After a round of violent market fluctuations, the crypto market is in a downturn. Market funds are constantly flowing out, on-chain activities are sluggish, and there is a serious market-scaling. After experiencing a narrative bottleneck period, the industry is facing a period of project elimination and structural reconstruction. Behind this deep change, perhaps it is also a turning point for the traditional financial order to quietly reconstruct Web3.

Liquidity Exhaustion and Narrative Fog

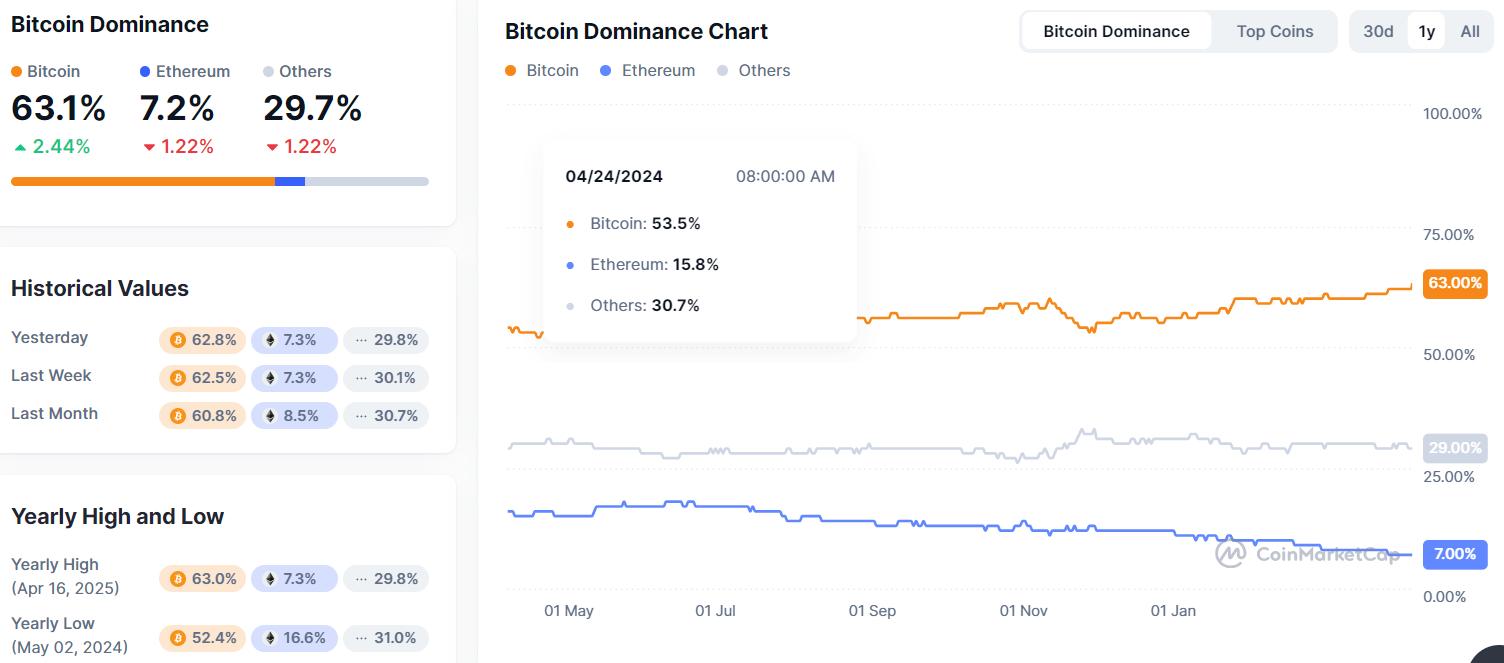

The current crypto market presents a mixed picture. On the one hand, BTC, as the cornerstone of the market, continues to absorb blood. Driven by spot ETFs, the concentration of institutional holdings continues to rise, gradually moving closer to traditional finance, and prices show a certain resilience. On the other hand, the overall activity on the chain has not kept up with the rhythm of this round of market, and the bubble burst is accelerating.

This round of rise is more like a structural market. The market rose, but liquidity did not spread. Funds repeatedly played games between local assets, resulting in serious "mutual cutting" in the market. After a large number of VC star projects airdropped and cashed out, the actual retention rate was extremely low, and most users were "fleecing". The copycat coins almost collapsed across the board, and the secondary market was in a depression.

