Author: Hedy Bi, OKG Research

On the evening of March 3 (Beijing time), US President Donald Trump confirmed the imposition of additional tariffs on Canada and Mexico, and that reciprocal tariffs would take effect on April 2, shattering the hope of reaching an agreement with Canada and Mexico at the last minute to avoid comprehensive tariffs.

Bitcoin, which still has time to digest the honey of the "crypto strategic reserve" of the previous day, fell 8% in less than 48 hours. At the same time, the US stock market also suffered a "black start" due to the impact of tariffs, with the Nasdaq index falling 2.6%. In just over a month since Trump took office, the market value of the crypto market has evaporated by 22%, and Trump Media and Technology Group (DJT) has fallen by 34.75%. Musk, who has always supported Trump, was not spared due to the "simple and crude" approach of the DOGE department and excessive involvement in international politics. Tesla's stock price fell by 32.87%.

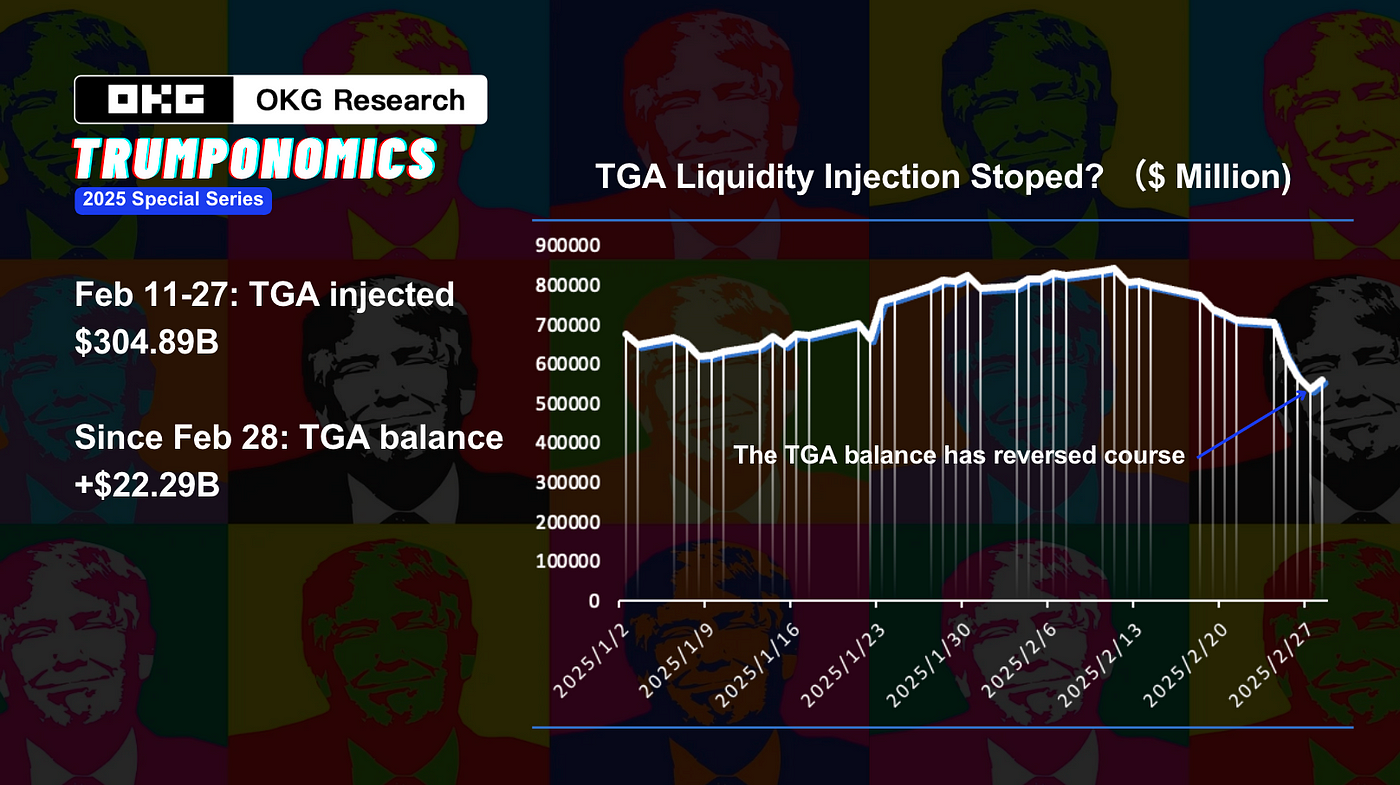

Trump's words are pulling the nerves of the crypto market, which means "success or failure depends on Xiao He". In 2025, OKG Research will continue to track the impact of Trump 2.0 government on the crypto market, especially the "Trumponomics" special topic. In the previous article of this special topic, "A new round of liquidity is coming. Can the crypto market take advantage of it to break through new highs?", we proposed that the market should pay attention to real liquidity (TGA can be paid attention to in the short term) rather than market news and public opinion, and pointed out that without real liquidity support, the "talk but no action" foreign exchange rise will not last. Not only that, according to the latest official data of American investors, since February 28, the TGA account has stopped injecting liquidity into the market, resulting in TGA injecting a total of US$304.89 billion into the market.

