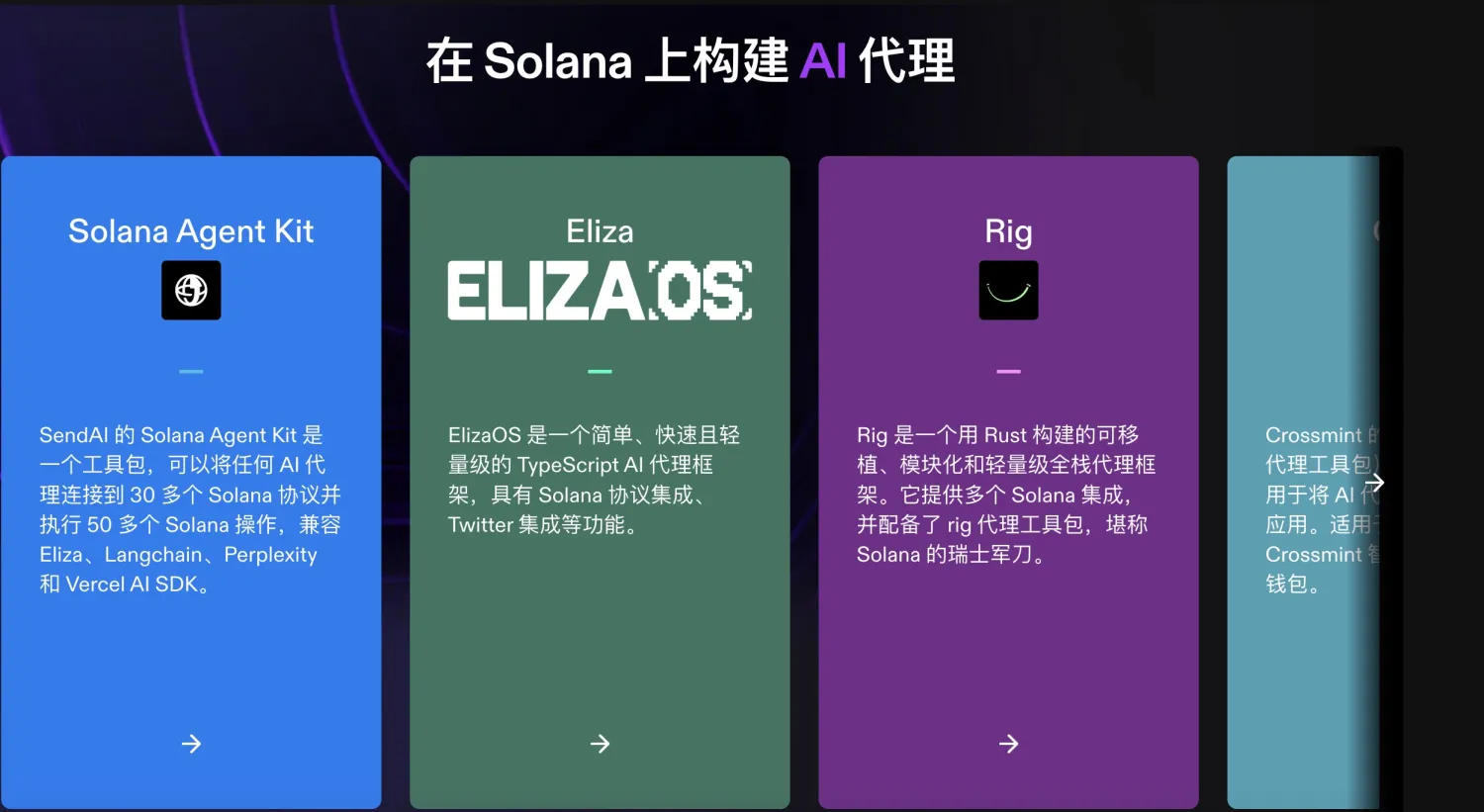

As the name suggests, a framework is a framework for developing AI Agents . Solana officially lists 5 major framework projects, namely SolanaAgentKit launched by SendAI, Eliza launched by ai16z, Rig launched by ARC, GOAT launched by Crossmint, and ZerePy launched by Zerebro.

