Written by Tyler

In today's Crypto, it is no longer difficult to obtain a consumer U card, but if you want to have a bank account-level, personal real-name compliant foreign currency account, it is still quite scarce.

Whether you are a Crypto user or an ordinary player who has never been exposed to Web3, you probably want to easily deposit funds into overseas brokerages such as Interactive Brokers (IBKR) to invest in European and American stocks, pay foreign currency payments to overseas related services, or remit tuition fees for overseas relatives and friends across borders.

To put it bluntly, most users need more than just a foreign currency prepaid card that can directly consume cryptocurrencies, but a complete and compliant financial account system. At the beginning of the year, the author had an in-depth experience of the bank channel service launched by SafePal in cooperation with Swiss Fiat24 Bank.

This service not only provides a Mastercard that is convenient for small purchases and withdrawals, but more importantly, it is also a compliant Swiss bank account that supports transfers in Euros and Swiss francs, and can be used for deposits and withdrawals in overseas brokerages (such as Interactive Brokers, Charles Schwab, Tiger, etc.) and crypto exchanges (such as Kraken, Bitstamp, Binance, etc.) (Extended reading "Understanding SafePal Bank Accounts and Mastercard in One Article: A Complete Guide from Account Opening to Depositing Funds at Overseas Brokerages ", " Use U to Spend, a Nanny-level Tutorial on Registration and Use of SafePal Mastercard ").

After nearly 3 months of in-depth testing, the author found that the SafePal & Fiat24 bank channel service essentially provides users in mainland China and other regions that previously lacked similar services with a low-threshold and convenient channel for Euro SEPA transfers and remittances: based on the IBAN Euro transfer channel, for the first time, Crypto wallets have the capabilities of nearly full-featured commercial bank accounts.

To put it simply, compared with the traditional "U card", the SafePal bank channel service not only covers Crypto consumption functions, but is also a complete financial account that can freely send and receive euros, associate crypto assets, and has a compliant identity label - users can open a compliant Swiss offshore bank account remotely without leaving home, and enjoy a sound bank account deposit and withdrawal, transfer and remittance functions, which is especially suitable for users with cross-border transfer and remittance, deposit and withdrawal needs.

Therefore, this article will focus on the derivative use scenarios that can be achieved using the Euro SEPA transfer and remittance channel, and conduct in-depth testing of overseas brokerages, traditional banks/remittance service providers, crypto exchanges, Apple Pay/Google Pay, and other aspects to help everyone better obtain and master a bank account that is both compliant and multifunctional.

1. Two-way connection between Crypto and Euro

As mentioned above, the bank channel service jointly launched by SafePal and Fiat24 essentially provides users with a low-threshold compliant channel for two-way conversion between crypto assets and the euro.

Before making a transfer or deposit/withdrawal of Euros, you must first ensure that there is enough Euro balance in your bank account. There are currently two main ways to do this:

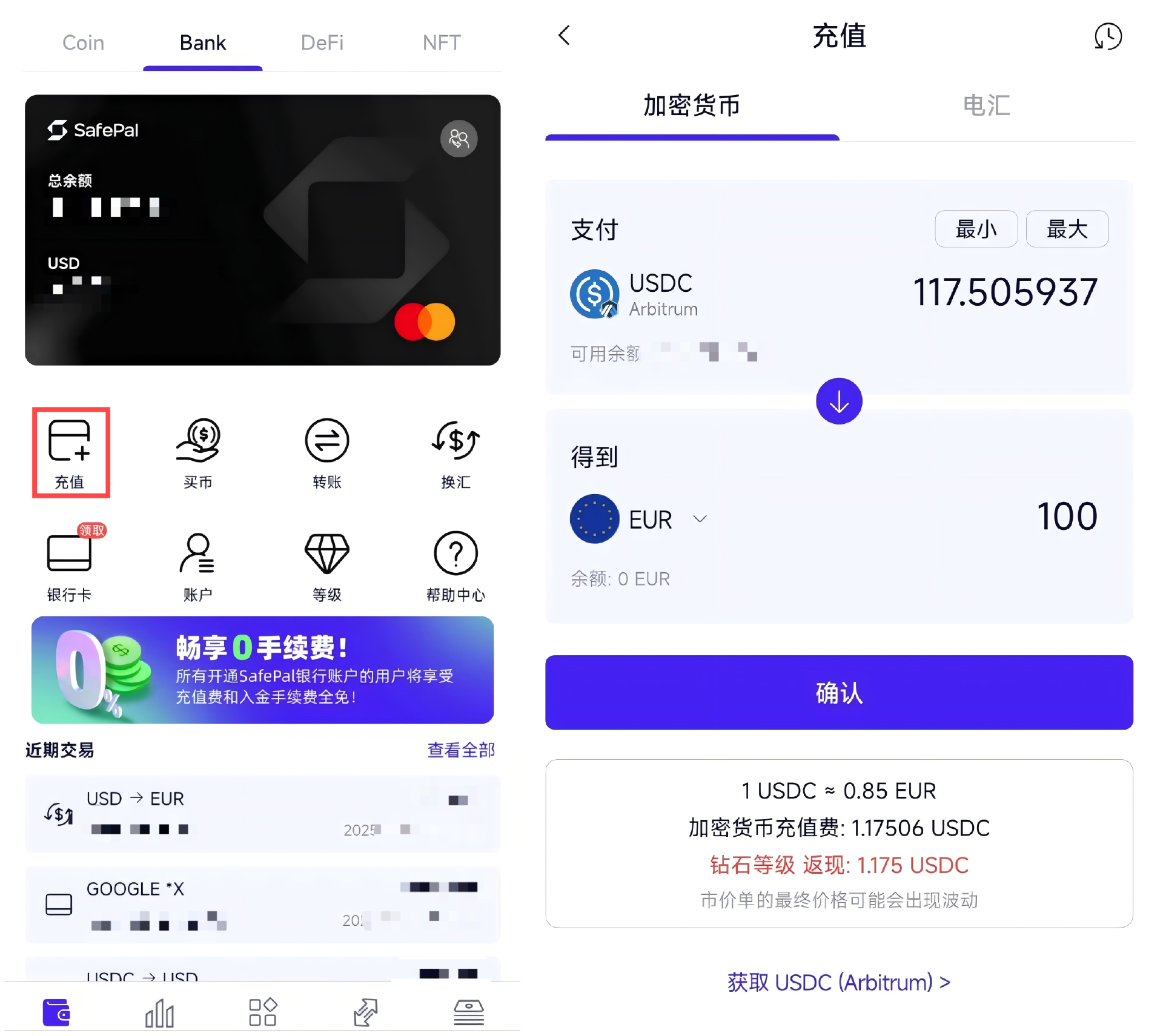

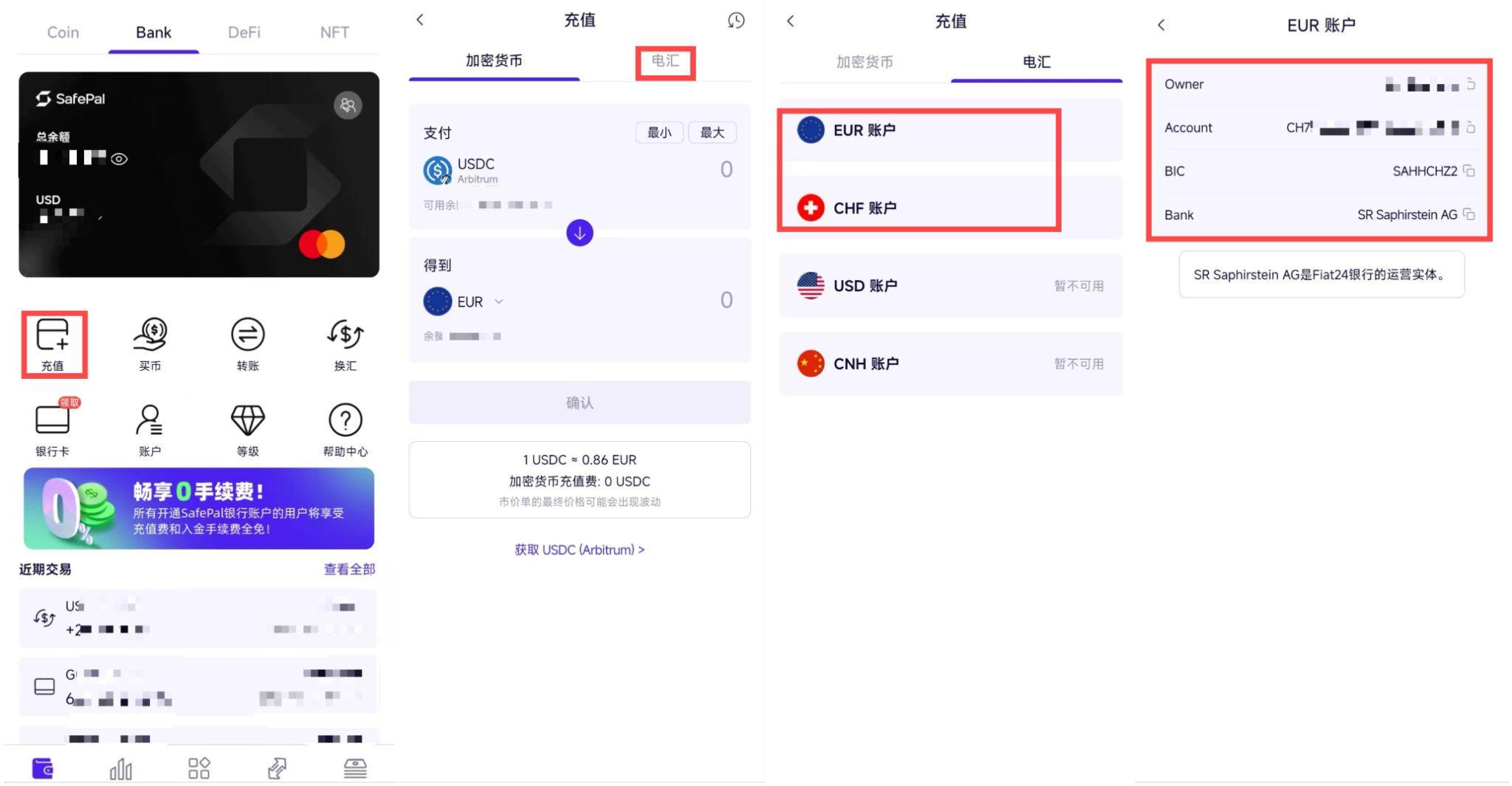

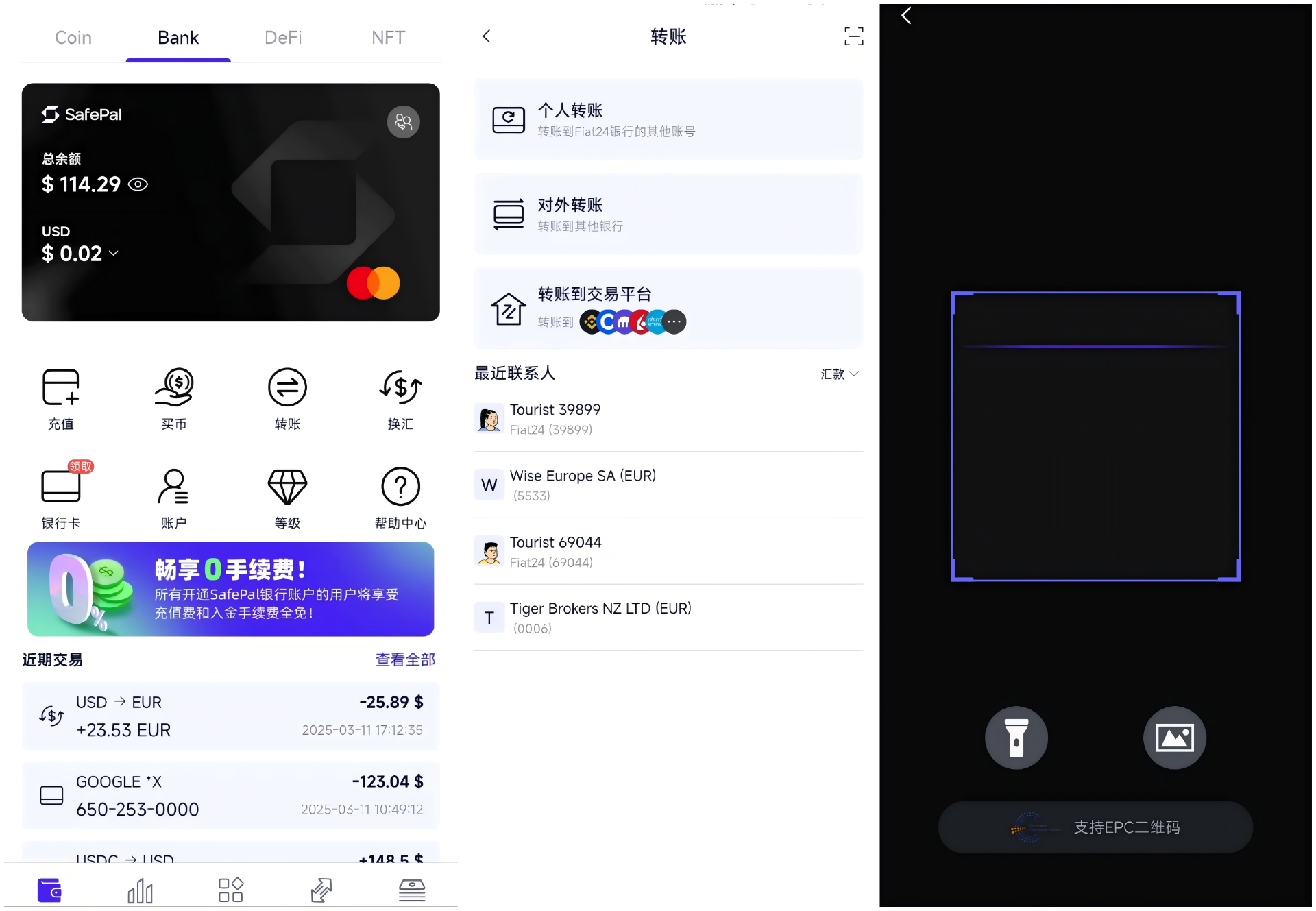

1. Deposit USDC (Arbitrum) into Euros via the SafePal Wallet App

Users can select the "Recharge" service on the "Bank" page of the SafePal Wallet App to recharge the USDC (Arbitrum) on the chain to EUR. The system will automatically convert USDC to EUR based on the real-time exchange rate.

As shown in the figure, when 117.5 USDC are used to exchange 100 EUR, the exchange rate displayed by the system is approximately 1 USDC ≈ 0.85 EUR, and a recharge fee of 1.175 USDC (1%) will be displayed.

It should be noted that SafePal currently implements a 100% refund policy for all USDC to fiat currency recharge fees. In other words, the fees paid by users will be fully refunded in the form of USDC, which can be viewed and withdrawn in "Level" - "Total Rewards".

2. Transfer Euros to your personal SafePal Swiss bank account via SEPA transfer

In addition to recharging through crypto assets, users can also transfer euro funds from other banks or financial institutions to Swiss bank accounts provided by SafePal through SEPA (Single Euro Payments Area). This method is suitable for users who have euro funds in other banks or financial institutions.

The specific steps are as follows:

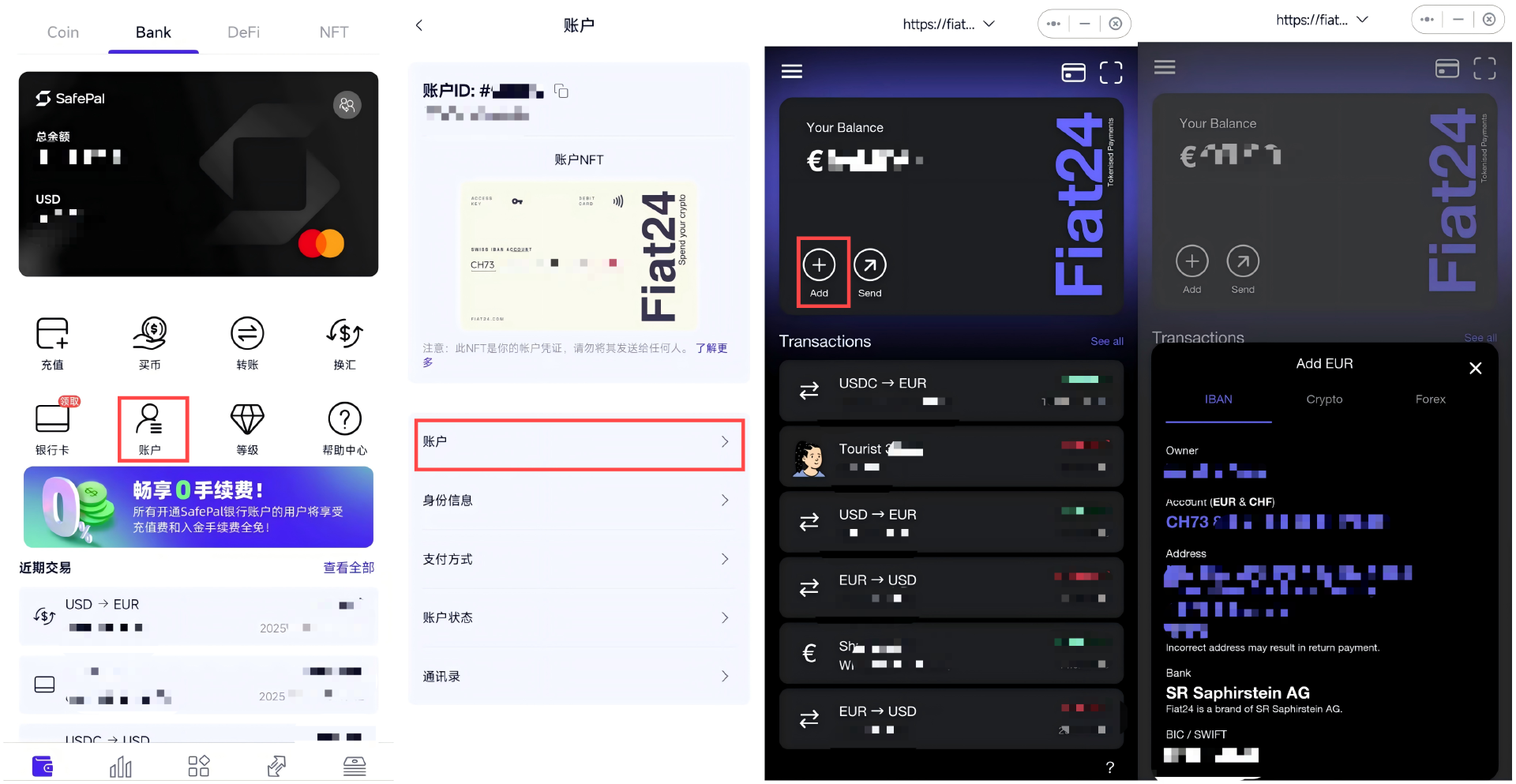

On the "Bank" page in the SafePal Wallet App, click "Account" to enter the account details page, and click the "Add" button to obtain your personal IBAN (International Bank Account Number) and BIC/SWIFT (Bank Identification Code);

Or, in the "Bank" page of the SafePal Wallet App, click "Recharge" directly, and you can enter the account details page on the right to obtain your personal IBAN (International Bank Account Number) and BIC/SWIFT (Bank Identification Code).

Then, initiate a SEPA transfer in your other bank account where you hold Euro funds. When filling in the payee information, enter the IBAN and BIC/SWIFT you obtained in the SafePal App. After confirming that the transfer information is correct, submit the transfer request.

This also means that after users transfer euros to their personal Swiss bank accounts provided by SafePal, they can then redeem the euros for on-chain USDC or other crypto assets (currently supporting other Swap-supported currencies) by "buying coins", thereby achieving two-way connection between Crypto and euro deposits and withdrawals.

It should be noted that since SafePal & Fiat24 provide Swiss bank accounts, the personal IBAN starts with CH (the IBAN code for Switzerland) + a 19-digit account number.

At the same time, although SafePal and Fiat24 do not charge bank transfer fees, if non-EU cross-region transfers involving euros (such as New Zealand banks in non-EU regions) are involved, third-party banks may charge a certain fee. Therefore, it is recommended to consult the relevant bank's fee policy before making a transfer.

In summary, through the above two methods, SafePal users can easily convert crypto assets into euros, or transfer euro funds from other banks/financial institutions to personal Swiss bank accounts and exchange them for on-chain currencies such as USDC to meet the deposit and withdrawal needs of compliant fund flow.

On this basis, whether it is used for deposits and withdrawals of overseas brokerages, CEX deposits and withdrawals, daily consumption, transfers, or payment of subscription fees for international services such as 𝕏, SafePal bank channel provides efficient and low-cost solutions.

2. Practical application scenarios of SafePal banking channel service

The bank channel service jointly launched by SafePal and Fiat24 provides users with a low-threshold compliant channel for two-way conversion between crypto assets and euros. The following are several typical scenarios of the service in actual application:

1. Euro deposits and withdrawals from overseas brokerages (such as Interactive Brokers and Charles Schwab)

Since the personal Swiss bank accounts provided by SafePal support euro transfers and remittances, users can directly transfer euro funds to overseas brokerage accounts that support euro SEPA deposits, such as Interactive Brokers (IBKR), Charles Schwab, etc., providing a more convenient channel for funds in and out for cross-border investment needs.

This article takes the Euro deposit process of Interactive Brokers as an example. The whole process is lossless and there is no deposit fee (and through Interactive Brokers, you can also convert it into other currencies such as US dollars and Hong Kong dollars at the best exchange rate and withdraw it to US cards or Hong Kong cards, etc. You can also develop and test more channels by yourself).

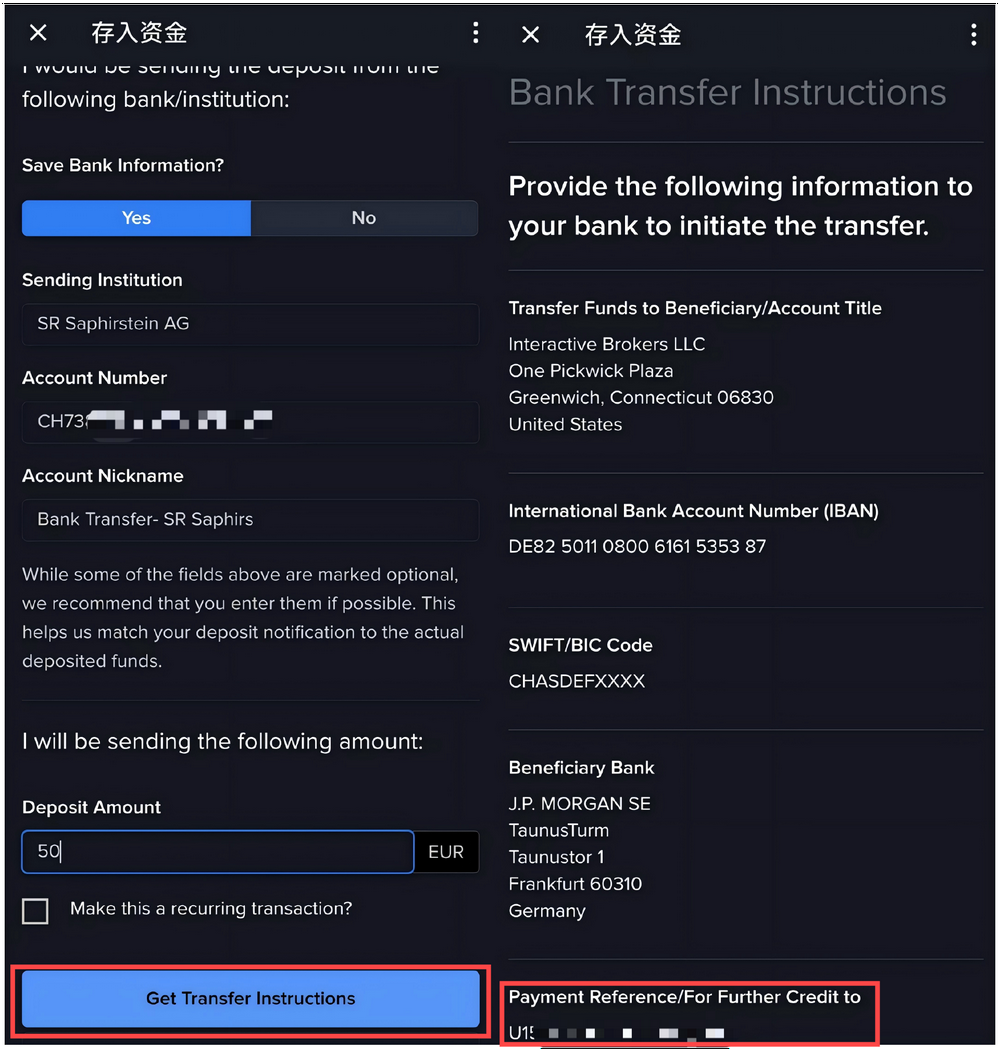

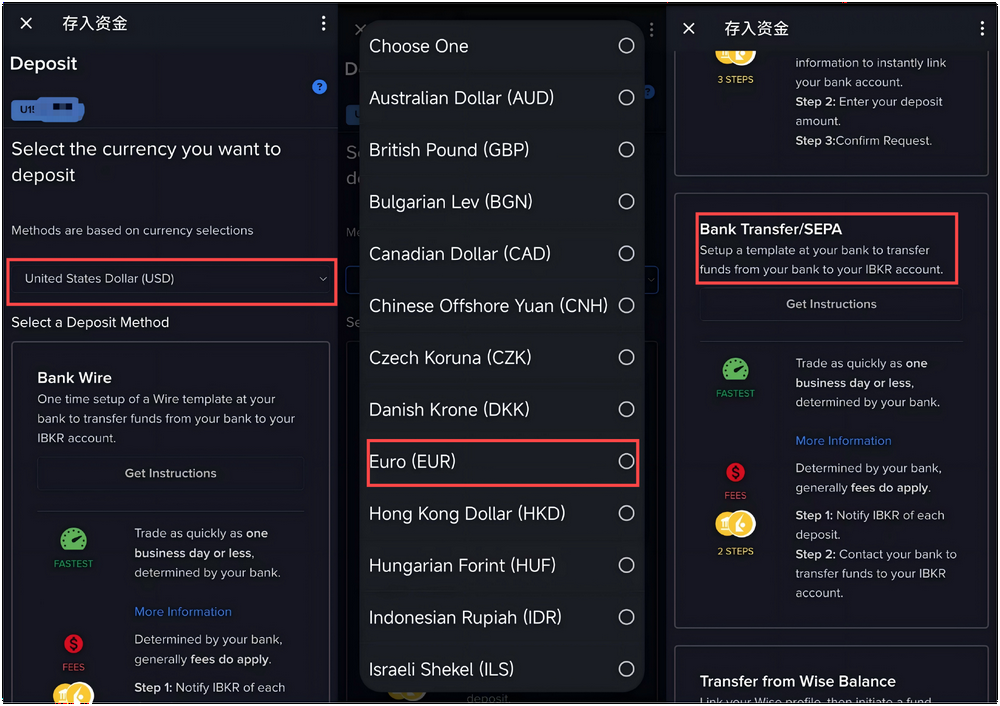

First, open the Interactive Brokers APP (the PC version can refer to the similar process), click the menu button in the upper left corner, and enter the personal settings page.