As the first big stick, the tariff policy has had a huge impact on the global risk market with "American attributes". Why do both Trump 1.0 and 2.0 have a special liking for the destructive policy? This article, as the fifth article of the OKG Research 2025 special topic - "Trump Economy", will use the trade war as a framework to analyze the deep content and implications of Trump's "tariffs on the left hand and encryption on the right".

Tariff leverage

Trump’s bilateral commitments when he came to power were very clear, but the first stick to fall was tariffs.

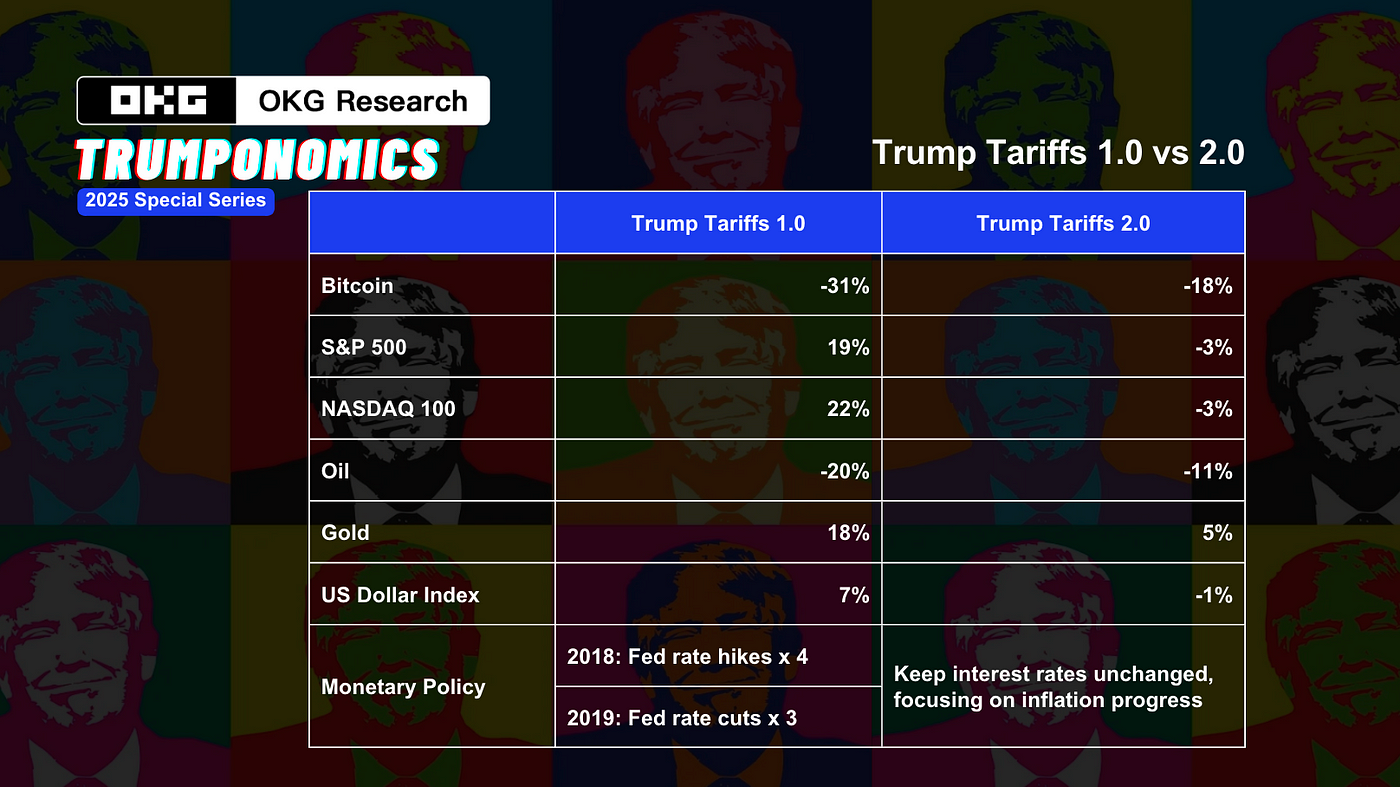

On the surface, Trump's tariff increase is intended to reduce the trade deficit and boost employment and the economy. However, Trump's trade war 1.0 and the global trade wars caused by tariffs before 1930 show that this is not a "good business". The Congressional Budget Office (CBO) stated that the trade war in 2018-2019 caused the United States to lose 0.3% of GDP, about 40 billion US dollars. According to the data from the Peterson Institute for International Economics, the aluminum tariffs in 2018 alone caused the US manufacturing industry to lose about 75,000 reserves. In addition, US companies restored domestic inventories and instead transferred production to countries such as Vietnam and Mexico (Carney). The trade wars implemented by other presidents also failed to achieve good results: in 1930, the United States implemented the Smoot-Hawley Tariff Act, and global trade volume recovered by about 66%. The US export value fell by 67%, and it caused price disruptions and led to a large number of unemployment.