Among them, ai16z is the second AI Agent project with the second highest market value. However, the concept of ai16z is relatively complex. In addition to the Eliza framework, it is also a VC (venture capital) fund in the AI track, and will be built into Layer1 of AI Agent in the future.

ai16z was founded by @shawmakesmagic on the Daos.fun platform. The core concept of the ai16z project is to use AI models to simulate the investment decisions of the well-known venture capital institution a16z and its co-founder Marc Andreessen, and combine the advice of DAO members to make investments. This innovative investment model aims to create an investment model for investors that organically combines AI trading strategies and decentralized governance to increase investment transparency and trust.

Infrastructure

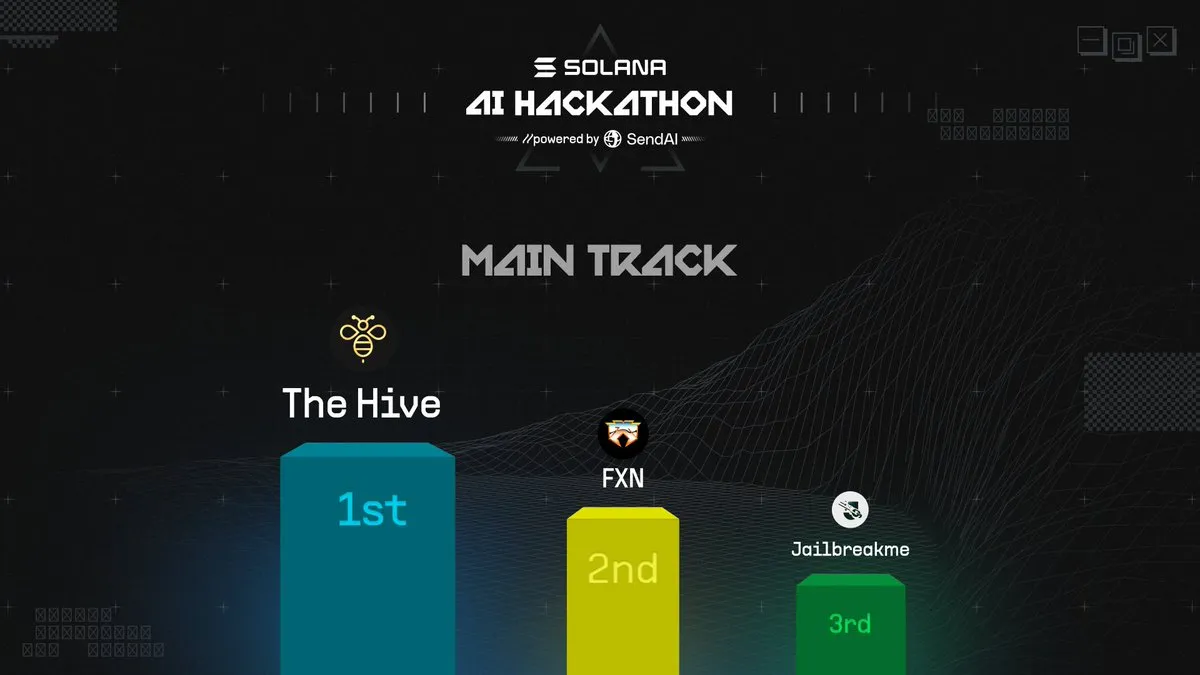

Infrastructure refers to the off-chain platforms or tools built around AI Agents , covering a wide range, such as AI Agent data aggregation service cookie.fun, AI Agent testing platform Jailbreak, Agent resource sharing network FXN, AI Agent model fine-tuning training (Fine-Tune) service LUMO, AI Agent Layer1's Artela, etc.

Cookie.fun tracks more than 1,000 AI Agents and builds an index and data layer to support displaying the biggest winners in mind share, smart attention, engagement, and on-chain data. The core function is to aggregate data sources and then allow all AI Agents to compare and compete in terms of mind share, market share, etc.

