Written by: AIMan@Golden Finance

On April 25, 2025, Citi Institute, a subsidiary of Citibank, released a research report on "Digital Dollar". The key points of the research report are:

1. 2025 is expected to be the "ChatGPT moment" for the application of blockchain in the financial and public sectors, a trend driven by regulatory changes.

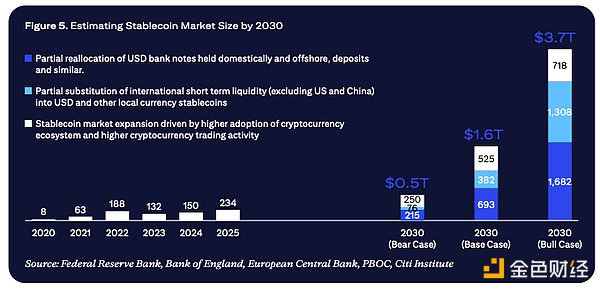

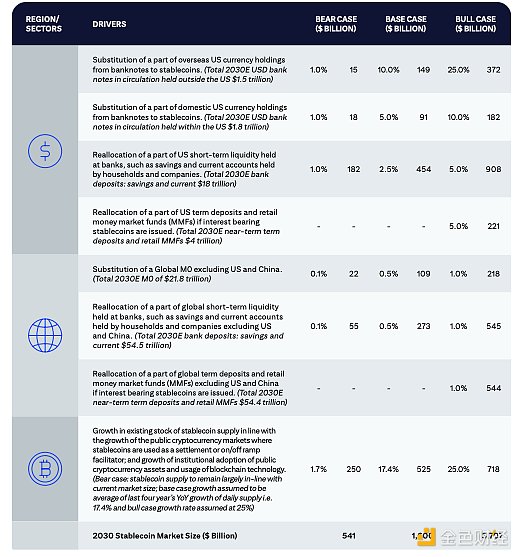

2. Citi predicts that the total circulating supply of stablecoins in 2030 may grow to US$1.6 trillion under the base case scenario, to US$3.7 trillion under the optimistic case scenario, and to around US$500 billion under the pessimistic case scenario.

3. It is expected that the supply of stablecoins will still be mainly denominated in US dollars (about 90%), while non-US countries will promote the development of their own CBDCs.

4. The U.S. regulatory framework for stablecoins may drive new net demand for U.S. Treasuries, and by 2030, stablecoin issuers may become one of the largest holders of U.S. Treasuries.

5. Stablecoins pose a certain threat to the traditional banking ecosystem by replacing deposits. But they may also provide opportunities for banks and financial institutions to provide new services.

As the title of its report "Digital Dollar" implies, Citi is highly optimistic about stablecoins. The report has a special chapter explaining "The ChatGPT moment of stablecoins is coming." Golden Finance AIMan specially compiled the chapter "Stablecoins: A ChatGPT Moment?" as follows:

How do stablecoins work?

A stablecoin is a cryptocurrency that aims to maintain a stable value by pegging its market price to a reference asset. These reference assets can be fiat currencies such as the U.S. dollar, commodities such as gold, or a basket of financial instruments. The key components of a stablecoin system include:

Stablecoin Issuer: The entity that issues the stablecoin and is responsible for maintaining its price peg by holding an underlying asset equal to the circulating supply of the stablecoin.

Blockchain ledger: After stablecoins are issued, transactions are recorded on the blockchain ledger, which provides transparency and security by tracking the ownership and transfer of stablecoins between users.

Reserves and collateral: Reserves ensure that each token can be redeemed at the pegged value. For stablecoins collateralized by fiat currencies, these reserves typically include cash, short-term government securities, and other liquid assets.

Digital Wallet Providers: Provide digital wallets, which can be mobile apps, hardware devices, or software interfaces, that allow stablecoin owners to store, send, and receive their tokens.

How do stablecoins maintain their pegged value?