Then click "Deposit Funds", select the first "Standard Deposit" in the pop-up options, and enter the deposit page:

- I have previously deposited in Euros through SafePal & Fiat24 many times, so as shown in the picture, there is a record of "Bank Transfer-SR Saphirs", which can be directly clicked later;

- If it is the first time for a new user to deposit in Euro, you need to click "Use a new deposit method" below to select and add a deposit payment method;

Then select EUR in the remittance currency, select the second deposit method "Bank Transfer/SEPA", and then click "Get Instructions" to enter the transfer instructions page.

After entering the transfer instruction page, there are 4 items to be filled in from top to bottom:

- Remittance institution (required): You can fill in "SR Saphirstein AG" (the name of Fiat24's operating entity);

- Account number (optional): the personal IBAN account number mentioned above (CH+19 digits);

- Deposit Instruction Notes (Required): Generally, this item will be automatically filled in after filling in the first item;

- Deposit amount (required): Fill in the specific amount you plan to remit, for example, 50;

Note that after filling in the above 4 items, there is no need to check the "Make this a recurring transaction" below. Just click "Get Transfer Instructions" to get the transfer instructions.

As shown in the right half of the picture below, detailed transfer instruction information will be presented. Just copy the payment reference at the bottom - personal UID/personal name in pinyin starting with U + numbers, similar to "U12345678/Tyler" .

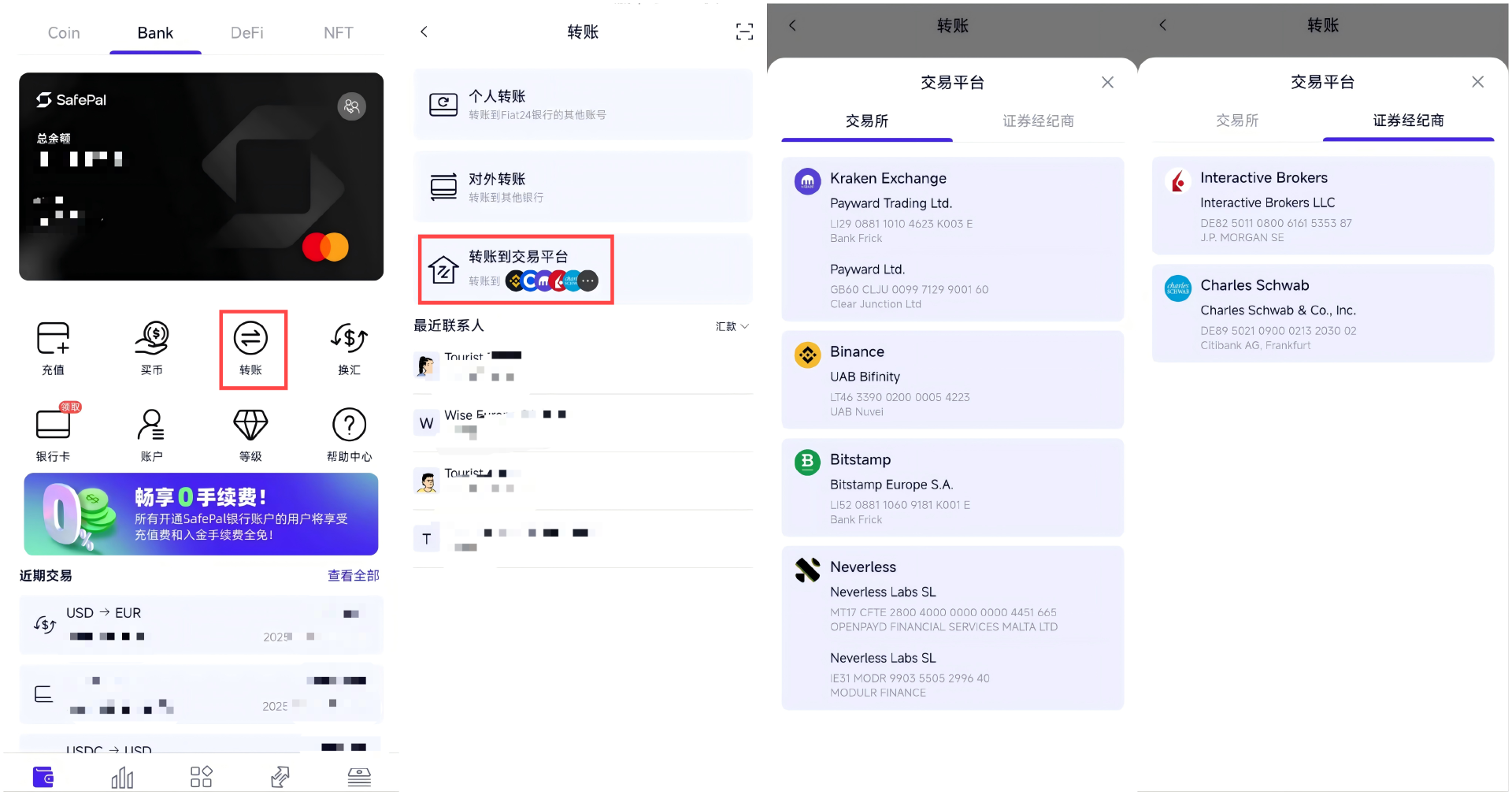

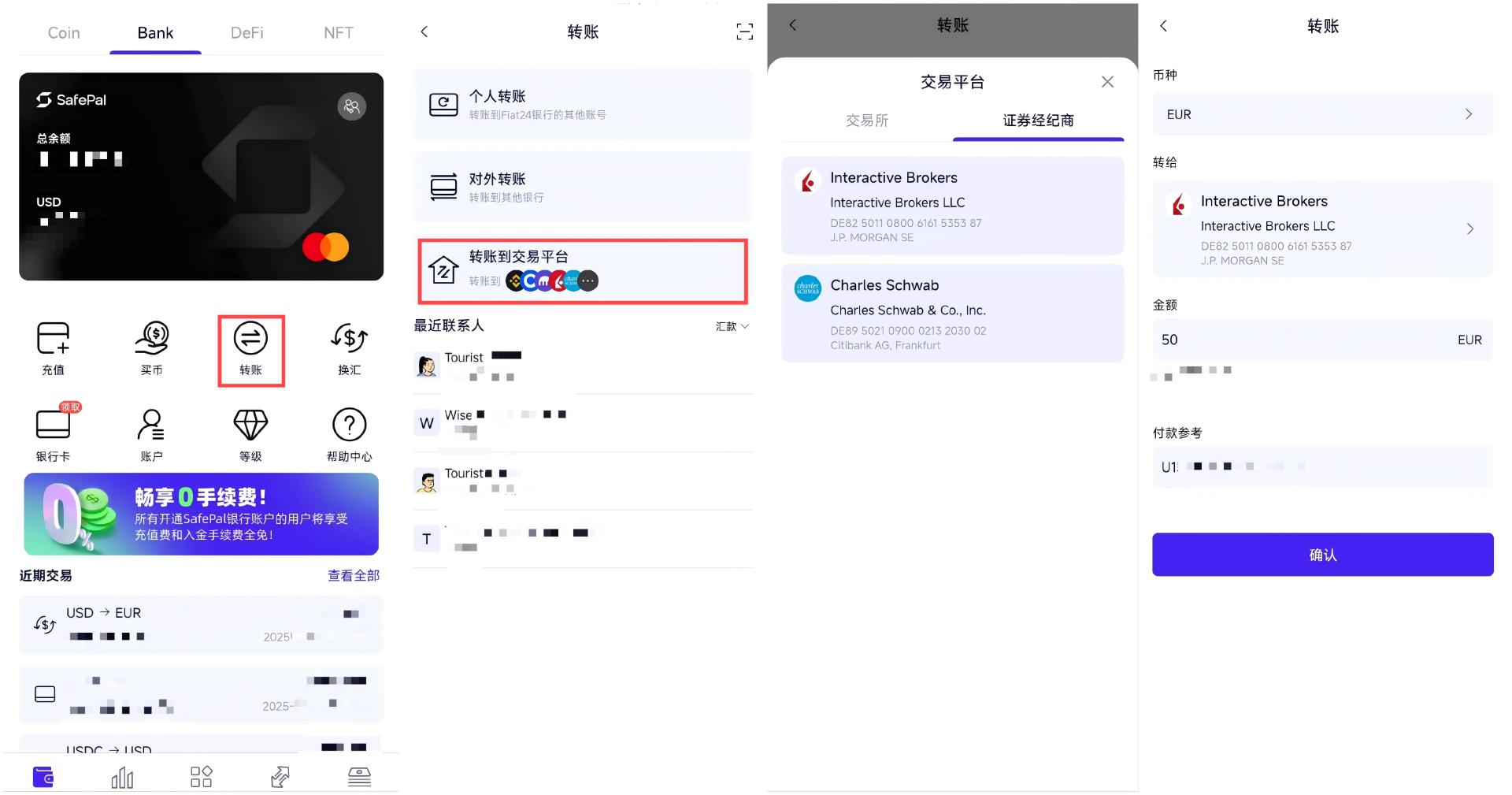

Then return to the "Bank" page in the SafePal wallet app, enter the "Transfer" service, click the "Transfer to Trading Platform" option, select "Securities Broker" and Interactive Brokers, and finally fill in the same transfer amount and payment reference as before in Interactive Brokers, click Confirm and complete the on-chain transfer.

