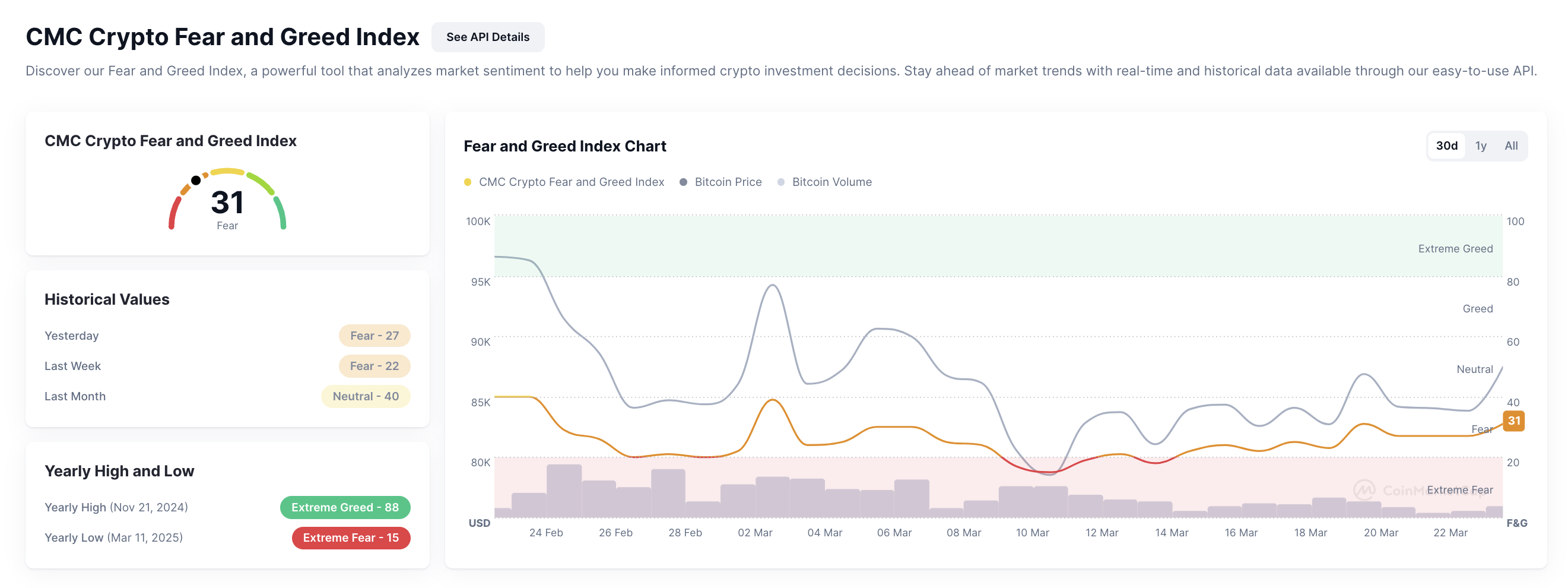

On March 24, 2025, under the repeated pull of the global virtual asset market, BTC once again broke through 87,000, alleviating a certain fear in the crypto market - according to CoinMarketCap data, the market sentiment is 31, an increase of 4 points compared to yesterday.

At the same time, a piece of mining-related news has probably made some small splashes in the market:

According to Public Pool and Umbrel, at 08:30 Beijing time on March 23, an individual miner used a self-hosted Umbrel node and a Bitaxe mining machine to successfully mine the first Bitcoin block (888989) through the Public Pool protocol, with a block reward of 3.15188086 BTC.

I believe that for many conservative Web3 investors, participating in mining in the early years is one of the best ways to make a profit. However, due to the rectification of virtual currency mining in China, it has been dormant in recent years.

With the changes in global regulatory policies and the continued rise in BTC prices, going overseas to participate in mining may become everyone’s next “opportunity”?

So, at this moment, can individual and institutional investors still enter overseas BTC mining, and how will they balance the benefits and risks?

Portal Labs has the answers for you.