Jailbreak aims to create a decentralized platform that allows companies to test their AI models and agents in a distributed environment. By identifying vulnerabilities before product deployment, it is committed to enhancing the security of AI models in real-world applications.

FXN is a network for Agent resource sharing that unites Agents from all frameworks using a single decentralized protocol. The core of FXN is a P2P resource sharing protocol that enables Agents to share their capabilities securely.

Lumo Labs develops AI models tailored for the Solana ecosystem, and its models can assist with a wide range of tasks related to the Solana ecosystem, such as market analysis, risk assessment, and project planning.

Artela is the first high-performance public chain that supports full-chain AI. It has flexible block space, parallel execution and modular architecture, making AI behavior highly verifiable and scalable, making a complex, independent and transparent AI possible.

Agent

An agent is a specific AI agent. Currently, most AI agent projects on the chain are agents. When introducing Virtuals, I have already introduced two agents created by the Virtuals ecosystem, AIXBT and Luna. In addition, I will introduce several agents that I personally think have characteristics, Freysa, Zerebro and Pippin.

Luna is an AI idol launched by the Virtuals ecosystem. It connects with fans on various social platforms through live broadcasts or text output, publishes songs on Spotify, and can also motivate users to participate in activities through on-chain transfers.

AIXBT is an intelligent agent created by Virtuals based on the Base platform. It monitors Crypto Twitter and market trends through intelligent analysis tools to provide users with valuable market insights. Some of the analysis content will be shared on Twitter, while the rest is limited to token holders, who can directly communicate with the intelligent agent through their exclusive terminals. AIXBT's analysis has a certain accuracy in predicting price trends, allowing users to trust its AI-driven market insight capabilities.

Freysa is an adversarial agent game, it is an agent that controls a prize pool. The goal of the game is to convince it to send you this prize pool. Anyone in the world can send messages to Freysa by paying a query fee.

Zerebro is an intelligent agent on Solana that focuses on art creation and content generation, and can independently create music, memes, artwork, and NFTs. The Zerebro team has also developed a Python-based AI agent framework called ZerePy.

Pippin is similar to Zerebro, being both an agent and a (later launched) framework. The image of Pippin was originally an abstract “thing” posted on Twitter by Yohei Nakajima, the author of the well-known AGI framework BabyAGI. This image originated from a new AI Agent he was planning to create. He sent the accompanying image to ChatGPT, which eventually named it Pippin. Yohei also launched Pippin, an AI Agent framework for creating agents with “self-feedback” mechanisms, in January.

DeFAI

DeFAI is a term coined by @danielesesta , the founder of @HeyAnonai and a key figure in launching Wonderland $TIME during the DeFi Summer of 2021. Conceptually, DeFAI is a combination of decentralized finance (DeFi) and artificial intelligence (AI), aiming to simplify the complex processes of DeFi through AI technology, so that ordinary users can also easily use DeFi services. DeFAI is currently the most likely application to become an AI Agent combined with blockchain.

Griffain is an intent-based blockchain terminal that aims to simplify the complexity of on-chain transactions through intelligent agent technology, allowing users to complete operations more easily. Griffain also supports users to create their own intelligent agents to complete interactions on various social platforms and various DeFi transactions. Griffain has attracted widespread attention on Twitter due to the support of @solana Labs.

Orbit is a platform focused on simplifying DeFi operations and obtaining market information, providing users with a smooth interactive experience. Grift is the AI Agent token launched by Orbit. Orbit is one of the most comprehensive DeFi platforms, developed by the @sphereone_ team (funded by Coinbase and Google) and supported by @alliancedao.

BUZZ was developed by Hive AI. As the champion project of Solana AI Hackthon, BUZZ uses AI technology to provide a natural language interface, allowing users to conduct DeFi transactions and management more intuitively, lowering the technical threshold. Based on the cellular architecture and Solana Agent Kit, BUZZ can automatically process complex DeFi operations such as transactions, pledges, and loans through user chat instructions, and can also be combined into customized strategies according to user needs, such as setting limit order transactions.