Tips: After Fiat24 remits euros, users will receive an email notification; once the transfer is made, the funds can generally be deposited into Interactive Brokers accounts within a few hours during European and American working days.

2. Euro deposit and withdrawal guide for traditional banks/remittance service providers (such as domestic banks, Wise/Panda Express, etc.)

For users who wish to deposit and withdraw Euros through traditional financial channels, SafePal provides personal IBAN accounts in cooperation with the Swiss licensed bank Fiat24, which supports SEPA standard Euro transfers. The following will detail how to operate through domestic banks or third-party remittance service providers (such as Wise and Panda Express).

(1) Deposit service

In terms of deposits, users in mainland China can transfer Euro funds to SafePal bank accounts based on the legal foreign exchange purchase services of domestic banks through the following steps:

- Purchase foreign exchange: Purchase Euro spot in a mainland bank account under one’s name;

- Get payment information: As mentioned above, in the SafePal Wallet App, click "Bank" > "Account" > "Account" > "Add" to get your personal IBAN account information (or on the "Bank" page, directly click "Recharge", and you can enter the account details page on the right to get your personal IBAN account information);

- Remittance: Remit the purchased Euro cash to the Swiss bank account provided by SafePal through bank counter or online banking;

- Buy Crypto: After the funds arrive, enter the "Buy Coins" function on the SafePal bank page, convert Euros to USDC or other Swap supported currencies, and the funds will be automatically transferred to the user's SafePal wallet address;

Tips: Most domestic banks' mobile apps support online foreign exchange purchases and overseas remittances, which can easily complete the above operations (pay attention to comparing the foreign exchange purchase and remittance fees of various banks to find the most favorable route); in addition, you can also complete the deposit through international remittance service providers such as Panda Express, using the CNY-->EUR route.

(2) Withdrawal service

Similarly, when withdrawing funds, you can also choose to remit the euros back to a domestic bank that supports SEPA euro payments for settlement and withdrawal.

In addition, users can also transfer Euro funds from their SafePal bank account to their Wise account, and then use Wise to transfer the funds to bank accounts in other countries or regions, such as Alipay or WeChat in mainland China, thereby achieving cross-border transfer of funds. This method is particularly suitable for users who need to transfer funds back to their home country.

To do this, you need to register and activate a Wise account first: new users can download the Wise App, complete the registration (users in mainland China can use their passports), and then activate the Euro account - generally Wise will require you to transfer a certain amount (such as 20 euros) to activate the account. The transfer steps are as follows (the same steps apply to subsequent remittances to Wise).

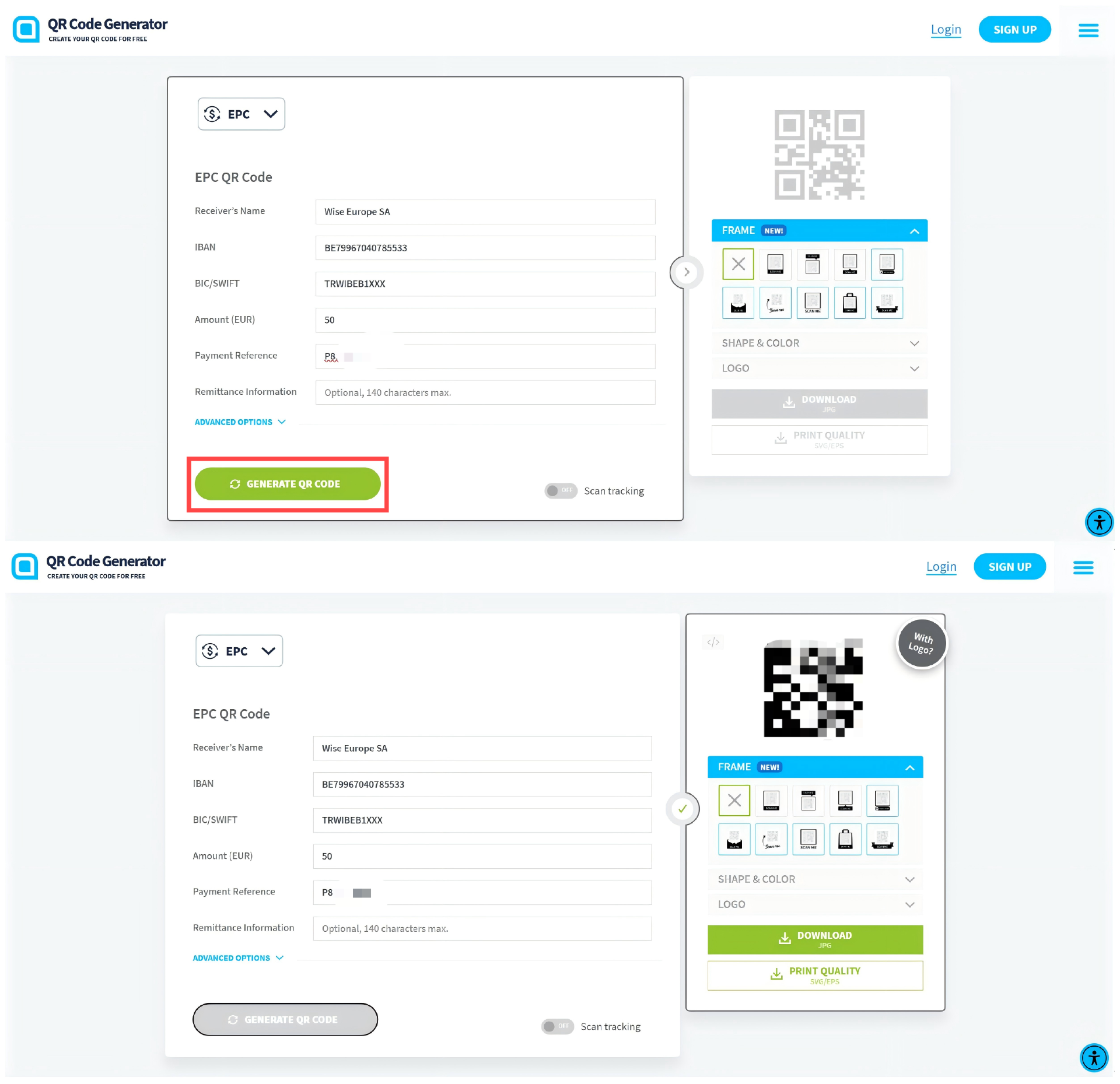

First, open Wise, click "Recharge" on the homepage, select EUR, enter the amount you want to transfer to Wise (for example, 50 EUR), and then select "Manual bank transfer" as the payment method (other methods are currently not available for mainland users).

Then open the QR code generator website : Based on the payee account information on the last page of Wise above, fill in the 5 required information in sequence and generate a QR code ( except for the last item UID, the first 4 items are theoretically the same for all users ):

- Name of recipient: Wise Europe SA;

- IBAN: BE79967040785533;

- BIC/SWIFT: TRWIBEB1XXX;

- Amount to be remitted: Fill in the specific amount you plan to remit, for example, 50;

- Payment reference: Starting with P + 8-digit UID;

Then click "GENERATE QR CODE" in the lower left corner to generate a transfer QR code.

Finally, return to the "Bank" page in the SafePal wallet app, click "Transfer", and then use the QR code scanning function in the upper right corner to scan the QR code generated above, authorize the remittance transfer, and then you can remit the specified amount of funds to the receiving account provided by Wise.

After Wise receives the Euro remittance, you only need to select the remittance to RMB (CNY) in the Wise App, and select Alipay or WeChat as the payment method. The maximum limit for a single transfer from Wise to mainland China is RMB 50,000, and each recipient can receive up to the equivalent of US$50,000 in RMB per year.

In terms of fees, Wise charges about 1% for remittances to mainland China, and the specific fee depends on the remittance amount (the higher the amount, the higher the fee, but the increase is getting smaller and smaller. In actual tests, it costs about 450 RMB to transfer 50,000 RMB, which is less than 1%) - SafePal remittances in euros/Swiss francs to any financial institution such as Wise are free.

