Original title: “Tokens aren’t just CAC: they are instruments for underwriting user behavior”

Written by: Lauris

Translated by: Daisy, Mars Finance

Tokens are more than just CAC: they are an underwriting tool for user behavior

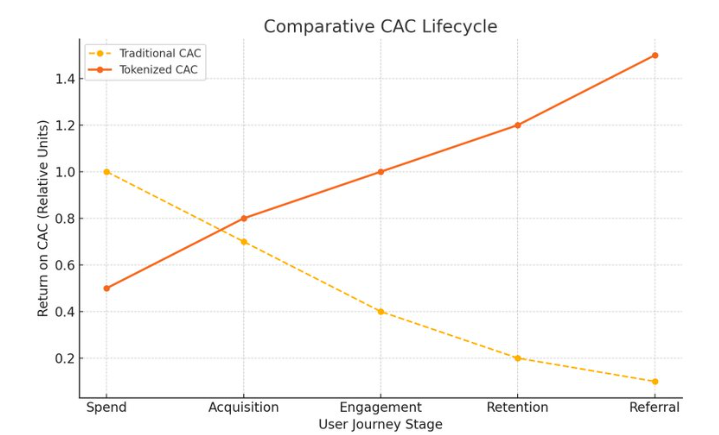

Most founders view CAC as an accounting metric. In the cryptocurrency space, especially in applications or protocols that require frequent user interaction, it is closer to structured finance. Tokens are not just an incentive; they are an underwriting tool.

They embed choice into user behavior, transforming growth expenditures from sunk costs into a portfolio of contingent claims on future participation. When you issue tokens, you’re not “rewarding” users: you’re actually programming a behavioral derivative.

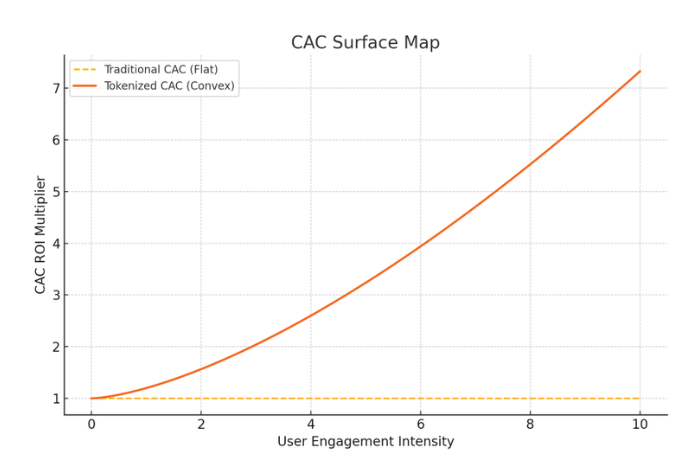

Traditional CAC is cash outlay. Token CAC is exposure with convex returns, intrinsic pricing, and reflexive momentum. This is not marketing. This is capital formation, abstracted to the user level. Getting this right is critical to generating upward momentum in acquisition, retention, and mind share.

There’s a reason people like @nikitabier are getting more involved in crypto. Crypto is one of the last frontiers outside of proxy development where there is real innovation in growth and distribution engineering.

Airdrop Mining: A Premature Yield Curve

Airdrop mining is often misunderstood. Yes, it is extractive. Yes, it is often manipulated. But beneath the mercenary surface lies a deeper truth: users are expressing forward-looking expectations about the value of tokens, and pricing their time accordingly. This is not behavior for reward. This is behavior as option exercise.

Early airdrops created the original behavioral market. Many of us, including myself, started participating in DeFi based on the expectation of future rewards through mining.

Speculators front-run the protocol’s generosity by simulating belief. The protocol tolerates this leakage because even noisy activity creates liquidity, distribution, and narrative framing. This attention capture ultimately aids price discovery.

Mining is not hacking. It is the first market to price attention futures. Ultimately, cryptocurrency is a place to trade and financialize attention.

CAC as structured exposure

In traditional growth models, CAC is a constant. In crypto, it’s a curve shaped by emission, vesting, decay, and game mechanics.