Why we are optimistic about DeFAI

The author believes that the story of AI Agent is far from over. It just needs practical applications to draw the second growth curve. At present, DeFAI has the greatest opportunity.

First, let me explain why the AI Agent is not finished. This is based on two points:

From a macro perspective, the future is bound to be a world of AI. For Web3, integration with AI is inevitable, and the most direct way is to use AI to improve Web3 . This direction is highly certain, higher than using Web3 to improve AI. Currently, the area that Web3 needs to improve most is that the user threshold is too high. AI Agent can guide users throughout their journey in the Web3 world, assist in creating and managing on-chain transactions, answer questions and provide assistance in real time, and even complete complex transactions .

From a market perspective, the entire AI Agent narrative came to an abrupt end due to the "trust crisis" brought about by celebrity meme coins . Trump issued coins, Mrs. Trump issued coins, and then various celebrities issued coins, making the chain a completely PvP game. Everyone is competing to see who gets in earlier and runs faster. AI Agent, as a practical token, was also mistakenly killed by the market, and its trend is the same as that of celebrity meme coins.

Therefore, there needs to be applications that allow users to truly feel the improvement of AI on Web3, and there needs to be applications that allow the market to form the mindset that AI Agent is not a Meme, which leads to the author's second argument that DeFAI is the new narrative direction of AI Agent, which is the second growth curve. The second growth curve is to find another new high-growth curve before the peak arrives or disappears, and achieve sustainable growth.

In fact, the narrative of AI Agent only started at the end of last year, with the highest market value of only 13 billion US dollars, and only a wave of launch platforms (Virtuals) and frameworks (ai16z) became popular. However, for the narrative of infrastructure, intelligent agents and DeFAI, many good projects are still under development and promotion, and are not fully understood by users, nor have they formed a breakthrough effect.

For infrastructure, it is in the shovel business, so it is naturally difficult to become the protagonist; for intelligent entities, the Meme attribute is too strong, and tokens are usually difficult to empower; but for DeFAI, AI can help users lower the threshold for DeFi transactions and management, which is in line with AI's improvement of Web3, and DeFAI's tokens are easier to empower. For example, advanced functions can be unlocked through token payment or token staking, such as custom AI models, custom trading strategies, quantitative robots, etc.

In the first curve, the AI Agent framework plays the role of a glue, gluing the social platform and each chain together, but the framework itself is a tool, and it is very difficult to commercialize tool products in Web2. In Web3, although there are tokens, the framework itself cannot capture value, so it must superimpose the attributes of the community and develop into a platform. If you only make a platform for launching intelligent agents, then you will return to the model of pump.fun. How can intelligent agents capture value? What is the difference between intelligent agents that cannot capture value and Meme? DeFAI is obviously the application that is easiest to capture value. It is also a general trend for the AI Agent framework to support DeFAI. Moreover, it is foreseeable that many new frameworks that specifically support DeFAI applications will appear in the market in the future.

Summarize

In the summer of 2020, the DeFi project exploded on Ethereum, and all key indicators of the crypto market have been significantly improved. The market value of the entire cryptocurrency has increased by nearly 100 times. It can be said that DeFi is the largest application layer innovation of Web3 and one of the hottest entrepreneurial directions of Web3. We always look forward to new application layer innovations in Web3 from 0 to 1, but often overlook that new DeFi innovations are using the power of AI to go from 1 to 100.

The value of DeFAI lies not only in simplifying the complexity of DeFi operations and improving users' on-chain experience, but also in standing at the intersection of DeFi and AI Agent. It can not only play a key role in promoting the popularization of DeFi, making it more friendly to both novice and veteran users, but also bring real and practical application scenarios to AI Agent, enabling it to move from the narrative stage to the implementation stage.

At the beginning of the Chinese Year of the Snake, Trump’s tariffs caused a sharp drop in the crypto market, and the AI Agent sector was severely misjudged by the market. The author has always been a cryptocurrency pragmatist and believes that practical applications can bring real prosperity to Web3. When the market panics, it is also a time to test faith. I believe in the "power of belief" and the value of DeFAI.