Stablecoins rely on different mechanisms to ensure that their value is consistent with the underlying asset. Fiat-backed stablecoins maintain their peg by ensuring that each issued token can be exchanged for an equal amount of fiat currency.

Major stablecoins

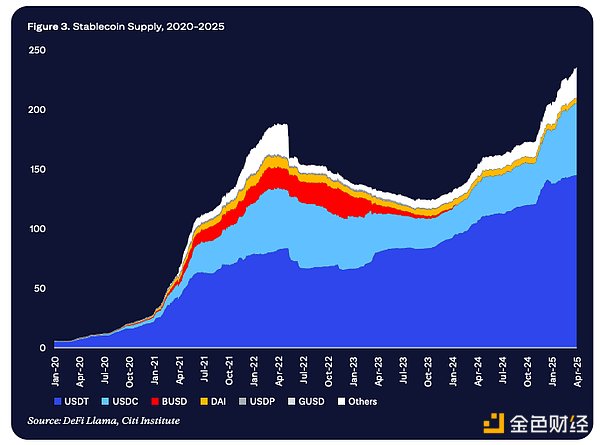

As of April 2025, the total circulating supply of stablecoins has exceeded $230 billion, an increase of 54% since April 2024. The top two stablecoins dominate the ecosystem, with a market share of over 90% by value and transaction number, with USDT in first place and USDC in second place.

Figure 3 Stablecoin supply from 2020 to 2025

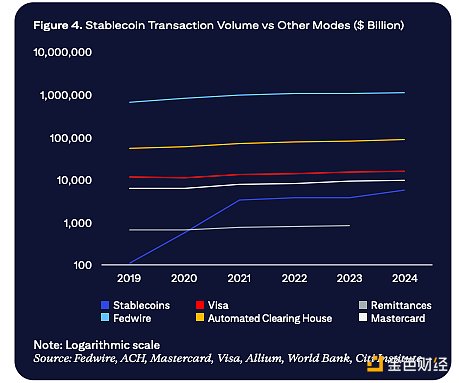

In recent years, the transaction volume of stablecoins has grown rapidly. After adjustment, the monthly transaction volume of stablecoins in Q1 2025 is between 650 billion and 700 billion US dollars, which is about twice the level from the second half of 2021 to the first half of 2024. Supporting the crypto ecosystem is the main application scenario of stablecoins.

The largest stablecoin, USDT, was launched on the Bitcoin blockchain in 2014 and expanded to the Ethereum blockchain in 2017, enabling its use in DeFi. In 2019, it further expanded to the TRON network, which is widely used in Asia due to its faster speed and lower costs. USDT has largely operated offshore, but times are changing.

Figure 4 Comparison of stablecoin transaction volume with other payment methods (Unit: billion US dollars)

We will definitely see more players (especially banks and traditional institutions) enter the market. Stablecoins backed by the US dollar will continue to dominate. Ultimately, the number of players will depend on the number of different products required to cover the main use cases, and there will probably be more players in this market than in the bank card network market. - Matt Blumenfeld, Global and US Head of Digital Assets at KPMG

What are the drivers of stablecoin adoption in the U.S. and around the world?

Erin McCune, founder of Forte FinTech:

Practical advantages (speed, low cost, 24/7 availability): creating demand in both developed economies (particularly where instant payments are not yet widely available, SMEs are underserved by existing institutions, and multinational corporations want to move funds around the world more easily) and emerging economies (where cross-border transaction costs are high, banking technology is immature, and/or financial inclusion lags).

Macro demand (hedging inflation, financial inclusion): In some regions, stablecoins have become a "lifeline" for people. Countries such as Argentina, Turkey, Nigeria, Kenya, and Venezuela have large currency fluctuations, and consumers use stablecoins to protect their funds. Today, more and more remittances are made in the form of stablecoins, and consumers without bank accounts can also use digital dollars.