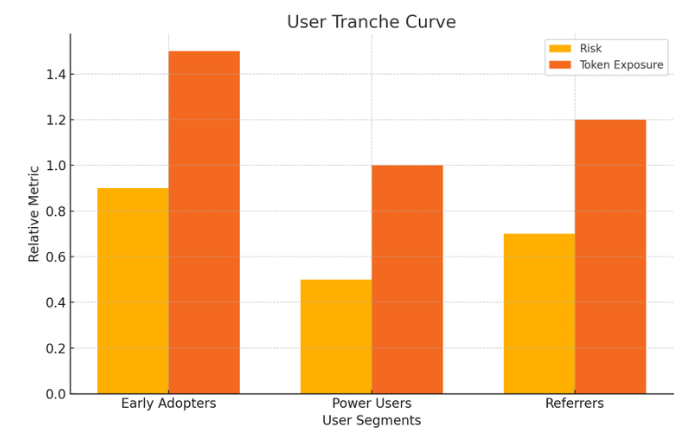

You can think of each user as a portion of the exposure:

- Early adopters = high risk, high leverage.

- Core users = stable cash flow, low volatility.

- Recommender = a distribution agent with embedded network delta.

Tokens allow you to dynamically price these tranches, not just in USD, but in protocol-native instruments that reflexively appreciate as the network scales. This is not "paying users." This is writing call options on your future traction and distributing them to those who create it.

Motivating Design: Fractal Convexity

Well-designed token systems create hierarchical convexity:

- You are rewarded for early action.

- If others take action because of your action, you will be rewarded again.

- If the system itself reprices upward as a result, you will be rewarded a third time.

Some of the most interesting systems in crypto leverage these mechanisms to create natural Schelling points: through the reflexivity of on-chain activity. Just 3;3 bro.

Everyone knows that the payoff is not linear. It’s recursive. This creates fractal convexity where every bit of effort has second and third order exposure to the success of the protocol.

Effective incentive design encodes this into the system:

- The points system is both a soft warrant and a volatility surface.

- Vesting plans act as synthetic locks.

- Differently tiered action costs (in terms of underwriting) to appeal to different user personas, including investors.

You're not offering certainty. You're offering exposure to potential. That's why it spreads.

Mechanism Design: Rhythm, Reflexivity, and Pace

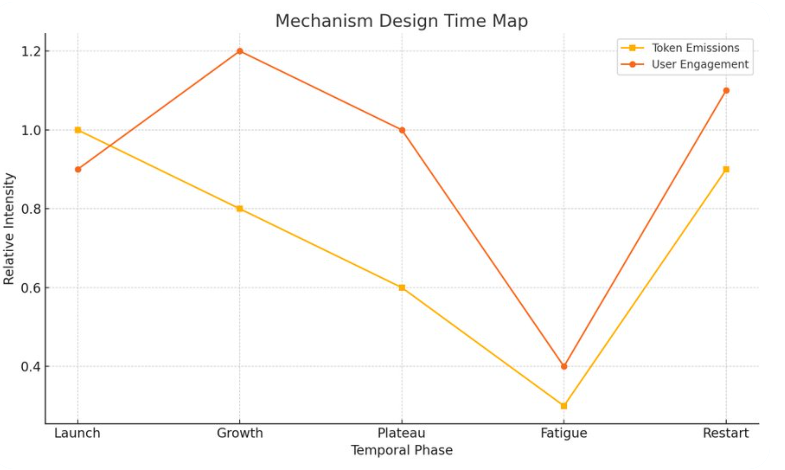

Traditional CAC is static. Tokens let you control cadence. Time-based unlocks. Seasonal emissions. Expiration multipliers. These all shape behavioral density, the frequency and intensity of user engagement.

A well-designed CAC system balances:

- Reflexivity (users price their own behavior),

- Scarcity (earning window closes),

- Narrative (progress can be shared),

- Volatility (the outcome is uncertain, but non-zero).

In crypto, referrals are not affiliate marketing, but meme underwriting. Users become CAC agents, compensated not for coverage but for reflexivity: their ability to attract others who also want exposure.

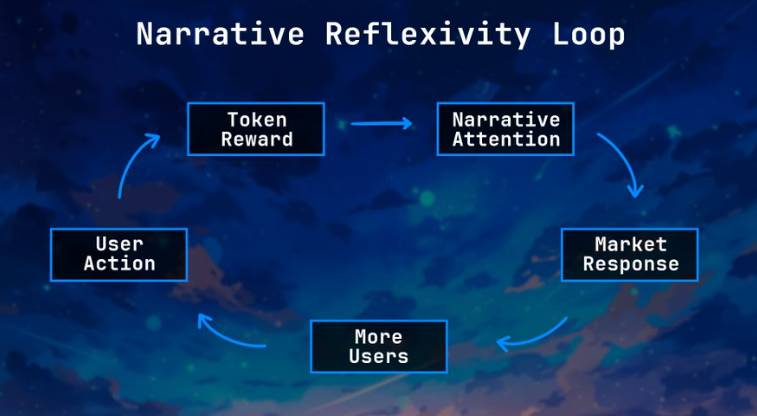

This turns virality from a coefficient (the k-factor) into a financial feedback loop:

Invitations → Points → Influence → Attention → Price Increases → More Invitations.