Tips: Wise's initial attempt may sometimes fail and result in a refund. From my personal experience, if the attempt fails, try a few more times and gradually increase the amount. After the remittance is successful, wait for a while and the SafePal transfer page will have a contact record. After that, you can directly select historical contacts for remittance transfer without scanning the code (according to official disclosure, a channel for adding contacts by yourself will be launched directly in the second quarter).

3. Deposit and Withdrawal Guide for Crypto Exchanges (Binance, Kraken, etc.)

In the current financial environment, some traditional financial institutions may trigger risk control mechanisms for fund transfers directly from crypto exchanges (such as Kraken), resulting in the return or freezing of funds.

To avoid such risks, users can use the crypto-friendly banking services provided by SafePal & Fiat24 as a transit channel to avoid risks and achieve smooth flow of funds.

Withdrawal operation: withdraw funds from the exchange to SafePal bank account

Users can withdraw Euros from exchanges such as Kraken to Swiss bank accounts provided by SafePal. This operation not only reduces the risk of being controlled by traditional banks, but also ensures the safe arrival of funds. After the withdrawal, users can choose to convert the funds into USDC or other stablecoins for further investment or transfer.

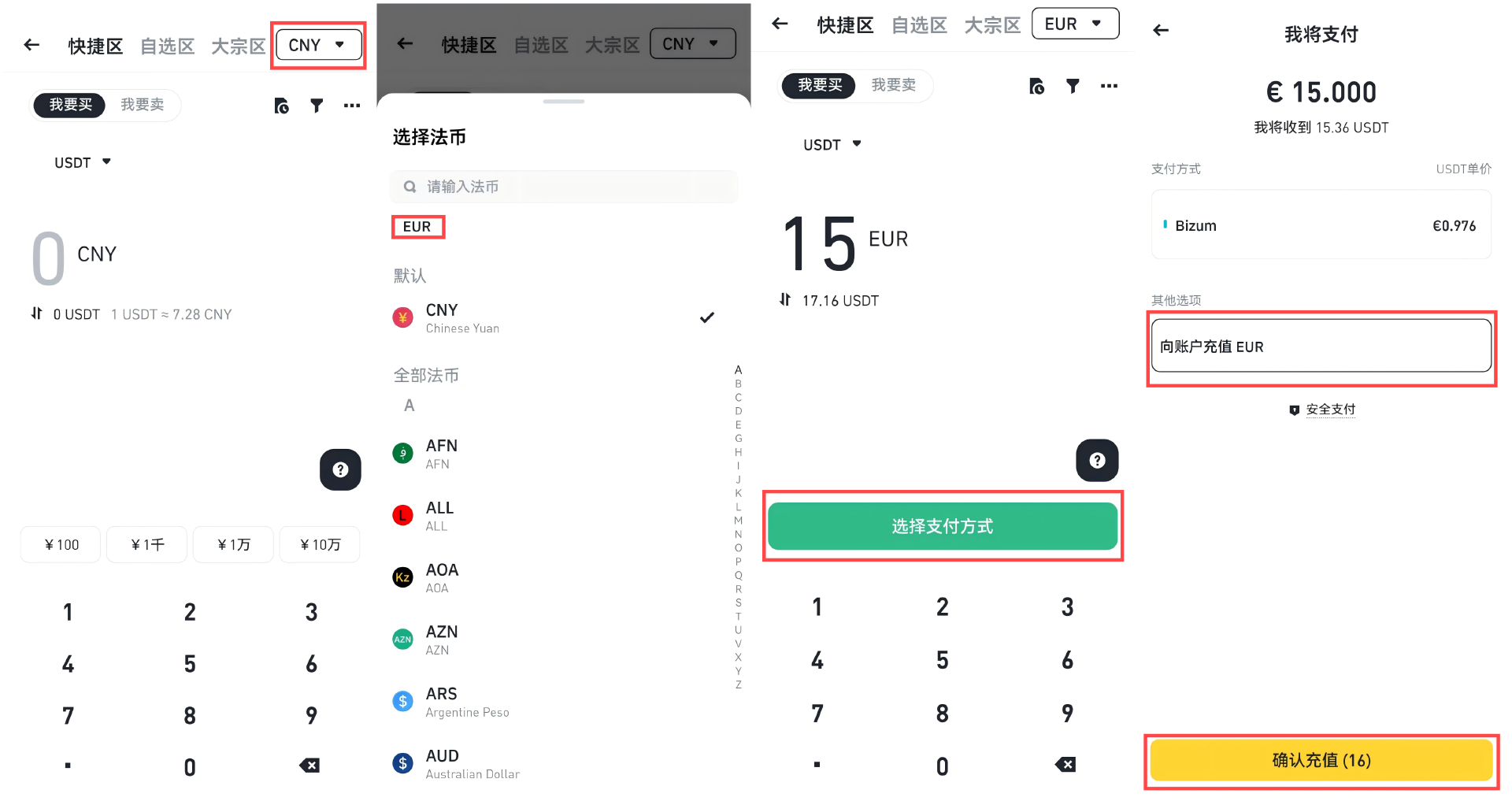

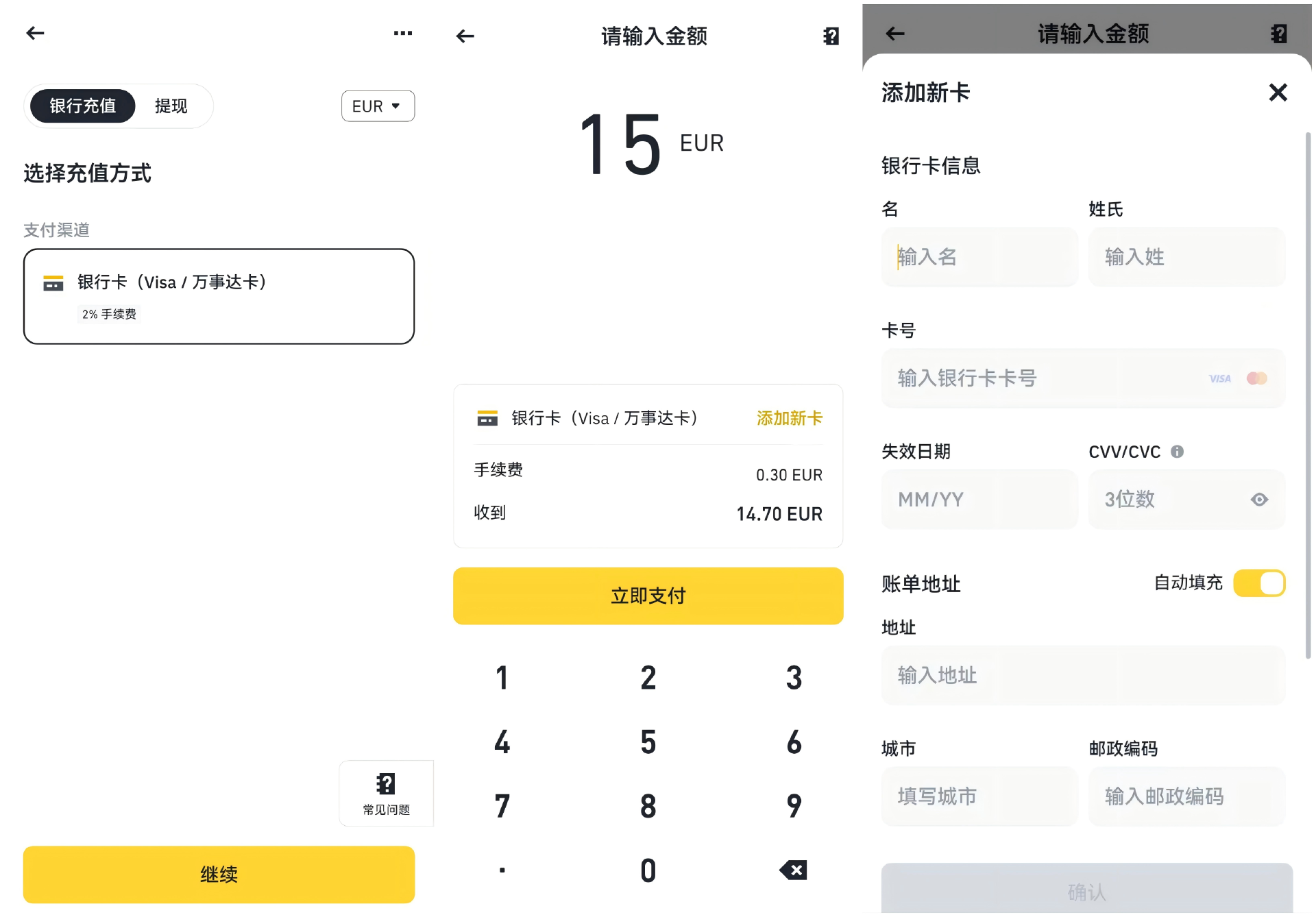

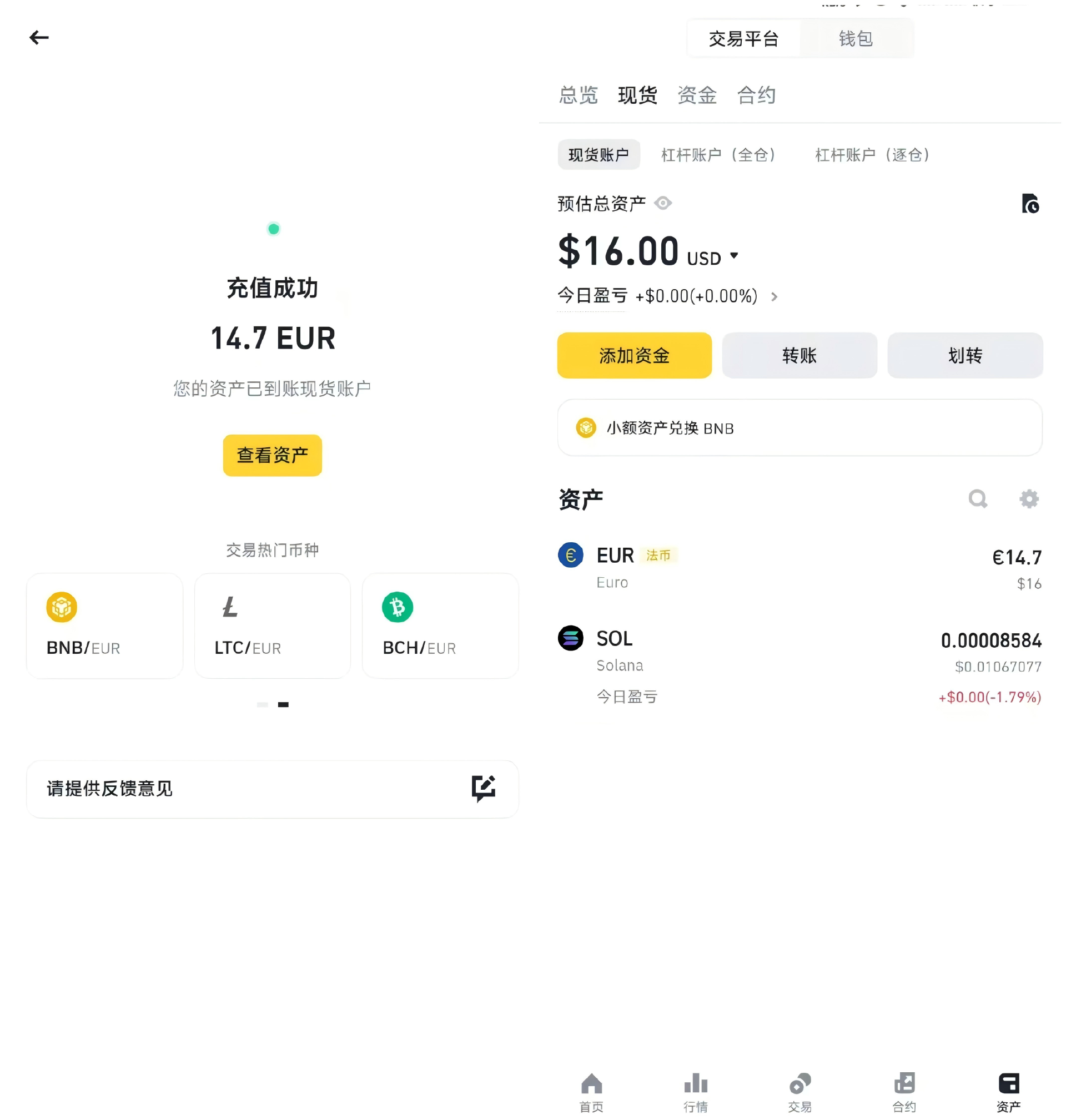

Deposit: Deposit EUR to Binance via SafePal co-branded Mastercard

For deposits, you can also use the co-branded MasterCard card of SafePal banking channel service to deposit euros. There are two entrances in the Binance APP (you can choose either one):