Support and integration with existing banks and payment providers: This is key to legitimizing stablecoins (especially for institutional and corporate users) and can rapidly expand their adoption and utility. Mature, large-scale payment networks and core processors can bring transparency and facilitate integration with familiar solutions that businesses and merchants rely on. Implementing clearing mechanisms between different stablecoins and between banks and non-bank institutions is also critical to achieving scale. Technology improvements for consumers (easy-to-use wallets) and merchants (integration of stablecoin acceptance capabilities into acquiring platforms via APIs) are removing barriers that once limited stablecoins to the fringe of crypto.

Long-awaited regulatory clarity: This enables banks and the broader financial services industry to adopt stablecoins in both retail and wholesale operations. Transparency (audit requirements) and consistent liquidity management (reliable parity) will also ease operational integration.

Matt Blumenfeld, KPMG's global and U.S. head of digital assets:

User experience: The global payment landscape is increasingly shifting towards real-time digital transactions. But the challenge for every new payment method in its rollout is the customer experience – whether it is intuitive, whether the application scenarios are visible, and whether the value is clear. Any institution that successfully improves the customer experience, whether it is for retail or institutional users, will stand out in their respective fields. Integration with current payment methods will drive the next wave of payment method adoption. On the retail side, this is reflected in the combination with bank card payments or penetration in the mobile wallet field; on the institutional side, it is reflected in simpler, more flexible and more cost-effective settlement methods.

Regulatory clarity: As new stablecoin regulations are introduced, we can see the extent to which regulatory uncertainty has previously inhibited innovation and adoption around the world. The launch of the EU’s Markets in Cryptoassets (MiCA), regulatory clarity in Hong Kong, and the advancement of stablecoin legislation in the United States have all triggered a wave of activity focused on simplifying the flow of funds for institutions and consumers.

Innovation and efficiency: Institutions must view stablecoins as a means to enable more flexible product development, which is not easy today. This means providing a more convenient, creative and attractive medium that enhances the capabilities of traditional bank deposits, such as generating income, programmability and composability.

Potential market size of stablecoins

As Erin McCune, founder of Forte Fintech, points out, any prediction of the potential market size of stablecoins needs to be approached with a degree of caution. There are many variables, and our scenario analysis shows that the range of predictions is wide.

We constructed a forecast range based on the following factors driving the growth of stablecoin demand:

A portion of the US dollar overseas and in the United States has shifted from paper money to stablecoins: US dollar paper money held overseas is usually a safe haven against local market fluctuations, and stablecoins are a more convenient way to obtain such a hedge. Domestically, stablecoins can be used for certain payment functions to a certain extent and are held for this purpose.

Households and businesses in the United States and internationally have reallocated some of their short-term U.S. dollar liquidity to stablecoins: This is because stablecoins are easy to use (such as enabling cross-border transactions around the clock), which helps with cash management and payment operations. If regulations allow, stablecoins may also partially replace income-generating assets.

In addition, we assume that short-term EUR/GBP liquidity held by US households and businesses will also see a similar reallocation trend to short-term USD liquidity, albeit on a much smaller scale. Both our overall baseline and optimistic case forecasts for 2030 assume that the stablecoin market remains dominated by the US dollar (with a ~90% share).

Growth of the public cryptocurrency market, where stablecoins are used as settlement instruments or on-ramp-outs. This is driven in part by institutional adoption of public cryptocurrency assets and the general application of blockchain technology. In our base case, we assume that the trend of stablecoin issuance growth continues from 2021 to 2024.

Citi Research Institute estimates that the base case scenario for the stablecoin market size in 2030 will be US$1.6 trillion, the optimistic scenario will be US$3.7 trillion, and the pessimistic scenario will be US$0.5 trillion.