It raises the stakes for distribution. Incentivized action with social reach becomes a self-priced narrative velocity.

Tokens are CACs with a rhythm. Hence the adage: “Technology is good when prices go up.” If reflexivity persists, the network effects native to crypto can outlast many traditional viral flywheels.

Superfluidity

Blur and Blast: Mechanized Liquidity Extraction

@blur_io executed CAC as a tool with surgical precision.

Points are not loyalty badges. They are emission futures, weighted based on leaderboards and time. Each user becomes a micro-market maker, competing under a decaying incentive curve.

Leaderboards are more than just gamification. It’s about on-chain price discovery about who can trade the hardest under pressure. We can blame Blur for destroying the NFT market, and maybe even NFT finance as a whole. Fractal convexity means that all assets, all series, and all actions become tightly correlated.

But the system does exactly what @PacmanBlur intended: actively cornering the market.

Deep liquidity. No CAC burn. Perfect information asymmetry. This is not marketing. This is a structured auction for liquidity and attention.

Blast takes it a step further - CAC is more than just a cost. It becomes a meta-game.

The early Blast era was one of the most interesting times in crypto for many dApp users. It heavily underwrote user behavior and explicitly financialized that underwriting. An OTC market formed around Blast Gold and Points. Teams competed for traffic by publishing and capturing attention. The metagame was multi-player, zero-sum, and speculative by design.

A lot has been said about what the Blast team did right and wrong, but it’s clear that the Blast system has had a significant impact on the design space of token incentives. The rules are clear, speculation is accepted, and new markets are created around the future value of user actions that are underwritten on a regular and systematic basis.

Abstract: Gamification of user behavior underwriting

Speculative games with imperfect information are inherently convex. Pre-mainnet, as more clarity is gained, the velocity of speculation decreases. As the system approaches the mainnet event horizon, the gap between hope and reality narrows. Any hardcore Blast user in May/June would have experienced this acutely. As a result, smart teams are looking elsewhere for inspiration.

@AbstractChain’s incentive design is not as explicitly financialized as Blast’s, but the speed of speculative interest is driven by taking some lessons from game design. Most cryptocurrency users are very familiar with the reward systems that exist in games — achievements, status, titles, gear, etc.

Abstract is positioned as an easily accessible general purpose L2 for consumer cryptocurrency applications. The Abstract Portal naturally explicitly gamifies on-chain interactions while underwriting user behavior through XP mining, albeit less explicitly. Based on my observations, their approach is proving sustainable.

While there will be less volatility and narrative generation in future token prices, there is strong user acquisition velocity and real, organic application usage. Using badges and unlockable achievements to create a dopamine loop for users and farmers creates an intermediate stage between incentive activities and mainnet launch - allowing chain teams and core builders to not have to rush to launch tokens, and to bring enough users into the chain to maintain organic product-market fit.

Fat App Theory: CAC Becomes the Balance Sheet

Fat protocol theory says that infrastructure will capture value. This may still be true, but the CAC primitive here implies something else:

Apps are balance sheets. These are more than just products — they are synthetic economies with their own currencies, emissions, and belief markets. Blur. friend.tech. Blast. Each designed a CAC system while bootstrapping liquidity, distribution, and narrative.

CAC is not a cost. It is a tokenized growth underwriting model. Tokens are synthetic equity.

CAC is now a financial surface

In crypto, CAC is not something you lower. It’s something you price. You don’t spend money acquiring users. You write tools to expose them to the upside of their own behavior.

That’s why the best cryptocurrency growth engines feel more like games, hedge funds, or cultural movements than startups. They are systems designed to:

- Underwriting the Attention Game

- Financial surfaces that generate reflexivity

- Looks like a growth engine for structured products

While I still think to some extent onboarding is a meme and some of the most successful protocols in the space are relatively closed, I think we are approaching an inflection point where, through gamification, non-native users will be able to experience the benefits of having their actions underwritten by a protocol or product, and thus be able to see the benefits of owning a financial meta-game.

Getting started is a meme because tourists want to build non-speculative use cases for cryptocurrencies. Cryptocurrencies are purely speculative on a consumer level. Listen to the traders, farmers, and actual users, not those who are entering the space to professionally mine from the latest Alt L1 funding.

Onboarding will not happen by introducing a bunch of random consumers to on-chain applications, but rather when the technology, know-how, and design solutions underwritten by user behavior become an essential component of any consumer application in this zeitgeist of financial nihilism and uncertainty.