As a narrative-driven market, Web3 has been full of stories, from DeFi to NFT gamefi, to ZK, Restaking, modularization, AI, etc. However, the life cycle of new concepts is getting shorter and shorter, the landing logic is getting weaker, and users are doubting everything.

When most projects lost their users, funds, and product closed loops, the market began to move towards liquidation and elimination. Funds are increasingly concentrated in leading projects such as Bitcoin. The market no longer pays for narratives, but increasingly values actual value.

Structural transformation from freedom to order

In the early days of Web3, it was a carnival for retail investors. Under the grand narrative, various hot spots continued to play out, and FOMO emotions drove the surge and plunge of countless projects. Today, the market's voice is shifting to institutions. Financial giants are accelerating their layout, and compliance has become a hot spot for mainstream funds. Circle and Visa are testing USDC settlement in the global payment network, Coinbase is promoting the on-chain of US stocks through Base, and asset management giants such as BlackRock and Franklin have launched RWA products in an attempt to map real assets to the chain.

These actions show that institutional funds value predictable returns, compliance frameworks and low volatility more than decentralization and high-risk gambling. The retail-dominated gambler market is being replaced by an institutionalized asset allocation market, and the project is evolving from a flourishing market to a narrative convergence with adequate supervision.

Two tracks running in parallel, ideals and reality coexisting

In this change, the crypto industry has shown a clear dual-track trend. On the one hand, there is the familiar "wild flow" or Web3 native faction, which pursues decentralization, technical freedom and privacy protection; on the other hand, there is the increasingly formed "standard flow", which pursues a compliant, trustworthy and regulated institutional system.

Web3 is no longer a single utopia, and the split into two parallel worlds does not mean that traditional finance is "swallowing" Web3, but rather that Web3 is actively embracing the evolution of reality and the beginning of large-scale application. The two complement each other, coexist for a long time, and gradually differentiate in a space with clear boundaries: the former is a technical experimental field for the decentralized world, continuing to fight for privacy and freedom; the latter is a compliant version of the on-chain financial infrastructure, striving for mainstream seats and resources for Web3. The two will realize their respective values in different scenarios.