Tariffs are just the beginning. The Trump administration is curbing economic uncertainty in exchange for bargaining chips. The core of the tariff game is not just the flow of goods, but also involves technology-collateralized capital, flows and currency competition. The essence of the trade war is not limited to tariff barriers, but has a profound impact on the global financial system. From the foreign exchange market to the stock market, from the global interest rate of government bonds to asset risks, the capital market is not immune.

Buffett made a rare warning that punitive tariffs could lead to inflation and harm consumer interests. The expected impact on the real economy will further exacerbate the Fed's dilemma - how to control inflation without causing serious economic structural changes. Consumer confidence may drag down the economy, while inflationary pressure limits the Fed's room for rate cuts, ultimately further tightening liquidity and putting the Fed in a recession.

For the crypto market, a participant in the global risk asset market sentiment, the market performance of crypto assets is comparable to the volatility of US technology stocks. Whether it is the fact that 70% of Bitcoin computing power relies on Nvidia GPU-powered mining machines, or that crypto-related companies such as Coinbase and MicroStrategy are included in the Nasdaq 100 Index, the impact of US financial policies and regulatory guarantees on the crypto market has further deepened.

Relatively speaking, the crypto market is not a derivative variable of US financial policy, rather than a hedging tool (see OKG Research article "Crypto Market Repositioning: The Transformation Pain of Troubled Global Liquidity", July 2024). In the future, assuming that macro expectations remain unchanged, the market reaction to this tariff factor: if other countries choose to make concessions, the current crypto market performance is only short-term unchanged, and the medium-risk long-term view will be beneficial to the US stock market, including the inclusion of assets marked with US attributes, and the United States will also use the tool of tariffs to achieve its real goals in the negotiations; if other countries respond strongly, including but not limited to hitting back with the same tariffs, apologize for risky assets.

Crypto assets may become an extraordinary solution for extraordinary times

How can Trump 2.0, who can neither achieve the superficial goals nor benefit Trump's supporters "MEGA" (giant interest group) with destructive tariff policies and a "hardcore" stance even though the companies behind him have fallen by 40%, make America great again with "left-hand tariffs and front-line crypto assets"?

For more than a month, the turmoil in the US financial market is accelerating the loss of "national confidence". As Paul Krugman, an American economist and winner of the 2008 Nobel Prize in Economics, wrote in his recent blog post, "Elon Musk and Donald Trump have wreaked havoc on multiple fronts since taking power five weeks ago - including rapidly destroying America's influence in the world. The United States has suddenly redefined itself as a rogue state that does not fulfill its promises, threatens headquarters, attempts mafia-style blackmail, and refuses democratic elections.

History tells us that when a country's credit system begins to collapse, capital does not remain static, but instead seeks new ways to circulate.