Figure 5 Forecast of stablecoin market size in 2030

Figure 6 Stablecoin market size in 2030

Note: The stock of total money supply (cash in circulation, M0, M1 and M2) in 2030 is calculated based on nominal GDP growth. The Eurozone and the United Kingdom may issue and adopt local currency stablecoins. China may adopt sovereign central bank digital currency and is unlikely to adopt foreign privately issued stablecoins. The size of non-US dollar stablecoins in 2030 is expected to be US$21 billion, US$103 billion and US$298 billion in the bear market, base and bull market scenarios, respectively.

Stablecoin Market Outlook

Erin McCune, Founder, Forte Fintech

Q: What is your view on the optimistic and cautious outlook for the stablecoin market size in the near term, and the potential factors driving its development trajectory?

Predicting the growth of the global stablecoin market requires a great deal of confidence (or overconfidence) as there are still many unknowns. With that as a reminder, here are my scenarios for both the bull and bear cases:

The most optimistic forecast is that the market will expand 5-10 times as stablecoins become an everyday medium for instant, low-cost, and low-friction transactions around the world. In the bull case scenario, the value of stablecoins will grow exponentially from about $200 billion today to $1.5-2.0 trillion by 2030, penetrating global trade payments, person-to-person remittances, and mainstream banking. This optimistic expectation is based on the following key assumptions:

Favorable regulation in key regions: not only Europe and North America, but also markets such as Sub-Saharan Africa and Latin America where demand for alternative local fiat currencies is greatest.

Genuine trust between incumbent banks and new entrants: and widespread confidence among consumers and businesses in the integrity of stablecoin reserves (e.g., $1 stablecoin = $1 in equivalent fiat currency).

Income (and savings) along the value chain is intentionally distributed: to promote cooperation.

Widespread adoption of technologies that bridge old and new infrastructure: Promote structural efficiency and scale. For example, merchant acquirers have already started using stablecoins. For wholesale payment applications, corporate treasury and accounts payable solutions and treasurers will need to adapt. Commercial banks will also need to deploy tokenization and smart contracts.

In the bear scenario, the use of stablecoins will be limited to the crypto ecosystem and specific cross-border use cases (mainly markets with illiquid currencies, which currently account for a small proportion of global GDP). Geopolitical factors, resistance to digital dollarization, and widespread adoption of central bank digital currencies will further hinder the growth of stablecoins. In this scenario, the market capitalization of stablecoins may stagnate at $300-500 billion, with limited relevance in the mainstream economy. The following factors will lead to a more pessimistic scenario:

If one or more major stablecoins experience a reserve failure or depeg event: this would significantly erode trust among retail investors and businesses.

Friction and cost when using stablecoins for everyday purchases: For example, remittance recipients cannot use them to buy groceries, pay tuition and rent, and businesses cannot easily use funds for wages, inventory, etc.

Retail central bank digital currencies have yet to gain traction: but in regions where public-sector digital cash alternatives achieve scale, stablecoins may become less relevant.

In regions where stablecoins develop and further erode the relevance of local fiat currencies: central banks may respond by tightening regulation.

If a fully reserve-backed stablecoin grows too large: this could “lock up” a large amount of safe assets as backing, potentially restricting credit in the economy.

Q: What are the current and future application scenarios of stablecoins?

As with any other form of payment, the relevance and potential growth of stablecoins must be considered based on specific use cases. Some use cases have already received attention, while others remain theoretical or are clearly impractical. The following are the stablecoin use cases that are currently (or in the near future) meaningful, ranked from largest to smallest in terms of contribution to the total final market (TAM) of stablecoins:

Cryptocurrency trading: Currently, individuals and institutions using stablecoins to trade digital assets is the largest application scenario for stablecoins, accounting for 90-95% of stablecoin trading volume. This activity is mostly driven by algorithmic trading and arbitrage. Given the continued growth of the cryptocurrency market and its reliance on stablecoin liquidity, trading (retail + decentralized financial activities) may still account for about 50% of stablecoin usage by value in the mature stage.