Inventory of recent mining policies

First of all, I need to remind everyone that mining in the country is definitely not allowed.

Although going overseas is feasible, it depends on the regulatory policies of specific regions. For example, in the past two months, some countries and regions that have been mining overseas have released signals:

United States: Regulation is warming up, and local governments have expressed their support

Recently, the U.S. Securities and Exchange Commission (SEC) finally made it clear that PoW mining does not constitute securities behavior, which greatly reduced the compliance pressure on mining companies. At the same time, Kentucky and Utah have successively passed bills to protect mining rights, clarifying the legality of individuals and companies conducting mining, self-custody and node operations. Of course, don't ignore that some states are still cautious about energy regulation and environmental protection policies.

Belarus: The president personally promotes and encourages the use of excess electricity for mining

In March 2025, the President of Belarus personally instructed the energy department to promote the development of the crypto mining industry, and particularly emphasized the full use of excess electricity resources. At present, the Mogilev region has obtained government approval and has begun to actively prepare for the construction of a large-scale mining farm. This high-level political support undoubtedly brings positive signals to the mining industry.

Pakistan: U-turn from ban to initial support

It is worth noting that Pakistan previously had a strong prohibition on crypto mining. However, its attitude began to change in 2023, and mining was officially included in the energy resource utilization plan in 2025. Although the legal framework is still in the early stages of exploration, this positive shift also provides some room for investors to imagine.

Russia and Kazakhstan: Energy giants continue to exert their strength

Russia has issued a number of bills in 2024 to actively promote the operation and development of legal mines in the country, further enhancing the competitiveness of its mining industry. Kazakhstan is also encouraging large-scale mining farms to comply with regulations and operate on a large scale while maintaining strict electricity supervision.

Canada: British Columbia Energy Policy Restrictions

Although Canada has always been open to BTC mining, British Columbia recently passed a court ruling to support local power companies’ restrictions on mining power usage. Energy supply pressure has become an important limiting factor for local mining expansion, which is a key factor that must be considered for investors planning to invest in Canadian mining.

The current trend of mining supervision shows "polarization":

One category is represented by the United States and Belarus, where mining policies are tied to the development of the energy industry and digital economy strategies, and mining is incorporated into the energy dispatch system;

Another type is some parts of Canada, where policies are tightened due to carbon emissions and energy load considerations. Investors should focus on whether the energy policy of the region is linked to the mining economy to prevent future policy reversals.

But no matter what, the recent global regulatory trend has clearly turned positive, reflecting the mainstream market's renewed recognition of BTC mining.

The core drivers of this change include the economic benefits brought by the rise in BTC prices, the potential role of mining in energy transformation, and the strategic considerations behind countries' rush to develop the Web3 industry.

For example, a report in February showed that the U.S. Bitcoin mining industry has directly or indirectly created more than 31,000 jobs, and mining activities contribute more than $4.1 billion to the U.S. GDP each year. It also effectively supports the stable operation of local energy infrastructure by serving as a load balancing resource for the power grid.

BTC Global Mining Status

In addition to complying with regulatory policies, investors also need to understand: What is the return on investment if they participate at this point in time? You can't invest tens of thousands or hundreds of thousands of dollars and not even hear a response, right?

For investors, there are only three ways to participate in mining: mining pool hosting, forming a mining pool or individual miners. So, what are the current data of these two paths?

Mining pool hosting data

In February 2025, the total computing power of the global Bitcoin network exceeded 810 EH/s, and the block output and output data of the top five mining pools are as follows:

These mining pools control approximately 88%-90% of the global computing power. Foundry USA and AntPool have built their own mining farms in multiple locations and provide large-scale hosting services.

Under the mining pool hosting model, investors do not need to manage the equipment themselves. They only need to pay the hosting fee and mining pool handling fee to obtain stable income according to the proportion of contributed computing power. The hosting service provided by the current leading mining pools has an annualized return of 18%-30%, and the mining pools are highly scaled and compliant, which is suitable for high-net-worth investors to enter the market with low risk.