(1) Enter from "Add Funds" on the homepage, first switch the currency in the upper right corner from "CNY" to "EUR", and then click "Top up EUR" to enter.

(2) In the C2C service, first switch the currency in the upper right corner from "CNY" to "EUR", and then click "Recharge EUR to Account".

(2) In the C2C service, first switch the currency in the upper right corner from "CNY" to "EUR", and then click "Recharge EUR to Account".

Use any of the above two methods, that is, enter the recharge page as shown below, enter the recharge amount, fill in the card number, expiration date and CVV of the SafePal MasterCard, and make the payment.

After the payment is completed, the actual funds can be transferred to the Binance account in seconds, realizing Euro (SafePal MasterCard) → Euro (Binance account).

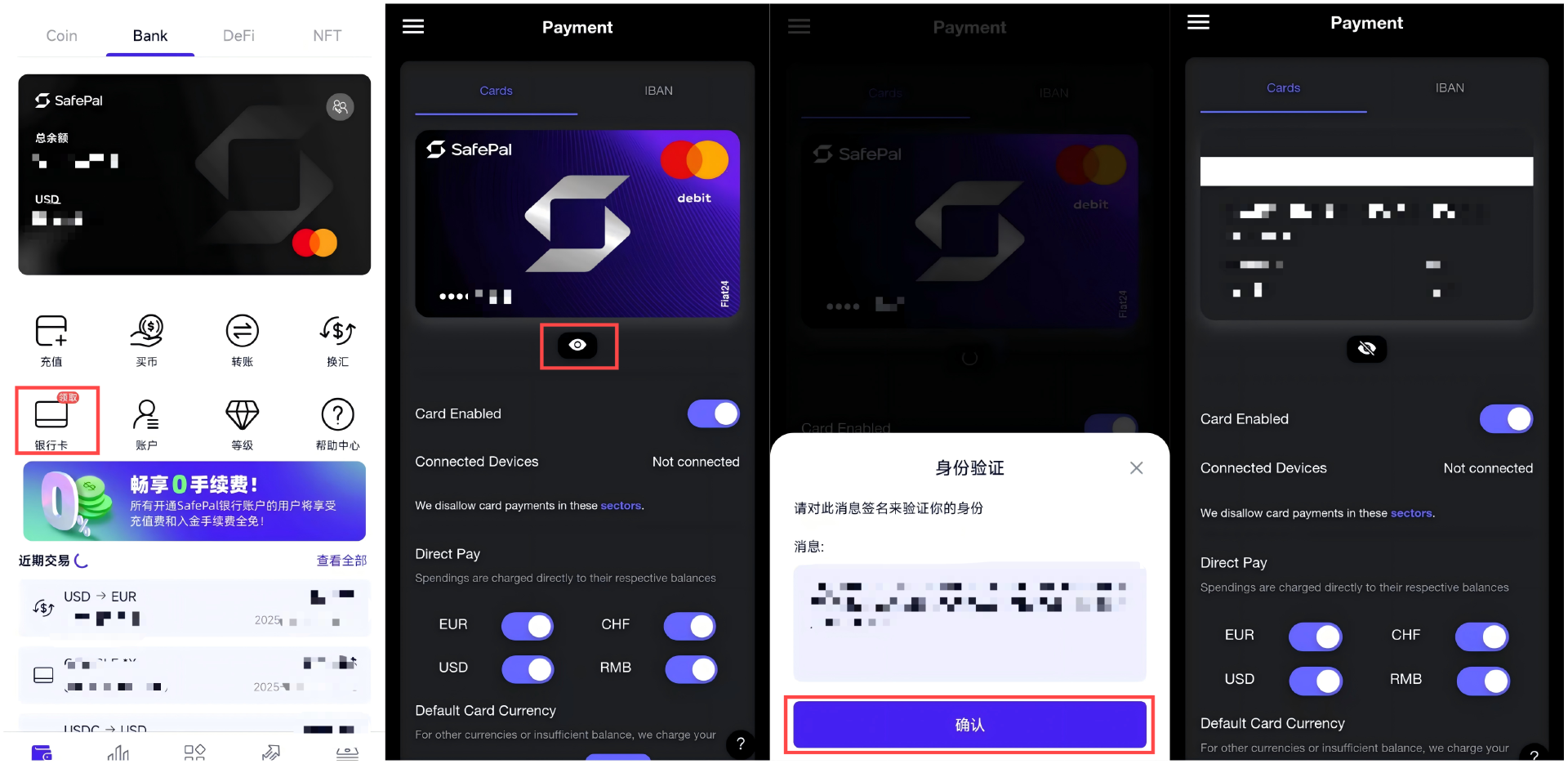

Note: To view the MasterCard details required above, you can copy the card information in the SafePal Wallet App:

- On the "Bank" page, click "Bank Card" to enter the details page;

- Click the eye icon;

- Click "Confirm" in the identity verification pop-up window to complete the wallet signature;

- After authorization, you can click to view the complete card number, expiration date and CVV security code so that you can bind it to WeChat, Alipay or use it in other payment scenarios (Note: do not disclose the CVV security code and card number to anyone );

Tips: It is theoretically possible to use SafePal Mastercard to pay in USD, but it is not very meaningful because the euro can be mainly transferred from other financial institution accounts to SafePal/Fiat24 through IBAN, and then deposited into Binance, which is equivalent to providing a personal real-name account transfer channel for euro deposits into CEX. As for USD, the USD in the Mastercard itself is recharged from USDC, and it goes back again after a long journey.