Business-to-business payments (corporate payments): According to the Society for Worldwide Interbank Financial Telecommunication (Swift), the vast majority of transaction value in traditional correspondent banking reaches its destination in minutes via the Swift global payments innovation platform. But this occurs primarily between money center banks, using liquid currencies and during banking hours. There is still a lot of inefficiency and unpredictability when doing business with low- and middle-income countries in particular. Corporates using stablecoins to pay overseas suppliers and manage treasury operations could take up a significant share of the stablecoin market. Global business-to-business flows amount to trillions of dollars, and in the long run, even if only a small portion shifts to stablecoins, it could account for around 20-25% of the total eventual stablecoin market.

Consumer Remittances: Despite a steady shift away from cash and toward digital payments, regulatory pressure, and efforts by new entrants, it remains expensive for workers abroad to send money to friends and family back home (5% on average for a $200 transaction, five times the G20 target). With lower fees and faster speeds, stablecoins are poised to capture a significant share of the roughly $1 trillion remittance market. If they can deliver on their promise of instantaneous delivery and significantly lower costs, this could account for 10-20% of the market in a high adoption scenario.

Institutional trading and capital markets: The use case for stablecoins to settle transactions between professional investors or tokenized securities is expanding. Large-scale fund flows (forex, securities settlement) may begin to use stablecoins to speed up settlement. Stablecoins can also simplify the funding process for retail stock and bond purchases, which is currently typically achieved through batch automatic clearing house processing. Large asset management companies are already piloting the use of stablecoins for fund settlement, laying the foundation for widespread use in capital markets. Given the large amount of payment flows between financial institutions, even if the adoption rate is not high, this use case may account for about 10-15% of the stablecoin market.

Interbank liquidity and funds management: The use of stablecoins by banks and financial institutions for internal or interbank settlements is relatively small (probably less than 10% of the total market), but has a large potential impact. Industry leaders have already launched blockchain projects with daily transaction volumes exceeding $1 billion, which shows its potential, although regulation remains unclear. This area may grow significantly, but there may be some overlap with the institutional use cases mentioned above.

Stablecoins: bank cards, central bank digital currencies and strategic autonomy

We believe that the use of stablecoins is likely to grow and these new opportunities will create space for new entrants. The current issuance duopoly is likely to continue in the offshore market, but new players may join the onshore market in each country. Just like the bank card market has evolved over the past 10-15 years, the stablecoin market will also change.

Stablecoins have some similarities to the bank card industry or cross-border banking. All of these areas have high network or platform effects and strong reinforcing loops. More merchants accepting a trusted brand (such as Visa, Mastercard, etc.) will attract more cardholders to choose that card. Stablecoins have a similar usage cycle.

In larger jurisdictions, stablecoins are often outside of financial regulation, but this is changing in the EU (Markets in Cryptoassets Regulation 2024) and the US (where regulation is moving forward). The need for tighter financial regulation, coupled with the high costs of partnering, could lead to the centralization of stablecoin issuers, as we have seen with bank card networks.

Fundamentally, having a handful of stablecoin issuers is good for the broader ecosystem. While one or two major players may seem concentrated, too many stablecoins can lead to fragmented, non-interchangeable forms of money. Stablecoins thrive when they have scale and liquidity. Raj Dhamodharan, Executive Vice President of Blockchain and Digital Assets, Mastercard

However, evolving political and technological developments have made the bank card market increasingly heterogeneous, especially outside the U.S. Will the same happen in the stablecoin space? Many countries have developed their own national bank card programs, such as Brazil’s Elo card (launched in 2011), India’s RuPay card (launched in 2012), and so on.

Many of these national card schemes were launched out of national sovereignty concerns and driven by local regulatory changes and political encouragement for domestic financial institutions. They also facilitate integration with new national real-time payment systems, such as Brazil’s Pix system and India’s Unified Payments Interface (UPI).