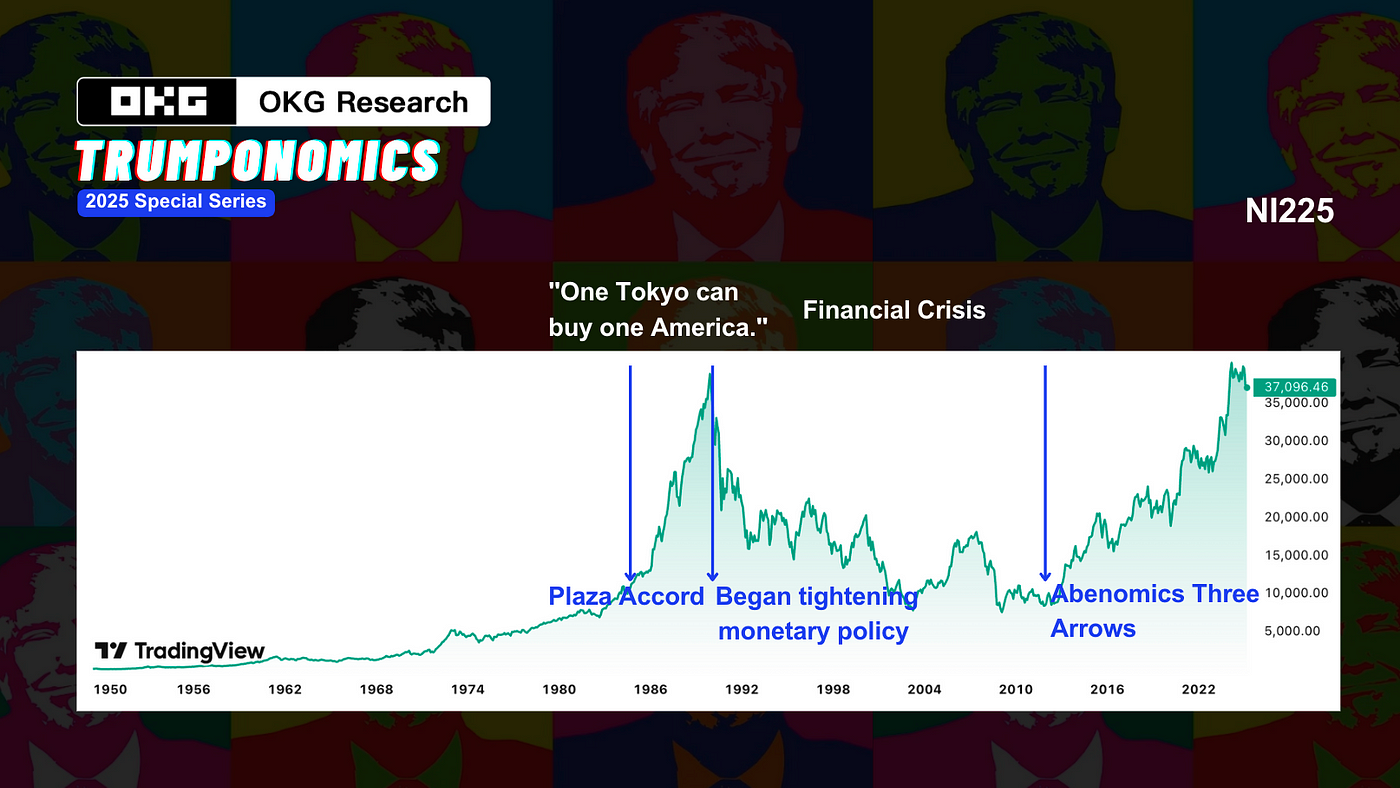

Looking back to the last century, Japan's economic rise led to a trade imbalance between the United States and Japan, which led to trade difficulties. The United States believed that the yen would appreciate through the "Plaza Accord", which hit Japan's export-oriented economy hard and caused turmoil in the financial system. The asset bubble burst and the Japanese government strengthened regulation. The market quickly sought alternative channels, giving rise to the black market economy - gold smuggling, offshore US dollar transactions surged, and the foreign exchange market flourished. According to Nikkei statistics, there were as many as 17,000 black markets in major Japanese cities. This "underground financial system" became a spontaneous hedge against the collapse of the traditional financial system. Afterwards, it supported its economy through war orders and currency liberalization, creating a scene of "one Tokyo can buy the entire United States". However, the subsequent excessive interest rate cuts led to the bursting of the bubble, and the Japanese economy went from prosperity to decline. I saw him build a red building and entertain guests, and I saw him build a pavilion again.

Looking back at history, both the "black market" and "financial liberalization" have played a key role in the trade war. At this time, the Trump administration announced the establishment of a national reserve of crypto assets. On the surface, it is financial innovation, but in fact it is more likely to be "an extraordinary measure for extraordinary times."

There are two reasons for this: Facing the dollar credit panic, the Federal Reserve's monetary policy has become extreme, and the United States urgently needs new chips to maintain the trust of global capital. Crypto assets may be this "quasi-financial weapon": once the strategic reserves are in hand, the government will have greater room for maneuver in global flows; the market's "de-dollarization" trend is beginning to emerge. As the trade war escalates, countries are bound to accelerate the allocation of non-dollar assets to hedge against the risks of the dollar system. The rise in gold prices at the beginning of 2025 is a clear proof of this. Against the backdrop of accelerated "de-dollarization", if crypto assets can maintain true centralization but are manipulated by a single country, they may gain new geopolitical premiums in the global financial game.

Trump 2.0's increasingly prominent attitude towards the United States' dominance in the global economic system, the Trump administration is trying to break the international political and financial system order since World War II. Compared with directly strengthening the credit of the US dollar and establishing crypto asset reserves to provide the government with more "non-direct intervention" means in the market, with the continuous obstacles of crypto assets and technology, a new cross-border payment system can be formed in the future, and even a state-led crypto financial network can be formed in the future.

In the book Trump, Trump's family is from Germany, and he is described as a "fighter" who believes that passion is far more important than intelligence and talent. For him, the pleasure of "impatiently" making deals and defeating opponents is his biggest motivation. However, in the trade war, "impatiently" making new deals and "defeating opponents" will undoubtedly be the best conclusion for the Trump administration.