Assets on the chain, the rise of RWA narrative

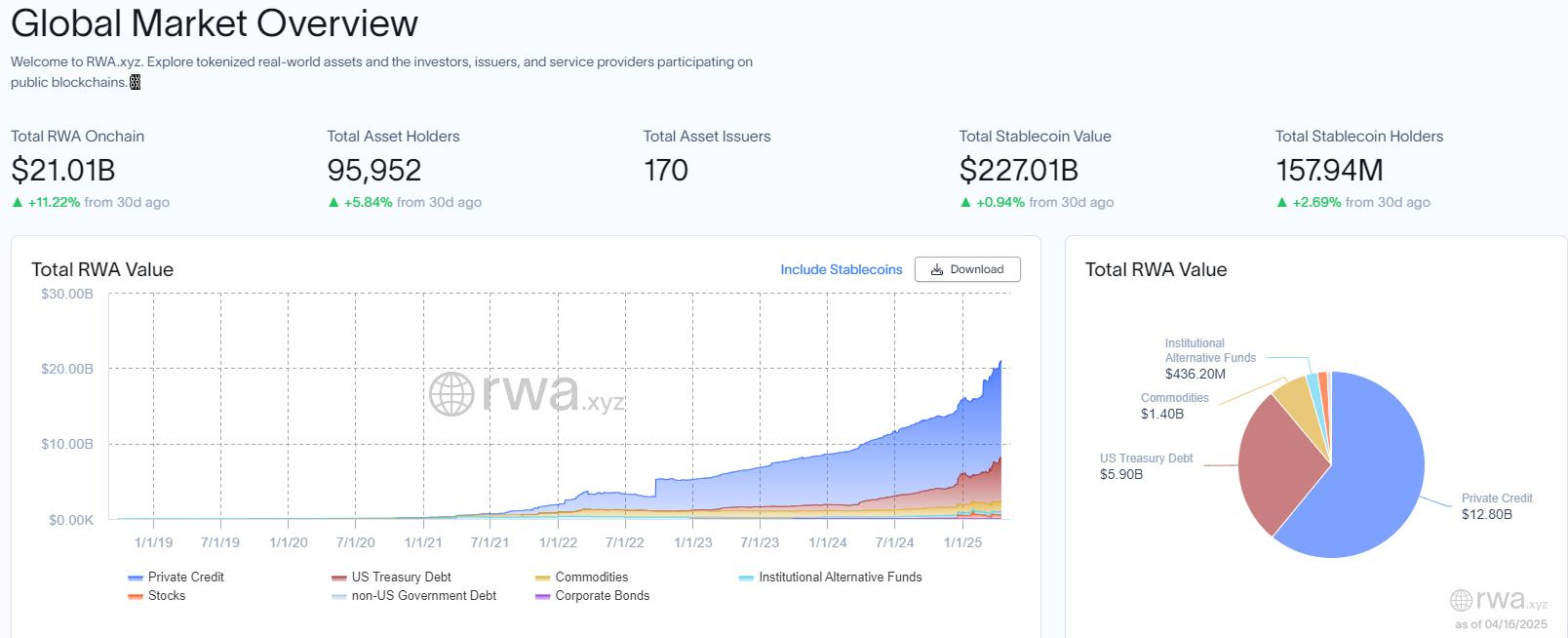

The crypto industry is at a critical turning point. Liquidity exhaustion and narrative vacuums expose the limitations of speculative models, while the collapse of altcoins highlights the need for sustainable models. The industry's only digital dollar that has been implemented and widely used, namely USDT and USDC, which map the dollar to the chain and tokenize it, has become a compliant and highly profitable business, and the tokenization of real-world assets (RWA) is becoming the most promising narrative.

Currently, the assets in the cryptocurrency market are generally poor, but the traditional market is unimaginable. For example, tokenized US stocks, bonds, commodities, etc., there can be a large number of high-quality assets that complement the cryptocurrency market. Through the blockchain network, the whole world can be reached, spot and derivatives can be traded without permission, and then seamlessly combined with DeFi gameplay, which has great imagination and practical needs.

On-chain finance is no longer limited to the circulation of virtual assets, but has expanded to the issuance, settlement and trading of generalized assets. The scenario of "stablecoin payment + on-chain RWA + large-scale user entry" is a familiar logic and structure for compliant funds; for Web3 on-chain protocols, it is a path choice to connect with the real world. This kind of structural narrative driven by real needs can bring more lasting and deeper market evolution, and is expected to carry tens of trillions of dollars in assets, injecting vitality into the crypto industry beyond the bull-bear cycle.

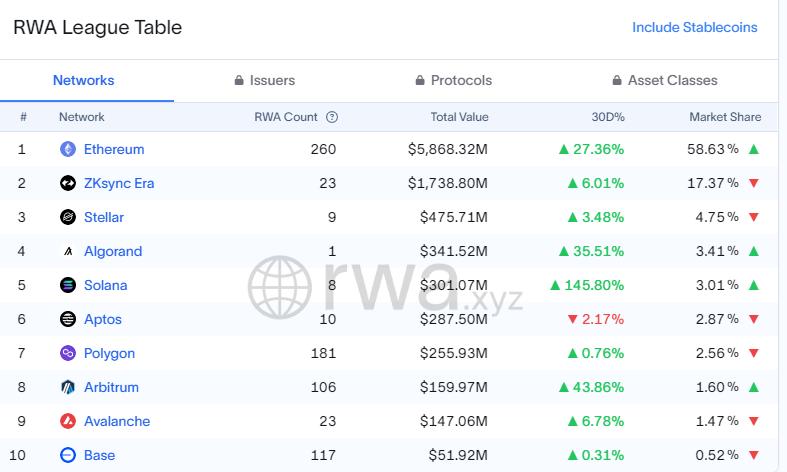

However, the current channel between traditional finance and crypto finance still faces many obstacles. The market size is too small and there are still certain obstacles for users to participate in transactions. According to rwa.xyz data, the total value of RWA assets on the chain is about 21 billion US dollars (excluding stablecoins), mainly including private credit, US Treasury bonds, commodities, stocks, etc., of which Ethereum chain assets account for more than half, followed by Zksync and Stellar. The total holding addresses of RWA assets on the chain are less than 100,000.

Although RWA has a bright future, it will take some time to truly achieve the deep integration of encryption and traditional finance. In this context, 4E Exchange's one-stop financial asset trading service may be able to bridge the gap between traditional finance and Web3.