Institutional mining data

If high net worth investors do not consider custody, they can also directly invest in or cooperate with large mining farms. Let's take a look at the actual data of five typical mining companies in February 2025:

Among them, Marathon and Riot completely operate their own mining farms, while Bitdeer, Canaan and BitFuFu also have partially self-built and partially managed businesses, with relatively stable rates of return.

Currently, the leading mining pools are showing a dual layout trend of "self-operated mining farms + global hosting", and the concentration of computing power has increased by more than 10% since 2023. In an environment where the monopoly of mining pools is stabilizing, it is more difficult for retail investors to compete in computing power.

Therefore, if high-net-worth investors simply rely on retail investors to splice computing power, the volatility of returns and high transaction fee costs will be relatively high. It is recommended that they directly connect with mining pool hosting or institutional mining farm equity cooperation, which can not only reduce operational risks, but also benefit from the scale dividend of the mining pool.

Personal miner data

Although large mining pools dominate the overall market, individual miners remain active.

In particular, through the following two modes:

One is the individual miners we mentioned at the beginning, who use their own mining machines and nodes, and then successfully mine blocks through the Public Pool protocol;

The other is Solo miners. According to public statistics from Mempool, in February 2025, the average number of blocks produced by Solo miners on the entire network was about 1-2 per day, accounting for less than 0.7% of the total number of blocks produced. The probability of success is extremely low, but there is still the possibility of profit.

However, on March 24, 2025, the difficulty of Bitcoin mining increased by 1.43% to 112.15T, close to the historical high, and the price of Bitcoin remained in the range of US$76,500 to US$85,000, which means that the competition environment for individual miners is still fierce.

Currently, the price of mainstream mining machines has dropped to about $16 per terahertz (TH), a significant drop from 2022. In terms of performance, mainstream models include:

Antminer S21 XP Hyd.: 473 TH/s, power consumption 5676 W, energy efficiency 12 J/TH

WhatsMiner M63S+: 424 TH/s, power consumption 7208 W, energy efficiency ratio 17 J/TH

Avalon A1566: 185 TH/s, 3420 W power consumption, 18.5 J/TH efficiency

Assuming that individual miners use Antminer S21 XP Hyd., the electricity cost is 0.05 USD/kWh, and the average price of BTC is 87,000 USDT. Then, according to public market data, the average cost of mining a Bitcoin is about 24,119 USD, and the daily net income of individual miners may be 7.8-10 USDT, and the static payback period is about 12-16 months.

However, electricity costs are often the biggest uncertainty factor. At the same time, the problems faced by individual miners are not limited to costs, such as the halving of block rewards and equipment depreciation, which will affect actual profits. In addition, in the next three years, as the BTC halving cycle progresses and overseas compliance pressure increases, the income fluctuations and cost pressures faced by individual miners may continue to increase.

Therefore, it is recommended that individual investors act within their means and give priority to mining pool hosting or node partnership to reduce operational risks.

Conclusion

In general, the current BTC mining industry is in a period where multiple factors converge: “high coin prices – friendly policies – approaching halving”, which has brought certain profit margins to the mining industry.

If project owners and investors can take advantage of this window to complete computing power and compliance layout, they may be able to gain an advantage in future cycles. However, whether choosing a mining pool hosting, self-built or individual miner model, investors still need to make reasonable plans based on their own financial strength, risk tolerance and operational resources.

Here, Portal Labs recommends that investors focus on regions with friendly regulation, stable energy, and significant electricity cost advantages for mining layout, and give priority to cooperating with mining pools or mining farm hosting service providers with good credit records and stable operating capabilities to ensure the sustainability and compliance of profits.

At the same time, investors still need to be vigilant about multiple risk factors such as currency price fluctuations, policy adjustments, equipment depreciation, and operation and maintenance costs, and plan asset allocation rationally to hedge risks and respond flexibly.

* Tip: Investment is risky. Please participate in Web3 legally and in compliance with regulations.