While international card schemes have continued to grow, their share has declined in many non-U.S. markets in recent years, where technological change has led to the rise of digital wallets, account-to-account payments and super apps, all of which have eroded their market share.

Much like the proliferation of national initiatives we have seen in the card market, we are likely to see jurisdictions outside the United States continue to focus on developing their own central bank digital currencies (CBDCs) as a tool of national strategic autonomy, particularly in the wholesale and corporate payments sectors.

A survey of 34 central banks by the Official Monetary and Financial Institutions Forum (OMFIF) showed that 75% of central banks still plan to issue central bank digital currencies. The proportion of respondents who expect to issue central bank digital currencies in the next three to five years has increased from 26% in 2023 to 34% in 2024. At the same time, some practical implementation issues have become increasingly apparent, with 31% of central banks delaying issuance due to legislative issues and the desire to explore broader solutions.

CBDCs began in 2014, when the People’s Bank of China began research on the digital yuan. Coincidentally, this is also the year Tether was born. In recent years, stablecoins have developed rapidly, driven by private market forces.

In contrast, central bank digital currencies are still largely at the official pilot project stage. The few smaller economies that have launched national central bank digital currency projects have not seen a large number of spontaneous users. However, the recent increase in geopolitical tensions may attract more attention to central bank digital currency projects.

Stablecoins and Banks: Opportunities and Risks

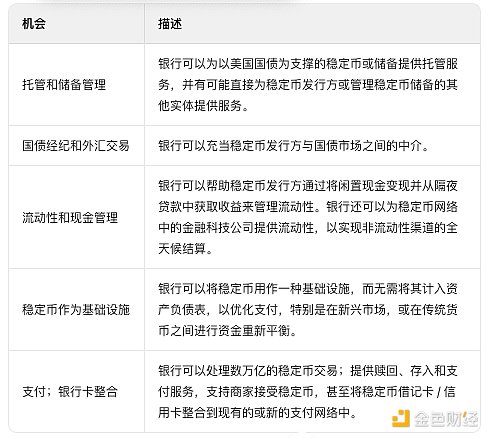

The adoption of stablecoins and digital assets provides some banks and financial institutions with new business opportunities to drive revenue growth.

The role of banks in the stablecoin ecosystem

Matt Blumenfeld, Global and US Digital Asset Leader, PwC

There are many opportunities for banks to participate in the stablecoin space. This can be directly as a stablecoin issuer, or in a more indirect role as part of a payment solution, building structured products around stablecoins, or providing general liquidity support. Banks will find ways to continue to be a medium of exchange for the flow of funds.

As users seek more attractive products and better experiences, we see deposits flowing out of the banking system. With stablecoin technology, banks have the opportunity to create better products and experiences while keeping deposits within the banking system (where users generally prefer deposits to be protected), just through new channels.

Figure 7: Banks and Stablecoins: Revenue and Business Opportunities

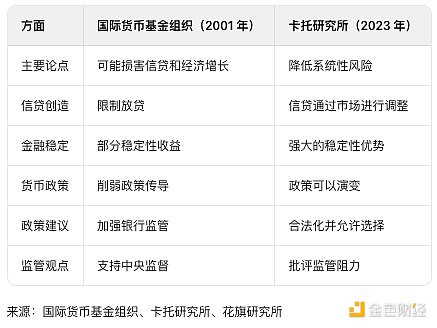

At the systemic level, stablecoins could have similar effects to “narrow banks,” the pros and cons of which have long been debated at the policy level. The shift of bank deposits into stablecoins could affect banks’ lending capacity. This reduction in lending capacity could at least dampen economic growth during the transition period as the system adjusts.

Conventional economic policy opposes narrow banking, as summarized in an IMF report in 2001, due to concerns about credit creation and economic growth. The Cato Institute put forward an opposing view in 2023, with similar voices arguing that "narrow banking" can reduce systemic risk, and credit and other financial flows will adjust accordingly.

Figure 8: Different views on narrow banks