4. Bind Apple Pay and Google Pay to pay for 𝕏 Blue Label and other overseas subscriptions

The MasterCard service in SafePal's bank channel service currently also supports binding to mainstream payment platforms such as Apple Pay, Google Pay, and Samsung Pay. Users can use the US dollars, euros, Swiss francs, and RMB funds in SafePal bank accounts for daily consumption.

The binding process for Apple Pay, Google Pay, and Samsung Pay is similar: (1) Open the "Wallet" app/"Google Pay" app/"Samsung Pay" app on your iPhone and click Add Card; (2) Enter the card number, cardholder name, expiration date, and CVV security code of the SafePal Mastercard (detailed information is as described above); (3) Complete the mobile phone number verification according to the prompts and enter the received verification code to complete the binding.

Once the binding is successful, users can use SafePal Mastercard to pay at merchants that support Apple Pay, Google Pay or Samsung Pay:

- In-app purchases: such as purchasing apps, in-game items, etc. in the App Store or Google Play;

- Online shopping: shopping on e-commerce platforms that support MasterCard, such as Amazon, eBay, etc.

- In-store purchases: Make contactless payments at physical merchants that accept Apple Pay, Google Pay or Samsung Pay;

- Subscribe to other services : international subscription services such as Netflix, Spotify, YouTube Premium, etc.

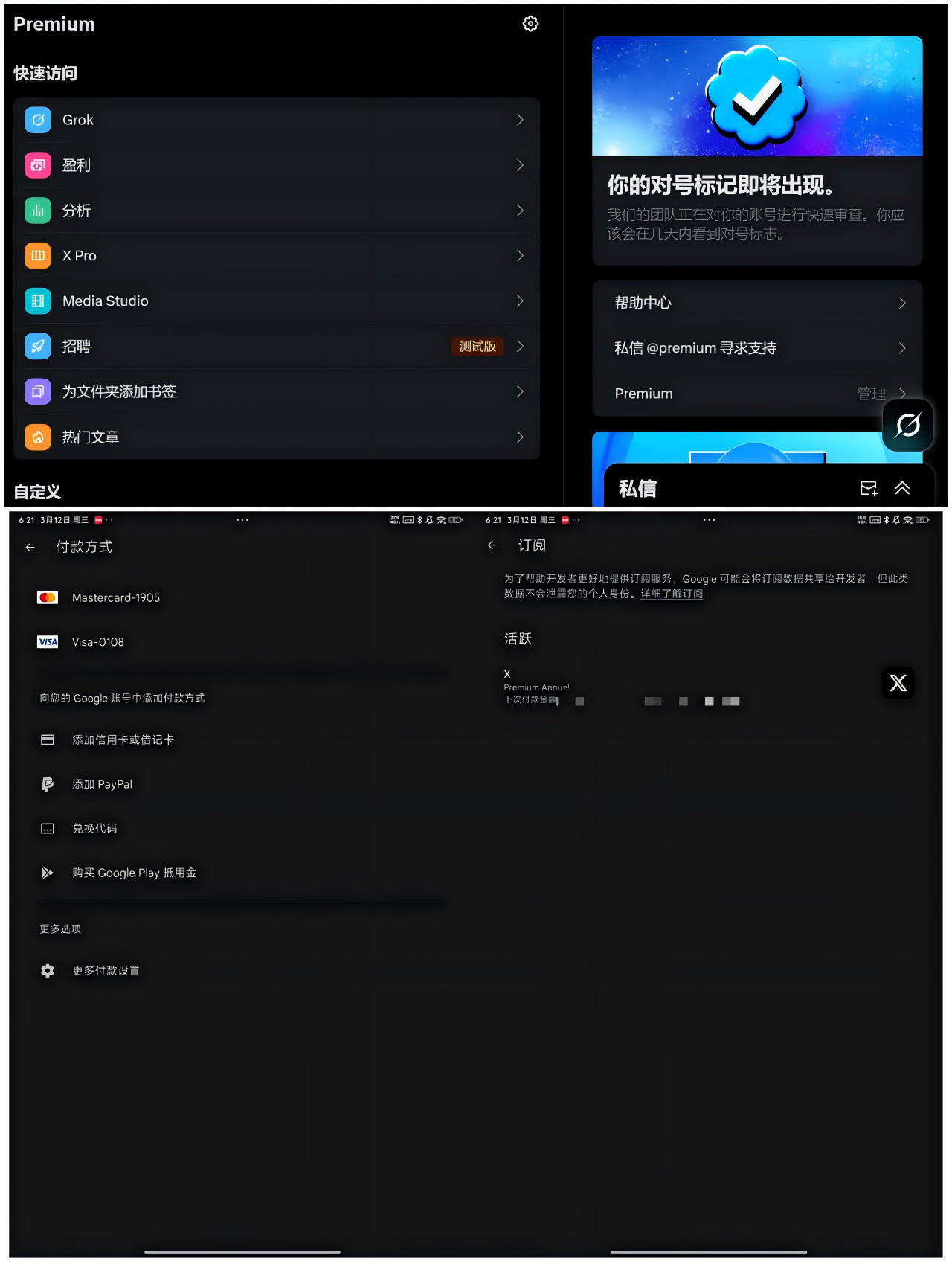

Here, let’s take the recent 𝕏 Blue Label subscription as an example. Domestic users who lack easy-to-use overseas cards often encounter the problem of limited traditional payment methods. Through the following steps, there is a roundabout way to successfully subscribe using SafePal Mastercard:

- On your Android device, open the "Google Play" app, go to the "Payment Methods" settings, add and bind your SafePal Mastercard;

- Open the 𝕏 (Twitter) app, go to "Settings & Privacy" > "Subscriptions" > "Twitter Blue", and select the subscription option;

- On the payment page, select Google Play as the payment method, and the system will automatically call the bound SafePal MasterCard to complete the payment (but it will cost more than the web version);

It has been tested that through the above method, the limitations of traditional payment channels can be bypassed and the subscription of 𝕏 Blue Label can be successfully completed.

3. User experience and precautions

In general, the banking channel services of SafePal & Fiat24 can be divided into two parts:

- Compliant Swiss bank accounts (IBAN starting with CH): Applicable to SEPA or SWIFT transfers in Euro (EUR) and Swiss Franc (CHF), commonly used for deposits and withdrawals to overseas brokerages (such as Interactive Brokers, Charles Schwab) or exchanges (such as Binance, Kraken);

- Co-branded MasterCard: Suitable for daily consumption, can be linked to payment platforms such as Alipay, WeChat, Google Pay, etc., to realize online and offline payment;

For deposit and withdrawal operations of personal real-name bank accounts, each path is in cooperation with licensed financial institutions/traditional banks, and all fund flows comply with the foreign exchange control regulations of mainland China, which provides a deposit and withdrawal channel that is far more compliant and secure than C2C.

According to the regulations of the State Administration of Foreign Exchange of China, individuals can purchase and sell foreign exchange equivalent to US$50,000 each year. Through SafePal's bank account, users can make full use of this amount to achieve efficient conversion between crypto assets and legal currency, and meet the needs of cross-border receipts and payments and asset allocation.

In actual testing, since SafePal is currently running a long-term fee-free activity and there is no additional charge for remittances, users only need to bear the exchange loss and the related fees of mainland banks (third-party transit banks in some cases) during the deposit and withdrawal process. The comprehensive cost loss is about 1%-3% - it is recommended to perform currency exchange operations on weekdays to obtain a better exchange rate.

It needs to be emphasized again that the ownership of SafePal bank accounts and Mastercard cards is bound to the user's wallet address through NFT. Be sure to keep the mnemonics and private keys properly to avoid asset loss, and remember to ensure that Mastercard-related information (card number and CVV security code) is not leaked to others.

Last words

Recently, encrypted payment cards such as U Card have flooded the Web3 ecosystem and have become the new darling of the market. However, to be realistic, many products under the "U Card Carnival" are essentially just prepaid cards, and their functions are still limited to basic consumer payments - mainly focusing on binding Alipay/WeChat for offline scanning and consumption, and online payment subscriptions.

This makes it difficult to meet users' diversified needs in cross-border capital flows, asset allocation, etc. After all, the U card only achieves "consumer terminal access" but cannot build a complete ecological closed loop for capital flow - for example, when users need to transfer funds to Interactive Brokers, 99% of U cards can only remain silent.

Therefore, objectively speaking, the services represented by SafePal & Fiat24 are not only competitive in terms of rates, but also differentiated in terms of functionality. Compared with the traditional "U card", SafePal is based on its own personal real-name compliant Swiss bank account. It is one of the few products that currently supports Euro transfers and remittances, providing users with a compliant, convenient and secure Crypto-fiat currency system deposit and withdrawal channel.